Summary:

- PayPal Holdings is one of the largest companies in the global digital payments market.

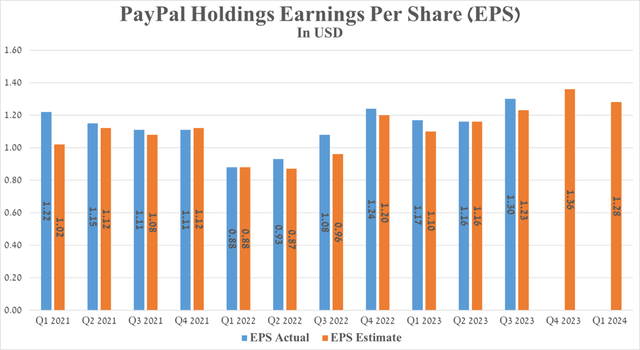

- The company’s aggressive use of a share repurchase program, its policy of cutting operating costs, and year-over-year revenue growth have helped it beat analysts’ consensus estimates in recent quarters.

- PayPal’s revenue for the three months ended September 30, 2023 reached $7.42 billion, up 8.3% year-over-year and beating analysts’ expectations by $40 million.

- PayPal’s TPV was about $387.7 billion in the third quarter of 2023, an increase of 15.1% year-on-year, even as key central banks maintained high interest rates and relatively low global economic growth.

- I’m initiating coverage of PayPal stock with a “buy” rating.

Iona Studio/iStock via Getty Images

PayPal Holdings (NASDAQ:PYPL) is one of the largest companies in the global digital payments market.

Thesis

Despite a challenging year for PayPal bulls in 2022, its share price was able to break through a resistance line dating back to August of the previous year, marking a positive shift in Wall Street’s perception of the company’s prospects and calling into question the pessimism prevailing among retail investors regarding it.

In recent quarters, PayPal has continued to transform its business, starting with Alex Chriss taking over as CEO in September 2023 and ending with strategic decisions aimed at expanding the number of services related to cryptocurrencies, which is especially important as their popularity grows. For example, the price of Bitcoin (BTC-USD) has increased by more than 70% over the past three months.

The company’s aggressive use of a share repurchase program, its policy of cutting operating costs, and year-over-year revenue growth have helped it beat analysts’ consensus estimates in recent quarters. Also, given that PayPal is trading at a discount to its historical 5-year average P/E ratio, I believe it is an attractive asset for long-term investors looking for undervalued assets from the financial sector ahead of the anticipated Fed interest-rate cuts in 2024.

I’m initiating coverage of PayPal with a “buy” rating.

Increased full-year 2023 guidance, share repurchase program, and strong balance sheet

On November 1, 2023, PayPal published results for the third quarter of 2023, which were pleasantly surprising despite the slowdown in global economic growth caused, among other things, by the war between Ukraine and Russia and high interest rates by central banks. Also, the company’s management increased its financial guidance for 2023 despite the continued decline in active accounts since the fourth quarter of 2022.

We’re slightly increasing our expectations for full year 2023 non-GAAP EPS, which we now expect to be approximately $4.98, representing 21% growth from last year. This increase reflects the benefit of Q3 outperformance and changes to our tax rate assumption. In addition, we now expect free cash flow for 2023 to be at least $4.6 billion.

