Summary:

- Fintech and bank valuations are likely to remain under strain as the market reels from recent bank collapses.

- PayPal’s user growth is slowing down dangerously; the fintech may post negative account growth in 2023.

- PayPal’s guidance for the present year is not great and only stock buybacks may help the stock regain some momentum in 2023.

JasonDoiy

PayPal Holdings Inc. (NASDAQ:PYPL) is experiencing significant difficulties with the growth of its user base, which has a negative impact on the company’s revenue growth.

According to PayPal’s guidance for 2023, the fintech will likely continue to face challenges because both user and sales growth are not approaching previous highs of 2020 and 2021. In reality, PayPal showed its user/account growth declining for the fifth time in a row since 4Q-21, highlighting fundamental growth issues that, in my opinion, will push PayPal’s stock to new lows in 2023.

Having said that, the only benefit I can see for PayPal is its potential to use free cash flow to fund share repurchases. Even this potential catalyst, though, ignores the significant rise in market risk that the SVB fallout has caused this year.

Profound Challenges To Sentiment And Risk-Taking Behavior

There have already been three bank failures, and more could follow.

Making the argument for investing in bank or fintech stocks has gotten much more difficult, even if I don’t believe that the U.S. financial industry is about to experience a shock similar to the one that occurred in 2008.

Just one major bank failure or a Credit Suisse-like fire sale, and market confidence could take a much bigger hit than the one that has already occurred.

I would advise against purchasing banks, even those of tier 1 banks like Bank of America, for that reason alone. I’m reluctant to suggest bank stocks as well as those of financial service companies and payment processors like PayPal.

PayPal’s User Growth Challenges Will Remain On Burden On PayPal’s Stock Price

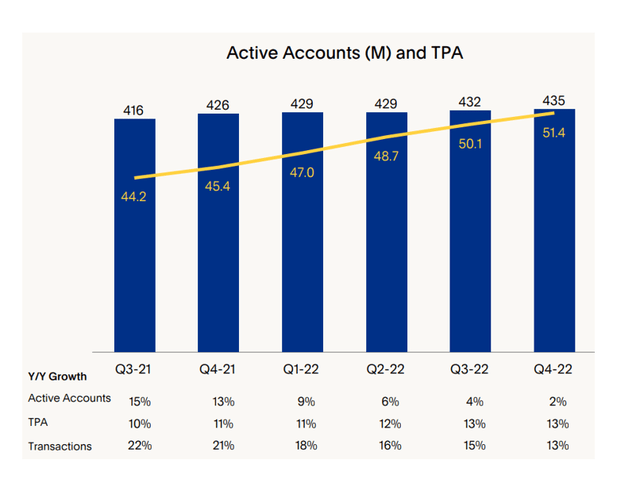

The issues PayPal is facing go far beyond sluggish sales growth. In the fourth quarter, PayPal reported its fifth consecutive fall in user growth. PayPal only saw 2% growth in user accounts in 4Q-22, which is a poor growth rate for a fintech that only a few quarters before saw double-digit account growth each quarter.

Inflation difficulties are reflected in sluggish user growth, and despite PayPal’s user base reaching 435 million by the end of 2022, growth problems still exist.

Active Accounts (PayPal Holdings Inc)

Even while PayPal’s forecast for 2023 is not promising, the fintech should still generate enough free cash flow to fund share repurchases, which are now the only thing PayPal is doing well.

In 2023, PayPal anticipates generating $5 billion in free cash flow, of which it will repurchase shares for about 75% of the total. This translates to $3.75 billion set aside for repurchases in 2023, which is actually not that much given PayPal’s market value of $84 billion. Having said that, any share repurchase is probably preferable to none. PayPal has not provided projections on user growth for 2023, and the fact that it hasn’t says a lot.

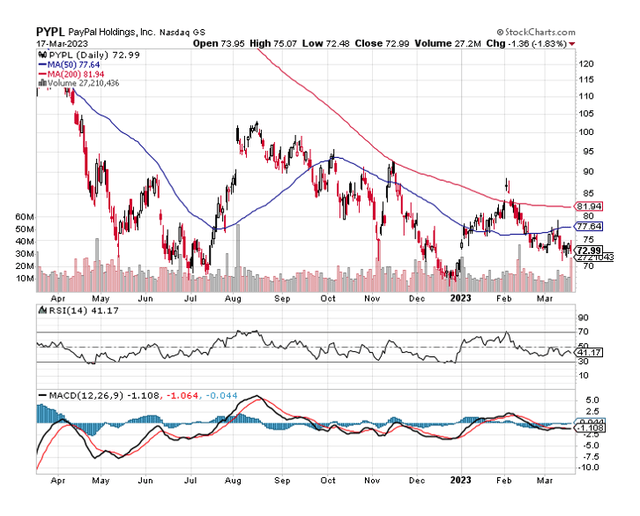

Technical Profile: It May Get Worse From Here

Recently, two significant negative chart signs flashed, both of which indicate more decline in the near future. One is the crossing of the 50-day moving average line in March, which came after the 200-day crossing in February.

The second is the breach of the $75 support level, which opens the door for PayPal’s stock to decline much further and perhaps challenge its 52-week low, which is at $66.39.

Moving Averages (Stockcharts.com)

Expectations And Earnings Multiple

In line with the fintech’s forecast of $4.87 per share in projected profits, the market projects profits of $4.88 per share for 2023. PayPal’s profit forecasts imply an earnings multiple of 14.8x based on its current stock price of $72.19 per share. Lower profit expectations and, thus, a greater profit multiple may result from a recession or sluggish user/account growth.

Earnings Estimate (Yahoo Finance)

PayPal’s Downside And Upside Risks

The downside and upside risks for PayPal are related to both its profit outcomes, particularly with regard to user growth, and the changes in the macroeconomic environment.

The largest threat to the macro environment would be a significant bank failure, which could fuel additional anxiety, increase volatility, and cause valuations to plummet as a whole.

On the other side, the absence of a banking crisis can cause recent valuation losses to be reversed.

My Conclusion

The most recent quarterly financial report from PayPal showed continued decline in terms of sales and user growth. The decline in user/account growth from 15% in 4Q-21 to 2% in 4Q-22 revealed fundamental business issues that have not yet been resolved by PayPal.

I currently only see the potential for share repurchases as positive. Also profitable, PayPal anticipates $5 billion in free cash flow this year, giving the fintech considerable room to maneuver in terms of share repurchases.

I believe that PayPal’s stock will continue to decline and hit new lows in the very near future due to the fintech’s fragile chart profile and rising market risks in the financial sector.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.