Abbott Labs’ Reversal Is Here – CGM Tailwinds In 2024

Summary:

- ABT continues to ride the diabetes tailwinds, as the market turns increasingly optimistic about the synergistic use of CGM and Ozempic/Mounjaro for overall patient care.

- The growing adoption has directly triggered the stock’s rally thus far, further aided by the management’s promising FY2024 guidance and growing profit margins.

- As its core portfolio growth accelerates compared to the hyper-pandemic levels, it appears that the management’s R&D efforts are paying off after all, further aided by the highly efficient operations.

- Combined with its excellent dividend investment thesis and prospective capital appreciation, we are maintaining our Buy rating for the ABT stock.

miodrag ignjatovic/E+ via Getty Images

We previously covered Abbott Laboratories (NYSE:NYSE:ABT) in October 2023 as a Buy, discussing Ozempic/Mounjaro as the driving force surrounding the increased adoption for ABT’s glucose monitoring equipment, FreeStyle Libre.

The same had been observed in the company’s Diabetes Medical Devices and Nutrition segment performances over the past few quarters, further contributing to its profitable growth trend then.

By now, it is apparent that ABT has exceeded expectations, with the stock’s +22% rally outperforming the wider market at +20%, further aided by the management’s promising FY2024 guidance and growing profit margins.

As a result of the dual-pronged prospects through capital appreciation and dividend income, we maintain our Buy rating for the ABT stock.

The Diabetes CGM Investment Thesis Remains Robust

For now, ABT has reported a top-line beat in its FQ4’23 earnings call, with revenues of $10.24B (+0.9% QoQ/ +1.5% YoY) and adj EPS of $1.19 (+4.3% QoQ/ +15.5% YoY), with FY2023 numbers of $40.1B (-8.1% YoY) and $4.44 (-16.8% YoY), respectively.

Most of its recent tailwinds are attributed to the growing demand for Medical devices, particularly the Diabetes Care, with $1.55B (+5.4% QoQ/ +22% YoY) of sales in the latest quarter, increasingly driving the company’s revenues at 15.1% (+0.7 points QoQ/ +2.6 YoY).

This is unsurprising, since ABT’s Freestyle Libre, the Continuous Glucose Monitoring system, now boasts over 5M users globally (+25% from FQ4’21 levels of 4M) with 2M concentrated in the US (+100% from FQ4’21 levels of 1M).

With $1K in recurring annualized revenues per user, we can understand why the market is increasingly excited about the company’s long-term prospects, especially since Libre is increasingly being rated positively as the best value option by patients.

As the World Health Organization [WHO] estimates up to 422M diabetes patients globally and Centers for Disease Control and Prevention [CDC] estimates 38.4M diabetes patients in the US, we can understand why ABT has guided a growth year in 2024, as Libre 3 is fully “unleashed.”

With Libre already generating FY2023 sales of $5.3B (+24% YoY), we concur with the management’s ambitious FY2024 overall revenue guidance of +9% YoY at the midpoint (ex COVID-19 testing), approximately at $41.96B, with an adj EPS of $4.60 (+3.6% YoY).

This number implies an accelerated growth in its core portfolio, mostly aided by the Diabetes Care, compared to the CAGR of +4.8% reported between FY2019 with overall revenues of $31.9B and FY2023 ex-COVID overall revenues of $38.5B.

Readers must also note that ABT’s investments in the US Pediatric Nutritionals and growing pipeline/ approvals in the Vascular, Structural Heart, and Electrophysiology have resulted in great success on a QoQ and YoY basis, further lifting its prospects.

It is apparent from these numbers that ABT may very well shed the normalization effect from the COVID-19 diagnostic tests, as sales dwindled to $1.6B in FY2023 (-80.9% YoY).

In addition, the management has also taken the prudent steps to resize their operating expenses nearer to pre-pandemic averages, despite the intensified R&D efforts/ partnerships across lab automation systems, medical devices, and biosimilars.

This naturally triggers the expansion of its operating profit margins to 20.1% in FQ4’23 (+2.7 points QoQ/ +2.8 YoY/ +5.2 from FY2019 levels of 14.9%).

At the same time, ABT has prioritized deleveraging its balance sheet, with $13.59B of long-term debts by the latest quarter (-7.1% QoQ/ -6.4% YoY/ -18.4% from FY2019 levels of $16.66B).

The $2.6B maturing through 2025 is not an issue as well, attributed to the $7.27B of cash/ investments (+3.2% QoQ/ -28.5% YoY) and robust prospects as discussed above.

