Summary:

- PayPal is going to submit its earnings sheet for the fourth-quarter on February 9, 2023.

- I believe 3 key metrics will be especially important to watch in order to evaluate PayPal’s business trajectory in 2023.

- PayPal’s shares could see a revaluation this year if the payment services provider submits a strong outlook.

chameleonseye

PayPal (NASDAQ:PYPL) is going to report earnings for its fourth-quarter on February 9, 2023 and I believe three key metrics are especially important for investors to pay attention to. Although PayPal increased its EPS guidance for FY 2023 in the last quarter, investors must brace themselves to see unimpressive results on multiple fronts, especially regarding PayPal’s net new active account growth. A strong outlook for FY 2023 as well as aggressive stock buybacks, however, could give PayPal’s shares new impetus!

PayPal Q4: What to watch

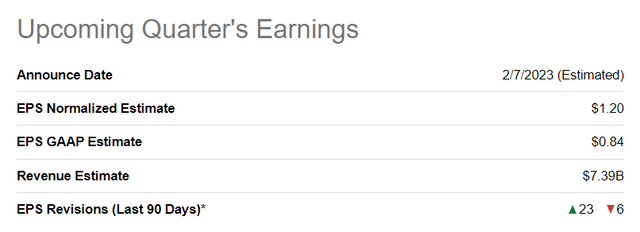

Expectations are not high for PayPal’s fourth-quarter earnings release as the market already saw a slowdown in many key metrics throughout FY 2022. For the fourth-quarter, analysts expect $1.20 in adjusted EPS and $7.4B in revenues. For the full-year, PayPal has guided for ~$4.07-$4.09 per-share in adjusted earnings. Before the third-quarter, PayPal guided for ~$3.87-$3.97 in adjusted EPS. PayPal may have a good chance of meeting expectations, but the potential for a significant up-side surprise, in my opinion, is rather limited.

Importantly, I believe 3 key metrics should be watched later this week.

3 key metrics to watch this week

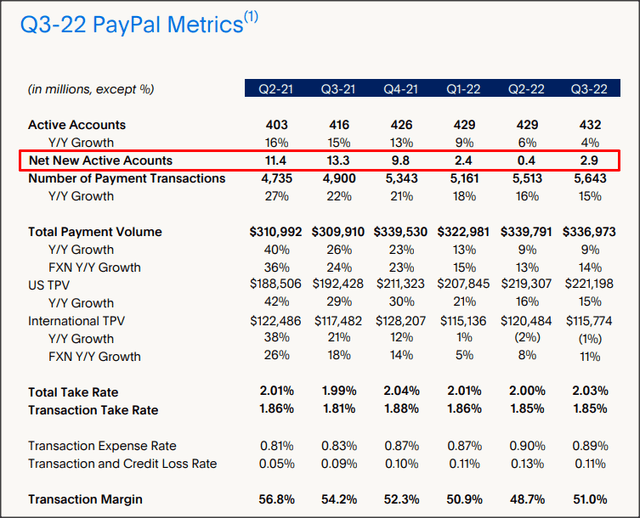

PayPal expected to add up to 20M new accounts early in FY 2022, a guidance that has been down-graded to just 8-10M in the third-quarter. I believe we are going to see net-adds at the lower end of this guidance due to persistent challenges on the consumer front (inflation).

PayPal saw a bit of a rebound regarding active account growth in Q3’22 as the payments company added 2.9M new customers in the third-quarter, following a disappointing second-quarter in which PayPal added just 0.4M new customer accounts. Between January and September 2022, PayPal’s new account total was 5.7M, meaning PayPal would have to add 2.3M accounts in the fourth-quarter to meet its low-end of guidance and 4.3M to meet its upper-range target of 10M new customers in FY 2022.

I don’t believe that PayPal has seen a whole lot of momentum regarding customer acquisition in the fourth-quarter due, like I said, persistently high inflation and slowing economic growth that likely continued to force consumers to cut back on spending. I estimate that PayPal had a somewhat decent, but not great quarter with approximately 3.5M account net-adds which would bring the firm’s new account additions in FY 2022 to 9.2M.

The second key metric I will be watching is free cash flow… which has been key to PayPal’s high valuation multiplier factor in the past and is what likely attracted Elliott Management to buy a stake in the payments company last year.

