Summary:

- PepsiCo has always stood strong against all market headwinds and outperformed the index in any turmoil.

- The company is a financially sound, defensive, and an ever-rising dividend-paying name with the expectation of providing an almost 3% dividend yield in the coming years.

- It has recently launched innovative products – Pepsi-Zero Sugar and Starry – in the beverage segment.

- From my analysis of the PEP stock using four different valuation models, I arrive at an intrinsic value of $181, which implies a 7% upside to current share price.

- I believe PepsiCo is a must-have stock in every dividend-focused portfolio, ETF, and mutual fund.

Fotoatelie/iStock Editorial via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Rishav Jain as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

At its current market price of $170, I believe PepsiCo, Inc. (NASDAQ:PEP) is trading below its intrinsic value. While the broader index has had difficulties in the past year, PEP stock has outperformed the market. The company is expected to gain further ground, especially in the beverages segment, and close the gap with The Coca-Cola Company (KO), aided by recent launches of new products and increased R&D focus to strengthen its product portfolio. From my analysis using four different valuation models, I find that PepsiCo is currently undervalued and is available at a 2.5% dividend yield.

Company Information

PepsiCo, Inc. is a company that doesn’t need any introduction, and almost everyone knows about it. It is one of the leading global non-alcoholic beverage and convenient food business companies serving customers in more than 200 countries worldwide. It is a parent company of popular brands like Pepsi, Lays, Cheetos, Gatorade, Quaker, and many more.

Sector Overview and PepsiCo’s Positioning

The global market for non-alcoholic beverages has grown in the single digit and was valued at $833.1 billion in 2021. As per Grand View Research and The Brainy Insights, it is expected to grow at a compound annual growth rate of 5.6% till 2030. The Asia-Pacific region accounted for 30% of the global market share in 2021, and emerging markets, especially India, are expected to grow at 8.7%, as reported by the Mint.

Similarly, the global market size for snacks was valued at $1.4 trillion in 2021, and is expected to grow at a compound annual growth rate of 2.7% till 2030. Several key trends are playing out in the industry, such as shifting consumer focus to healthier choices, sustainability, and premiumization.

PepsiCo, Inc. has been working on emerging themes for several years, and its innovation and in-depth understanding of consumer behavior have helped substantiate its position as one of the industry’s leading players just behind Coca-Cola. Further, due to its extreme focus on R&D, the company has recently launched some innovative and competitive products. These are

- the new and improved Pepsi Zero-Sugar, which is the result of the innovation the company does by identifying consumer preferences and meeting consumers’ evolving needs.

- Starry, a new lemon-lime soda that will compete directly with Coca-Cola’s Sprite. This new product will help PepsiCo capture the market of lemon-lime soda, contributing 7% to the $82 billion US soda market.

Financials and Valuations

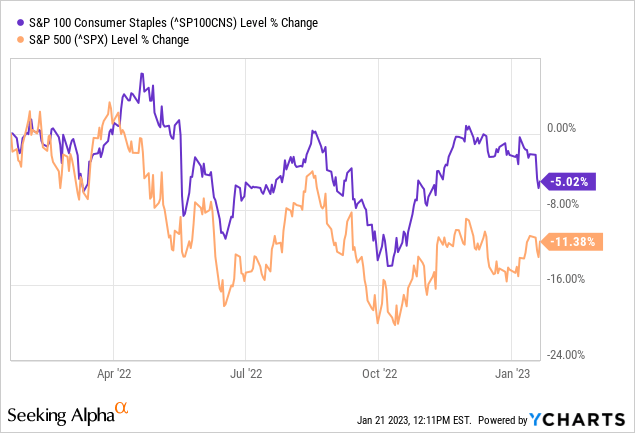

Food & beverage is a defensive sector where investors park their money in case of any turmoil in the stock market. In the last year, the broader market has gone through a deep correction with the S&P500 dropping ~20% before recovering (and is still 11.4% down), whereas the S&P 100 Consumer Staple Index is down by only 5% over the same period, creating a significant alpha for this sector-specific portfolio.

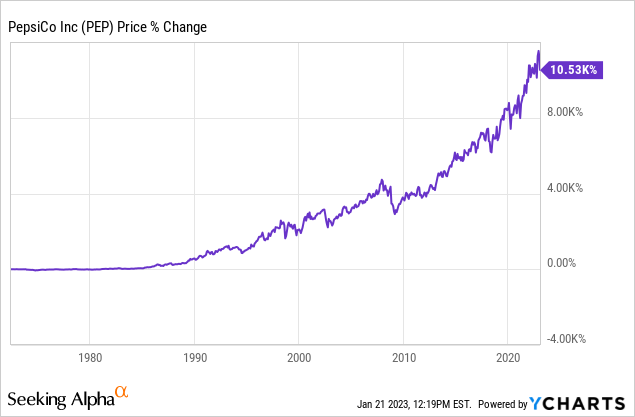

PepsiCo, Inc. has been an enormous wealth creator for its stakeholders. If I look at the share price from the day of the listing, it has been in a parabolic move and has weathered the Dot-Com bubble in 2000, the Great Recession in 2008, and the Coronavirus pandemic in 2020.

