Summary:

- Q4 results were strong — but that was completely eclipsed by poor 2024 guidance.

- Investors didn’t like the guidance due to management’s “shock the world” statement.

- In short, management overpromised and underdelivered. But hopefully, they’ll do the opposite throughout 2024.

- They need to outperform expectations in 2024. Otherwise, the stock will continue to struggle.

- Watch out for management’s “updated” guidance.

SOPA Images/LightRocket via Getty Images

Introduction

Being a PayPal Holdings, Inc. (NASDAQ:PYPL) investor has been particularly frustrating. Since its peak in July 2021, the stock is down 80%. Furthermore, the stock has been bleeding slowly over the last twelve months, making lower lows and lower highs.

As investors try to look past PayPal’s dismal years, many investors have high expectations for PayPal heading into 2024 given recent management changes and the new CEO’s “we will shock the world” statement.

Unfortunately, investors were recently slapped in the face as the company’s Q4 earnings disappointed – the actual results were great, but 2024 guidance was a real party pooper.

Management overpromised and then underdelivered. Simple as that.

Hopefully, they’re just sandbagging guidance.

For the time being, PayPal still trades at depressed valuations, which still makes it an attractive long-term investment opportunity.

Growth

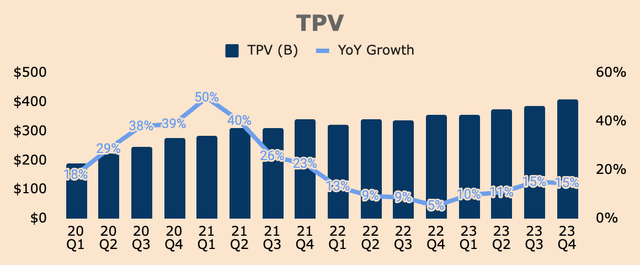

Looking at PayPal’s Q4 results, Total Payment Volume (TPV) was $410B, up by 15% YoY. This strong growth was mainly driven by:

- Unbranded Processing TPV, which grew 29% YoY. Unbranded Processing now represents 35% of Total TPV, up from 30% last year.

- International TPV, which grew 22% YoY.

This was offset by:

- Branded Checkout TPV, which grew 5% YoY. Branded Checkout now represents 29% of Total TPV, down from 30% last year.

- Venmo TPV, which grew 8% YoY.

- US TPV, which grew 11% YoY.

Higher engagement also contributed to growth.

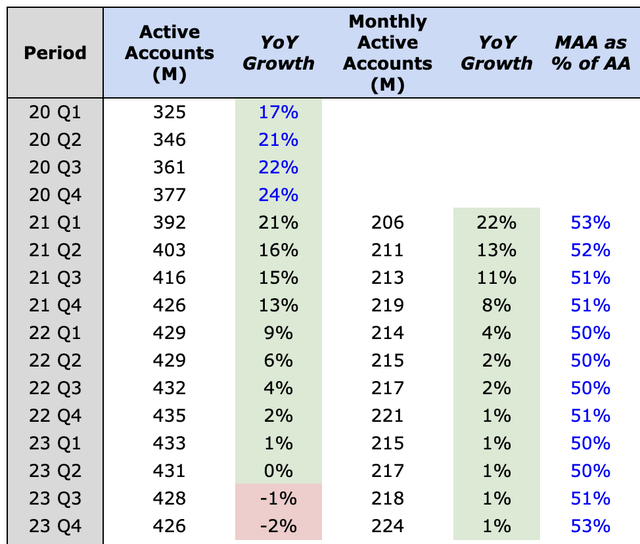

Active Accounts (AA) – which are accounts that have completed a transaction within the past 12 months – were down 2% YoY to 426M, reflecting churn of unengaged accounts.

While this looks concerning, Monthly Active Accounts (MAA) – a new metric disclosed by management – grew 1% YoY to 224M, showing growing engagement within the platform.

To track the quality of PayPal’s account base, I also calculated MAA as a percentage of AA – the higher the percentage, the more engaged PayPal’s account base is, which is what we want to see.

