Summary:

- Texas Instruments has had total shareholder returns of 87% in the last 5 years compared to 46% for the S&P 500.

- The company has succeeded thanks to a disciplined capital allocation framework and a strong business model.

- The company has returned cash to shareholders at a high rate, not just over the last five years, but since 2004.

- The firm remains an attractive bet.

imagedepotpro

Texas Instruments, Inc. (NASDAQ:TXN) has been a great investment on the stock market over the last five years. This has been a result of a profitable business with sustainable competitive advantages, a disciplined capital allocation model and a generous cash return policy. Texas Instruments remains an attractive bet for investors.

Excellent Stock Market Performance

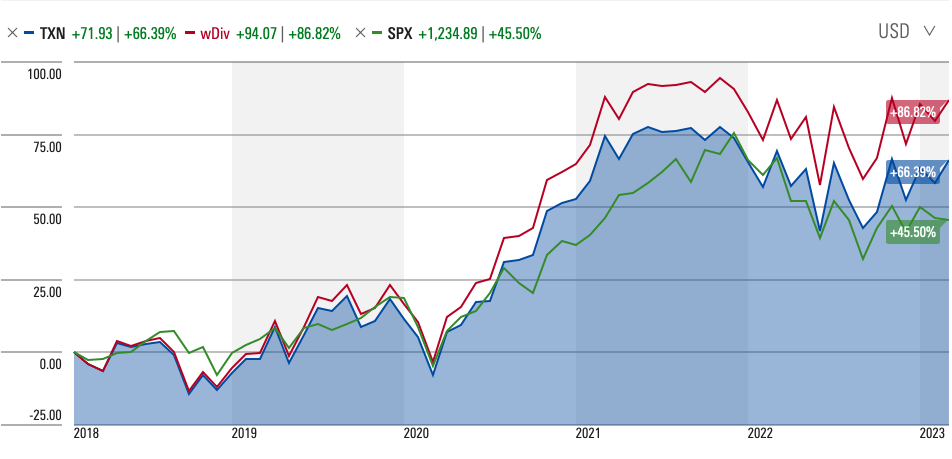

In the last five years, Texas Instruments has handily outperformed the stock market, growing total shareholder return (TSR) by nearly 87% compared to nearly 46% for the S&P 500.

Source: Morningstar

This success is based on a strong, profitable business model, with competitive advantages and a disciplined capital allocation framework.

A Profitable Business Model

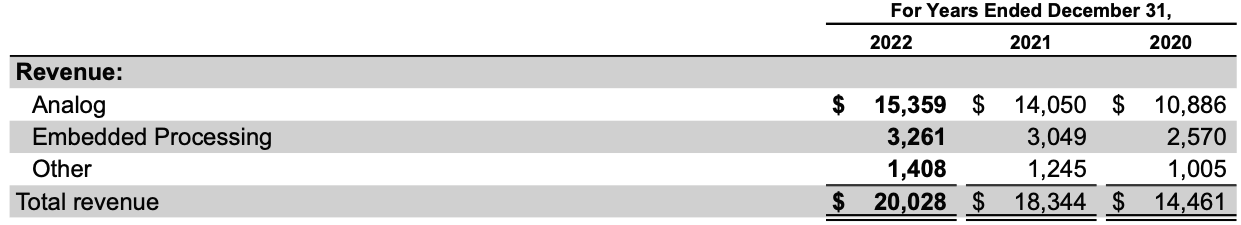

As a designer and manufacturer of semiconductors for electronics designers and manufacturers, Texas Instruments has two reportable segments: Analog and Embedded Processing. Analog is by far the largest reportable segment. In 2022, Analog represented nearly 77% of total revenue. Analog is responsible for designing and manufacturing analog semiconductors, which, according to the 2022 Annual Report, “change real-world signals, such as sound, temperature, pressure or images, by conditioning them, amplifying them and often converting them to a stream of digital data that can be processed by other semiconductors, such as embedded processors”. Analog semiconductors are also used to manage power in all electronic equipment by converting, distributing, storing, discharging, isolating and measuring electrical energy, whether the equipment is plugged into a wall or using a battery. Our Analog segment consists of two major product lines: Power and Signal Chain. Texas Instruments describes its Embedded Processing products as “the digital ‘brains'” of various kinds of electronic equipment. In 2022, this segment represented about 16.3% of total revenue. Other represents Texas Instruments remaining business. In 2022, this segment was responsible for about 7% of total revenue.

