Summary:

- Promising announcements, such as the ad business division and the Cash Pass features, could help the business improve its lagging revenue growth rates, which have suffered from a three-year decline.

- Apple’s introduction of Tap to Pay, along with declining KPIs in active accounts and take rates, raises concerns about the company’s market share going forward.

- Even with many company-specific risks, the stock is exhibiting a PEG of 0.24x in its valuation, indicating an asymmetrical risk profile that justifies a mid-term buy rating.

JasonDoiy

PayPal (NASDAQ:PYPL) is the second largest company in the Transaction & Payment Processing industry in terms of TTM Revenue with $30.43 billion, only surpassed by Visa (V). At the same time, they rank #4 in terms of market cap after peers such as Visa, Mastercard (MA), and Fiserv (FI). Simultaneously, from a list of 43 names, this is the company from the payments processing industry, above $1 billion, with the cheapest valuation after discounting growth expectations with a GAAP PEG ratio of 0.24x.

In this analysis, I will analyze the financial metrics and KPIs of the business that are deteriorating vs. the ones that are improving, provide an outlook, check on the valuation, and discuss specific risks to finally come to a buy rating conclusion despite the cons.

Deteriorating Fundamentals

Over the past three years, probably nothing of the growth machine that was PayPal during the pandemic remains. To illustrate, here are four metrics where PayPal has been experiencing deteriorating fundamentals.

#1 Revenue Growth

The first one is of course revenue. Although many holders of PayPal continue to point out that the company remains growing, the revenue growth rate has significantly deteriorated after 2021, and over the last three years, the company has reduced its YoY growth rate each year to the point of decreasing -66.9% from the pandemic growth levels.

| Mar – 2024 | Mar – 2023 | Mar – 2022 | Mar – 2021 | Mar – 2020 | Mar – 2019 | |

| Total Revenues (B) | 30.43 | 28.08 | 25.82 | 22.87 | 18.26 | 15.89 |

| YoY Growth | 8.4% | 8.8% | 12.9% | 25.2% | 14.9% | 15.1% |

Source: YCharts

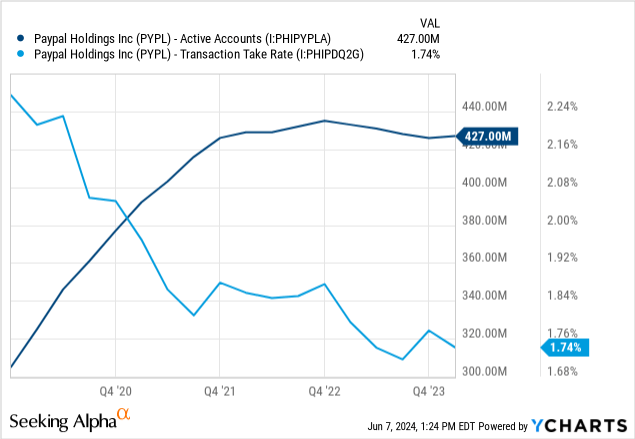

#2 Active Accounts and Take-Rate

The second one, and probably the most concerning in the long term, is the reduction in active accounts. As seen in the graph below, the number of active accounts had a steep growth during the pandemic to then consolidate in 2022, and a further decline in 2023. At the same time, their take-rate has been exhibiting a significant constant decrease over the quarters to the point where it now sits at 1.74%, when it used to be 2.27% in Q4 of 2019. These detriments of the KPIs signal that fewer people are using PayPal, and what PayPal is keeping per every dollar of transaction is getting lower.

#3 Total Payment Volume Growth

Third, the total payment volume (TPV) growth rate consolidated since the outstanding 2021 but remains lower than the growth rates experienced pre-pandemic of around 20%. Here, although the active accounts levels decreased in the past fiscal year, the TPV was still able to grow from the previous year.

| Mar – 2024 | Mar – 2023 | Mar – 2022 | Mar – 2021 | Mar – 2020 | Mar – 2019 | |

| Total Payment Volume | 403,860 | 354,508 | 322,981 | 285,447 | 190,567 | 161,492 |

| YoY Growth | 13.9% | 9.8% | 13.1% | 49.8% | 18.0% | 22.0% |

PayPal ’24, ’22, ’20, ’19 10-Q

#4 Transaction Expense Rate

| Mar – 2024 | Mar – 2023 | Mar – 2022 | Mar – 2021 | |

| Transaction Expense Rate | 0.97% | 0.93% | 0.87% | 0.80% |

Last, the transaction expense rate, which is calculated by dividing transaction expense by total payment volume (TPV), has been on the rise for the past three years. Clearly not a sign that displays the benefits of economies of scale, but rather one that signals diseconomies of scale.

