Summary:

- Palantir’s 2023 SEC filing reveals a paradigm shift for the company. Sales efficiency is ramping up customer acquisition dramatically.

- Intrinsic value has risen with Q4 results, helping investors project future margin expansions. However, the market is currently pricing Palantir fairly.

- Q4 results show hints of AIP bootcamps paving the way for scalability and profitability, but revenue impact is yet to be seen.

Michael Vi

The 2023 form 10K SEC filing is out for Palantir Technologies (NYSE:NYSE:PLTR), and I am seeing some very interesting data points converging into a paradigm shift for the company. Q4 was a solid quarter that gave us a lot of hints and insight into what the future holds for Palantir.

I have covered Palantir recently in an article that focused on dismantling the bear arguments surrounding the company. In the article, I rated Palantir a buy based on intrinsic value following a discounted cash flow (DCF) model presented in the article. In this article, I am focusing on what hints the Q4 financial results give investors in regards to Palantir being able to scale their operations and how efficiently they may do so. I also revisit my valuation model and raise the intrinsic value, even though I downgrade the stock to a hold due to stock price appreciation already reaching fair value.

In 2021, the operating system for modern enterprises that Palantir developed was too robust to scale efficiently. The platform was immensely powerful, offering way too much capability to be sold to solve specific, narrow use cases. Like purchasing a luxurious pool when all you wanted was a bucket.

In 2022, the commercial Foundry product was beginning to be offered in modules, making it a more attractive offering for enterprises smaller than the Fortune 100. The problem was that Palantir’s software still required forward deployed engineers to help set up the software against the use cases the business was trying to solve. This was a step in the right direction, but it still lacked a scaling lever.

Finally, in 2023, Palantir released their Artificial Intelligence Platform (AIP) which allows interaction against Palantir’s platform through text based queries, similar to ChatGPT. This expands the potential user base of customer employees beyond engineers and operators, reducing time to value and, as Palantir puts it, from zero to use case in days. This also allows for a new onboarding and scaling lever: Palantir bootcamps. Palantir runs bootcamps where they gather potential AIP customers for hands-on, intense 1- to 3 day sessions. Palantir shows how they can make the attendant businesses more efficient and help resolve issues they are facing by leveraging AIP’s capabilities.

CEO Alex Karp says the following in their Q4 2023 earnings call:

You also see just this enormous demand and our ability to meet that demand with a pilot — new piloting approach that we call bootcamp. So, we went, like — two years ago, we did 92 pilots. And last year, really mostly the second half of the year, we did over 500 bootcamps.

More boldly, Karp claims that Palantir can show customers more value in mere hours compared to what they would be able to accomplish in months or years using other vendors:

Our 10 hours, your 10 months. Any products you want, any vendor you want, any hyperscaler you want, you pick them, we’ll show up.

AIP was launched in Q2 of 2023, and at first, Palantir did not have a pricing strategy for the product. The focus was simply to gain as much market share as possible, which made it difficult for analysts to project any implications AIP will have on business results in the future. However, as of Q4, we are starting to see the fruits of their labor in the data.

Data that speaks for itself

I have been on the lookout for any hints of AIP’s impact on Palantir’s financial results since its launch. I want to see evidence of AIP enabling what I am expecting it to do: allow scalability, faster customer growth, more efficiency in the sales process, and ultimately, a margin expansion.

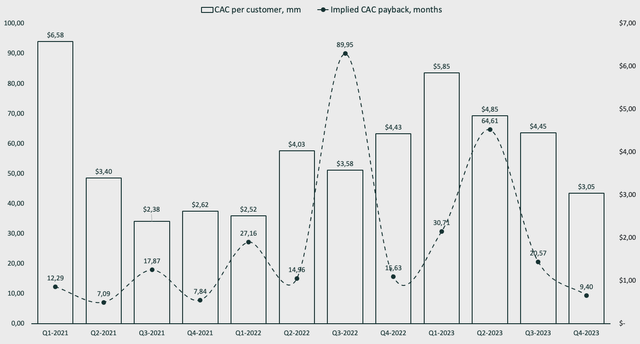

The first hint can be found in the customer acquisition cost (CAC) per customer. Palantir does not report this metric, but I calculate it with the following formula:

- Previous period Non-GAAP S&M/Current period net addition of customers. Non-GAAP S&M in this formula is sales and marketing costs minus stock-based compensation related to sales and marketing.