Source: Texas Instruments 2022 Annual Report

Over the last five years, revenue has grown from $15.78 billion in 2018 to $20.03 billion in 2022, at a 5-year sales CAGR of 4.89%.

Gross profits rose from $10.28 billion in 2018 to $13. 77 billion in 2022, at a 5-year CAGR of 6%. Operating profit, in turn rose from $6.7 billion in 2018 to $more than $10 billion in 2022, at a 5-year CAGR of 8.6. The firm’s operating margin in that time rose from 42.5% to 50.63%, demonstrating the company’s ability to make money.

Earnings have grown from $5.58 billion in 2018 to $8.75 billion in 2022, at a 5-year CAGR of 9.41%.

A Resilient Business

According to Robert Novy-Marx’ research, a gross profitability of 0.33 or higher marks a stock out as attractive. In that 5-year period, Texas Instruments’ gross profitability declined from 0.6 in 2018 to 0.51 in 2022. This is a reflection of the rise in the firm’s total assets, from $17.14 billion in 2018 to $27.21 billion in 2022, at a 5-year CAGR of 9.68%. There is an inverse relationship between asset growth and future returns, a phenomenon known as the “asset growth effect“. In other words, low asset growth stocks outperform high asset growth stocks. This is especially true in the cyclical semiconductor sector, whose booms and busts lead to managers and investors overestimating future growth in boom times, and underestimating future growth in down cycles, leading to periods of excess or shortages in inventory.

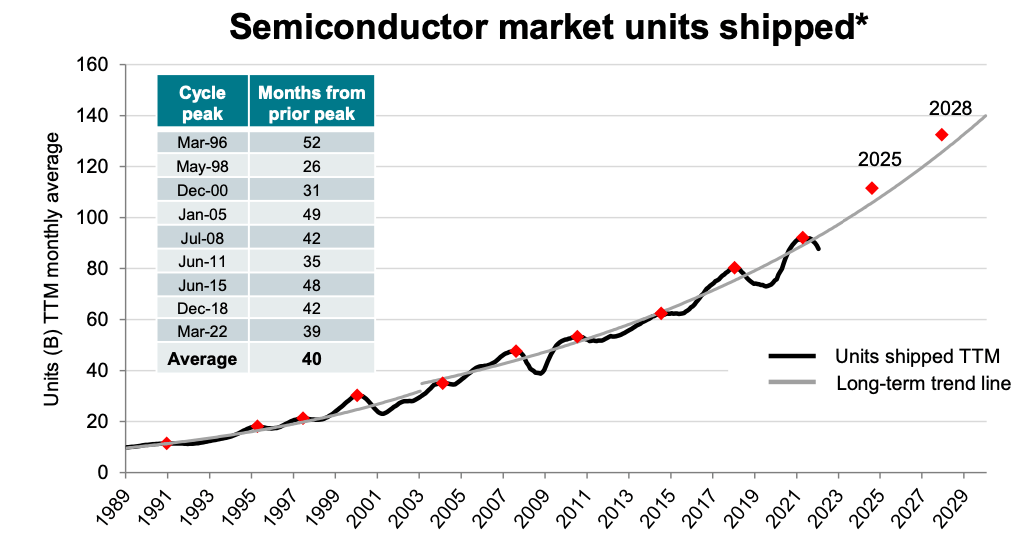

Source: “Capital Management”, Texas Instruments

As the chart above shows, Texas Instruments has been able to ship out a pretty steady number of units since 1989, which reflects on its four sustainable competitive advantages, namely, (1) manufacturing and technology, (2) broad product portfolio, (3) reach of its market channels, and (4) diverse and long-lived positions.

The reason for the asset growth effect is contested, but we can crudely say that managers, during periods of high growth, are liable to overestimate growth opportunities, raise too much capital, and invest too much in expanding production, such that, when their growth targets are missed, market returns collapse in response to the firm’s inability to earn anticipated profits. Texas Instruments has been able to avoid this because of their superior capital allocation, which minimizes its risk of misallocating capital.

