Summary:

- PepsiCo is one of the most impressive companies in the world through its excellent worldwide moat and large portfolio of billion dollar brands.

- I believe the growth outlook for PepsiCo is better than many expect it to be, driven by its exposure to emerging markets, high investments, and consumer focused approach.

- The company is a dividend king after 51 years of consecutive dividend increases and is well positioned to keep boosting the dividend at a decent pace.

- PepsiCo trades at a premium, but this seems completely justified once one considers the stability it offers and the very solid growth outlook.

- I believe PepsiCo is trading around fair value and with it rarely trading at a discount, I believe buying this defensive compounder at fair value is not bad at all.

Justin Merriman/Getty Images Entertainment

Introduction

I have been following PepsiCo (NASDAQ:PEP) for quite some time now. I am very much intrigued by the business fundamentals as I believe that this defensive compounder could actually see very decent growth over the remainder of the decade. The company has an excellent portfolio of both food and beverage brands, and it is very well capable of using its worldwide strength and financial power to introduce new products or make bolt-on acquisitions. Its brand strength also allows it to increase prices when input costs rise, like they have done over the past year, in response to decade-high inflation. Yet, despite this, PepsiCo has been able to keep its margins steady and increase prices without losing a lot of sales volume. That is true brand strength right there.

Sadly, this is also the exact reason why this company never trades at a discount. Investors need to pay a hefty price to buy the shares with these valued at a forward P/E of close to 24x. Yet, with decade-high and stubborn inflation, rising interest rates from central banks, falling consumer spending and confidence, a war in Ukraine, and since quite recently also banks getting in trouble, there is enough market turbulence to wish for a little bit of stability, like the one offered by the likes of PepsiCo or Coca-Cola (KO).

Within this article, I am going to take a deep dive into PepsiCo to see where the company is at today, what investors can expect from the company over the next several years, and to find out whether PEP stock is a buy, despite its demanding share price.

So, without further ado, let’s dive in!

PepsiCo – A company with an impressive moat

PepsiCo is a multinational food and beverage corporation formed in 1965 through the merger of Pepsi-Cola and Frito-Lay. Today, PepsiCo operates in over 200 countries and territories and employs more than 300,000 people worldwide. PepsiCo’s portfolio today includes a wide range of food and beverage brands known across the world, including Pepsi, Mountain Dew, Gatorade, Tropicana, Quaker Oats, Lay’s, Doritos, Cheetos, Ruffles, and many others. Through this excellent portfolio of products and strong brands, the company holds the #1 position in convenient foods and #2 position in beverages worldwide, based on annual sales, only behind close peer Coca-Cola. The company is a true industry giant, and its collection of strong brands gives it an incredible moat all across the world, which comes with great pricing power. This is how management described their brands during the CAGNY 2023 Conference:

we have a portfolio of beautiful brands that consumers love and buy very regularly around the world, some of them billion-dollar plus brands, some of them a bit smaller but growing very fast.

Brand portfolio PepsiCo (PepsiCo)

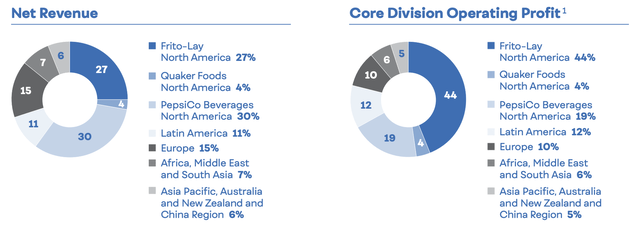

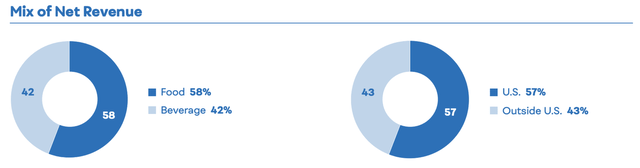

The company ended 2023 with $86 billion in revenue and a little over $12 billion in operating profit. 58% of this is coming from its convenient food brands, or almost $50 billion, and 42% comes from beverages, $36 billion. Some incredible numbers indeed, and combined with its impressive worldwide moat, this has earned the company a market cap of close to $250 billion, making it one of the largest companies in the world. That the company has indeed quite impressive pricing power is shown by the financial results it managed to report for FY22. Despite decade-high inflation, a war in Ukraine, and consumer spending under pressure, PepsiCo did not even see the slightest slowdown in its revenue growth as it was able to push on the price increases to consumers without losing any sales volume. As a result, PepsiCo was able to grow its revenues by 8.9% for the full year, also taking into account a 3% negative impact from foreign exchange. Organic revenue growth even came in at 14.4% which is really impressive and shows just how well the company is at navigating these headwinds. The most impressive part of all is the fact that despite the product price increases PepsiCo reported flat volume growth for its convenient food and even 3.5% growth in volumes in beverages, perfectly illustrating its impressive moat.