Then, I look at the implied CAC payback in months. This calculation is to see how long it takes Palantir to recoup the customer acquisition cost. The Excel formula is more complex:

- (CAC per customer/((Implied net new annual recurring revenue/net addition of customers)*((total revenue-(cost of revenue-SBC included in cost of revenue-depreciation and amortisation))/total revenue)))*12.

Emir Mulahalilovic, Palantir SEC Filings

The 2021 period and the beginning of 2022 are heavily skewed by the SPAC investments Palantir made, which artificially boosted its revenues. With this in mind, Q4 of 2023 represents the lowest CAC per customer Palantir has had, and it’s clearly trending down since the launch of AIP. The same is true for the CAC payback in months, which should go hand-in-hand with the customer acquisition costs.

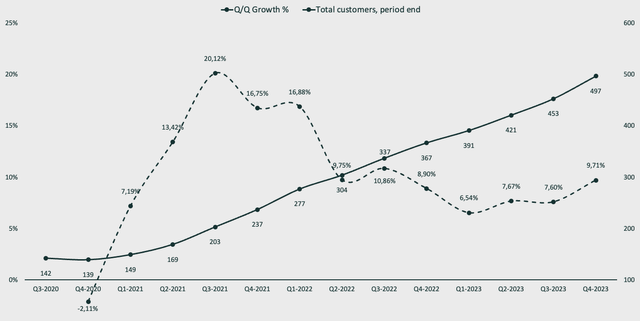

The next metric is more straightforward; I want to see a re-acceleration of customer count growth. For many periods, we did not see any hints of Palantir being able to scale their customer count, and the growth was either down-trending or staying stagnant. As of Q4 2023, we have a solid re-acceleration, despite it growing harder as the total customer count increases. This is a very important sign to note.

Emir Mulahalilovic, Palantir SEC FIlings

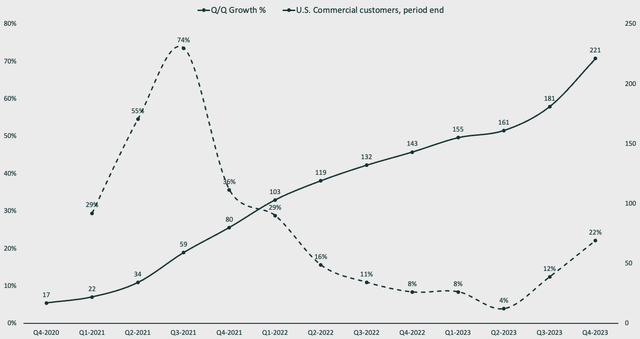

AIP is primarily used as a growth lever for U.S. commercial count growth; as such, it is important to confirm the same trends within those metrics as well. Here, it is much steeper and easier to see the AIP impact from Q2 2023 and onwards. I expect this trend to continue as we move into 2024.

Emir Mulahalilovic, Palantir SEC Filings

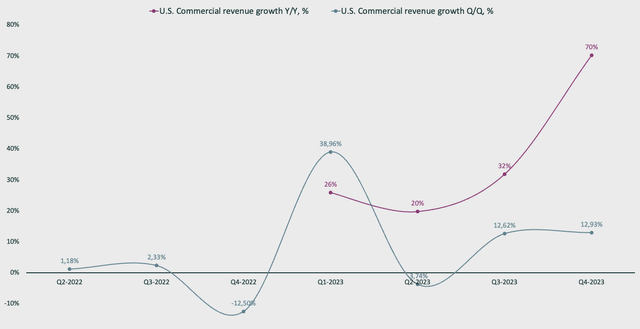

As for the revenue from AIP, I still can’t see any clear hints of future revenue credited to AIP. For example, Palantir boasted about a 70% growth year-over-year in their U.S. commercial customer count, hinting that it’s due to AIP during the Q4 earnings call. CRO/CLO Ryan Taylor says the following:

AIP and bootcamps are accelerating our business, particularly in US commercial, where fourth quarter revenue grew 70% year-over-year, evidencing a significantly expanding addressable market.