Returning Cash to Shareholders

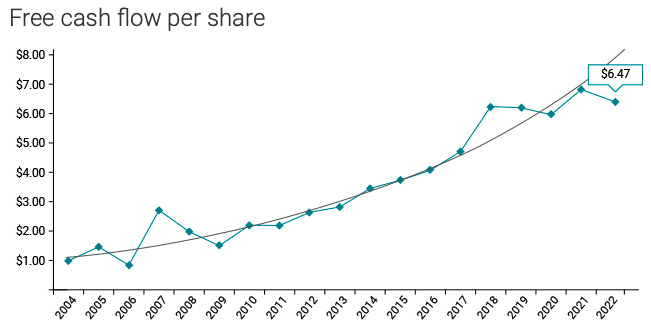

Management is encouraged to take the perspective of an owner-operator with a long-term view. In doing so, the company believes that maximizing FCF is the best way to ensure that long-term value grows. If we judge management by its own standards, they have done very well. Texas Instruments’ free cash flow (FCF) declined from $6.06 billion in 2018 to $5.92 billion in 2022, at a 5-year CAGR of -0.47%. Although FCF has declined modestly, the long-term trend is upward, with FCF compounding at 11% per year since 2004. Furthermore, the company has been able to achieve its target of FCF being 25% to 35% of revenue.

Source: “Capital management”, Texas Instruments

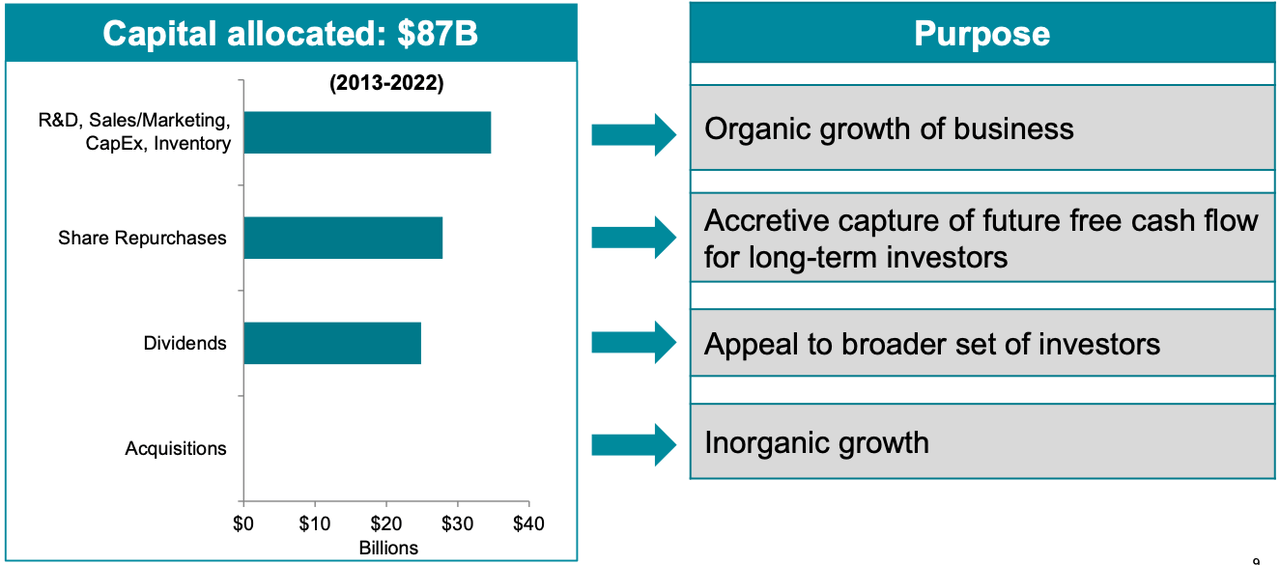

Texas Instruments has a disciplined capital allocation framework that guides their decision making, for example, in selecting research & development (R&D) projects, developing new products and capabilities such as TI.com, expanding capital expenditure, making acquisitions, and returning cash to shareholders. Once Texas Instruments has made necessary investments to grow long-term FCF, it returns cash to shareholders in the form of dividends and share repurchases.

