Summary:

- Palantir Technologies Inc. is experiencing strong growth in its commercial business, driven by its artificial intelligence platform and boot camp approach.

- The company reported a surge in revenue and an increase in the number of clients using its products.

- Palantir has secured large government contracts and has a strong growth trajectory, but its high valuation makes it a hold for now.

BlackJack3D

This article was coproduced with Chuck Walston.

Those that follow my work know I concentrate on dividend stocks, and that I have a penchant for dividend growth investing. It is rare indeed that I report on companies that provide low yields, let alone one that does not pay a dividend. However, Palantir Technologies Inc. (NYSE:PLTR) is an intriguing prospective investment.

Palantir initially specialized in detecting terrorist activities targeting government and defense agencies. By analyzing enormous amounts of data, the firm is a provider of big data analytics.

However, the company recently launched an artificial intelligence platform (“AIP”) catering to commercial customers. Coupled with large language models (“LLM’s”), Palantir’s AIP drives efficiency and productivity for its clients, thereby lowering costs and increasing profits.

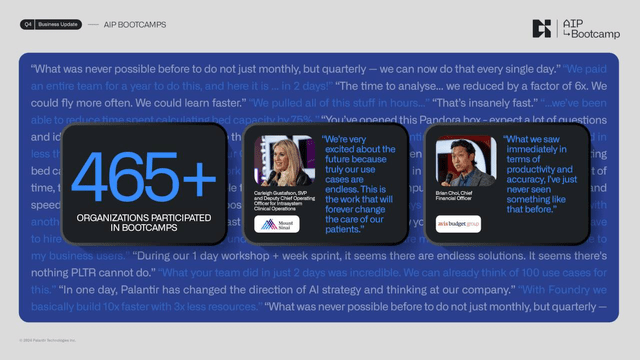

PLTR utilizes immersive seminars known as boot camps to highlight the multiple uses for its software and the tangible advantages AIP provides for businesses. In FY 2023, Palantir conducted 560 boot camps for 465 businesses. That initiative is driving extraordinary growth for the company.

The most recent earnings revealed a surge in revenue for the firm. The number of clients using Palantir’s products has also increased markedly, and the company has a strong growth trajectory.

Q4 2023 Earnings: Lots To Unwrap Here

Palantir reported Q4 2023 earnings on the 5th of February.

Non-GAAP EPS of $0.08 matched analysts’ estimates. GAAP EPS stood at $0.04.

Full year adjusted EPS was $0.25, and GAAP EPS was $0.09.

Revenue jumped 19.6% year-over-year to just over $608 million, besting consensus by $5.55 million. Revenue increased by 9% from Q3.

The adjusted operating margin for the quarter hit 34%, marking the fifth consecutive quarter in which that metric increased.

Adjusted free cash flow (“FCF”) for Q4 was $305 million with over $731 million in FCF for the full year.

For the full fiscal year, revenue of $2.2 billion increased by 17%, adjusted operating margin was up 600 basis points to 28%, and adjusted FCF was $731 million.

GAAP operating income and net income for FY 2023 was $120 million and $210 million, respectively.

The company’s customer count hit 497, a 35% increase over FY 2022.

Management guides for revenue in a range of $612 million to $616 million and adjusted income from operations in a range of $196 million to $200 million in Q1.

For the full fiscal year, PLTR forecasts revenue in a range of $2.652 billion to $2.668 billion and adjusted income from operations of $834 million to $850 million.

Adjusted free cash flow for FY 2024 is forecast in a range of $800 million to $1 billion.

Focusing On The Commercial Business

As I noted in the introduction, PLTR began as a company that provided governmental agencies with protection from malware. It recently began offering an artificial intelligence platform designed for commercial customers. Using its boot camp system to introduce AIP, Palantir’s growth among commercial clients has skyrocketed.

In FY2023, total commercial revenue was up 36% year-over-year to $457 million.

In Q4, US commercial revenue surged by 70% year-over-year and 12% quarter-over-quarter to $130 million in Q4 and $284 million for the fiscal year.

In the U.S., the number of commercial customers increased 55% year-over-year and by 22% quarter-over-quarter.

In contrast, government revenue increased by 11% year-over-year and 5% quarter-over-quarter to $324 million.

