Summary:

- PayPal stock took a hit of nearly 20% from its post-earnings highs as investors buckled up for the impact of the recent banking crisis.

- However, we discuss why PayPal’s robust balance sheet is well configured against imminent liquidity risks.

- According to Hindenburg Research’s short-selling report, Block’s threat against PayPal may have been overblown.

- PYPL’s buyers could also be returning to defend against further selling downside.

- PYPL’s attractive valuation, potential consolidation, and credible management should appeal to long-term buyers to return.

chameleonseye

PayPal Holdings, Inc. (NASDAQ:PYPL) has suffered the brunt of sellers regaining the initiative after its FQ4’22 earnings release. Accordingly, PYPL declined more than 20% through last week’s lows.

We gleaned that PYPL also suffered from the recent worries over the collapse of Silicon Valley Bank or SVB (SIVB) and Signature Bank (SBNY), as seen in PYPL price action in the week of the banks’ failure.

Despite posting a solid FQ4 performance, PayPal buyers seem unwilling to lift PYPL’s valuation, taking profits quickly after its earnings release.

We assessed the recent events surrounding the banking crisis have also led to a risk-off sell-down in the market that impacted the financial sector. Therefore, a “sell first, ask questions later” perspective has taken over centerstage as investors fled the scene.

As a financial technology company, PayPal has also not been spared, as investors scrutinized whether it loaded its balance sheet with long-duration debt securities that fell victim to the Fed’s record rate hikes over the past year.

A closer inspection of PayPal’s balance sheet should inform investors that they don’t have to be unduly concerned. The company updated in its 10-K that it held about 57% of its “total cash, cash equivalents, and investment portfolio” in cash and equivalents.

Notably, PayPal reported $7.78B in cash as of the end of 2022, out of a total asset base of $78.7B. However, most of it was held as current assets amounting to $57.5B (73.4% of its total assets). Moreover, with current liabilities amounting to $45.1B, PayPal is unlikely to face imminent liquidity risk.

Also, we parsed its available-for-sale or AFS securities on its balance sheet. We were pleased with what we saw as management demonstrated that it managed to navigate its interest rates risks remarkably well.

Accordingly, PayPal posted $22.87B (gross amortized cost) in AFS securities as of 31 December 2022. However, it recorded unrealized losses of just $592M (2.6% loss ratio), resulting in a fair value of $22.28B.

Also, $10.16B of AFS securities had a duration of fewer than 12 months, posting unrealized losses of $150M or 1.5% of its $10.16B base. Despite that, its AFS securities over 12 months in duration resulted in unrealized losses of 4.3% of its AFS securities over 12 months.

Hence, it’s clear that while PayPal was also markedly impacted by its longer-term investments, its prudent asset allocation strategy helped avoid the massive unrealized losses experienced by distressed regional banks.

We believe it further demonstrated management’s credibility and also bolstered PayPal’s ability to weather the recent headwinds that engulfed the financial sector well.

Morningstar also corroborated management’s investment decisions in a post-earnings note, as it articulated: “The company’s balance sheet is sound, its capital investment decisions are fair, and its capital return strategy is appropriate.”

We believe it vindicated the sound investment decisions of management. As Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett once said: “You only find out who is swimming naked when the tide goes out.”

Moreover, in the recent Hindenburg Research report that “attacked” Block (SQ) CEO Jack Dorsey & his team, Hindenburg also highlighted its opinion about PayPal.

While the report did not focus on PayPal’s thesis, we assessed that there were notable mentions of PayPal in the short report. Hindenburg articulated, “Unlike Block, PayPal has stated in its filings since 2015 that its interchange fees are subject to regulatory risk.”

One of the central thesis concerning Block’s report was aimed at its interchange fees earned, which the research firm derided as “vague.”