As you can see, MAA as a percentage of AA was 53% as of Q4, an improvement of 2 percentage points YoY. So while Active Accounts have been declining, PayPal is retaining more “active” accounts.

Besides, it’s better to have an account that transacts once per month than to have an account that transacts once per year.

As more unengaged accounts churn off and PayPal drives more engagement among existing accounts, I expect this metric to improve to 60% or more.

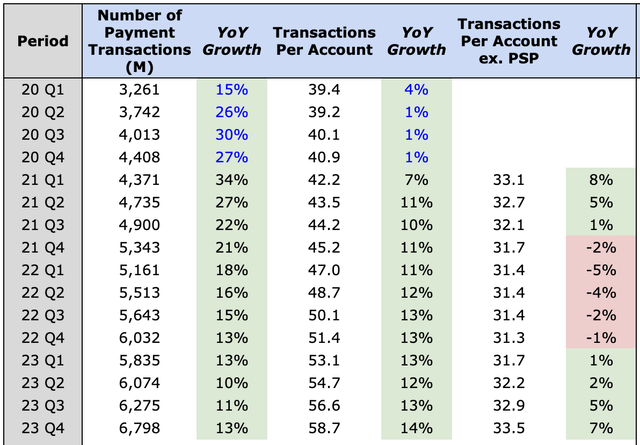

Another sign of growing engagement is PayPal’s increasing Number of Payment Transactions, which was 6.8B in Q4, up by 13% YoY. In addition, Transactions Per Account (TPA) grew 14% YoY to 58.7, mainly due to Braintree (or Unbranded Processing). If we exclude Braintree, TPA ex. PSP – a new disclosure that assesses Branded Checkout activity levels – was 33.5 in Q4, up by 7%.

Put simply, management’s plan to drive higher engagement within the PayPal ecosystem seems to be working.

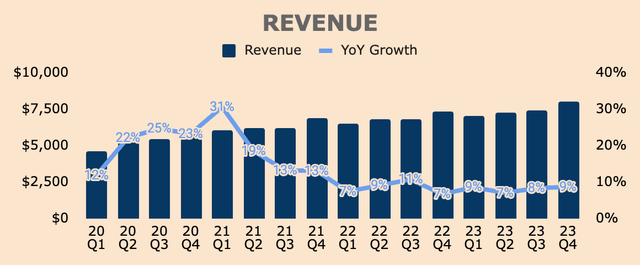

Altogether, higher TPV and higher engagement drove a 9% growth in Revenue in Q4, to $8.0B. This beat analyst estimates by $130M, or 2%. This also beat the high end of management’s guidance by 2 percentage points.

PayPal continues to be underestimated, to say the least.

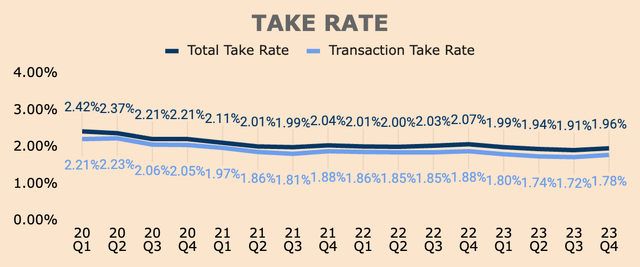

Regardless, Revenue is still growing slower than TPV, due to lower Take Rates:

- Q4 Total Take Rate was 1.96%, down from 2.07% last year.

- Q4 Transaction Take Rate was 1.78%, down from 1.88% last year.

However, it seems that Take Rates have bottomed, as seen by the sequential improvement in both metrics. It’s too early to tell, but that’s a promising sign – higher Take Rates typically lead to improved profitability.

All in all, PayPal showed robust growth in Q4, despite the narrative that “PayPal is a dying brand” or “competition is eating PayPal’s lunch”.

Yes, PayPal is going through some tough challenges and transitions.

However, PayPal continues to process more dollars and its account base is more engaged than ever, which is a testament to its scale and brand moats.

