Activision Blizzard: Latest Approval Marks A Significant Milestone In Complex Merger Journey

Summary:

- Microsoft-Activision merger navigated global regulatory hurdles, gaining crucial approvals in the EU and USA after significant concessions.

- The UK’s CMA initial blockage and subsequent preliminary approval of Microsoft’s acquisition of Activision Blizzard mark a crucial development.

- Activision-Blizzard investors and employees will receive $95 per share post-acquisition, with clear provisions for vested and unvested options.

- Given the limited 1.13% upside and uncertain completion date of the acquisition, Activision is considered a hold despite anticipated approval.

Kevork Djansezian

Investment Thesis

I believe Activision Blizzard Inc. (NASDAQ:ATVI) is a hold. The journey of the Microsoft (NASDAQ:MSFT) Activision merger has been a complex tapestry of regulatory negotiations, marked by significant concessions to gain approvals from stringent global regulators, notably in the EU and USA. The UK’s Competition and Markets Authority (CMA) played a pivotal role, initially blocking the deal due to competition concerns, but a revised proposal has substantially addressed these concerns, marking a significant step forward in the merger process. For Activision Blizzard investors and employees, the acquisition translates to a clear and structured financial outcome, receiving $95 per share and having provisions for both vested and unvested options. However, the investment perspective on Activision is nuanced. The limited upside of 1.13% and the uncertainty surrounding the completion date of the acquisition make Activision a hold, despite the high probability of the acquisition’s completion, reflecting the intricate balance of opportunities and challenges in this high-stake merger.

Company Overview

Activision Blizzard, Inc. is a leading global developer and publisher of interactive entertainment content and services, developing content for video game consoles, PCs, and mobile devices. It operates esports leagues and offers digital advertising within some of its content. Activision Blizzard’s key product offerings include titles and content for franchises like Call of Duty and Blizzard Entertainment’s Warcraft, Diablo, and Overwatch.

On January 18, 2022, announced plans in an all-cash transaction valued at $68.7 billion, offering $95.00 per share. This acquisition has been approved by Activision Blizzard’s shareholders and is expected to accelerate growth in Microsoft’s gaming business across mobile, PC, console, and cloud gaming. However, the completion of this acquisition is subject to obtaining required regulatory approvals and satisfaction of other customary closing conditions. Microsoft and Activision Blizzard have agreed to extend the merger agreement through October 18, 2023, to resolve remaining regulatory concerns. Recent developments from government regulators across many of Activision’s major markets suggest to me that a deal is close.

A Long Journey with the End in Sight

The journey of the Microsoft-Activision Blizzard merger has been a labyrinth of regulatory hurdles, marked by approvals, rejections, and ongoing scrutiny. The merger has received the green light in numerous countries, including the European Union (EU), China and the USA. I note these countries in particular because these are some of Activision’s largest markets and have historically made it difficult for Big Tech companies such as Microsoft to acquire smaller business and this takeover attempt has been no different.

In order to get approval from regulators, the company had to concede on many issues. The European Commission had concerns around the mergers impact on competition in the cloud gaming space and as such it proposed to provide free licenses that would allow European consumers to stream Activision games on various cloud gaming services for the next ten years. This compromise was pivotal in swaying the Commission, with the EU’s competition commissioner, Margrethe Vestager, commending the decision as a promoter of competition and growth within the cloud gaming sector. Activision’s biggest market, the US, was one of the last major markets to approve the merger and was strongly opposed to the proposal with the Federal Trade Commission (FTC) attempting to halt Microsoft’s purchase of Activision. This was until July 11 when the US appeals court rejected the FTC’s request to halt Microsoft’s $69 billion purchase. This decision was crucial as it eliminated one of the major barriers Microsoft faced in finalizing the deal and expanding its gaming empire and left only one major market left, the UK.

Approval in the UK is a Pivotal Moment

The recent developments in Microsoft’s acquisition attempt of Activision Blizzard signify a pivotal moment in Microsoft and Activision’s ongoing dance with regulatory scrutiny. The UK’s CMA has been a significant hurdle, initially blocking the deal over concerns it would stifle competition, particularly in the burgeoning cloud gaming sector. However, the CMA’s recent statement on September 22, that Microsoft and Activision Blizzard have “substantially addressed” the antitrust concerns mark a crucial step forward, potentially setting a precedent for future tech mega mergers.

In my opinion, Microsoft’s strategic navigation through the regulatory landscape, marked by its willingness to transfer cloud streaming licensing rights of Activision Blizzard games to Ubisoft Entertainment, reflects a sophisticated understanding of balancing innovation and market dominance. This move, intended to prevent Microsoft from monopolizing the cloud gaming sector by releasing Activision games exclusively on its own streaming service, is a significant concession. It demonstrates a pragmatic approach to compliance, potentially serving as a blueprint for other tech giants in future acquisitions.