Moreover, while competitive concerns have been leveled against PayPal as Apple (AAPL) Pay encroaches further into PayPal’s space, Block’s competitive threat against PayPal could have been overstated. Hindenburg stressed:

With its principled mission and easy to use Cash App payment platform, Block has gained a reputation as an innovator and one of the most well-known publicly traded fintech companies. By contrast, what we found is that the company’s payment system does not seem to offer a discernible edge over its key competitors like PayPal/Venmo, Zelle, or Apple. Rather, it seems to have simply embraced non-compliance as a tactic to grow its user base. – Hindenburg Research report on Block

Therefore, should buyers be expected to return to defend PYPL’s recent slide once the dust on the banking crisis settles?

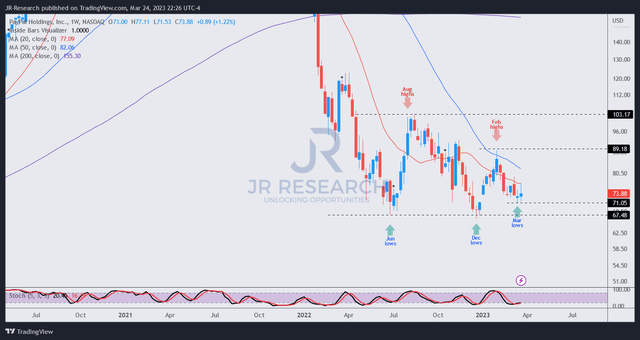

PYPL price chart (weekly) (TradingView)

We gleaned that PYPL buyers returned over the past week in their attempt to stanch a further decline, as seen in its price action above.

While the attempted rally this week has not panned out, buyers held last week’s lows. As a result, PYPL’s critical December lows were also defended, which is essential for its medium-term recovery thesis.

While we have not gleaned constructive price action suggesting buyers have returned strongly to help guide its recovery trajectory, we remain confident about holding its December lows.

However, an optimal entry point has not been validated. Therefore, more conservative price action-based investors might need to observe further for a validated bullish reversal before taking action.

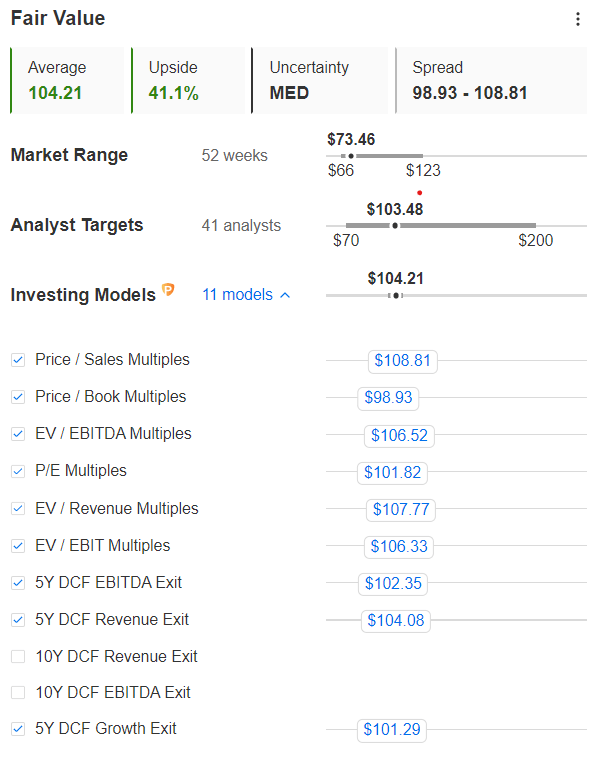

PYPL blended fair value estimates (InvestingPro)

Despite that, PYPL’s blended fair value estimates suggest that there seems to be a reasonable margin of safety, even if buyers could face more downside volatility.

As a guide, we believe investors should continue watching how the banking crisis unfolds, as the malaise might not be over. Moreover, given the recent events, we believe PayPal could also be hit, even though its balance sheet is sound.

Hence, buyers looking to “front run” the market should consider appropriate allocation strategies that help them to dollar-cost average against potential downside volatility.

Still, we assessed that PYPL’s nascent consolidation, as seen in its price action, attractive valuation, and management’s sound risk management, should attract long-term buyers back.

Rating: Strong Buy (Revised from Buy).

Important Note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Disclosure: I/we have a beneficial long position in the shares of PYPL, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the S&P 500 had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!