Summary:

- PayPal’s uncertain revenue trajectory makes for conservative assumptions.

- Stiff competition in all areas is taking away market share.

- Even with the large drop in share price, it is still a little pricey.

- Some potential for revenue growth in BNPL area.

chameleonseye

Investment Thesis

I have been a customer of PayPal (NASDAQ:PYPL) for quite some time now, mainly because I have moved countries, and using PayPal to pay for anything I need online is hassle-free, unlike using my foreign cards which sometimes get rejected due to possible security issues. After the huge drop that we have seen in the tech industry overall, I wanted to see if PayPal might be worth looking into after the shares have become quite more affordable than they were in mid-2021 and the earnings are just around the corner, and frankly speaking, I was curious about how the company is doing financially.

After looking at its financials, the sentiment around the company, its fierce competition in the space, I concluded that the company is still quite expensive. I will discuss my findings regarding the company’s financials and my assumptions on future revenue growth that could make it a good investment in the future, but right now it gets a hold rating. This article is driven by the results I got from the DCF models, and the research done online that help me come up with reasonable, and somewhat conservative assumptions for the models on the growth of the company. It is better to be safe than sorry when it comes to buying stocks. You can buy a great company, but if you pay too high, you can still lose money.

I will be discussing what could stall PayPal’s revenue growth in the future and what could increase it in the following sections.

Revenue Generation

In the latest 10-Q report the company managed to generate a respectful 9% revenue growth. The management also revised its guidance for the full year 2022 to grow at 13%. The numbers are not as robust as in previous years, suggesting some slowdown is afoot that may continue to linger, however, with over 400 million customers and 35 million merchants using the platform that is quite a decent growth. The company has been losing market share to competitors like Stripe and Shopify (SHOP) Pay Installments, losing around 10% of the market share globally.

Stiff Competition Preventing Higher Revenues

Speaking of competition, the fees offered by other competitors are more favorable in some instances than PayPal’s fee structure. There are a lot of different alternatives to PayPal that offer more benefits and more flexibility. If PayPal wants to keep its customer base intact or even increase it and gain back market share, it would want to think about giving merchants more customizable payment options at lower fees and improving its point-of-sale systems to further compete with the rising threats of other competitors. If they do nothing, they risk becoming antiquated and falling behind more modern and higher-quality service providers like Stripe or Skrill.

Potential of BNPL Service

The buy now, pay later or BNPL has become quite popular in recent years, even though it’s been around for decades now. The space is expected to grow at 45% CAGR. There is a lot of stiff competition for PayPal in this area also. Affirm (AFRM), AfterPay, owned by Block Inc (SQ), and Klarna are the leading competitors that have a large presence. PayPal is playing catch up in this space, but if they can convince people to use the service, this could be great for business in the future, but right now I am not sure how much it can contribute to revenue growth. In their latest 10-Q report they mentioned that they acquired Paidy, a platform that primarily provides BNPL services in Japan. This will add around 6 million customers to its already massive customer base. The potential of the service to PayPal will need to be revisited later if they can get more customers to use this service.

Negative Sentiment

I felt I should mention the debacle of $2,500 fines for customers who spread misinformation. The company later announced that it would not go into effect, but the damage has been done and many people were outraged. The fiasco became quite a trending topic on Twitter and other social media platforms. The share price immediately tanked over 5% on the news and many people vowed to delete their accounts. We can see that this news has affected the share price, however, how much this news affected actual customer numbers is unknown. What we do know is that searches on Google on how to delete PayPal have increased dramatically, over 1300%.

Seeing that the customer base has been increasing every quarter, the debacle did not appear to cause many problems.

Financials

Now let’s have a look at some important financials that helped me in deciding what numbers I should use for the DCF models.

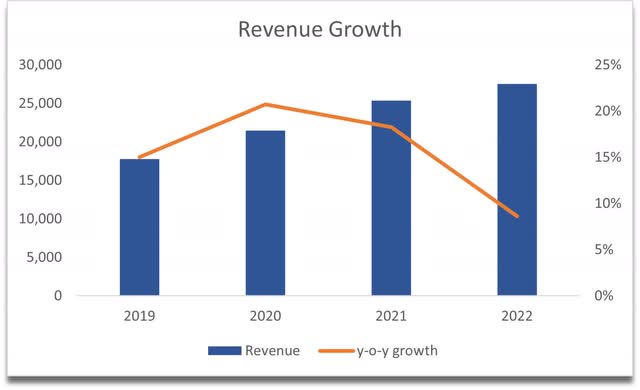

The revenue growth is the big one that I considered for my DCF and the growth historically has been 15% to 20%. Recently, however, judging by analysts’ estimates by the end of its fiscal 2022, we will only see a 9% growth in revenues and rebounding slightly in 2023 to 10%.

Historical Revenue (Own Calculation)

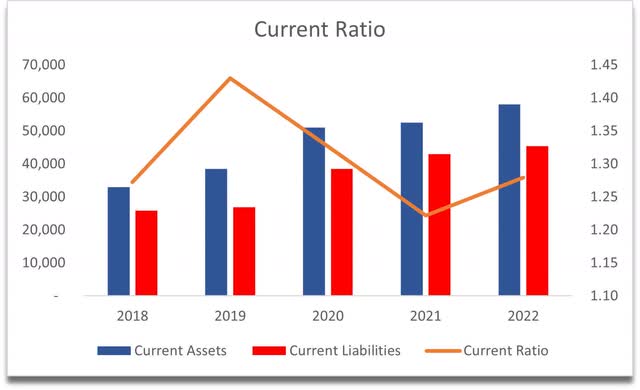

The current ratio of the company is decent, sitting at 1.27 most recently, and is projected to be increasing over the coming years.

