Summary:

- PepsiCo is a newly minted Dividend King for having paid a growing dividend for 50 consecutive years.

- The company is a leader in the beverage and snack industry.

- PepsiCo is considered by many to be a recession-proof stock.

Fotoatelie

PepsiCo (NASDAQ:PEP) is an American multinational corporation headquartered in Purchase, New York. It is one of the world’s largest food and beverage companies with its largest competitor being Coca-Cola Company (KO).

Here are some of PepsiCo’s most well-known products:

- Pepsi

- Frito-Lay

- Quaker Oats

- Gatorade

- Tropicana

- SodaStream

The company was founded in 1965 through the merger of Pepsi-Cola and Frito-Lay. The company has since expanded through a series of acquisitions, including the acquisition of Quaker Oats in 2001 and Tropicana Products in 1998.

PEP operates in more than 200 countries and territories. The company’s products are sold in grocery stores, convenience stores, vending machines, and restaurants. PepsiCo also has a number of food service businesses, including Frito-Lay Foodservice and Quaker Oats Foodservice.

PepsiCo is a vertically integrated company, which means that it owns and operates all of the steps in the food and beverage manufacturing process. This gives PepsiCo a great deal of control over its products and allows it to keep costs down.

Given that the US economy seems like it is headed for a recession, a company like PepsiCo, being that it is a major player in the global food and beverage industry, could be a great stock to hold. The company’s products are enjoyed by consumers all over the world and management has gotten smart with product sizes as well, which appeal to a greater audience. PepsiCo is committed to innovation and to providing its customers with high-quality products.

The awareness of health and interest in eating and drinking healthy has risen in the US over the years, as US consumers look for healthier options when it comes to what they drink and food they consume. PepsiCo has a number of innovative products in the pipeline, including a new line of healthy snacks and a new type of soda that is made with natural ingredients, which should attract these types of customers.

A Dividend King With Plenty Of Fizz

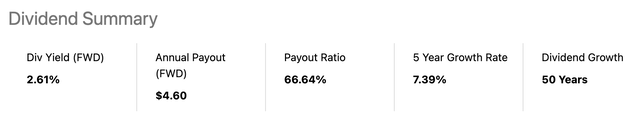

PepsiCo is a company that undoubtedly focuses on returning money to shareholders. They have shown this through share buybacks and growing dividends. In fact, PepsiCo is one of the newest additions to the prestigious Dividend Kings list for having hiked the dividend for 50 consecutive years now and counting.

PEP currently pays an annual dividend of $4.60, which equates to a dividend yield of 2.6%. The company’s payout ratio is 66% and over the past five years, the company has hiked the dividend an average of 7.4% per year, which is in line with the most recent hike.

PEP is still hiking its dividend at a decent rate, one that normally outpaces inflation, and they have an ok payout ratio, which tells me if the company continues to perform at the current pace, the dividend should continue to climb in the coming years.

Recent Financial Performance

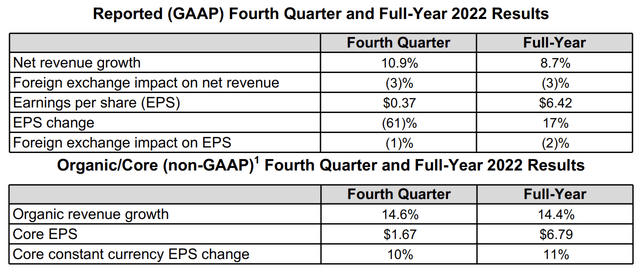

In February, PepsiCo released their Q4 and full year 2022 earnings. The company saw revenues climb 10.9% to roughly $28 billion in Q4 and revenues grew 8.7% over the entire year. Organic revenue growth grew 14.6% in Q4, which was largely in-line with the full year in 2022.

Given the impact of inflation, PepsiCo was forced to hike their prices in 2022, which is one reason we saw solid results. Q4 results were higher than analysts’ expectations during the quarter, beating on both the top and bottom lines.

Here is the Q4 results compared to analyst expectations:

- Earnings per share: $1.67 adjusted vs. $1.65 expected

- Revenue: $28 billion vs. $26.84 billion expected

Either the company does a fine job outperforming expectations or analysts are poor at generating estimates because PEP revenues has topped expectations in 28 out of the past 32 quarters. Meanwhile, EPS has beaten to the higher side in 34 of the past 36 quarters. Both are very impressive in their own right.

Looking ahead to 2023, management is calling for the following:

- 6% increase in organic revenue

- 8% increase in core constant currency EPS

- A core annual effective tax rate of 20%

- Total cash returns to shareholders of approximately $7.7 billion, comprised of dividends of $6.7 billion and share repurchases of $1.0 billion.

Is PEP A Buy, Sell, or Hold?

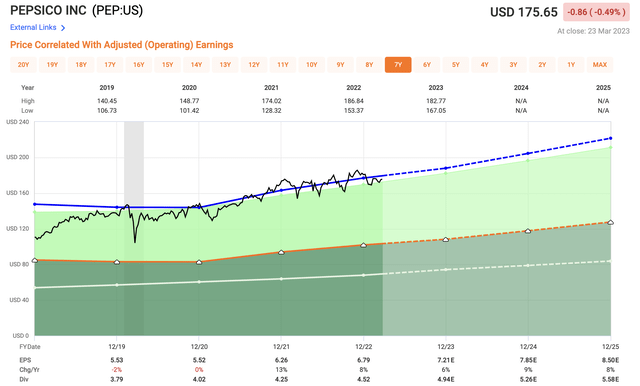

Analysts are looking for PEP to generate adjusted EPS of $7.21 in 2023, which is slightly below the 8% increase management is expecting. Given that, shares of PEP are currently trading at a forward earnings multiple of 24.4x. Over the past five years, shares of PEP have traded closer to 26x.

This suggests shares are slightly undervalued, however, as we move the timeline out to the past decade, shares of PEP have traded closer to 23.1x. Today’s monetary policy is drastically different from the cheap conditions we saw in the markets, thus the 23.1x average multiple seems more realistic.

Given that, I would personally rate shares of PEP a HOLD at the current moment.

Investor Takeaway

As we have seen, PepsiCo is a leader in the beverage and snack industry. They battle it out with KO in the beverage space, but add a little more to the table given that they have the snack component of the business.

Regardless of the economic backdrop, US or even global consumers like to consume snacks. Most of PepsiCo’s products are low in dollar value, which can still appeal to customers as money gets tighter if we fall into a recession.

PepsiCo’s management team does a great job prioritizing returning capital to shareholders, evidenced by both the 50 consecutive years of dividend growth and by the $7.7 billion they expect to return to shareholders in 2023 alone.

However, there are a lot of great companies in the market, but valuation matters and right now, although the stock does not look extremely overvalued, the valuation is not all that compelling at the moment. This is a stock I plan to keep on my watchlist in the event we get a pullback.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No marketing to add