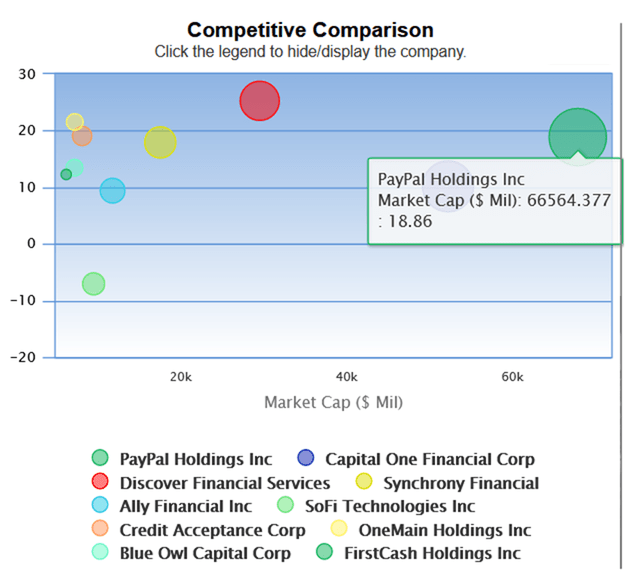

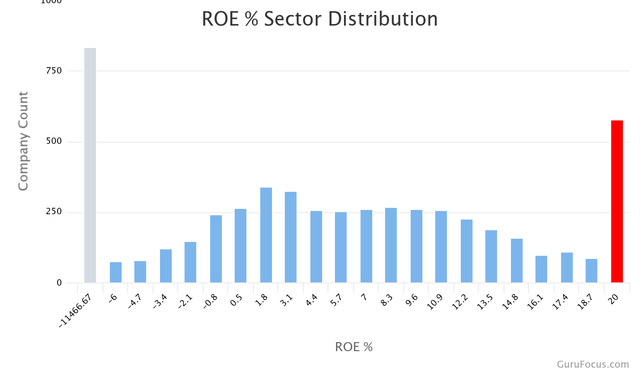

Also, PayPal has a return on equity of about 18.86%, which indicates the continued effectiveness of its financial policy and demonstrates the successful adaptation of its business strategies to changing conditions in the economic environment.

According to GuruFocus, this financial metric is higher than that of most companies belonging to the financial services sector.

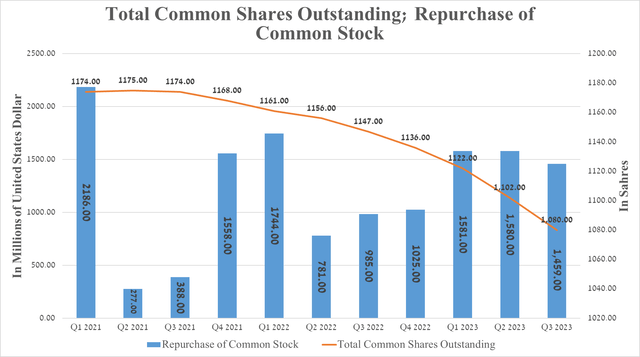

Despite continued pessimism about PayPal’s prospects, its management continues to take advantage of the current situation and resorts to active use of its share buyback program. So, for the three months ended September 30, 2023, the company repurchased shares for a total amount of about $1.46 billion, which is $474 million higher than the previous year.

As a result, the number of common shares outstanding amounted to 1.08 billion at the end of September, which is 56 million less than at the beginning of 2023. According to the 10-Q, PayPal still has about $11.5 billion left to buy back its shares in the future, potentially increasing earnings per share and reducing the appetite of short sellers in their desire to break through the strong support zone located between $59.5 and $60.

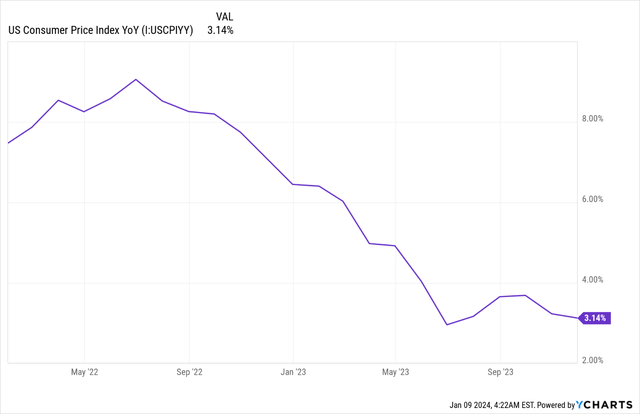

A significant decline in US consumer inflation will lead to interest rate cuts by the Fed

Since June 2022, there has been a decrease in consumer inflation in the United States.

One of the reasons for this is the effective monetary policy of the Federal Reserve, one of the goals of which was to offset the negative consequences of the multi-trillion-dollar COVID-19 relief efforts adopted by the US government aimed at mitigating the damage from the pandemic.

