Summary:

- Good revenue performance on paper, but digging deeper, driven mainly by price increases as volume sales drop, with margins contracting.

- I see further weakness developing over time, as price increases seem unsustainable.

- The balance sheet can be improved but I don’t see any potential red flags.

- I assume more margin contraction in the near term while in the long run will see improvements.

- The 10-year DCF model and a dividend model suggest the company is slightly too expensive at these levels. New, patient investors should wait for a better entry point.

Derek White

Investment Thesis

PepsiCo Inc. (NASDAQ:PEP) has seen strong performance for a while now, so I decided to look into how the company might fare in a deflationary environment over the next couple of years which in the short run might affect their margins slightly and then recover once again when everything normalizes. I argue that with current net decreases in volume sold in most of the segments, coupled with the inflation coming back down over the next 2-3 years, the company will not see good growth in revenues and margins will slightly contract in the first couple of years and then the company will be able to initiate some cost-cutting measures to bring the margins back up to 2019 levels as a conservative measure.

The company currently trades at a bit of a premium than my models suggest, and I give PEP stock a hold rating and wait for a pull-back into more reasonable levels, which may come due to the looming recession in the next year or two.

FY2022 Results

On paper, the company delivered another strong year, revenues increased by around 10% y-o-y while operating margins have contracted by 70bps due to higher commodity costs and other operating cost increases. The company did see some good net revenue increases in most segments primarily driven by effective net pricing, as most of the segments saw volume declines. The company managed to increase prices without losing many customers, which seems that the consumer was not very price-sensitive at first, but now with declines in volume sales, we see that the price increases may not be sustainable in the long run and the company will have to bring them down.

Assumptions for the Model

The three standout segments that grew in the mid-teens and outperformed are Frito-Lay NA, Quaker Foods NA, and LatAm which sells most FLNA and QFNA products in Latin American countries. These segments performed so well, that I believe we will see numbers that are going to be not as impressive going forward for two reasons, FLNA and QFNA saw volume sales decrease y-o-y, while LatAm had volume sales up, with some cracks showing already in Brazil. Another reason is because of the decrease in volume sales, the company will have to reduce prices. Inflation will no doubt come back down in the next couple of years, which may bring a recession in the meanwhile, people will continue to buy less, and the prices will keep coming down. I assume that we will see some further declines in margins for the next few years, after that, the company is going to implement some cost-cutting measures that will improve margins slightly and the company manages to find a price mix that will not drive away consumers, which will let the company grow at a steady pace.

I will not reduce the margins too much because, other segments of the company are growing and gaining market shares, like Rockstar, and Celsius, with high growth in the Pepsi Zero brand and good progress in their ready-to-drink coffee products sold at Starbucks. The company has a lot of different products that I feel won’t be affected that much by a recession and so margins will stay relatively similar.

Financials

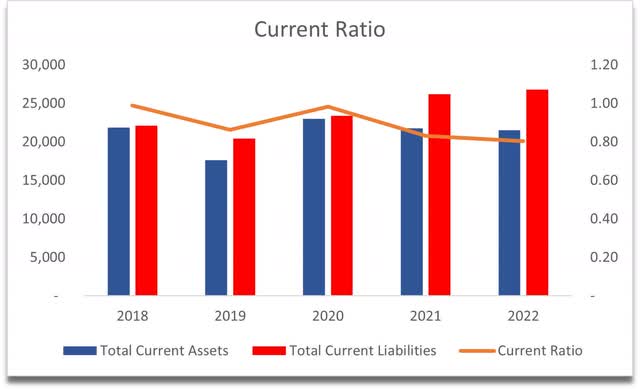

In terms of liquidity, the company has a decent amount of cash and short-term investments. These are not able to cover the debt that the company is in, however. I don’t see this being a huge problem. The company will be able to pay the interest from the cash it has and through cash from operations as well. The company’s current ratio isn’t very good and has been below 1 for a while now. I’d like to at least see a 1:1 ratio there.