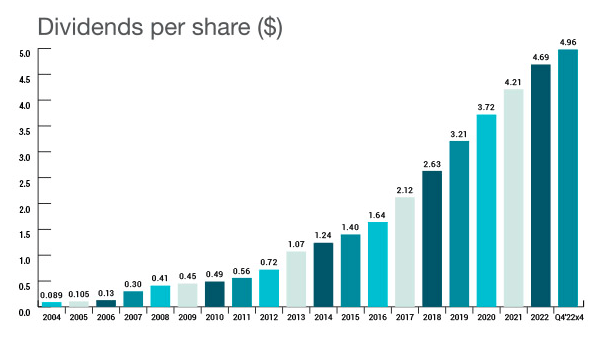

In the last five years, dividends have grown from $2.63 per share to $4.96 per share, at a 5-year CAGR of 13.53%. Taking a long term view, dividends have compounded at 25% since 2004.

Source: “Dividends & Stocks Splits”, Texas Instruments

Furthermore, management has reduced the total outstanding shares by 47% since 2004. Overall, in the last decade, the company has avoided acquisitions and used its FCF to invest in the business and returned cash to shareholders, allocating $87 billion to these three buckets.

Source: “Capital Management”, Texas Instruments

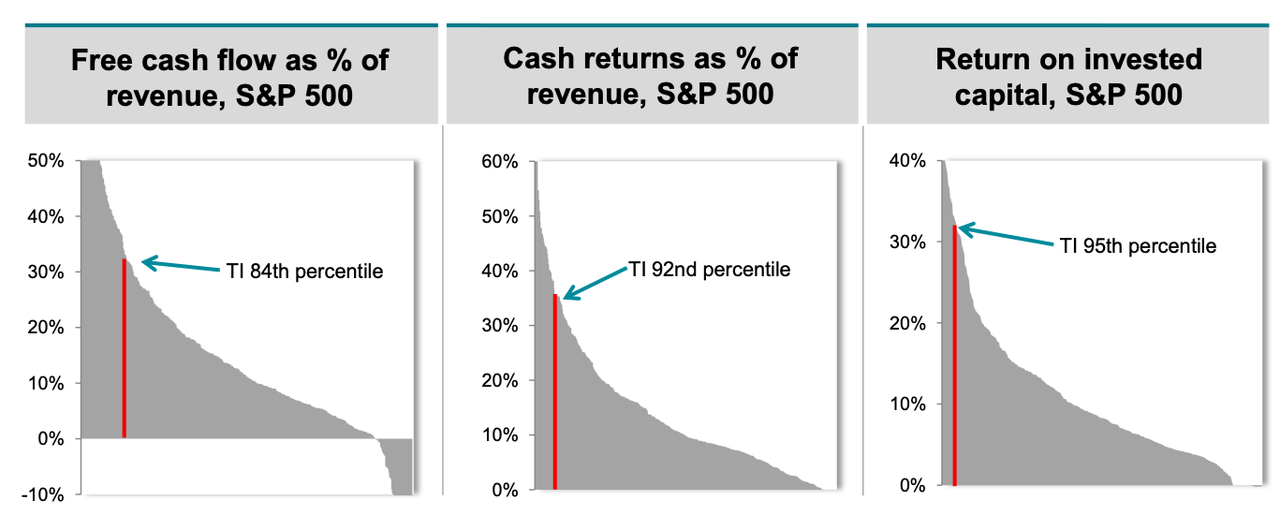

This has translated into cash returned to shareholders compounding at 17% per year since 2004. In 2022, investors earned $8.64 per share in yield, or 134% in FCF. These results make Texas Instruments one of the best firms in the S&P 500, in terms of FCF, cash returns and return on invested capital (ROIC). At present, Texas Instruments has a shareholder yield of 3.72%.

Source: “Capital Management”, Texas Instruments

Although ROIC has declined from 51% in 2018 to 44.2% in 2022, its results are still, as the figure above shows, in the 95th percentile of S&P 500 firms.

Valuation

Texas Instruments has a P/E multiple of 19.16 compared to 21.03 for the S&P 500. Furthermore, the company has an FCF yield of 3.6%, compared to an FCF yield of 1.8% for the 1000 largest firms in the United States, as calculated by New Constructs. This tells us that the firm is attractive on a relative valuation basis and that its FCF is available at a more attractive price than the general market. Finally, as highlighted above, with a gross profitability of 51, the company is very attractive in terms of profitability.

Conclusion

Texas Instruments has built a strong business that is profitable, generates enormous FCF, and allocates capital in a disciplined and intelligent manner, and ensures that shareholders enjoy rich and rising cash returns. Furthermore, the business is attractive on a relative basis, with its FCF trading at an attractive yield.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.