Despite account growth challenges in FY 2022, PayPal has been able to defend its free cash flow due to its moat-like payments business. The resilience of PayPal’s free cash flow is what gives the FinTech strong recession value as well. PayPal generated $4.1B in free cash flow in the first nine months of the year and its FCF has consistently been above $1.0B a quarter. PayPal’s guidance for FY 2022 calls for at least $5.0B in free cash flow which implies a Q4’22 minimum free cash flow of $892M. I believe PayPal will be able to slightly meet its FCF guidance due to strong engagement and report free cash flow around $5.1-5.2B.

|

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Growth Y/Y |

|

|

Revenues ($M) |

$6,182 |

$6,918 |

$6,483 |

$6,806 |

$6,846 |

11% |

|

Free Cash Flow ($M) |

$1,286 |

$1,550 |

$1,051 |

$1,291 |

$1,766 |

37% |

|

FCF Margin |

21% |

22% |

16% |

19% |

26% |

(2 PP) |

(Source: Author)

Obviously, PayPal’s strong free cash flow facilitates stock buybacks. PayPal repurchased $3.2B of its shares in the first nine months of the year and $939M in Q3’22. I am looking at a similar level of buybacks (~$1.0B) in Q4’22, but any statements about a possible acceleration of stock buybacks could be a potent catalyst for PayPal’s shares.

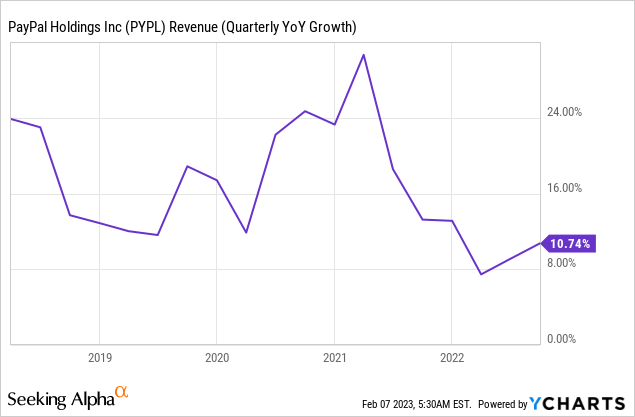

The third metric I will be watching is PayPal’s outlook for FY 2023. PayPal has seen a post-pandemic slowdown in its top line growth, so the outlook for FY 2023 could be a significant catalyst for PayPal’s shares later this week as well. PayPal has guided for 10% revenue growth in currency-adjusted terms for FY 2022. On the other hand, a successive slowdown in FY 2023 would likely heavily weigh on the FinTech’s shares.

PayPal’s valuation

PayPal is expected to see double-digit annual EPS growth in the coming years. In FY 2024, PayPal is projected to generate $5.55 per-share in earnings, resulting in a P/E ratio of 14.8 X. I believe PayPal’s strong free cash flow and moat-like payments business that includes 432M accounts justifies a higher P/E ratio. At a P/E ratio of 25 X, considering the firm’s free cash flow strength, I would consider PayPal to be fairly valued.

|

PayPal |

FY 2023 |

FY 2024 |

FY 2025 |

|

EPS |

$4.76 |

$5.55 |

$6.34 |

|

YoY Growth |

16.95% |

16.65% |

14.22% |

|

P-E Ratio |

17.3 X |

14.8 X |

13.0 X |

(Source: Author)

Risks with PayPal

Moderating top line growth is a big risk for PayPal which is something that has already materialized in FY 2022. A slowdown in net new active accounts is likely going to weigh on the FinTech’s shares while strong net new active account acquisition reported for the fourth-quarter on Thursday would be a positive for a stock. If PayPal reports weakening account growth (and engagement) for FY 2022, the FinTech’s shares are likely going to run into further resistance.

Final thoughts

I believe there are three key metrics that investors would want to pay special attention to on Thursday: (1) PayPal’s net new active account growth (engagement), (2) free cash flow and (3) the growth outlook for FY 2023. If PayPal reports weakening net new active account growth rates and submits a weak revenue outlook for FY 2023, then PYPL stock could get pushed into a new down-leg on Thursday!

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.