Profitability

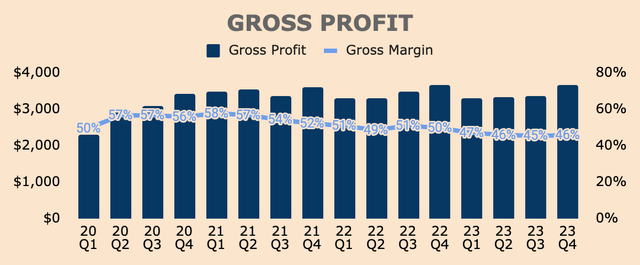

Turning to profitability, Q4 Gross Profit was flat YoY at $3.7B, representing a Gross Margin of 46%.

Gross Margin follows the same pattern as Take Rates: down YoY, but up QoQ.

- Gross Margin was down YoY due to 1) lower gains from foreign currency hedges and 2) higher volumes from larger merchants, which typically have lower take rates.

- The metric improved QoQ due to 1) lower merchant contractual compensation and 2) a more favorable mix between Braintree and Branded Checkout.

Regardless, it’s still early days to call a bottom on Gross Margins.

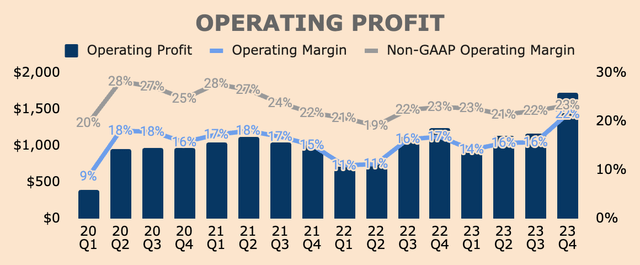

Moving on, Q4 GAAP Operating Profit was $1.7B, up 39% YoY, representing a GAAP Operating Margin of 22%, which, as you can see, improved significantly YoY and QoQ. Before you get too excited about this improvement, this was due to a one-time pre-tax gain of $339M in Q4, as a result of the sale of Happy Returns.

Adjusting for this divestiture, Q4 Non-GAAP Operating Income was $1.9B, up 11% YoY. This represents a Non-GAAP Operating Margin of 23%, which is a 39 basis point improvement YoY.

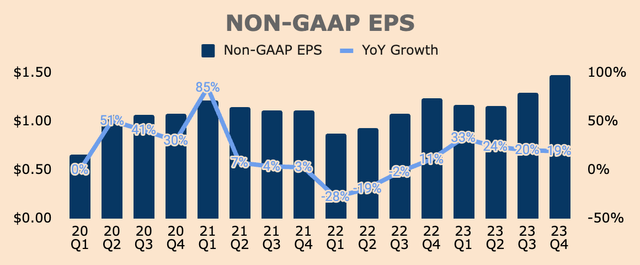

Finally, Non-GAAP EPS was $1.48 in Q4, up 19% YoY, driven by operating leverage and share buybacks. This beat both analyst estimates and management’s guidance of $1.36.

As you can see, non-GAAP EPS reached an all-time high for the company.

That being said, PayPal’s bottom line continues to improve, which is encouraging to see, but the real issue pertains to PayPal’s Gross Margin, which it is too early to say – with complete confidence – that it has bottomed.

If management can reverse the downward spiral in Gross Margin, PayPal has a good chance of expanding EPS meaningfully. If they can’t, earnings growth might be muted, as there’s a natural limit to how much management can cut non-transaction-related expenses.

Health

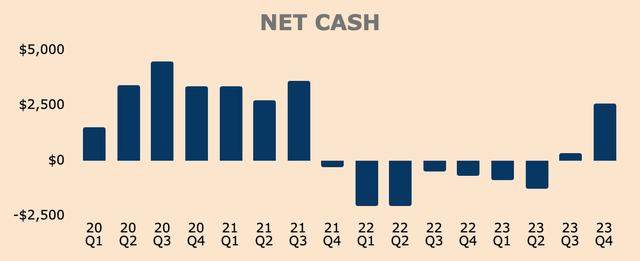

Growth and profitability weren’t the only things that improved – PayPal’s balance sheet improved as well.

