Summary:

- Green shoots are emerging with Palantir Technologies Inc., as strong customer growth has eventually led to surprising cRPO growth.

- Palantir management is guiding for 20% full-year revenue growth, but I predict further acceleration as customers camp up spending.

- The company has generated positive GAAP net income for 5 quarters straight and awaits potential inclusion in the S&P 500.

- I explain why I have sold my Palantir position.

Chip Somodevilla/Getty Images News

All good things may eventually come to an end. I have enjoyed investing deep in tech stocks over the past few years, but with valuations approaching bubbly levels (in my humble opinion), I have been needing to say goodbye to many high-quality names. Today I say goodbye to Palantir Technologies Inc. (NYSE:PLTR), a stock which I view to be the implementer of generative AI.

While the company has yet to fully show its predicted “Nvidia (NVDA) moment,” green shoots are beginning to show in the fundamentals including in the accelerating customer and remaining performance obligation growth. Yet, with the stock trading at nearly 20x sales, I am of the view that this optimism is now priced in.

PLTR Stock Price

I last covered PLTR, in January, where I explained why strong customer growth may be predicting an eventual acceleration in top line growth even as actual revenue growth rates remained modest. The stock is up around 35% since then, though it is not clear how much of a role broader tech volatility played in that run-up.

The latest report showed more signs of a potential acceleration beyond just customer growth, and management guidance was constructive as well.

PLTR Stock Key Metrics

PLTR is an enterprise tech company who, in their own words, “builds software that empowers organizations to effectively integrate their data, decisions, and operations.” Not every business will benefit the most from an intelligent chatbot, and that’s where PLTR comes in. I view the company as being an implementer of generative AI, as it helps customers discover personalized use cases for artificial intelligence that a one-size-fit-all solution might not encompass.

Perhaps it is unfortunate that the rise of generative AI has occurred during a tough macro environment highlighted by higher interest rates and increased scrutiny on IT budgets, as I believe these are masking the underlying growth opportunity for PLTR. In its most recent quarter, PLTR generated 20% YoY revenue growth to $608 million, handily beating guidance for $599 million to $603 million (and consensus estimates for $603 million). As usual, the company saw its greatest growth rates from its commercial customers, especially those located in the United States.

The government business, which continues to form the majority of overall revenues, grew at a slower 11% YoY pace, but I view these revenues as being of higher quality and I wouldn’t be surprised to see growth accelerate at some point in the future. It is possible that geopolitical uncertainties are keeping a lid on government budgets.

These growth rates are admittedly modest and may cause some investors to grow skeptical of the valuation, but readers should look beneath the surface. After reporting just 8% YoY billings growth in the third quarter, PLTR saw billings growth accelerate to 56% YoY and 10% QoQ.

Many investors may look towards short-term remaining performance obligation (“cRPO”) growth as an indicator of future revenue growth. After many quarters of single-digit growth, PLTR reported a stunning 24.3% YoY growth in cRPOs to $643 million. It is unclear if seasonal factors played a role in this, though I note that the company saw RPOs decline 25% QoQ in the fourth quarter of 2022. While many tech companies saw overall RPOs get pressured in 2022 and into 2023 due to customers seeking smaller contract sizes (perhaps in part due to higher interest rates), cRPOs focus on RPOs is expected to be realized within 12 months and, in theory, are not so affected by these fluctuations.

The acceleration in cRPO growth may be evidence of what many PLTR investors have long anticipated: a surge in top line growth spurred by booming generative AI demand. The company saw customer growth accelerate further, with total customers growing 10% QoQ and 35% YoY to 497. Commercial customers grew even faster, at 14% QoQ and 44% YoY. A lot of these customers might still be discovering use cases and may take time to ramp-up spending. However, given the nature of PLTR’s business model in which customers need to form personalized solutions, I expect the strong customer growth today to eventually lead to sustained above-market top line growth in the future.

Like many tech peers, PLTR has made great progress in driving profitability gains – it arguably is among the top peers, as it has now generated 5 consecutive quarters of positive GAAP net income. The company generated $209 million in adjusted operating income, surpassing guidance of $184 million to $188 million and representing a stunning 34% margin. I still remember the numerous skeptics who questioned whether PLTR can ever generate sustainable profits when it first came public.