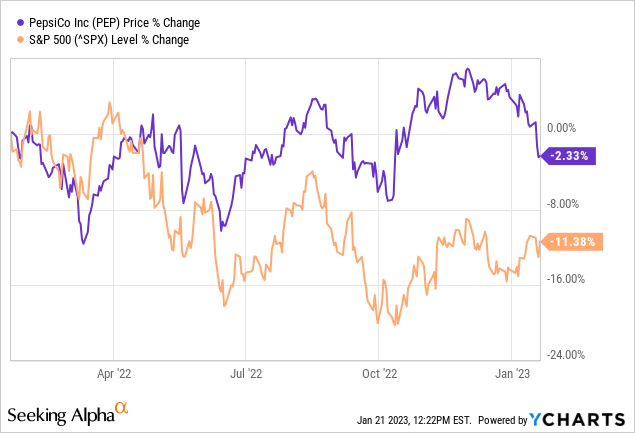

PepsiCo, Inc. has survived the storm of worsening macroeconomic conditions along with steep rate hikes by the Fed in 2022 and given a negative return of just 2%, while the S&P500 had shed 11.4% during the same time frame.

Financial Analysis

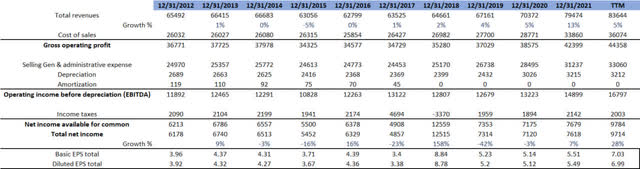

DataSource: MarketXLS, Created by Author (MarketXLS)

The top line of PepsiCo, Inc. has grown at a CAGR of 2.5% in the last ten years; however, it showed an improved performance, achieving a 7.6% CAGR in the last three years. Similarly, net profit has grown at a CAGR of 4.6% in the last ten years and 9.9% in the last three years. The company has delivered a very sub-optimal top-line growth while the bottom line grew more than the top line, due to the various cost optimization activities undertaken.

PepsiCo, Inc. was also negatively impacted by the COVID-induced lockdowns, but the demand for its products bounced back soon, enabling it to deliver 5% growth in FY 2020 and 13% in the FY 2021, beating all expectations. Even in the last quarter, the company beat market estimates, and the management increased its top-line growth guidance from 10% to 12% for the financial year 2022. It also increased its EPS guidance from 8% to 10%, which is lower than top-line growth estimations because of the margin pressure faced by the company in the first two quarters.

Valuation Approaches

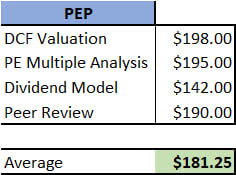

I arrive at my intrinsic value for PEP by valuing the company using four different approaches, as can be seen below:

1. Discounted Cash-Flow Valuation Model

To perform a DCF valuation, I have taken a couple of assumptions as mentioned below.

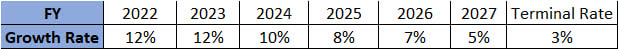

A) I assume that the free cash flow of PepsiCo, Inc. will grow at:

Source: Created by Author

According to management’s guidance, PepsiCo, Inc. will deliver 12% growth in 2022. Similarly, it will continue delivering 12% of growth as new launches will drive the next leap, followed by returning to the mean reversion of industry growth rate to nearly 5%.

B) I have considered a risk-free rate of 3.5% and a market risk premium of 5%.

DCF Valuation Model (MarketXLS)

I did the anchoring of the valuation using the assumptions stated above, and my calculations lead me to an intrinsic value of $198 for PepsiCo, Inc. Considering the current share price of $170, this implies that the PEP stock is trading below its intrinsic value with an upside potential of 16%.

2. EPS Growth and Price to Earnings Multiple Model

PepsiCo, Inc.’s earnings per share have grown at 6% in the last ten years and 10.4% in the last three years. The company has been a wealth creator for investors, as it has a policy of returning 70% to 75% of free cash flow through dividends and share buybacks. It did $10 billion worth of share buyback last year due to which the number of outstanding shares has come down, leading to the upside growth in EPS. As per the FCF estimates assumed above in the DCF valuation, EPS growth will be aligned with FCF growth, and PepsiCo, Inc.’s EPS will grow at 12% for 2023 and 10% for 2024.