However, the 70% year-over-year growth is on the basis of an extraordinarily weak Q4 of 2022, where revenue dropped compared to the prior quarter. I can’t draw any AIP pricing conclusions from the data we currently have available, as the revenue trends don’t follow customer count trends yet.

Emir Mulahalilovic, Palantir SEC Filings

The same can be observed for other year-over-year KPIs that I track. For the actual revenue impacts that AIP will bring, we will have to be more patient. The quarter-over-quarter growth for the same KPIs is still healthy and impressive, but it’s still too early to draw conclusions.

| Remaining performance obligations bookings growth Y/Y, % | 376,3% |

| Billings growth Y/Y, % |

56,3% |

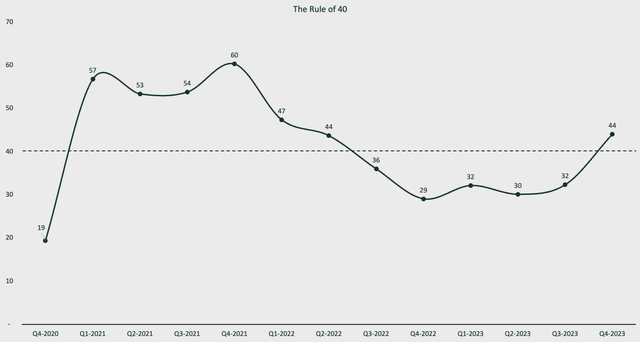

There are several metrics used to assess a software as a service ((SaaS)) business, most notably the rule of 40. In short, a healthy SaaS company should present a value at or above 40% when adding its revenue growth rate together with its profit margin. The growth rate used varies between the net revenue growth rate, monthly recurring revenue (MRR), and annual recurring revenue (ARR). The profit margin used differs as well, rather than net profit, analysts could also use EBIT, EBITDA, or cash flow margins depending on the maturity stage of the business. For my calculation, I use the last twelve months revenue growth rate and cash flow margins.

As of Q4, Palantir is back over the 40 line, or perhaps rather than back, it’s there for the first time organically. As I mentioned previously, the 2021 and early 2022 periods are heavily skewed by SPAC revenue boosts.

Emir Mulahalilovic, Palantir SEC Filings

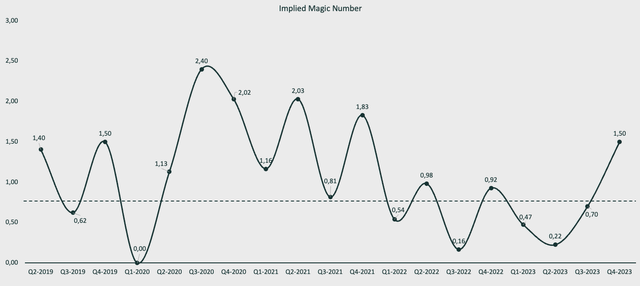

Another popular metric to track for a SaaS company is the Magic Number, a metric to gauge sales efficiency. In short, how much revenue is Palantir making compared to the money spent on acquiring new customers? This ties together with the CAC calculations we made earlier in this article. The formula is as follows:

- (Current period ARR – previous period ARR)/Prior period Non-GAAP S&M. Non-GAAP S&M in this formula is sales and marketing costs minus stock-based compensation related to sales and marketing.

The three targets of note in relation to the Magic Number are as follows:

| <0.5 | This indicates issues with the business model, go-to-market strategy, or pricing strategy. |

| <0.75 | Being close to the 0.75 threshold indicates that the business strategy is acceptable. Further granular analysis is needed to assess whether or not more investment in growth is beneficial. |

| >0.75 | Greater than 0.75 indicates a healthy business model with efficient sales. At this stage, the business is primed to start scaling growth. |

Lars Leckie who popularized the metric popular, says the following:

Fundamentally, the key insight is that if you are below 0.75 then step back and look at your business, if you are above 0.75 then start pouring on the gas for growth because your business is primed to leverage spend into growth. If you are anywhere above 1.5 call me immediately.

Someone should get ready to call Lars.