And a strong business moat is an important factor in a company’s long-term success. It allows a company to differentiate itself from its competitors and build a sustainable competitive advantage that can drive profitability and growth over time. In the food and beverage industry, this moat is all about brand recognition and economies of scale. Established brands like Coca-Cola, Pepsi, Nestle (OTCPK:NSRGY), and McDonald’s (MCD) have been around for decades and have built a loyal customer base. Consumers are often loyal to their favorite brands, and it can be difficult for new companies to build the same level of brand recognition which then creates incredibly high barriers of entry. And I believe many of you readers will be able to confirm this through your own experience. At least, I can. I love Lays and Doritos or Coca-Cola. When I go to the supermarket, I automatically grab these brands and don’t for a second consider grabbing a Pepsi or another potato chip brand. Please tell me if I am alone in this, but I don’t think so. Moreover, even when traveling on the side of the world, you will still find these same brands on supermarket shelves, increasing your relationship with these brands. So, whereas some brands in fashion, tech, or similar industries might be perceived as very strong, nothing compares to the brand strength of your daily food and beverage brands.

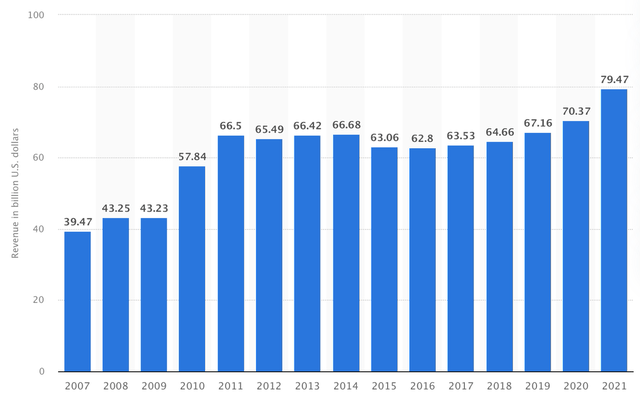

With Pepsi holding many of these daily consumed brands, it has been able to compound revenues over the last couple of decades and show quite impressive growth for a very defensive company, as shown below. PepsiCo has grown revenues at a CAGR of 5% over the last 14 years while growing EPS even faster.

Contributing to this is also great economies of scale. Large food and beverage companies have the resources and infrastructure to produce products at a lower cost than smaller competitors. This allows them to offer their products at a lower price, which can attract price-sensitive consumers. As a result, smaller companies most of the time get bought by the larger firms before they can reach these sizes or simply lose which decreases competition for PepsiCo.

Now, to complete the financial picture for PepsiCo, it also reported excellent EPS growth of 17% YoY, and 11% organic growth, resulting in EPS of $6.42. Free cash flow for the year was $5.9 billion. Revenue and EPS growth were driven by both food and beverages, showing great growth across the board.

PepsiCo is not done growing as the outlook looks solid

Despite its already sheer size, I believe there is still plenty of growth left for the business to drive very decent returns for investors as well. Management believes the same as with the introduction of the new strategy in 2019 they aimed to consistently deliver 4% to 6% organic revenue growth and high single-digit operating EPS. And that the new strategy has been working above expectations can be seen by the performance over the last couple of years. Just last year growth was above double digits and recorded already 2 years of double-digit EPS growth, which is quite impressive considering there was still the impact of covid. Also, the growth acceleration was visible in both the US business and international markets with growth in the US accelerating from around a 2% net revenue growth for 2016 to 2018 to 7.3% in the last 4 years, and international revenue growing from 6% to 9%.

In addition to this, according to management, PepsiCo operates in two very impressive industries with a market size, or TAM, of $500 billion and $600 billion, and industry growth for both is expected to be around the 5% mark. PepsiCo believes it can be a winner in both categories and it still has a long runway ahead of it. Despite it being an industry giant, it still only holds an 8% market share in the foods business and a similar percentage in the global beverage business. So, besides its already strong portfolio of brands, how is PepsiCo driving its growth?

One of the growth drivers for PepsiCo is the exposure the business has to emerging markets. PepsiCo derives 61% of its revenues from the North American continent, so still over half of its revenues. The other 39% then comes from international markets. Yet, something that is somewhat more remarkable is the fact that 31% of revenues come from developing and emerging markets, good for $27 billion in 2022. This gives PepsiCo a relatively high exposure to these markets which also happen to show much faster growth. By continuing the invest in these emerging markets, PepsiCo should be able to take more market share in these fast-growing regions, driving strong, above-industry revenue growth.