In Q4, PayPal’s Net Cash position expanded by $2.3B QoQ, to $2.6B. Since day one, the new CEO, Alex Chriss, has expressed his intent to create a leaner, meaner PayPal, and we’re already seeing that in action as observed by PayPal’s improving balance sheet.

I am in the process of evaluating our most profitable growth priorities and aligning our resources to those priorities. We will become leaner, more efficient and more effective, driving greater velocity, innovation and impact for customers.

(CEO Alex Chriss – PayPal FY2023 Q3 Earnings Call).

I expect Net Cash to continue to build up over the next few quarters as PayPal maintains robust cash flows.

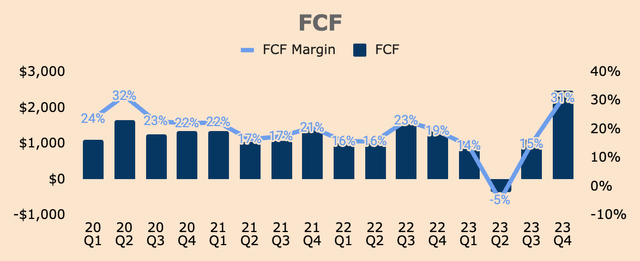

In Q4, Free Cash Flow was $2.5B, at a 31% FCF Margin, which includes a $1.7B net benefit from the sale of European BNPL receivables to KKR.

Without the BNPL benefit, Q4 Adjusted FCF would have been about $0.8B, representing an FCF Margin of just 10%, which is quite low compared to historical standards. Per management, “higher-than-expected changes in working capital and cash taxes” resulted in lower FCF in Q4.

Adjusted FCF was $0.8B and $4.6B for Q4 and 2023, respectively, which was down 46% and 11% YoY, respectively. Maybe that’s why management slowed down the pace of share buybacks in Q4.

Despite a lower average share price, PayPal purchased only $0.6B of stock in Q4, as compared to $1.4B in Q3.

With so much cash in hand, why wouldn’t PayPal buy back even more aggressively in Q4?

The $0.6B share buyback in Q4 doesn’t particularly scream management’s confidence that the stock is undervalued.

I think this angered a lot of investors. Heck, I was a little agitated too.

In any case, PayPal still has $10.9B of share buyback capacity left. I wish management would take full advantage of it given PayPal’s underperforming stock price.

They need to send a message to the markets that says: “Hey, if you don’t want to buy our shares at these prices, we’ll buy them. Shares are cheap now, and we’re playing it for the long haul”.

Unfortunately, they’re not signaling that kind of attitude.

Outlook

For 2024, management guided for share buybacks of “at least $5B” which is pretty much in line with 2023 levels. I was expecting a more aggressive approach towards buybacks.

That’s not all. Management did three more things that destroyed investor confidence:

- It guided for Q1 Revenue growth of 6.5%, a deceleration from Q4’s growth of 9%.

- They stopped annual revenue guidance.

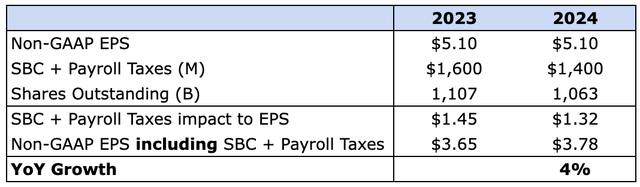

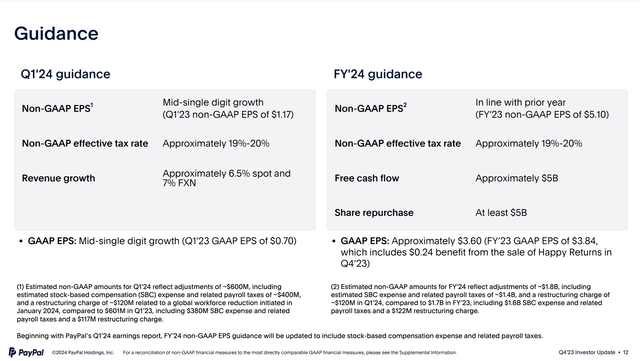

- Most importantly, they guided for 2024 Non-GAAP EPS of $5.10, which is flat YoY. This missed analyst estimates by $0.43!