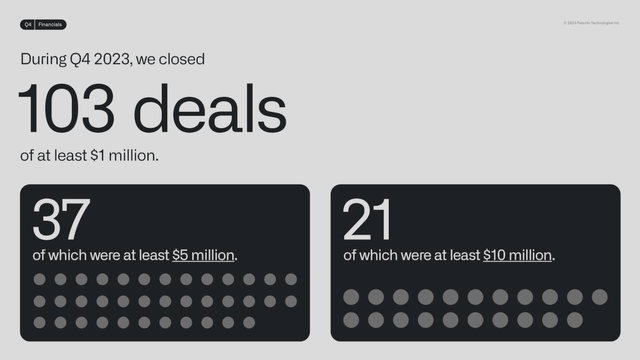

Combining the two, Palantir landed 103 deals worth over $1 million, twice the number of seven-figure deals compared to last year.

Palantir Investor Presentation

For FY 2024, the company guides for U.S. commercial revenue to top $640 million, up at least 40% over last fiscal year.

Where We’ll See Growth

Most of Palantir’s revenues stem from government agencies. The Department of Defense and the National Institutes of Health are particularly large clients, and we should continue to see robust sales from those sources.

As I was investigating PLTR on Good Friday, the company announced it was awarded a $9.8 million contract by the Defense Information Systems Agency. This follows the revelation early this month that the company was awarded a $178.4 million contract from the U.S. Army for a project known as TITAN. It’s estimated that the TITAN contract is the fourth-largest by annual revenue run rate in the company’s history.

However, Palantir is now gaining traction among commercial clients. As of the end of this quarter, Palantir’s commercial customer count is 13 times larger than it was three years ago.

Over the last 12 months, and for the first time in Palantir’s brief history, the commercial business surpassed $1 billion in revenue.

Late last year, the company won a seven-year, $414 million contract from Britain’s National Health Service.

Much of Palantir’s growth is fueled by the company’s AIP bootcamps. The firm describes the bootcamps as “immersive hands-on keyboard sessions (that) allow new and existing customers to build live alongside Palantir’s engineers, all working toward the common goal of deploying AI in operations.”

The company employs the bootcamps to teach prospective clients “how to apply AI to mission-critical operations,” to “develop initial use cases in AI,” and to “onboard and train users for rollout.”

The boot camps have been a resounding success. Last October, management set a goal of presenting 500 AIP boot camps over a twelve-month period. However, in Q4 alone, Palantir completed over 560 boot camps for 465 organizations.

During the last earnings call, management provided the following overview on how the boot camps are driving sales and harvesting customers.

We’re already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition, which rose to 22% sequentially for US commercial in Q4 versus 12% and 4% in Q3 and Q2, respectively. And we more than doubled the number of US commercial deals with TCV of $1 million or more from the fourth quarter in 2022 to 2023. We’re also seeing a meaningful increase in our US commercial TCV on a dollar-weighted duration basis, which is up 107% year-over-year and 42% sequentially.

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer.

Palantir Investor Presentation

Palantir’s AIP appeals to a broad swath of businesses. In Q4 alone, the company closed deals worth over $25 million each with a major rental car company, a telecommunication company, and “one of the largest pharmaceutical and biotechnology corporations in the world.”

Last quarter, PLTR also signed deals worth $5 million to over $10 million each with a consumer-packaged goods holding company, a bank, an equipment rental company, an automotive parts manufacturer, a health network, and a battery manufacturer.