PLTR ended the quarter with $3.7 billion in net cash, representing a bulletproof balance sheet.

Looking ahead, management has guided for up to 17.3% YoY revenue growth to $616 million and $200 million in adjusted operating income in the first quarter. Consensus estimates call for just over $617 million and $0.03 in GAAP earnings per share. For the full-year, management expects up to $2.668 billion in revenues, representing 20.2% YoY growth and more importantly, suggesting sequential acceleration as the year goes on. Management expects to generate positive GAAP profits in every quarter of the year. As a reminder, PLTR is eligible to be included in the S&P 500 Index (SP500), and I wouldn’t be surprised to see that finally happen at some point this year.

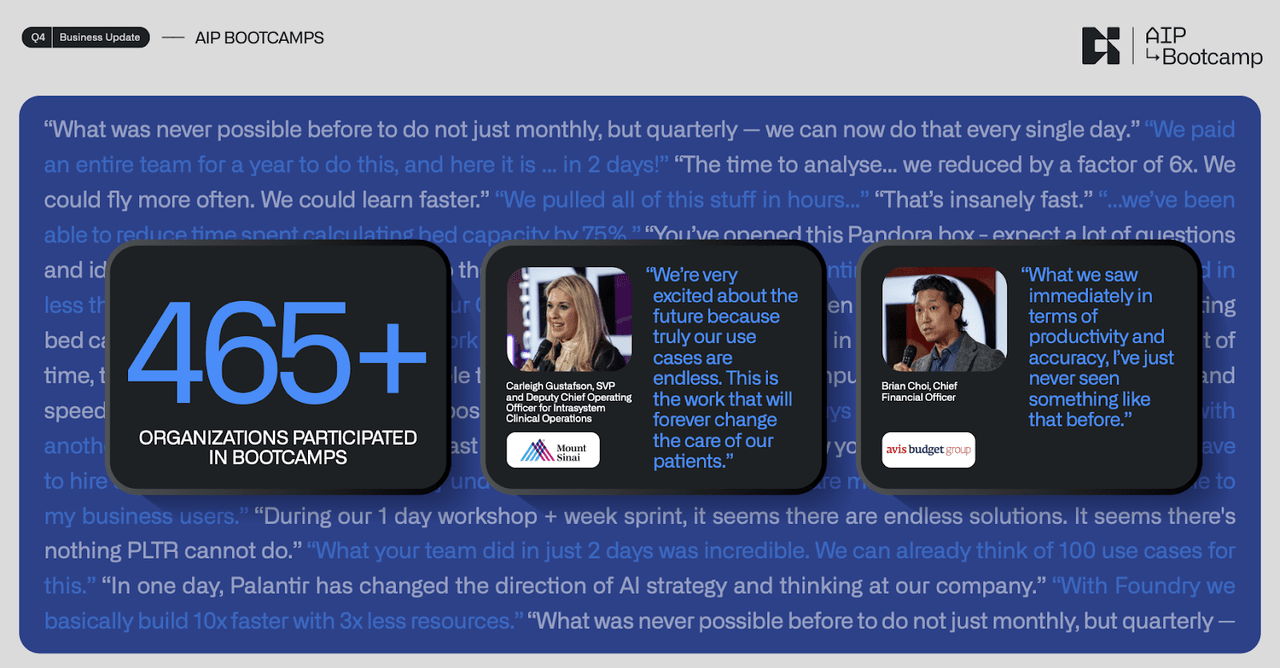

On the conference call, management noted that they had already conducted more than 560 AIP bootcamps since October, crushing their goal of 500 within a year. Management went on to call this their “Amazon.com-to-AWS moment,” which to some may sound like a hyperbole but makes sense to me given how important PLTR is to its customers, who otherwise may not know where to start in implementing generative AI for their personalized use cases. Management noted that “strategic commercial contracts” held back growth – excluding these contracts commercial revenue growth would have been 300 bps higher at 35% YoY. Management noted that revenue from these customers should make up approximately 2% of full-year 2024 revenue as compared to 4% in 2023, suggesting a declining impact.