Improving Fundamentals

Despite the aforementioned deteriorating fundamentals, there are three aspects that I identified PayPal has been improving.

#1 Operating Income, Growth, and Margin

First, operating income. In this matter, over the past twelve months, the nominal operating income sits at a historical level, coupled with an operating margin that’s close to the 17.9% exhibited in its rockstar year of 2021, and at the same time, the TTM Q1 YoY growth rate is at 15.7%, which is higher than pre-pandemic levels.

| Mar – 2024 | Mar – 2023 | Mar – 2022 | Mar – 2021 | Mar – 2020 | Mar – 2019 | |

| Operating Income (B) | 5.161 | 4.46 | 3.971 | 4.101 | 2.626 | 2.407 |

| YoY Growth | 15.7% | 12.3% | -3.2% | 56.2% | 9.1% | -2.7% |

| Operating Margin | 17.0% | 15.9% | 15.4% | 17.9% | 14.4% | 15.1% |

Source: YCharts

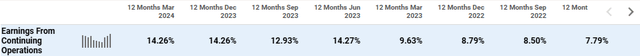

At the same time, when zooming in, on a quarter-over-quarter basis, the margin has extended and remained consistent above the 13% level for the last four quarters, compared to the inferior margins of no more than 9.63% exhibited before Q2 23.

Seeking Alpha

#2 Transaction Per Active Account

If someone is bullish on PayPal, it has to be on this: PayPal is currently experiencing great momentum in terms of customer engagement, which is measured by the transactions per active account which currently sits at 60. This is the highest number ever achieved, together with a growth rate of 13%. Nonetheless, this KPI has to be taken with a grain of salt, as the formula Total Transactions / Total Active Accounts allows a decrease in total active accounts to boost the KPI if total transactions remain constant. To conclude, this metric is seen as positive since both the total transactions and active accounts are growing, but transactions are doing so at higher growth rates, which is not the case for PayPal, at least in TTM Q1 24.

| Mar – 2024 | Mar – 2023 | Mar – 2022 | Mar – 2021 | Mar – 2020 | Mar – 2019 | |

| Transactions Per Active Account | 60 | 53.1 | 47 | 42.2 | 39.4 | 37.9 |

| YoY Growth | 13.0% | 13.0% | 11.4% | 7.1% | 4.0% | 9.2% |

PayPal ’24, ’21, ’20, ’19, ’18 10-Q

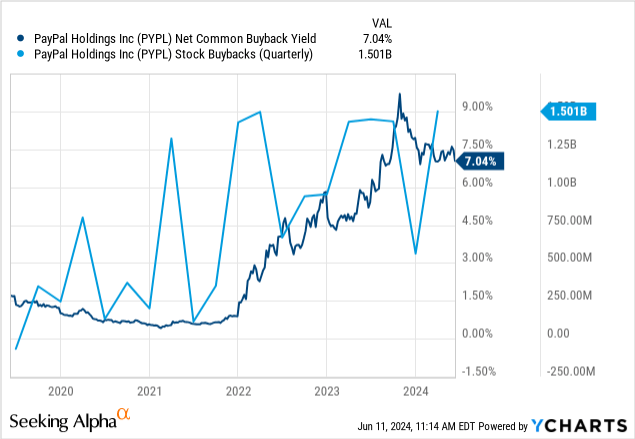

#3 Share Buybacks

Although share buybacks are not a financial fundamental of the company’s income performance, they are to the stock. As seen in the graph above, PayPal has maintained an elevated level of share repurchases that average above $5 billion over the last four years per year. In 2020 and 2021 when the stock was trading at $200 a share the effect on buybacks was potentially minimal to the current net common buyback yield of now. As the market cap trims and the buyback amount for common shares remain constant, the effect that these buybacks have on the stock could be impactful to the stock’s further price appreciation. Currently, the buyback yield continues to be elevated at 7.04% with a strong cash-to-debt ratio of 1.48.