EPS Prediction (Source: Created by Author)

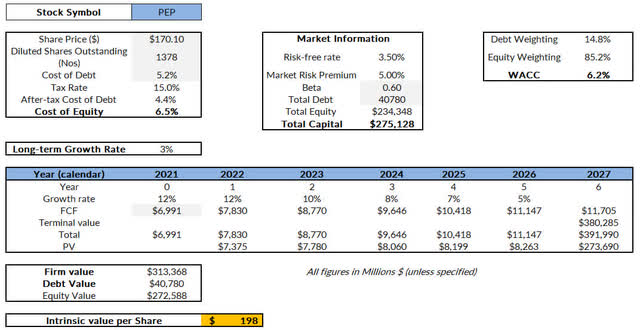

Furthermore, I analyzed the Price to Earnings ratio of PepsiCo, Inc. for the last ten years, and this metric has remained in a range of 20 to 30 for the majority of the time. Therefore, the median PE is assumed to be around 25.

Assuming a conservative price-to-earnings ratio of 22.5, PepsiCo, Inc.’s fair value turns out to be $195 on 2024 forward EPS, which highlights an upside potential of 14.5%.

3. Dividend Discount Model

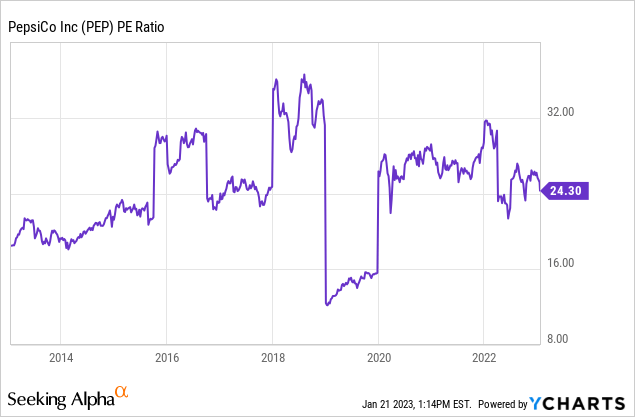

PepsiCo, Inc. has been one of the best dividend-paying shares for its shareholders. Almost every dividend-focused fund has the PEP stock in its portfolio. They have declared a dividend every quarter since 1965, and it has grown yearly.

Dividend Chart (MarketXLS)

Source: Created by Author using MarketXLS data

PepsiCo, Inc. declared a $4.53 dividend and a $10 billion share buyback program in Financial Year 2022. The dividend has grown at a 14% CAGR in the last 23 years. To apply Gordon’s growth dividend model, my assumptions and details are as mentioned below:

1. I assume that the dividend will continue to grow at 10% for next year, in line with EPS growth of 10%; thus, the dividend for the next year will be $4.98.

2. The cost of equity is 6.5%, as calculated in the DCF valuation.

3. The terminal growth rate is assumed as 3%.

By applying the dividend growth model using the value stated above, the intrinsic value turns out to be $142 for the company, thus showcasing that it is overvalued by 16% at the current market price.

4. Peer Review

The Coca-Cola Company, which is also the industry leader, is a key competitor for PepsiCo. Coca-Cola trades at 27x PE, whereas PepsiCo, Inc. trades at 24x PE. If PepsiCo, Inc. trades at 27x PE as Coca-Cola, then the intrinsic price for the company will be $190, representing a 11.7% potential upside from the current market price.

Valuation Verdict

PepsiCo Fair Value (Created by Author)

After valuing PepsiCo, Inc. from four different valuation models, the average intrinsic value turns out to be $181.25, which implies a 7% potential upside to the current share price.

Risks

PepsiCo, Inc. is an outstanding stock to own, based on the analysis performed from different angles. However, there are multiple risks associated with the company.

1. It has to continuously analyze consumer data and focus on R&D to launch innovative products. Consumer’s focus on health consciousness can negatively impact the company’s performance if it fails to cater to this new segment.

2. The economy is expected to be hit by a recession in the near term, and with rising interest rates, sales can get impacted as users switch to lower variants and cut down on their expenses.

3. The company has delivered more than estimated numbers in the last two years and is set to deliver another good set of numbers to end FY22 on the higher side. However, any miss on its estimates can lead to a contraction in the valuation.

Conclusion

PepsiCo, Inc. is one of the leading brands in the consumer staple industry whose products are enjoyed by consumers more than one billion times a day across 200 countries. It has been a great defensive play for investors, and has delivered consistent returns over a long period. The company has never disappointed anyone invested in it for a minimum period of 5 years. There are several growth triggers in the industry, and with innovation, premiumization, and new offerings, the company has been experiencing a new leap of growth. The management is very optimistic about growth and has raised guidance. As per the valuation analysis using multiple models, the share price is trading below its fair value of $181. The company is a defensive, ever-rising, dividend-paying stock with the expectation of providing an almost 3% dividend yield in the coming years. I therefore believe every dividend investor should have PepsiCo in their portfolio to provide stability and growth over a longer time frame.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PEP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.