Summary:

- PepsiCo continued to perform well during Q3 amid a rather challenging environment.

- I am optimistic that its strong profitability will very likely continue. Product innovation and acquisitions will keep it as a market leader.

- Thanks to its scale and robust demand, it’s enjoying peak operation efficiency, which is likely to continue too.

- However, I see the stock is slightly overvalued and as such, the total return potential will be limited in the next few years.

Mario Tama/Getty Images News

Q3 recap and investment thesis

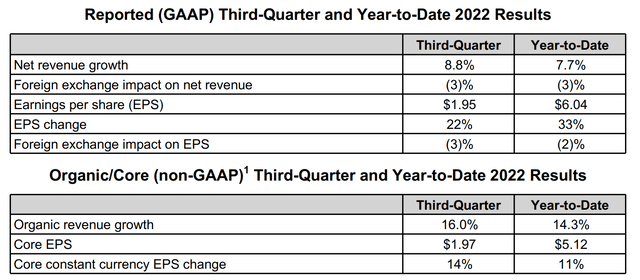

PepsiCo (NASDAQ:PEP) released its Q3 earnings report (“ER”) last month. It continued to perform well amid a rather challenging environment for another quarter. It results beat consensus estimates on both lines. Its non-GAAP EPS came in at $1.97, beating consensus estimates by $0.12. Its total revenue reached $21.97B, translating into an 8.8% YoY growth and beating consensus estimates by $1.15B. Foreign exchange rates impacted net revenue by 3%. So total revenue growth is a robust double-digit 11.8% when adjusted for currency rates. More importantly, the company also raised its 2022 full-year guidance. As commented by Chairman and CEO Ramon Laguarta during the ER:

“We are very pleased with our results for the third quarter as our global business momentum remains strong. Given our year-to-date performance, we now expect our full-year organic revenue to increase 12 percent (previously 10 percent) and core constant currency earnings per share to increase 10 percent (previously 8 percent)”

All told, consensus estimates now expect its GAAP EPS to reach $1.62 during the fourth quarter and $6.78 for the full year. Thanks to such strong results, its stock prices now hover around a record high. Its stock price is around $178 as of this writing, only about 3% below its record price of $184.

In the remainder of this article, you will why I am optimistic that its strong profitability will very likely continue. However, you will also see why I think the stock is slightly overvalued and as such the total return potential will be limited in the next few years.

Contextualizing Q3 results

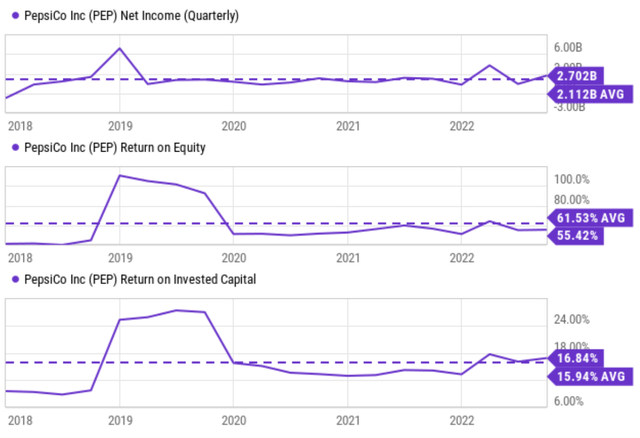

To provide a broader context for its Q3 results, the following charts show its profitability over the past 5 years. As seen from the top panel, PEP’s quarterly earnings have been remarkably consistent even during extreme market turmoil since the COVID break out in 2020. It consistently earns about $2.1B of net profit on average per quarter. And its current quarterly earnings of $2.7B are above this average by a good margin.

In the meantime, its key profitability metrics such as return on equity (ROE, middle panel) and return on invested capital (ROIC, bottom panel) have also been both robust and stable. To be more specific, its ROE only fluctuated within a narrow range around of mean of 61.5%, and the current level of 55.4% is quite close to the mean. Its ROIC shows the same pattern, and its current ROIC of 16.84% is slightly above its historical average of 15.94%.

Moreover, next, we will see that PEP has been turning the good knobs for its profitability also.

PEP’s stable margin and peak operation efficiency

As detailed in an earlier article,

Under the DuPont framework, management has 3 knobs to turn to drive up ROE or ROIC: profit margin (“PM”), asset turnover ratio (“ATR”), and leverage. Through simple math, we can show that ROE is just the product of these three things, i.e.,

ROE = PM x ATR x leverage.

Among these three knobs, PM could be a double-edged sword. Investors tend to like higher PM. But outrageously high PM tends to invite competition and other unwanted attention, and hence is often unsustainable. ATR is a good knob. It reflects the company’s know-how and accumulation of experiences. And finally, leverage is generally a bad knob to turn, especially beyond a certain threshold.