Current Ratio (Own Calculation)

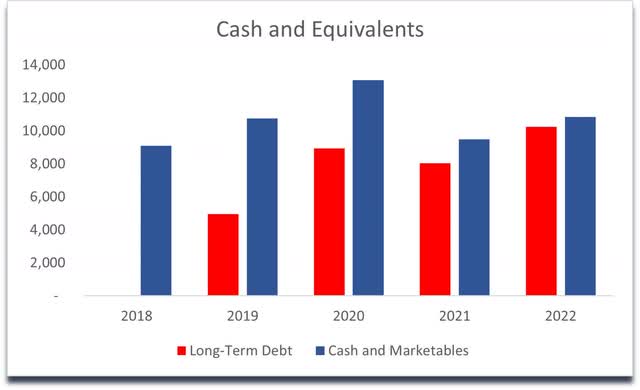

The company does have enough cash and short-term investments to cover its debts, however, just barely.

Gross margins for the company have been hovering at 55% over the last period, and it has decent EBITDA margins too, that have been hovering around 20%.

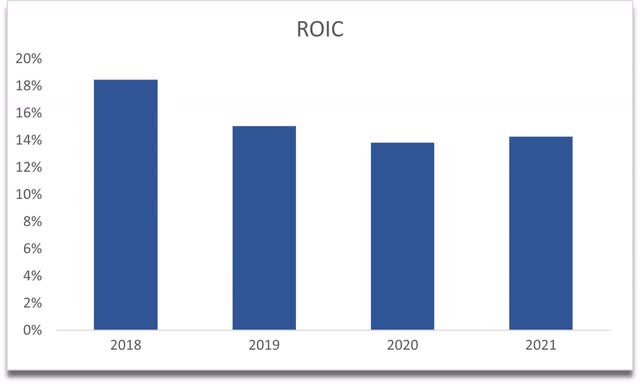

ROIC has been good historically, however, it dipped a little in recent years and we will have to wait and see if this trend continues or if will it pick back up in later years. The ROIC figure is still quite good, nevertheless.

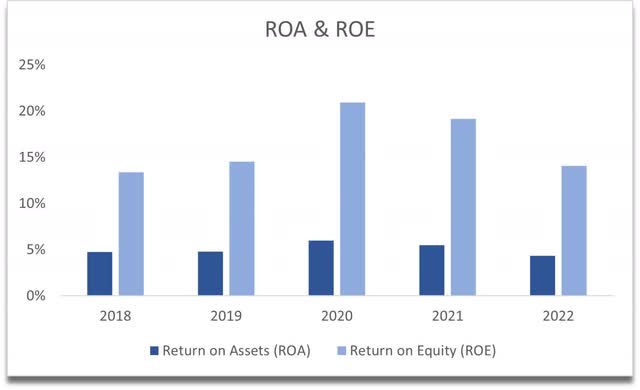

ROA and ROE in my opinion could be improved upon.

To be honest I have seen better balance sheets. Looking at all numbers, they just do not scream “invest now!” We could see an improvement over the next few years, sure, but these are the numbers right now, and my assumptions will be based on these numbers for my DCF models.

Valuation

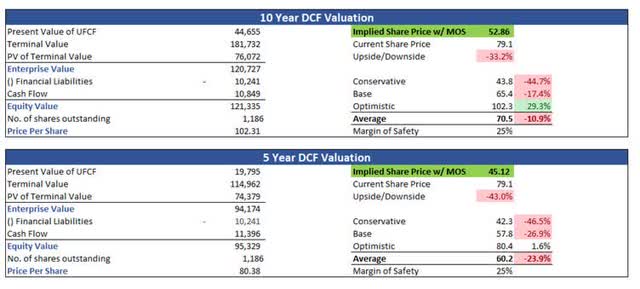

Taking into account the increased competition, the low double-digit guidance in revenues, and analysts’ estimates for the next few years, my growth assumptions for PayPal are 10%, 10%, and 9% for the years 2023, 2024, and 2025 respectively, then I decided to decrease the growth by 1% every year until 2032 for my base scenario.

For my optimistic case, my numbers are higher by 3% in all years and for my conservative case, the numbers are 2% lower from the base case. I also decided to keep a 21% tax rate on the base case, even though the company has been paying around 16% for the last couple of years, just to keep it more conservative.

I always like to apply a good margin of safety to the average price I get from all of the scenarios combined, and I went with 25%. With all the calculations in place, the growth numbers do not satisfy the current market price that the company is trading at. 10-year DCF and 5-year DCF models suggest that the price has further to fall. The average price with a margin of safety, as highlighted in green, for the 10-year period is $52.86 and the 5-year model is $45.12.

DCF Valuations (Own Calculations)

Conclusion

The big unknown of 2023 right now is if we are going to enter a recession with a not-so-softish landing. Spending can decrease substantially if this happens, so I am not able to be very optimistic in my assumptions on revenue, but we will have to wait and see how it all unfolds over the next 12 months.

In my opinion, I can conclude that at the current levels, PayPal is a hold right now until we see higher growth numbers. There are better investments out there with the same conservative numbers and margin of safety applied.

There will be different valuations suggested by many analysts and investors, and this is just one other. The valuations that I have come up with are completely based on my opinion and a lot of people may not agree with me and that is ok. My opinion, from the research that I have done on the company, I believe there is still room for PayPal to go down if its revenue growth is as I have forecasted for the next few years. If over the next couple of earnings reports, we will see a substantial shift in growth numbers, I will go back to the model and adjust as needed and update my investment thesis to reflect any new catalysts that may arise. I have this stock on my watchlist, ready to sell cash-secured puts at my desired strike price once the premiums are better. I can wait.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.