Summary:

- PayPal’s operations and financials have remained stable, making the risk/reward attractive at the current share price.

- Margins have improved, and total payment volume is growing, indicating positive growth potential.

- Venmo may not be a major revenue catalyst, but PYPL’s BNPL segment shows promise for future growth.

Justin Sullivan

Investment Thesis

The slowing down in revenue growth since the pandemic and a slight loss of total active users have brought PayPal (NASDAQ:PYPL) down since the last time I covered it. The operations of the company have not changed since then and the biggest deterrent from starting a position, which was the high asking price, disappeared and I believe the risk/reward is attractive right now.

A little background

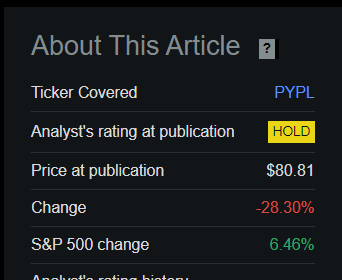

The company has retreated over 28% since my last article, in which my biggest gripe with the company at that time was revenue growth. So, for that type of revenue growth I required a higher margin of safety, which in order for me to accept the risks, the share price had to come down significantly. Fast forward to late September, and with my updated valuation, the company is trading at around the price I agree with.

PYPL price change since the first article (Seeking Alpha )

Latest Quarter

So, the latest results were about what I expected to see from the company. Revenues were up 7% in the 6 months ended June. Nothing outstanding, but I wasn’t expecting spectacular growth from the company with such a reach already. What I would like to see is how the company’s margins developed over the last 6 months since I covered it. Operating margins have improved by around 250bps compared to the same time last year, which is quite decent in my opinion. This marks the company’s 3rd consecutive quarter of margin improvements. This will be reflected in my valuation analysis too. The management is talking about using AI more to improve efficiencies going forward, and I am curious to see how they can use it to their advantage in the future.

The company’s total payment volume is still growing at a respectable rate of 11%, which is faster than at the end of FY22 by 2%. The company still has well over 400m active accounts, which stood at around 431m and slightly up from the prior year, and to see that the transactions per active account are increasing 10% y/y is rather impressive I must say. Since I covered the stock last, I didn’t have in mind that margins and growth would be at such numbers, so it warrants me to update my valuation also.

Venmo

The company I believe is falling behind in its competition like Block’s (SQ) CashApp and Zelle. It has had amazing growth since its beginnings; however, the growth has stalled, and I don’t see this being a major catalyst for the company’s revenue growth. I don’t think having Venmo in PYPL’s portfolio is going to hurt and the revenue segment can keep chugging along as it is. I can see the risk/reward to be skewed more towards positive in my opinion if the growth re-accelerates in the future.

Will the release of the company’s stablecoin 100% back by the US dollar deposits, short-term US treasuries, and similar equivalents present a significant opportunity for growth for Venmo? I will need to see more results in the next couple of quarters.

CEO

A change is not necessarily always good, however, when I hear companies are changing CEOs, I want to believe that the next guy will do all he can to right the ship and Alex Chriss will bring in a fresh perspective and a fresh set of eyes to see how the company can be helped. I’m not sure how qualified he is to run PYPL, however, he did a great job at Intuit by the looks of it.

BNP

I believe the segment is going to be very promising for PYPL and the news that the company is in the process of selling receivables of its European operations that originated in France, Germany, Spain, and the UK to KKR will bring in a good amount of cash for the company, which will help the company with its strategic initiatives. And it looks like it is going to use a good chunk of that money to repurchase shares, which I don’t think is the worst, but it’s not as exciting as actual growth initiatives. BNPL model has a massive potential for growth, which is projected to be at around 46% CAGR through ’30. I’d be a little more on the conservative side of this, but it is a positive development for PYPL.

Overall, I feel like the company is doing as well as it has since the last time I covered it. It seems to be growing slightly better than I assumed in January of this month in terms of margins. The only thing that changed in my view is that the stock has come down to my price target now while operations did not deteriorate, in other words, my thesis of the company has changed.

Quickly on the latest financials

As of Q2 ’23, PYPL had around $9.9B in liquidity against $10.5B in long-term debt. How worrisome is this? I would not say much since the company’s operating income came in at $2.1B six months ended June while interest expense stood at around $174m, meaning the interest coverage ratio is around 12x. What’s even better is that the company’s investments are yielding more than it is paying out in interest expenses on debt. So, it is safe to say the company is at no risk of insolvency there, even with so much debt.