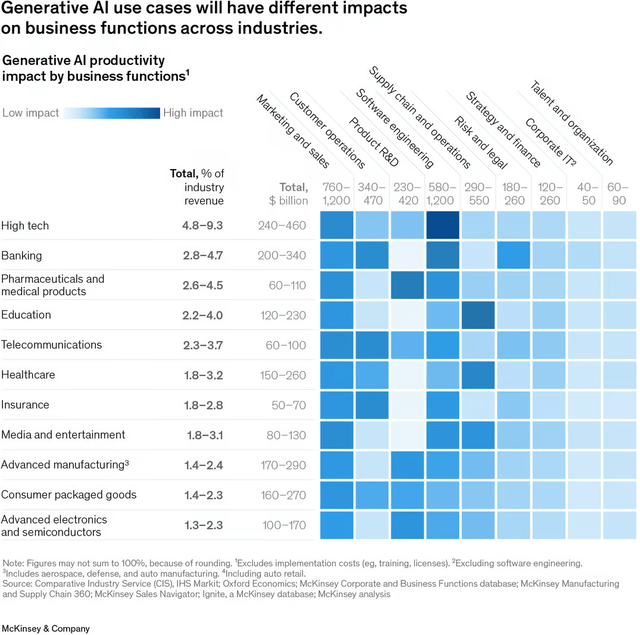

A report by McKinsey & Company illustrates how generative AI will fuel business efficiency and productivity, driving revenue and margins.

For example, McKinsey forecasts that in the banking industry alone, generative AI “could deliver value equal to an additional $200 billion to $340 billion annually if the use cases were fully implemented.”

The annual McKinsey Global Survey revealed that 40% of respondents plan to increase their investments in AI.

The following chart provides insights into the impact the adoption of AI will have on differing industries.

McKinsey’s study provides a compelling argument that many companies must adopt AI in order to remain competitive with peers.

According to McKinsey, annual global productivity could increase by $4.4 trillion with the widespread adoption of AI.

Debt And Valuation

As of the end of the fiscal year, PLTR had $3.7 billion in cash and equivalents and zero debt.

PLTR has a forward P/E of nearly 160x. The stock’s 5-year PEG ratio is 1.76x.

The 19 analysts that follow the company have a price target of $20.02. The stock is rated as a strong buy by 3 analysts while two rate PLTR as a buy. Eight analysts rate the stock as a sell or strong sell.

Is Palantir A Buy, Sell, Or Hold?

Count me as one that believes the market has gone a bit astray over AI. It seems to me that anything and everything with a hint of AI is now trading at a premium. Don’t misunderstand my intent. I’m not claiming there are no investment opportunities in AI related stocks, I’m simply noting that the market seems to be taking a scattershot approach to investing in AI companies.

Nonetheless, I do believe that Palantir’s boot camp approach is both creative and effective. By demonstrating to potential clients, the efficacy of the company’s artificial intelligence platform and large language models, Palantir has driven robust growth.

Since it reported Q4 results, PLTR was awarded the 24-month, $178 million U.S. Army Titan contract. That was followed last week by a $9.8 million contract from the Defense Information Systems Agency.

In addition to these large government contracts, the firm’s Q4 commercial total contract value booked was $699 million, up 156% year-over-year and 74% sequentially.

Palantir’s US commercial customer count reached 221 customers, a 55% growth year-over-year and 22% growth sequentially.

Now ponder that Palantir’s total revenue in 2020 was $900 million, and that analysts forecast $3.2 billion in sales for the company in 2025.

Unfortunately, the problem with Palantir Technologies Inc. stock at this juncture is its valuation. With a forward price-to-sales ratio of nearly 19x and a forward P/E of nearly 159x, Palantir has to notch very high growth for an investment in the firm to make sense.

Consequently, I must rate Palantir Technologies Inc. as a HOLD.

However, despite my hold rating, I took a very small position in Palantir Technologies Inc. stock. I fully acknowledge that this is a high-risk investment, but it may also provide outsized rewards, in time.

I’ll leave you with the perspectives of first a bear and then a bull analyst.

The company’s commercial business is witnessing a strong acceleration, especially in the US, as demand for the company’s AI Platform remains strong. The company’s latest marketing strategy of organizing short duration [AI Platform] bootcamps is accelerating new customer acquisitions.

– HSBC analyst Stephen Bersey (downgrade from buy to hold due to valuation).

In contrast,

Our recent checks on Palantir in the field have been incrementally more bullish as we believe the AIP foundation is becoming viewed by many US enterprises as the ‘launching pad of AI use cases.

With the AI Revolution now quickly heading towards the key use case and deployment stage, Palantir with its flagship AIP platform and myriad of customer bootcamps is in the sweet spot to monetize a tidal wave of enterprise spend now quickly hitting the shores of the tech sector in our opinion.

– Wedbush Securities analyst Dan Ives.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!