Management rightfully noted that their strong profitability “has positioned us to be able to escalate investment and resources to AIP.” Management committed to “expense growth below revenue growth for the full year” but noted that they intend to grow expenses to meet the AI opportunity.

Is PLTR Stock A Buy, Sell, Or Hold?

PLTR is performing very well from a fundamentals perspective, and the strong customer and cRPO growth may indicate an eventual acceleration in top line growth. However, I am questioning whether this optimism is already baked into the stock price, with the stock recently trading at 19x sales.

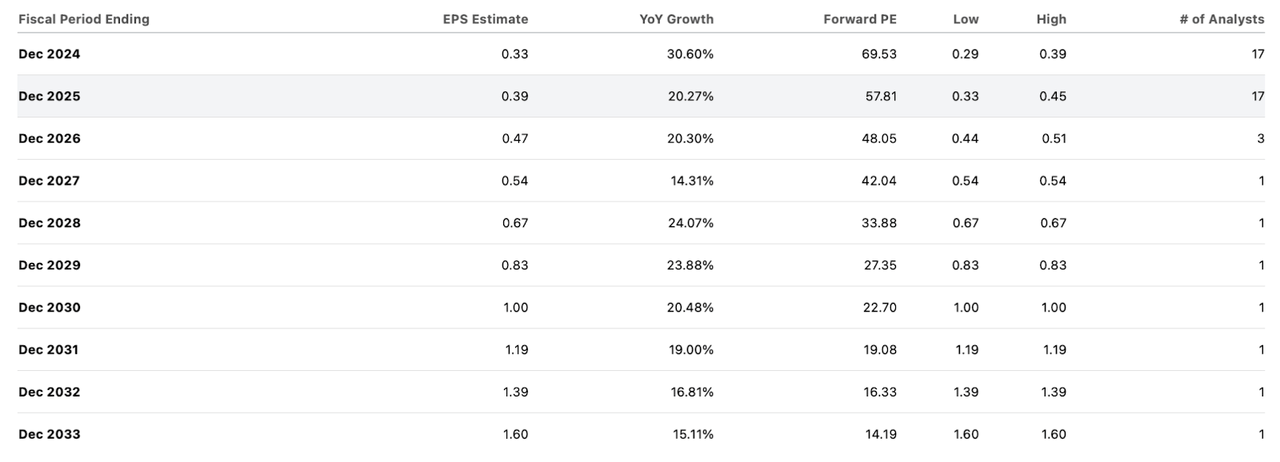

Consensus estimates call for the company to generate 31% net margins by 2033 and trade at 14x 2033e earnings.

In my view, these estimates appear to reflect a bullish view but rather achievable, assuming the company can gain traction from its AIP bootcamps. I apply a 10x sales multiple which correlates to a 30x earnings multiple assuming 33% long term net margins. That implies roughly 8.4% potential annual returns over the next decade.

But perhaps investors are more optimistic and believe that generative AI may lead to a greater acceleration in top-line growth than implied above. Below I give an example model which assumes an acceleration to 35% growth followed by gradual deceleration thereafter.

Author’s estimates

If we again assume that PLTR trades at 10x sales in 2033, then that implies 14.4% potential annual returns over a decade. To illustrate a point, we can ignore the bear case scenario and try to estimate the potential returns by applying a 50% probability to the initial bullish scenario and 50% probability to this ultra-bullish scenario. That would imply a stock price of around $70 per share by 2033, or 11.8% potential returns over a decade. This would likely be enough to beat the market’s typical 8% average return, and one can make the argument that PLTR deserves a lower valuation hurdle due to its GAAP profitability. However, this prospective return is just barely lower than my targeted hurdle rate even for stocks of this lower risk profile, as I would instead prefer prospective returns in the 13% level or higher.

Conclusion

I continue to expect Palantir Technologies Inc. to have a “breakout” quarter in which it shows a material acceleration in revenue growth, and I base that projection on the strong customer and cRPO growth rates. That said, I am also of the view that tech stocks as a whole have levitated to uncomfortable levels and that much of that optimism is already priced into the stock price. I am now downgrading Palantir Technologies Inc. stock from “Buy” to “Hold,” representing a neutral rating, and I have sold my position in the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!