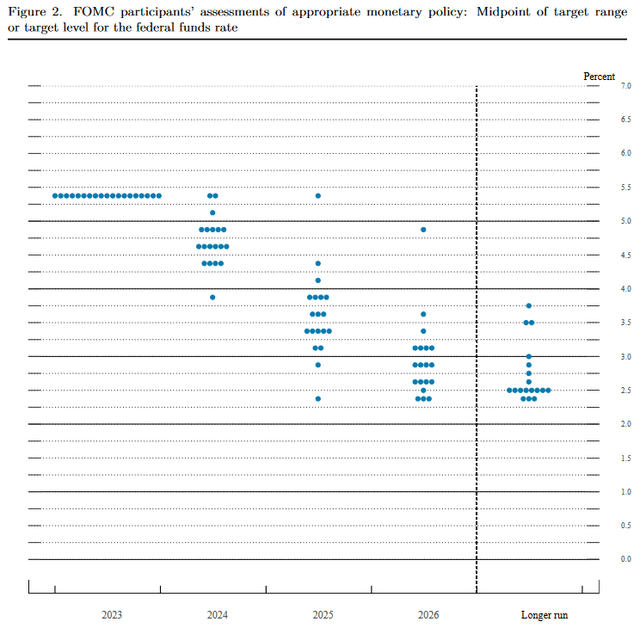

Published forecasts in the Summary of Economic Projections indicate that there will be three Federal Reserve rate cuts in 2024, potentially leading to growth in payment volumes and increasing investor interest in the digital payments industry.

PayPal’s financial results and outlook

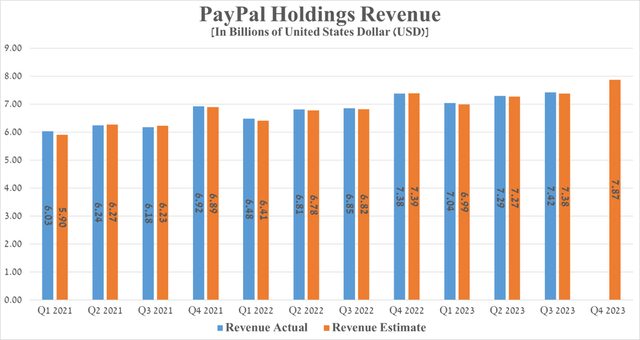

PayPal’s revenue for the three months ended September 30, 2023, reaching $7.42 billion, up 8.3% year-over-year and beating analysts’ expectations by $40 million.

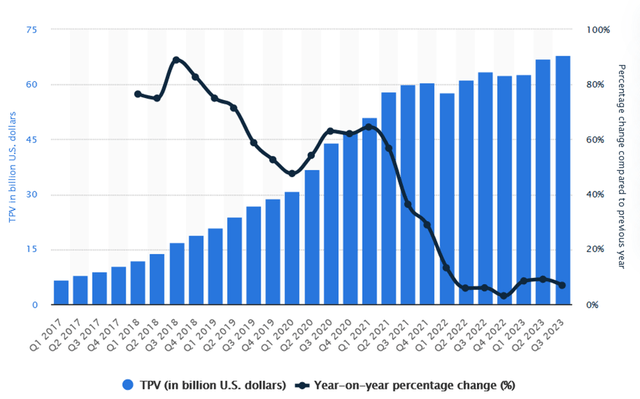

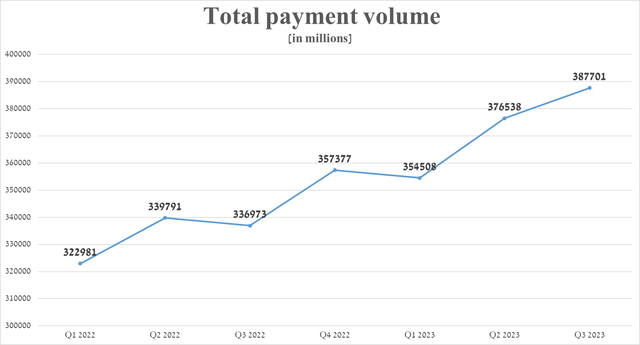

The increase in this financial indicator was mainly due to the rise in the total payment volume (TPV), the number of payment transactions per active account, referral, and gateway fees. So, the TPV was about $387.7 billion in the third quarter of 2023, an increase of 15.1% year-on-year, even as key central banks maintained high interest rates and relatively low global economic growth.