In addition to this, management also aims to keep increasing CapEx as it has been doing over the last couple of years. Since 2019, A&M has increased by 24% and now totaled $5.2 billion in 2022. Some of the subjects and segments the company plans to keep investing in are its core brands, consumer preferences, and digital innovation. This is how management described it:

Again, 3 key areas: one, investing in capacity and developing our supply chain; second, digital investments, make sure that we become a more intelligent company, more precise, more agile, more forward thinking; and the third one, making sure that our go-to-market get even more capillarity, become more extensive as we’re trying to get our products in front of consumers.

So, one of the parts that management focused on was investing in its core brands through improved packaging and improved brand awareness. And so far, the investments seem to be paying off quite well with multiple billion-dollar brands growing very strongly like Gatorade which grew 13% a year over the last 3 years, Doritos 11%, Cheetos 11%, and Lays grew at a CAGR of 9%. The key to boosting this growth is the consumer itself. PepsiCo tries to adapt its products to consumer preferences which results in choices like putting zero sugar at the center of its beverage offering. This means management offers new products under existing brands that take better advantage of current preferences, but it also launches new product brands which are centered around these trending topics, and this results in explosive growth for these small brands, like SodaStream for example. SodaStream is a more durable and healthy alternative to other bottles of soda. This makes it incredibly popular at a time when everyone is focusing on health and the climate. This is how PepsiCo described the function of these small brands:

but also investing in building new smaller brands that fill the portfolio in new cohorts or new spaces that are obviously coming up in our categories.

For PepsiCo, it is all about looking at what the consumer wants and playing into these trends. By doing this, it is able to increase brand popularity and sell new products which then results in financial growth. And it is also not just the emerging markets where it sees great growth potential but it believes there is still a huge opportunity to leverage in the US as well. This is how management describes these opportunities:

We think that we have a huge opportunity to broaden their portfolio, not only to continue to gain occasions in existing categories but probably expand it even more into macro snacks and capturing some of that opportunity; and at the same time, moving our portfolio closer to food, being part of meals, either on kind of the food trucks that I was showing to you earlier or being part of recipes and how people cook. And there is a huge opportunity for us to move into those spaces.

Summarized, PepsiCo still sees plenty of new product markets it could penetrate and offer products in through its strong worldwide brands, and this should enable it to also boost growth in these already very mature markets. PepsiCo has shown that it is very well capable of identifying these new trends and preferences, and with more money being invested in developing its large brands, it should be able to drive very consistent growth going forward. Especially with a determined focus on fast-growing product segments like meals, energy drinks, and zero-sugar products.

Another focus area for PepsiCo is digital. And you must be wondering what this exactly means as PepsiCo is not a real digital company except for commercials. Well, it is all about using digital to improve business operations. PepsiCo aims or already uses, the newest high-tech innovations like AI or IoT to improve business operations. This includes technology and information for salesmen to optimize the portfolio with precision store by store. This means that by leveraging technologies like AI, PepsiCo is able to maximize its store throughput, and so far, it has only been scratching the surface regarding these technologies. By increasing its use of these technologies to be better able to determine the previously discussed consumer preferences of each region, PepsiCo plans to be better able at playing into consumer needs.

Considering all these growth drivers and the excellent operational execution PepsiCo has shown over the last decade, I believe PepsiCo is still well positioned to show impressive growth going forward, driven by further growth in emerging markets, investments in its core brands, investments in digital, and a focus on consumer preferences and the latest food and beverage trends. Therefore, I believe the targeted growth range of 4-6% organic growth is still quite conservative by management. The last years have shown that PepsiCo can grow at a much faster pace, although revenues were in part boosted by significant price increases. Still, I believe investors should expect this business to grow revenues by closer to 6-7%, with top-line growth of close to 10% as management targets 20 to 30 basis point margin expansion every year.

This Dividend King still has enough dividend growth ahead

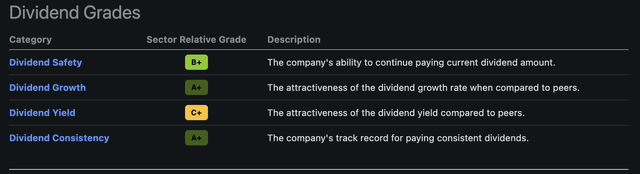

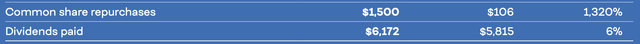

Another impressive feature of PepsiCo is the fact that the company has been increasing its dividends for 51 consecutive years now, making it a rare dividend king. And management remains committed to making sure that investors get bigger and better dividends every single year as confirmed during the CAGNY 2023 Conference. Management targets a dividend of around 2.5-3%, of course depending on the share price. And it does not stop here though, as PepsiCo is committed to returning all excess cash to shareholders through share repurchases, driving additional shareholder returns. FY22 was no different as shown below.