Emir Mulahalilovic, Palantir SEC Filings

The valuation

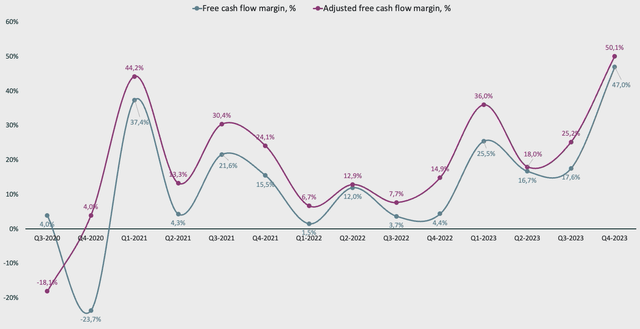

Q4 2023 has seen the business develop to be more efficient operationally, but it also translates to the financials. The most important metric, free cash flow, shows us significant signs of Palantir growing more profitable.

Palantir reports adjusted free cash flow in their filings, but actual free cash flow differs. There was a need to adjust the free cash flow to paint a picture of the generated cash while Palantir was operationally unprofitable. I calculate their free cash flow to firm manually to paint a more accurate picture. The formulas are presented below for both approaches:

| Adjusted FCF as reported by Palantir | Simple FCF to firm calculation |

| + Net cash provided by operating activities | + EBIT |

| + Cash paid for employer payroll taxes related to stock-based compensation | – Total tax |

| – Capital expenditures | + Depreciation & amortization |

| SUM: Adjusted free cash flow | – Capital expenditures |

| Net change in working capital | |

| SUM: Free cash flow to firm |

Emir Mulahalilovic, Palantir SEC Filings

We can see a clear increase in free cash flow margins, speaking of a more efficient business. Palantir has historically generated a lot of cash while staying debt free despite not being profitable. Now that Palantir is operationally profitable, it is also reflected in the cash flows. The new bootcamp scaling lever is starting to rear its head and is showcasing immense margin expansions.

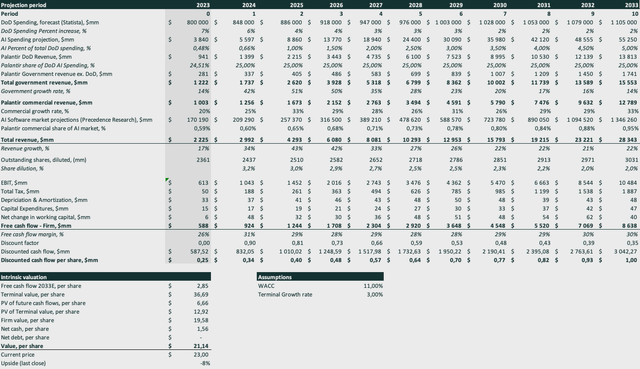

I underestimated how efficient Palantir will be operationally in my previous valuation, and have thus adjusted operating margins to scale up to 28% by 2033, compared to 24% in my previous model. The base assumptions for my DCF model are expanded in my previous Palantir article here on Seeking Alpha.

In addition, the scaling lever through bootcamps will allow a higher market share than I initially modeled in my DCF. Each period has a few basis points higher market share of the total AI software market, ending at 0.95% in 2033. The other assumptions are left the same as in my previous model until we have more clarity. I have used a 11% weighted average cost of capital (WACC) to represent execution risk and DoD AI spend uncertainties.

Emir Mulahalilovic, Palantir SEC Filings, Statista, Precedence research

Using these assumptions, intrinsic value shows that Palantir is currently fairly valued. However, if I were to be more confident in my assumptions and assume less risk by lowering WACC to 10%, Palantir’s fair value would be ~$25 per share. That is not an assumption I am confident in making for my base case, and as such, ~$21 per share is a fair output.

Conclusion

Q4 results have shown some significant hints of AIP bootcamps paving the way of scalability for Palantir. Many data points are converging and showing us signs of how profitable Palantir can be in the future. The revenue impact from Palantir scaling the customer count growth is yet to be seen in the numbers, but it is important for us as investors to capture the signs before they happen in order to generate alpha. The re-acceleration in customer acquisitions and the new onboarding method enable Palantir to grow immensely at very low customer acquisition costs. This will have a significant impact on margins in the future, unlocking unprecedented operational efficiency at Palantir.

In my previous article, I rated Palantir a buy. However, despite intrinsic value increasing as of the latest quarterly report, the market has raised the stock price to a fair value. Before we get more clarity on the revenue impacts of AIP, I rate Palantir as a hold while it trades in line with its intrinsic value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.