Current Ratio (Own Calculations)

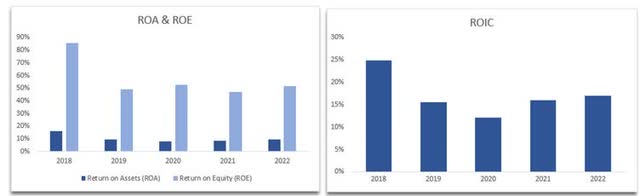

The next metrics that may justify a company to trade at higher multiples are ROIC, ROA, and ROE. These have been quite good even during the pandemic, which indicates the management can find a good use for the company’s capital, becoming more profitable and efficient.

ROIC, ROA and ROE (Own Calculations)

Overall, the books can be improved. Paying off the debt would be a good sign for the company, but they don’t seem to have a problem covering interest expenses as the coverage ratio is around 11x while the debt/asset ratio is .39 also which suggests there’s no real problem. I’d like to see the current ratio improving in the future though.

Valuation

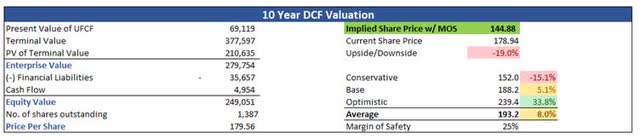

Starting with revenue assumptions, the management is guiding at 4%-6% long-term growth. In the past, they have been struggling to get 4%. Let’s call it slightly less than 5% growth over the next couple of years. 5% in ’23 and my model, I linearly grew it down to 3% growth by ’32 for my base case scenario. I have to be more conservative here than the management is predicting, mainly because as they said themselves, they weren’t able to achieve that long-term range previously. My long-term growth ends up being 3.9% for the model, which is still very close to where the management expects it to be. For the optimistic case, I went with 2% higher on all years, and for the conservative case, I went with 2% lower. This will give me a range of possible outcomes if the company manages to find the right price mix to keep the consumers buying at a better-than-expected pace and also if the demand for their products starts to falter a little bit.

For the margins in the base case, in ’23 I left the same margins as the company achieved in ’22 and until ’27, the margins will start contracting slightly, by only 50bps from current margins. From that point on the margins will start to improve and by ’32 margins will have improved by 200bps, to similar levels seen in 2019.

For optimistic and conservative cases I added/subtracted 50bps from the base case for all periods. To be more conservative as well, I like to add a margin of safety to the intrinsic value calculation to give me some margin of error. In my opinion, 25% is a good enough margin of safety there, given the environment we’re in right now.

The intrinsic value for the company is $144.88 a share which translates to around 19% downside from current valuations. Currently, the company is trading at almost 28x its earnings, and with $144.88 a share, the P/E ratio would be 22x. The company hasn’t seen that multiple since mid-May ’22. It hasn’t been that long but, the company has been performing very well and might see a pullback soon, especially if we see some recessionary environment kicking in.

10-Year DCF Model (Own Calculations)

Dividend Valuation

The company has been paying quite a good dividend for many years with solid y-o-y increases. The payout ratio is around 66% right now, but seeing that the company is a dividend king I don’t think they will stop rewarding their shareholders any time soon, although it is a little high. Just to complete my valuation analysis I wanted to do a quick dividend model to see what the company could be worth also. In the long run, I settled for around 3% dividend increases with a couple of higher increases in the next few years. I get a price per share of $179.55. This is what the company currently trades at, however, with a 25% margin of safety, the share price is $134.67.

In Conclusion

Both valuation methods show that the company is slightly overpriced and is due for a correction. I would agree with the above estimates of what the company is worth because trading at 28x earnings with not many growth catalysts in place is a bit rich for me. I would look into selling cash-secured puts at around the $150 mark; however, I don’t think this ticker would be liquid enough or profitable enough to be worth the effort, so I will just set a price alert at around that mark and see how the economy and the next couple of quarters turn out. In terms of dividends, it’s safe and current shareholders should keep on holding the shares and if an opportunity presents itself, buy more at lower prices. If I was a new investor and saw the stock right now, I would wait for a better entry point.

In this article, I wanted to show what the company might look like if margins contracted slightly and then came back up. I did not want to go deep into growth prospects that would potentially propel the company’s revenues, mostly because the cards are stacked against any catalysts like that. I expect revenues to be on the low end of estimates, maybe even missing estimates from time to time because of price pressures, looming recession, and other macroeconomic events that may present themselves in the near future.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.