PayPal Outlook

Last month, PayPal announced the hiring of Uber’s former head of advertising to consolidate a new division where PayPal wants to leverage its immense customer data and start selling ads to its merchants and also to non-endemic customers. This will open an opportunity to create a new source of revenue that PayPal hasn’t experimented with before. Currently, there is not much information about the matter other than the announcement, so it would probably take some time for this new service to start running.

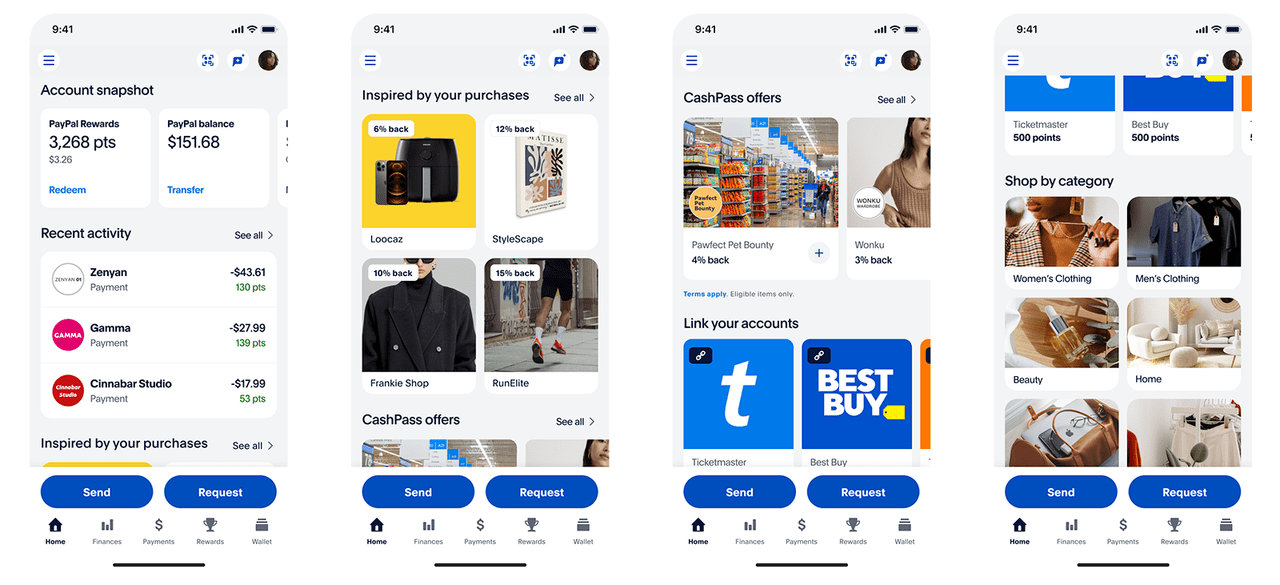

PayPal

Earlier in the year, PayPal announced six improvements to their offering, but the one that caught most of my attention was the introduction of CashPass. This completely adds a new reason for customers to use the app and boost customer engagement in the form of increasing transactions per active account. CashPass allows customers to obtain cash-back offers in the same PayPal app when checking out using PayPal on eBay, Priceline, Uber, Walmart, Best Buy, McDonald’s, and Ticketmaster’s websites.

Last, yesterday Apple announced the introduction of Tap to Cash, which is a “cool way” of paying with Apple Cash, which in my opinion would be of the likes of Gen Z. This new feature was first shared on Apple’s WWFC keynote when introducing the IOS 18 updates. Tap to Cash allows you to send P2P payments by touching iPhones via NFC technology. This might just be a new announcement with an unknown market usage response, but I assume this would add competitive pressure to Venmo. On yesterday’s post-market, the stock of PayPal fell by -2.50% due to Apple’s announcement.