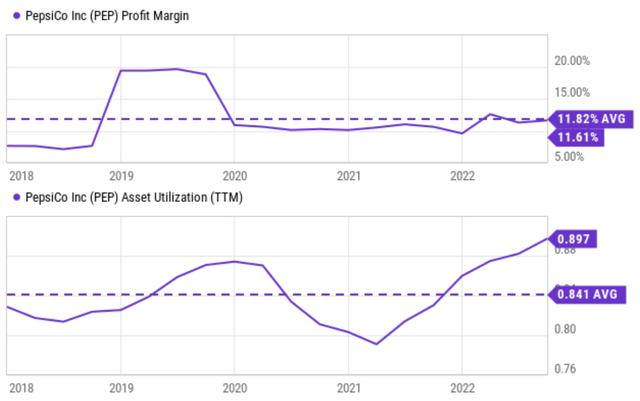

The chart below displays how management has been turning the first two knobs at PEP lately. The top panel shows its PM, and the bottom panel shows its ATR. As you can see, the PM for PEP has been again remarkably stable. With the exception of two quarters during 2019, the PM for PEP has fluctuated only very narrowly between about 10% to 1.25% around an average of 11.8%. Its current PM of 11.61% is essentially on par with its long-term average. To provide another reference point, the PM for the overall economy fluctuates between 8% to 10% and rarely exceeds 10% for extended periods.

The bottom panel shows the ATR (aka, asset utilization rates). As seen, here PEP was able to steadily improve its ATR over the years. Its ATR was about 0.82x five years ago in 2018. And PEP has gradually improved to the current level of 0.897x. The trend was temporarily interrupted by the COVID pandemic. But nonetheless, the overall trend is upward and its current ATR of 0.897x is not only far above its average of 0.841x but also at a peak level in 5 years.

PEP’s leverage and balance sheet strength

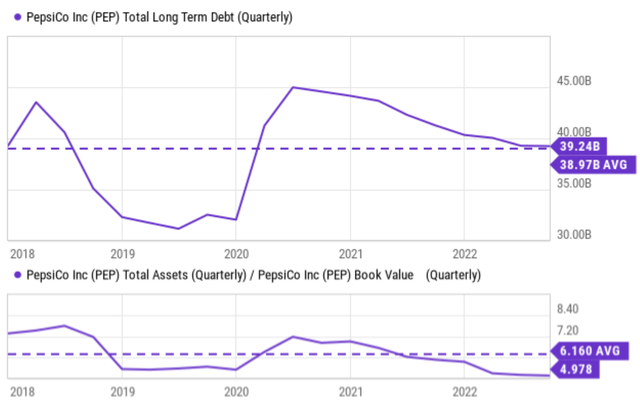

Finally, the chart below shows its leverage knob. as you can see from the top panel, the company’s total debt level was stable too over the years, oscillating in a relatively small range of $32B to $45B. Its debt peaked at $45B in 2020 and then decreased to the current level of $39.2B, essentially on par with its historical average. Since its current debt level is on par with its historical average while its profitability has steadily improved over the years, its leverage has steadily decreased as you can see from the bottom panel below. Its leverage ratio started at 7.2x five years ago in 2018. Now, it is only 4.97x. Again, its current level is not only far below the 5-year average but also at the more conservative level in 5 years.

Such financial strength ought to facilitate further growth endeavors, both organically and via acquisitions. Organically, the company is well-positioned within the beverage and snack markets. It keeps its market leader position through continuous product innovation of its iconic brands. And at the same time, it has also been active in acquisitions. For example, recently, it signed a long-term distribution agreement with Celsius Holdings, a beverage manufacturer that makes energy drinks with fat-burning capabilities. The $550 million investment has given PEP an 8.5% equity ownership and one member on the board of directors. The move further diversifies its income streams in the high-growth energy category and ought to prove beneficial to operations on a long-term basis.

Valuation, risks, and final thoughts

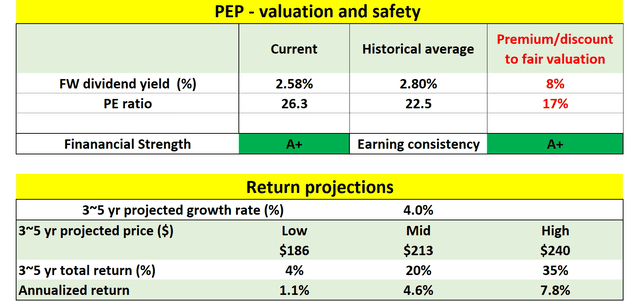

In terms of valuation, as aforementioned, I think the stock is slightly overvalued as shown in the table below. The overvaluation is about 17% in terms of PE multiple from its historical averages. Its FW PE currently stands at 26.3x, compared to a historical average of 22.5x. In terms of dividend yield, its current yield of 2.58% is below its 4-year average of 2.8% by 8%, indicating an 8% valuation premium. Consensus estimates expect its EPS to grow from $6.78 this year to $8.25 in 5 years, translating into an annual growth rate of 4%. Based on such a projection, for the next 3~5 years, its total return is projected to be in a range of 4% (the low-end projection) to about 35% (the high-end projection), translating into an annual return of 1.1%to 7.8%.

Source: author and Seeking Alpha data.

In terms of risks, I do not see any structural risks associated with the stock (that is, besides the valuation risks just mentioned). Some current headwinds will likely continue. The high rate of inflation, fears of a recession, and supply chain disruptions may also continue to impact investors’ sentiment. But I view these headwinds as largely either temporary or largely psychological issues only.

All told, I see these shares are best suitable for conservative accounts under the current conditions. The total return potential will be limited in the next few years (with a 4.6% annual return as my base case scenario). But there is no need to overlook such a modest return potential given the stock’s safe-haven status, A+ financial strength, and A+ earning consistency.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.