The CMA’s reversal is particularly noteworthy given the global context, with the deal having cleared regulatory barriers in other jurisdictions. It underscores the pressure on the last-standing regulatory body when the acquisition has received a nod in regions representing a substantial share of global revenues. The ongoing consultation until October 6 is now the focal point, with the final decision poised to impact not just the entities involved but also set the tone for regulatory approaches to tech acquisitions globally.

The broader implication of this development is the potential emboldening of Big Tech in pursuing large-scale acquisitions, albeit with a clearer understanding that substantial concessions may be inevitable. The tech industry’s growing power continues to be under the microscope, and how companies like Microsoft maneuver through this scrutiny will likely shape the industry’s acquisition strategies moving forward.

Given the extensive information and the recent developments, particularly the UK approval, I believe the probability of the Microsoft-Activision Blizzard merger reaching completion has significantly increased. The meticulous scrutiny and the subsequent approvals from various global regulatory bodies, including the decisive rejection of the FTC’s request to halt the purchase by the US appeals court, have been pivotal in steering the deal towards closure. These were substantial hurdles and overcoming them has brought a sense of inevitability to the merger’s completion.

What this Means for Investors

As I mentioned, the most recent development from the UK’s CMA has significantly increased the probability that the merger is complete, and the Activision is bought out for $68.7 billion or around $95 per share. As this acquisition is set to be all cash, Activision Blizzard shareholder will receive $95.00 for each share of Activision Blizzard stock they own after the closing of the deal.

For investors and employees holding Activision Blizzard options, the acquisition is also very clear. Activision Blizzard employees will be able to convert their unvested Restricted Stock Units (RSUs) and Performance Stock Units (PSUs) to Microsoft RSUs and is designed to maintain the existing schedule and structure of employee stock units. Employees with stocks that are yet to vest will have their stocks converted to Microsoft’s, adhering to the original timeline set by Activision Blizzard. This implies that upon the completion of the vesting period, employees will acquire Microsoft stocks instead of Activision Blizzard’s, ensuring a seamless transition of stock assets. For vested RSUs and options, the approach is distinct. Vested RSUs will be cancelled, and employees will receive $95.00 for each, compensating the value of the vested stocks at the merger consideration price. Vested options will also be cancelled, but employees will be compensated with the difference between the $95.00 per share merger consideration and the exercise price of the Activision Blizzard option. For instance, if an option allows an employee to buy a share at $80, the employee will receive $15 as the difference, compensating for the value they held. However, there is a specific provision for options that are ‘out of the money’, meaning the exercise price is equal to or exceeds the $95.00 per share merger consideration. If an employee or investor has the option to buy a share at a price equal to or exceeding $95, the option holds no intrinsic value and will be cancelled without any compensation. This provision is clear and unambiguous, ensuring uniform understanding among all stakeholders regarding the acquisition terms.

For Microsoft investors, you will be acquiring an industry leader in the video game industry with an impressive portfolio of well-known and established brands, including Call of Duty, World of Warcraft and Overwatch, as well as impressive financials which I will detail in the following section.

ATVI Major Titles (Activision Blizzard)

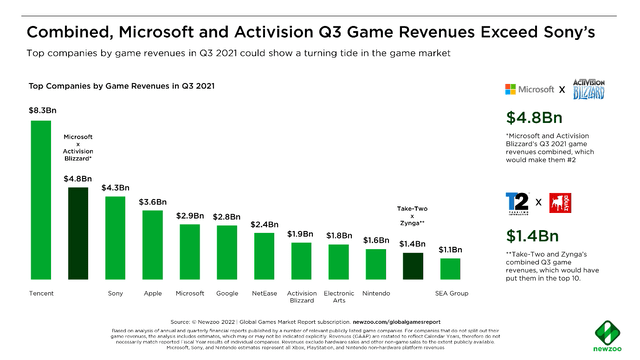

Activision also controls 8.3% of the video game software publishing industry, which is anticipated to grow at a compound annual growth rate (CAGR) of 13.4% until 2030. This acquisition will help Microsoft continue to increase its presence in the growing video game industry, surpassing some of its biggest competitors. In addition, Activision Blizzard will also contribute positively to cash flow generation for the Microsoft.