PYPL Stock Valuation

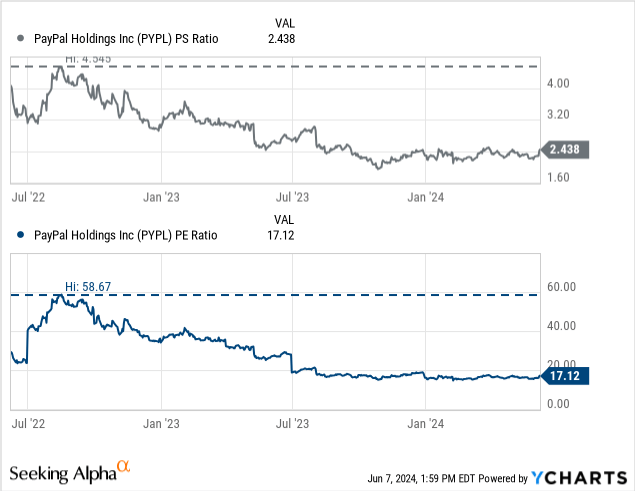

Even after removing the main stock collapse timeframe, from July 22, multiple contractions have followed. The market is pricing PayPal based on lower sustainable growth rates and lower net income margins based on where their PE and PS ratios are trading. From this historical multiple, all can be said is that fundamentally, PayPal is cheaper than ever and holds multiples that were unimaginable a few years ago. Currently, the PE ratio has remained at the same levels for almost a year now, and a similar situation is being exhibited at the price-to-sales ratio.

Risks of PayPal

In the end, this cheap valuation won’t matter if the active number of accounts continues to decline year over year and form a trend. No matter how good PayPal’s valuation was in the past if they don’t fix this, the multiple expansion would most likely not happen.

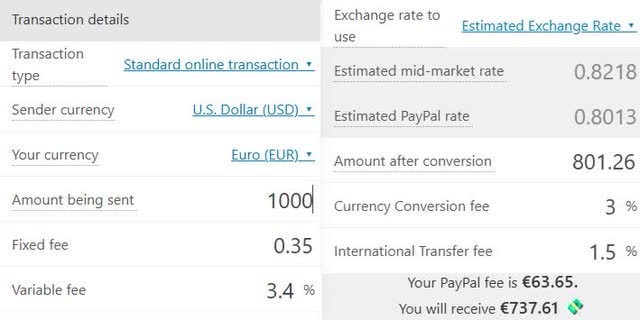

From the international side, PayPal has been the problem solver over the years to send and receive money from abroad, especially to foreign freelancers. But as a user, I believe that their money transfer services and currency conversion rates are simply too expensive to even be considered an option. Players such as Wise (OTCPK:WPLCF) and Payoneer (PAYO) are taking the lead on this, with the current easiness of hiring someone remotely in countries with no hard currency, I see this market growing, but PayPal losing market share due to their sub-part rates.

Elem, O. and Loo, W. PayPal Fee Calculator (Jun 11, 2024)

To put it in perspective, if someone in the eurozone receives a $1,000 payment in USD, above is the calculation displaying how much less he would end up after taking into account PayPal’s fees.

Doing the math for the exact take rate,

(1 + 0.034) x (1+ 0.03) x (1 + 0.015) x (1+ 0.35 / 1,000) -1

results in an elevated rate of 8.14%, where most of it comes from the FX spread even though it was made from the most liquid currency pair in the world, EUR/USD.

At the same time PayPal is suffering from reputational risks from the side of small businesses as banning accounts and freezing hard-earned funds is not an uncommon practice from their side, just search online “PayPal banned” and you will encounter numerous examples. It happened to me seven years ago and the reason for the ban was that I was using a VPN, which resulted in a 6-month ban of my account and a freeze of funds.

I also can’t leave this section without addressing the scandal they had almost two years ago when PayPal planned to fine customers up to $2,500 for spreading what they would classify as misinformation. Of course, this resulted in a massive controversy that made the company pull back but the reputational damage and the views of abuse from PayPal will remain in many people’s minds.

Conclusion

To conclude, this company at this valuation, can’t simply be a sale unless you want to move on. But I don’t think buying puts is a good idea, even more so with the elevated share buyback yield. At the end of the day, although top-line growth rates have been deteriorating, they are still positive, with improving operation and bottom-line margins, and taking that into account the stock becomes fundamentally richer. Last, their PEG GAAP (TTM) stands at a bargain at 0.24x, which demonstrates how fundamentally cheap is the stock after discounting expected growth.

But in the market cheap can get cheaper and the big players do fail. If PayPal isn’t able to bring back its active accounts growth again and instead starts a constant count decrease, I believe they would slowly become a falling business and would gradually diminish those $70 billion in market cap. I see this too far from happening but is the key metric that I would be looking at.

Balancing the elevated risks with the potential reward of a cheap valuation, I believe the rating has to be a buy since good news in the company would make the stock soar rapidly. Yet, this is not a company that I would be comfortable holding for the next three years, so I see it as a mean-reverting play.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.