As a result, it points to the growing attractiveness of PayPal’s core products among its customers, providing fast and convenient ways to transfer money, as well as the effectiveness of its business strategies that allow it to adapt to changing client needs.

Source: graph was made by Author based on 10-Qs and 10-Ks

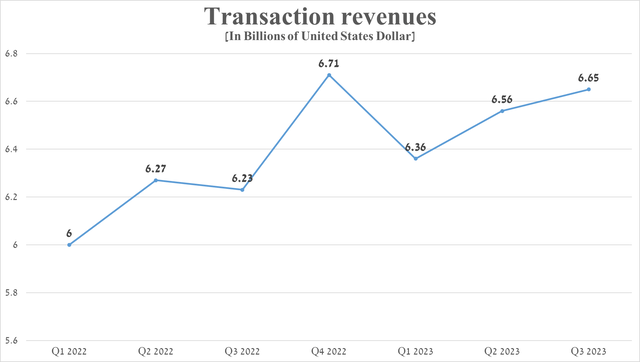

Despite TPV’s significant growth, PayPal’s year-over-year transaction revenues growth rate has been slow to accelerate, which is one factor that explains why its share price has been traded in a narrow price range from $55 to $60 in recent months.

Source: graph was made by Author based on 10-Qs and 10-Ks

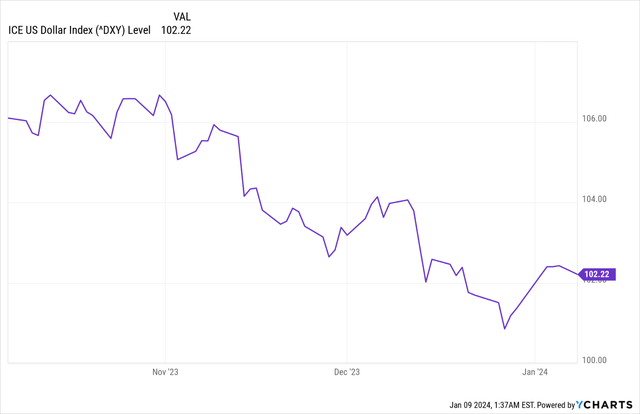

On the other hand, based on the third quarter 2023 results, the company generated about 42.6% of its revenue outside the US. Given the ongoing trend of the dollar weakening relative to other major currencies, PayPal’s services and products are becoming more accessible and attractive to its international customers, which also helps improve its competitiveness in the digital payments market.

Seeking Alpha offers financial data on Wall Street analysts’ expectations for the coming quarters. So, PayPal’s revenue for the fourth quarter of 2023 is expected to range from $7.7 billion to $7.95 billion, which is 6.6% higher than the fourth quarter of 2023

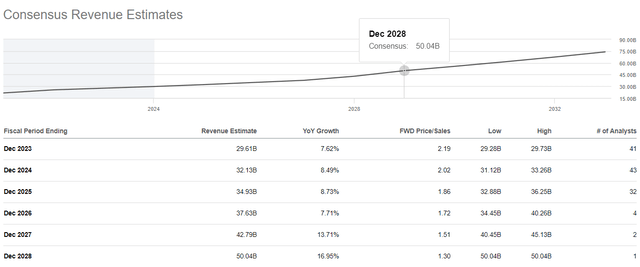

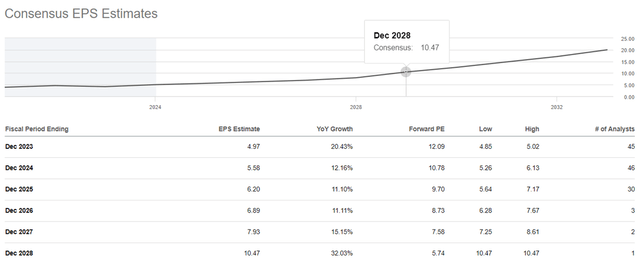

However, the company’s price/sales [FWD] is 2.19x, indicating that it trades at a discount to most of its peers in the payment processing industry. On a more global level, PayPal’s revenue is expected to grow in the coming years. The increase in this financial metric is accompanied by an anticipated decrease in the P/S ratio to 1.3x by 2028, making the stock more attractive to long-term investors looking for assets with the greatest potential ahead of the anticipated Fed interest-rate cuts in 2024.