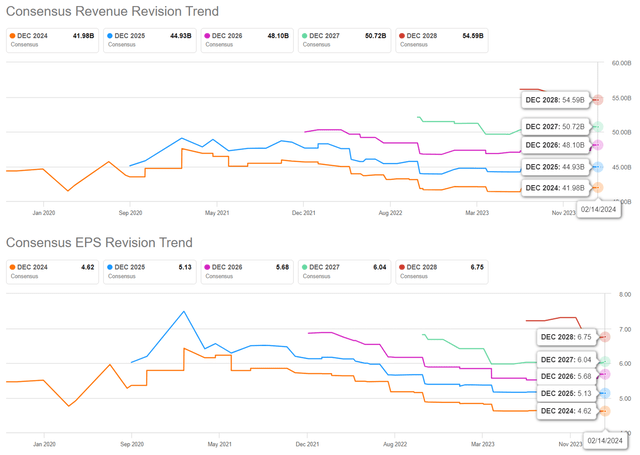

The Consensus Forward Estimates

Seeking Alpha

Perhaps this is why the consensus have moderately raised their forward estimates, with ABT expected to generate an improved top/bottom line expansion at a CAGR of +6.2%/ +8.6% through FY2026.

This is compared to the previous estimates of +5.3%/ +7.7%, while nearing the historical trend of +9.8%/ +10.6% between FY2016 and FY2023, respectively.

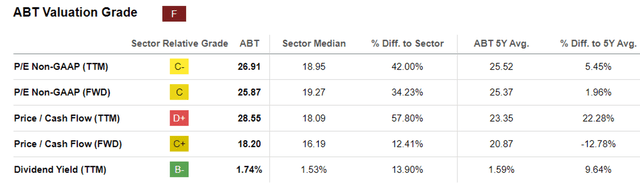

ABT Valuations

Seeking Alpha

This is also why ABT trades at premium FWD P/E valuations of 25.87x and FWD Price/ Cash Flow of 18.20x, compared to its 1Y mean of 23.33x/ 22.40x, 3Y pre-pandemic mean of 21.40x/ 19.40x, and sector median of 19.27x/ 16.19x, respectively.

The premium appears to be somewhat reasonable as well, especially when compared to its medical monitoring device peers, such as Medtronic plc (MDT) at 16.49x/ 16x and DexCom, Inc. (DXCM) at 66.84x/ 41.30x, which are expected to generate top/bottom line expansions at +4.9%/ +7% and +18.8%/ +22% over the same time period, respectively.

It is apparent that as diabetes drugs gain momentum, a similar boost has been embedded in ABT’s valuations, due to the mutually complementary effect on the overall patient care moving forward.

However, we would like to offer a word of caution here.

It is important for readers to differentiate between obesity and diabetes market opportunities, despite both being inexplicably interlinked at the moment.

While obesity drugs are expected to reach over $100B in annual sales by 2023, expanding at a CAGR of +59.3%, it is uncertain how much of a spill-over effect there may be for ABT’s Continuous Glucose Monitoring devices and Nutritional products, despite certain literature support.

Since ABT’s embedded premium valuations come with higher expectations, readers must expect greater volatility if consensus estimates are missed and growth decelerates.

So, Is ABT Stock A Buy, Sell, or Hold?

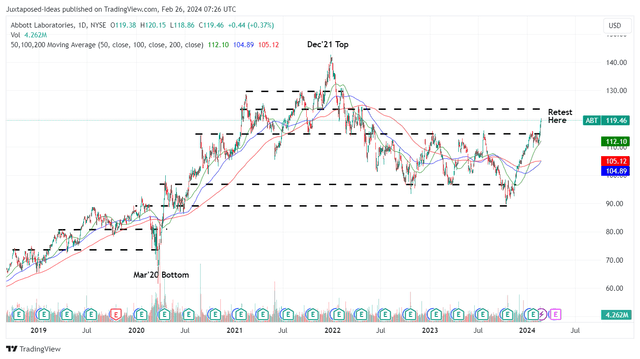

ABT 5Y Stock Price

Trading View

For now, ABT has broken out of its 50 day moving averages, while rapidly moving past of its previous resistance levels of $115.

Based on the FY2023 adj EPS of $4.44 and the FWD P/E of 25.87x, the stock appears to trade to our fair value estimates of $114.80.

Based on the consensus FY2026 adj EPS estimates of $5.68, there seems to be an excellent upside potential of +22.9% to our long-term price target of $146.90.

At the same time, ABT’s dividend investment thesis remains decent as well, with a TTM Interest Coverage ratio of 11.33x and TTM Dividend Coverage Ratio of 2.11x, compared to the sector median of 7.67x and 3.75x, respectively.

This is on top of the excellent 5Y Dividend Growth Rate of +12.39%, well exceeding the sector median of +6.31%, with the annualized dividend per share of $2.20 also nearly doubling from 2018 levels of $1.12.

As a result of the (prospective) dual pronged returns through capital appreciation and dividends, we are maintaining our Buy rating for the ABT stock.

Readers may want to observe the stock movement for a little longer before adding upon a moderate pullback for an improved margin of safety, preferably at its previous trading range of between $100 and $110.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.