Summary:

- PayPal’s challenges with slowing account growth persisted in the first quarter.

- PayPal’s account growth fell to just 1% in 1Q-23. The market now appears overly bearish.

- With that said, I believe PayPal’s valuation now reflects a high margin of safety.

Justin Sullivan

PayPal Holdings Inc. (NASDAQ:PYPL) continued to face significant challenges in terms of account growth in 1Q-23. Despite the fact that PayPal’s account growth slowed to 1% in the first quarter, I believe the company’s risk/reward tradeoff has significantly improved in the last few months.

While the market was overly bullish on PayPal two years ago, I believe the pendulum has swung back and the market is now overly pessimistic about the fintech’s growth prospects. PayPal has a P/E ratio of only 11x after the stock price plummeted following 1Q-23 results.

While I have previously been critical of PayPal, I believe the valuation at this point is too compelling to ignore.

Changing Position On PayPal

I’ve been concerned about PayPal’s slowing growth for a long time, and have frequently blogged about it in the last year. PayPal: Growth Is Now A Real Problem, my most recent fintech article, mentioned that headwinds to account for growth translate to sales headwinds as well.

However, when considering PayPal’s long-term value proposition in the digital payments market, I believe the fintech’s valuation now reflects a high margin of safety, and investors may want to consider taking a long position.

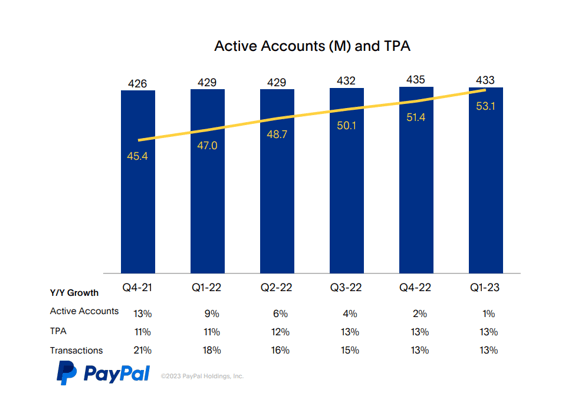

PayPal’s Account Growth Has Slowed To Just 1% In 1Q-23

When I consider PayPal, I believe that the most important KPI is customer account growth. As long as PayPal continues to add new customer accounts to its platform, it is likely that the fintech will continue to see sales growth, as it did in 1Q-23: Despite a drop in account growth to 1% YoY in the first quarter, PayPal’s sales reached $7.0 billion, representing 9% YoY growth, or 10% in FX- adjusted terms.

PayPal ended the first quarter with a solid 433 million customers using their PayPal accounts, and while acquisitions have slowed due to economic headwinds, I believe PayPal will continue to be a formidable player in the payments’ industry for a very long time.

Active Accounts (PayPal Holdings)

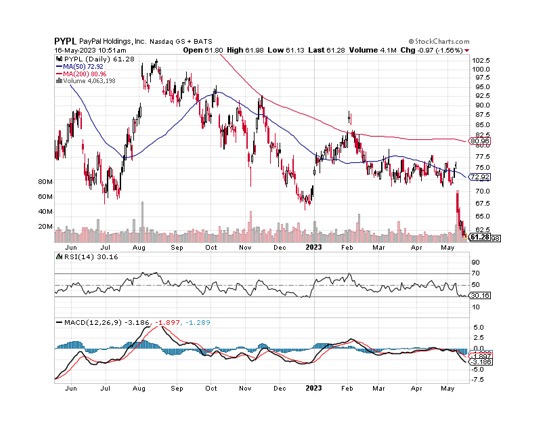

The Pendulum Has Swung The Other Way And I Am Buying The Post-Earnings Drop

PayPal’s stock price dropped sharply following the fintech company’s first-quarter results last week, and it has yet to recover. Disappointment with PayPal’s operating margin outlook (which was reduced from 125-basis point growth to 100-basis point growth) has caused the stock to become oversold in the technical sense, and the price has also reached a new 52-week low. For contrarian investors, this could be a good time to buy. The Relative Strength Index indicates a value of 30.16, putting PayPal close to oversold territory.

Furthermore, PayPal forcefully crashed through its 50-day moving average line, which is considered as a short-term sell signal. In the short term, there is a strong possibility that PayPal will suffer from ongoing stock price weakness and fall to new lows.

Having said that, I believe investors can now acquire a premier fintech brand with a large customer base at a valuation that, in my opinion, reflects a very high margin of safety.

Moving Averages (Stockcharts.com)

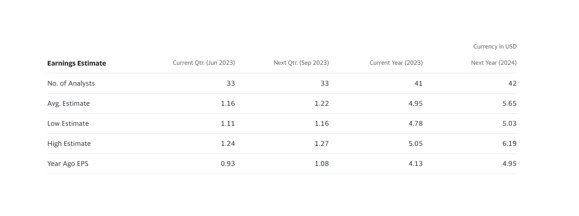

Drastic Revision Of PayPal’s P/E-Ratio

The market currently forecasts $4.95 per share in adjusted profits for PayPal’s fiscal year 2023, which is consistent with the company’s increased profit forecast (PayPal raised its EPS outlook for the current fiscal year from $4.87 to $4.95 per share).

The market anticipates 14% YoY profit growth in 2024, implying an earnings multiple of 10.8x based on the current stock price of $61.28. Despite the fact that the fintech’s overall growth is slowing, I believe PayPal is a steal at less than eleven times forward earnings and offers payment services to 433 million people.

Earnings Estimate (Yahoo Finance)

Why PayPal Could See A Lower/Higher Valuation

Investors should keep in mind that PayPal is a tremendously profitable fintech company (with 1Q-23 profits of $795 million and a profit margin of 11%), which I believe significantly limits the downside for PayPal’s stock. Share repurchases may also help to maintain or establish a floor under the fintech’s stock price.

However, there are risks here that should not be overlooked: If PayPal’s growth, particularly in platform accounts, continues to deteriorate, there may be more selling pressure and PayPal’s stock may reach new lows.

Softening operating margins are not a major risk in my opinion, because the change in operating margin growth forecast was relatively minor (+/- 25 basis points).

My Conclusion

My perspective on PayPal has shifted, owing in large part to a shift in market sentiment toward the fintech and the stock’s much, much more appealing valuation compared to last year, when PayPal’s stock traded at twice the valuation.

PayPal’s earnings multiple has compressed, and paying less than 11 times 2024 earnings for the world’s largest fintech brand now appears to be a steal, even if growth may be slowing.

PayPal’s platform still has an enormous global reach, and with approximately 433 million customers, the fintech, in my opinion, will retain significant clout in the industry.

I believe PayPal’s valuation reflects a very high margin of safety, with an earnings multiple of 10.8x, and the stock is now a steal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.