Dividend and Share Buybacks 2022 (PepsiCo)

PepsiCo shares currently yield a very decent 2.62% forward yield after the company announced a 10% dividend hike during the latest earnings release. This brings the 5-year growth rate of the dividend to 7.39% which, considering the nature of the company, is not something to complain about at all. The dividend is also well covered by cash flows as the payout ratio currently stands at a relatively safe 66%. And while I do always prefer a dividend payout ratio of below 50%, the stability and strength of this business allow for a somewhat higher dividend payout.

Overall, PepsiCo remains focused on rewarding its shareholders as it has been doing for over 50 years. I see no reason why this should change anytime soon and believe that investors should expect the dividend to keep growing at a similar pace of around 7% a year. In addition to this, the starting yield is strong, and the dividend looks safe considering the business stability. This is also reflected in the dividend grades the company receives from Seeking Alpha.

Outlook & Valuation

2022 was a very impressive year for PepsiCo with double-digit growth rates all across the board, driven by price increases and steady sales volumes. With inflation still high, we should expect further price increases for next year as well. Still, PepsiCo expects the growth rate to fall back somewhat which is not completely unexpected. Management projects revenue growth of 6%, combined 8% growth in EPS. including a 2-percentage-point headwind from foreign exchange, EPS is expected to be $7.20 or grow 6% YoY.

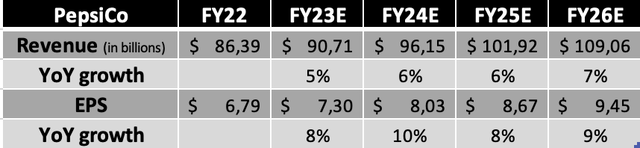

I believe these estimates from management look quite conservative which is something PepsiCo often shows at the start of the year, to then revise it upwards halfway through the year. Therefore, following my deep dive into the company and all the aspects laid out above, I arrive at the following financial expectations for the years until FY26.

(My 1Q23 estimate: Revenue of $17.42 billion, $140 million above Wall Street, and EPS of $1.42, $0.03 above Wall Street)

Shortly explaining these estimates, I expect PepsiCo to report solid growth rates for FY23 as price increases continue and volumes remain solid, although revenue will be slightly impacted by ongoing FX headwinds. Just as pointed out by management, EPS growth is expected to be slightly better driven by margin improvements. As for the following years, I expect PepsiCo to report steady growth rates of around 6-7% for revenues and close to 10% for EPS. Revenue will be driven by all factors discussed in this article and with management targeting continuous margin improvements every year, EPS is expected to grow at a slightly faster pace. Volume growth will most likely hover around the 3-4% mark but could come in higher depending on emerging market growth.

Overall, my estimates are slightly higher compared to those of Wall Street analysts, but I believe we will see these estimates being revised upwards during the year.

And with those estimates in place, we arrive at the valuation. That PepsiCo is not cheap is a given, but just how expensive is it? Well, based on the current EPS consensus from Wall Street, PepsiCo is valued at a forward P/E of 24x which is on par with its 5-year average. As for comparison, Coca-Cola and The Procter & Gamble Company (PG), two other consumer staple giants, are both valued at a very similar valuation, but both with slightly lower growth expectations. Therefore, I think PepsiCo might be trading at a fair valuation of 24x right. Considering the growth profile, stability, moat, and strength of the business, I think a 24x P/E is justified here.

Based on this 24x forward P/E and my EPS estimate for FY24, I calculate a target price of $193 per share, leaving investors with an upside of 10%, which is not overly much considering that I am using FY24 EPS. As for comparison, 23 Wall Street analysts currently maintain an average price target of $187, combined with a buy rating.

Conclusion

As I already mentioned in the introduction of this article, I am very enthusiastic about the growth prospects of PepsiCo as the business seems to have plenty of growth levers to pull. Excellent exposure to emerging markets and investments in core brands and digital innovation should drive solid growth over the next couple of years. Add to this the fact that PepsiCo is a dividend king offering a very solid yield and plenty of dividend growth potential, and it’s hard not to be a fan of this company.

Yet, no company is worth any price and PepsiCo is not cheap. With the shares valued at a forward P/E of 24x, the share price is quite demanding and requires PepsiCo to keep executing. But when comparing its valuation and growth rates to consumer staple peers, I actually believe the company is trading around fair value when also considering the very impressive expected growth rate and stability of the business.

Based on my own estimates for FY24, I calculate a price target of $193, leaving investors with a 10% upside potential. Yet, adding to this the 5% dividend investors would collect over this 2-year period, 15% returns are not bad at all considering the defensive nature of PepsiCo.

With this company rarely trading at a discount and its long successful track record, I believe it is not bad to be buying this company at fair value, positioning investors to benefit from continued growth over the rest of the decade, and most likely far beyond. Therefore, I rate PepsiCo a buy at a share price of around $175 a share. The company can offer some stability to anyone’s portfolio while driving very solid returns every single year, no matter the economic sentiment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PEP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.