That’s probably why the stock sold off 11% following the earnings report.

PayPal FY2023 Q4 Investor Update

And here’s where things get confusing.

Looking at the footnotes of the slide above, management guided for Non-GAAP EPS of $5.10, which includes the following:

Estimated non-GAAP amounts for FY’24 reflect adjustments of ~$1.8B, including estimated SBC expense and related payroll taxes of ~$1.4B, and a restructuring charge of ~$120M in Q1’24, compared to $1.7B in FY’23, including $1.6B SBC expense and related payroll taxes and a $122M restructuring charge.

So the guide includes $1.4B of SBC and related payroll taxes added back to EPS.

And then management also mentioned this:

Beginning with PayPal’s Q1’24 earnings report, FY’24 non-GAAP EPS guidance will be updated to include stock-based compensation expense and related payroll taxes.

(PayPal FY2023 Q4 Investor Update).

In other words, in Q1, PayPal will issue a new FY2024 Non-GAAP EPS guidance with $1.4B of SBC and payroll taxes subtracted from its current guidance of $5.10.

So, if we do the calculation:

- $1.4B of SBC and payroll taxes equates to a $1.32 impact on EPS, assuming a 4% reduction in shares outstanding in 2024 (which is in line with 2023).

- Subtracting that impact from its guide of $5.10, we get an updated FY2024 Non-GAAP EPS of about $3.78, which is only a 4% increase YoY.

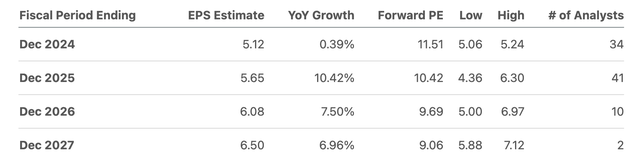

I’m not even sure if analysts are aware of these changes, since, collectively, they still have an FY2024 EPS estimate of $5.12 for PayPal.

I feel like management did not make this clear enough, and I think a lot of investors and analysts may be unpleasantly surprised when PayPal reports earnings that fall way short of analyst estimates, solely because of changes in Non-GAAP EPS calculations.

My concern is that the stock may sell off due to miscommunication on management’s part.

That being said – however, you look at it – a 0% to 4% Non-GAAP EPS growth in 2024 is definitely a big disappointment for many. It’s a “shock-the-world” moment, for sure.

The good news is that management’s guidance “includes a minimal contribution from the innovations we recently announced”, more specifically, the six new initiatives from its recent First Look event:

- Smarter, faster checkout.

- Fastlane by PayPal.

- PayPal Smart Receipts.

- PayPal CashPass.

- PayPal Advanced Offers Platform.

- Venmo Business Profiles.

Put differently, PayPal appears to be sandbagging its guidance, and thus, has a good chance of beating its own guidance. Higher-than-expected FCF and share buybacks should also help with EPS growth.

Whatever it is, management touted 2024 as the year of transformation and execution, with four key priorities:

- Accelerate Branded Checkout.

- Improve overall profitability.

- Leverage data.

- Operate more efficiently.

Easier said than done. Only time will tell if Alex Chriss and Co. can turn this company around.

But one thing’s for sure, I didn’t particularly like how management hyped the crowds, only to flop their 2024 guidance.

Valuation

Fortunately, shares remain attractively valued.

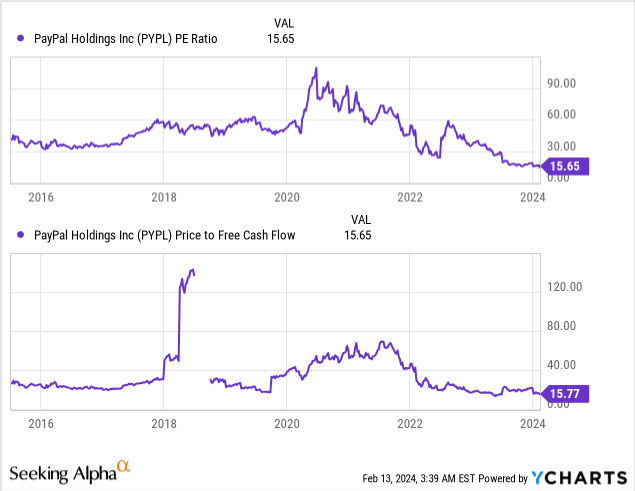

Based on LTM EPS and FCF, PayPal trades at a PE and Price to FCF ratios of about 15.7x, which is the lowest they have ever been for both metrics. So from a historical standpoint, PayPal looks significantly undervalued.