PayPal’s Q3 Non-GAAP EPS was $1.3, beating analysts’ consensus estimates by $0.07. Moreover, its EPS is expected to be in the range of $1.35 to $1.39 in the fourth quarter of 2023, up 10% year-over-year.

Wall Street predicts that PayPal’s net income will continue to grow, and more importantly, it will accelerate from 2025, reflecting analysts’ expectations of an improving global economic environment, the prospects for its transfer services for cryptocurrency, and its initiatives aimed at reducing operating costs, including by optimizing labor costs.

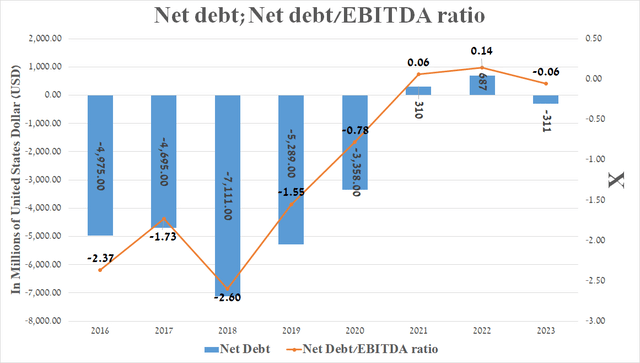

It is equally important to discuss PayPal’s debt, which, in my assessment, is not a risk to its financial position. In 2024, its net debt turned negative again and stood at about -$311 billion at the end of September 2023. Also accounting for year-on-year growth in its EBITDA, its net debt/EBITDA ratio decreased to -0.06x, reflecting the company’s continued improvement in its financial strength and the availability of financial resources to service its debt and repay its notes.

Key risks to consider

I will highlight two key risks directly related to PayPal that financial market participants need to consider to minimize potential losses.

Decrease in the growth rate of Venmo’s TPV

Venmo is one of the most popular peer-to-peer payment apps in North America. According to Statista, the growth rate of Venmo’s total payment volume has continued to slow in recent years and amounted to about $68 billion in the third quarter, up 6.9% from the previous year.

In addition, on December 7, 2023, news came out that Amazon (AMZN) would stop accepting Venmo payments as of January 10, 2024. However, investors perceived this event neutrally because the share of Venmo’s TPV of PayPal’s total TPV is about 17.5%, and the company has other products that are gaining popularity, including transfer services for cryptocurrency.

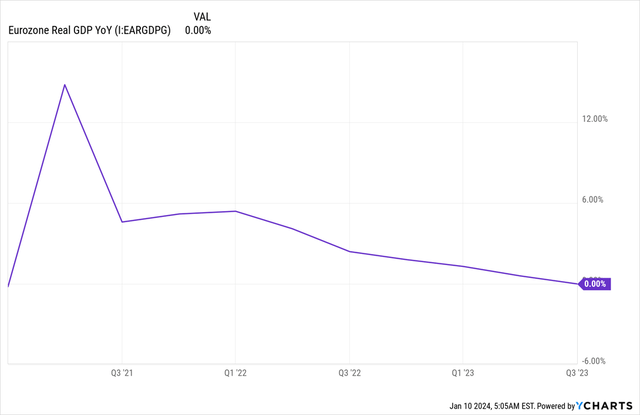

Slowdown in economic growth in the European Union

Due to the ongoing conflict between Ukraine and Russia, coupled with elevated prices of natural gas and oil from late 2022 to 2023, the European Union’s economic growth continues to slow. Ultimately, it could potentially lead to a downturn in consumer spending and slow down the growth rate of PayPal’s TPV.

Takeaway

The main risks that I highlight are a decrease in the number of PayPal’s active accounts from the fourth quarter of 2023, a relatively slow recovery of economic activity in the European Union, and a slowdown in the growth rate of Venmo’s TPV, as a result of increased competition in the global payment processing solutions market.

Otherwise, the company’s stable year-on-year revenue and operating income growth, active use of the share repurchase program by its management, strong balance sheet, and low total debt are among the main factors making PayPal an attractive asset for long-term investors looking for assets with the greatest potential ahead of the anticipated Fed interest-rate cuts in 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.