The company’s current ratio has been steady at around 1.3, which isn’t the best, but it isn’t bad either. It can easily cover its short-term obligations, so the company has no liquidity problems.

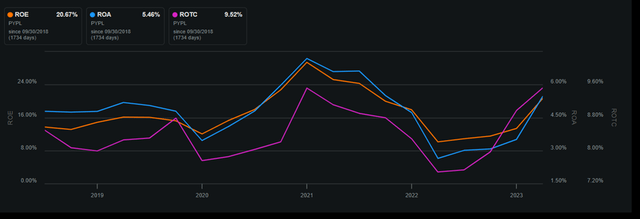

In terms of profitability and efficiency, the company’s ROA, ROE, and ROTC are decent, and what I can see is that these numbers are on the rise. Seems like the management is starting to utilize the company’s assets and shareholder capital more effectively than before, which should turn into increased value over time.

ROE, ROA, and ROTC decent and on an uptrend (Seeking Alpha)

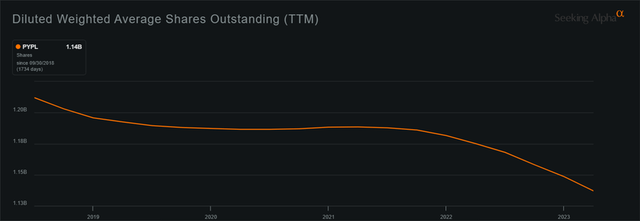

Shares outstanding have steadily been coming down also, and if the company’s average price is at around these levels that we see right now, then that’s a good sign because if the company purchased shares when they were overvalued, that would just be wasted cash that could have been used for further growth of the company.

Shares Outstanding (Seeking Alpha)

Overall, it’s a decent balance sheet, with no apparent red flags that I could see right now, and hasn’t changed too much since my first article. So, let’s see what has changed that made me change my rating.

Valuation

Well, what changed my rating the most was that the company has plummeted in share price since January. The operations of the company have been decent overall, but back in January it was a little too expensive to start a position and wanted to come down to around the $50-$55 range. Fast forward to today, the company is very close to that range.

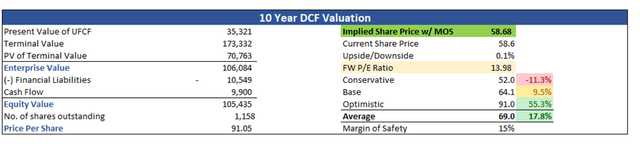

I updated my valuation numbers slightly as I got more information in the last couple of quarters, but I still kept it relatively conservative, because I went with GAAP EPS and margins for that extra cushion. I’ve also reduced my margin of safety to 15% since I believe the risks have subsided when it dropped over 27% since my last coverage.

With that said, my updated price target is around $58 a share, which is where the company is currently trading.

Risks

The short-term risk is the negative sentiment of the company continues for much longer and we will see further share price depreciation. I wouldn’t be surprised if we see further 52-week lows in the next 3 months or more, however, I believe a lot of the bad has been priced in and any further deterioration is an opportunity to average down.

We don’t know how well the new CEO is equipped to run a business like PayPal and we will have to see what he’s going to prioritize going forward.

Active accounts may start to drop once again if the company isn’t able to keep up with the competitors in the long run because of the lack of differentiation and it is too costly to be a user of PYPL’s products when the alternatives are cheaper to use and are more user friendly.

Macroeconomic headwinds have still not dissipated, which in turn may bring down stock prices further. Interest rates are going to be elevated a little while longer before the Fed is going to start to cut. We don’t know when that will happen as the Fed is open to any sort of action, which will be dictated by inflation reports and other economic reports over the next months.

Closing Comments

So, to be honest, I didn’t think it was going to come down to my conservative estimates in 8 months. Most of the comments surrounding PYPL seemed to be saying that the worst was gone and the company is going to see $100 before it comes down to the high $50s. Now that the biggest gripe for me of the company is gone, which was its elevated share price, I will be opening a position relatively soon, but will wait out this volatility slightly longer, which I believe will bring down the share price even further, but if it doesn’t in the next couple of weeks, I will be starting a relatively small position to test the waters.

The company is making cash hand over fist, buying back its shares consistently and its financials are showing a healthy company overall. The outlook, even if we look at it conservatively, is decent enough that should eventually reward shareholders in the long run, once the negative sentiment towards the company goes away. It happened to Meta (META); it is happening to PYPL now also. We might miss when the company’s going to take off just like Meta did when it was trading at a 10 PE ratio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.