But my concern lies with PayPal’s dwindling turnaround story, which, given management’s remarks recently, turned out to be more challenging than anticipated.

Furthermore, the lower multiples are justified given PayPal’s slowing top line and bottom line growth. What’s more, PayPal may not see any earnings growth in 2024, which may lead to the stock trading sideways for the remainder of the year.

In addition, there seems to be no real positive catalyst in the near term, which may lead to weak price action.

Fundamentals need to get better – whether it is growth, profitability, or earnings – for PayPal to see meaningful price appreciation. Additionally, management needs to do something above and beyond to instill confidence among PayPal investors – perhaps accelerated share buybacks, dividend initiation, or insider buys could do the trick.

Otherwise, the stock may continue to struggle.

Yes, the stock looks cheap. But the cheap can always get cheaper.

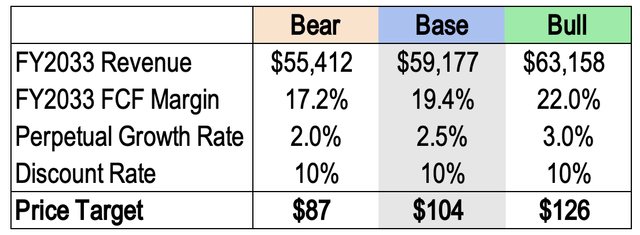

As for me, I maintain my price target of $104 a share for PayPal stock, based on the following assumptions:

- FY2033 Revenue of $59B. Growth follows analyst estimates for the first three years and then kept stable at 7% for the remaining years.

- FY2033 FCF Margin at 19.4% with gradual improvement due to operating leverage. As a reference, PayPal’s FY2023 Adjusted FCF Margin was 15.3%

- Perpetual Growth Rate of 2.5%.

- Discount Rate of 10%.

My price target of $104 represents an upside potential of 73% based on the current price of $60. In addition, my price target is higher than the average analyst price target of $72.

I’ve also included my bear and bull cases below, which both show that PayPal is undervalued.

Risks

- Competition: the fintech industry is highly competitive with players such as Apple Inc.’s (AAPL) Apple Pay, Adyen N.V. (OTCPK:ADYEY), Block, Inc. (SQ), Fiserv, Inc. (FI), and SoFi Technologies, Inc. (SOFI). The commoditization of digital wallets and payment processing services is a real threat to PayPal, which may erode Gross Margins, and subsequently earnings potential for investors.

- Guidance Update: As I’ve explained earlier, management will issue an updated FY2024 Non-GAAP EPS guidance, lower than its current guidance, which may come as a (negative) surprise to many investors.

- Management Changes: A lot of changes are happening in the executive suite – it’s too early to tell if they will succeed in turning the company or not.

Thesis

Q4 results were strong – but it was completely eclipsed by weak guidance.

PayPal’s investors didn’t particularly approve of management’s guidance, given CEO Alex Chriss’ promise that the company will “shock the world”.

Management certainly overpromised over the last few months building up to its Q4 earnings release and underdelivered on its guidance – there’s no reason to set high expectations and then come out guiding for virtually no earnings growth in 2024.

Well, I hope they do the opposite moving forward. I hope they’ll underpromise and overdeliver throughout 2024 because that’s the only way to turn around the stock for good.

Meanwhile, shares remain undervalued and the fundamentals of the business remain strong, which may offer some value for investors.

For me, I still consider PayPal in deep value territory – although I have to admit that it’s been frustrating holding PayPal stock.

2024 is the year of transformation and execution for PayPal. Only time will tell if PayPal comes out stronger on the other side.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.