Market Share of ATVI in 2021 (Newzoo)

Financial Overview

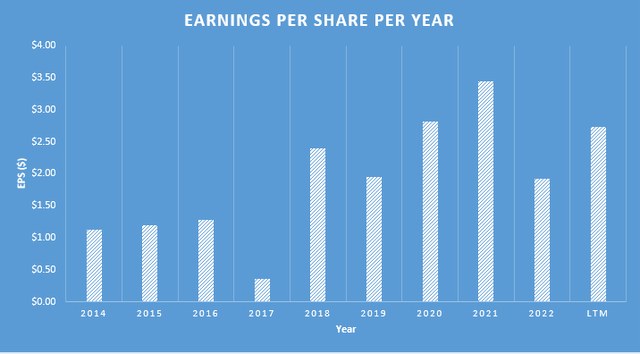

Over the past 5 years, the company has demonstrated strong financial performance. Its revenue grown steadily, increasing from $7.5 billion in 2018 to $8.71 billion in the last 12 months (LTM), however its worth noting its LTM revenue is below its 2021 revenue of $8.8 billion. The earnings per share (EPS), has also grown steadily from 5 years ago and like revenue, peaked in 2021 at $3.44 before dropping to $2.73 in the LTM, though we should consider that 2021 was an exceptional year for ATVI and was fueled by the tailwinds resulting from the pandemic.

ATVI EPS Per Year (DJTF Investments)

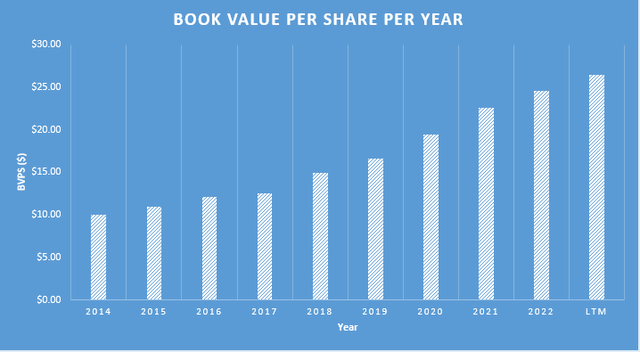

The book value per share (BVPS) has seen a consistent upward trend, growing from $14.91 in 2018 to $26.43 in the LTM, indicating a CAGR of approximately 12.1%. This suggests that the company has been successful in increasing its intrinsic value over the period. Free cash flow (FCF) has also been growing strong for ATVI, growing from $1.72 billion in 2018 to $2.45 billion in the LTM corresponding to a CAGR of 8.1%.

ATVI BVPS Per Year (DJTF Investments)

Activision Blizzard anticipate delivering robust financial performance for the entire year, propelled by the successful revitalization of the Diablo franchise and expansion in live operations throughout the company. However, they are mindful of potential risks, including those associated with their execution, consumer spending climate, and the labor market, and are thus cautiously forecasting their content releases for the second half. They continue to project at least high-teens year-over-year growth for revenue in 2023, and at least high-single digit year-over-year growth in net bookings and total segment operating income for the year.

Looking forward I anticipate the company continues to grow as the they continue to release strong, well-known titles in an industry that I anticipate will continue to see robust growth. Much of this growth of course, will be experienced by Microsoft who I expect to take control of Activision by October 18, which is when Microsoft executive Brad Smith said the firm is attempting to close the deal.

Valuation

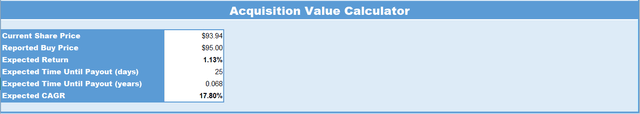

As I have mentioned throughout this article, now that the much of the regulatory concerns are behind us, I anticipate Microsoft will take control of Activision Blizzard. When the deal goes through, shareholders will receive $95 per share in exchange for all ATVI shares they own. Based on the current price of $93.92, this only corresponds to an upside of 1.13%, which is a rather limited upside. If you were to assume this deal were to be completed by October 18, which is 25 days from now, and the payout were to occur that same day, you would achieve a return of 17.8% CAGR. Obviously if the payout date were to occur any time after October 18 the CAGR achieved would continue to get worse.

ATVI Acquisition Valuation Calculator (DJTF Investments)

As I strongly believe this acquisition will happen and because of this limited upside, and the fact that there’s no guarantee of when this deal will be completed, I believe that ATVI is a hold.

Conclusion

The journey of the Microsoft-Activision merger has been a complex tapestry of regulatory negotiations, marked by significant concessions to gain approvals from stringent global regulators, notably in the EU and USA. The UK’s CMA played a pivotal role, initially blocking the deal due to competition concerns, but a revised proposal has substantially addressed these concerns, marking a significant step forward in the merger process. For Activision Blizzard investors and employees, the acquisition translates to a clear and structured financial outcome, receiving $95 per share and having provisions for both vested and unvested options. However, the investment perspective on Activision is nuanced. The limited upside of 1.13% and the uncertainty surrounding the completion date of the acquisition make Activision a hold, despite the high probability of the acquisition’s completion, reflecting the intricate balance of opportunities and challenges in this merger.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.