Summary:

- PepsiCo is a diversified blue-chip company with over 500 brands operating globally, with 23 of those brands pulling more than $1 billion in revenue each.

- Trades at a discount compared to its historical value and peers at just 21.0x earnings.

- Offers 3.1% dividend yield, and focuses on efficiency and growth with global capex spend.

jetcityimage

Investment Thesis

PepsiCo (NASDAQ:PEP) is a diversified blue-chip company providing beverages and snacks. PepsiCo operates in more than 200 territories and countries globally, with over 500 brands. The “flagship brands,” those that generate more than $1 billion in revenue, include 23 globally recognized names across both beverages and snacks.

PepsiCo trades at 21.0x earnings, below its 5-year average of around 25.0x. PepsiCo is a blue-chip dividend aristocrat, with 52 years of consecutive dividend increases, occupying a sweet spot between low cyclicality and stable global growth. Since the pandemic, PepsiCo has invested in increasing its efficiency, acquiring localized brands in growth areas, and improving the resilience of its supply chain. Thus, we feel it is a good buy for dividend growth investors seeking a dividend aristocrat paying out 3.1% yield with the potential for steady and reliable long-term growth in EPS and dividends.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $8.90 X 22.5= $200.25

We believe that in the short term a fair P/E is 22.5x given steady earnings growth in the 7-9% range, great brands and continuous business improvement.

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

2.6 |

2.5 |

2.4 |

|

Price-to-Earnings |

24.5 |

22.5 |

20.9 |

Core Business

We believe that having both beverages and snacks almost evenly split on total revenue provides significant diversification benefits to PepsiCo. Around 43% of business originates outside of the United States, with 59% of revenue coming from snacks, and 41% coming from beverages. In the global soft drinks market, Coca-Cola (KO) leads with 17.3% of market share, with Pepsi trailing at 8.5%. However, in the global snacks markets, PepsiCo leads with 15.9% market share, with the next closest competitor having just 6.6%.

|

1st Half 2024 |

||||||

|

Beverage |

Convenient Foods |

% of Total Revenue |

Revenue Growth (yoy) |

Operating Margin |

||

|

Latin America |

9% |

91% |

12.5% |

10.3% |

21.9% |

|

|

Europe |

47% |

53% |

13.4% |

2.6% |

15.1% |

|

|

Middle East North Africa |

33% |

67% |

6.5% |

1.7% |

14.9% |

|

|

Asia-Pacific |

21% |

79% |

5.3% |

1.6% |

21.0% |

|

|

North America |

42% |

58% |

62.3% |

-0.4% |

18.4% |

|

PepsiCo

On top of own-brands, PepsiCo has a long-list of distribution partnerships including Starbucks pre-prepared drinks, Keurig Dr Pepper for regional distribution and bottling of several brands, and even Celsius Energy. The most substantial recent partnership of PepsiCo is an 8.5% ownership stake purchased in 2022 for $550 million, in exchange for a long-term distribution agreement in both the US and Canada.

Risk

By the nature of PEP’s consumer exposure, the company is involved in several lawsuits ranging from advertising, pollution, and recalls. The most significant of these is the Quaker Foods recalls, in which 38 PepsiCo products and 30 licensed products were recalled for potential Salmonella contamination. The economic impact of this has so far been limited to a contraction in operating profit for the Quaker Foods division.

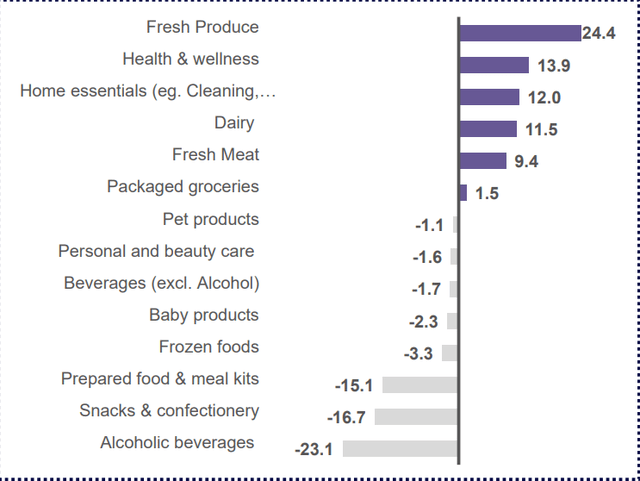

net change in spending expected by consumers over the next 12 months. Change calculated by subtracting % of respondents who will spend less from those who are spending more. (NielsenIQ)

The average consumer is financially strained with inflation sticky at around 3% causing consumers to re-think their carts with rising food prices being the top concern. The other side is a secular transformation in consumption styles. There are two distinct consumer groups, the immediate consumer and the grocery consumer. As the name suggests, immediate consumers are those that purchase snack foods and beverages at convenience stores for immediate consumption which has shown a marginal shift toward higher-quality pre-prepared foods but is still overall dominated by brands like Frito-Lay. However, grocery consumers have changed their preferences toward products that offer healthier options, more local options, and those that conform to their specific dietary requirements.

Financials

The quarter ending June 2024 saw weaker volumes overall, due to consumer strain and remaining impacts from the Quaker recall in late 2023.

|

YTD 2024 Volumes |

|||

|

Beverages |

Convenient Foods |

Organic Revenue Growth |

|

|

Latin America |

2% |

-4% |

4% |

|

Europe |

3% |

4% |

8% |

|

Middle East North Africa |

2% |

2% |

10% |

|

Asia-Pacific |

Flat |

6% |

6% |

|

Frito-Lay North America |

-3% |

1% |

|

|

Quaker Foods North America |

-20% |

-21% |

|

|

PepsiCo Beverages North America |

-4% |

1% |

|

|

Company Wide |

Flat |

-1.5% |

2% |

Organic Revenue Growth is growth less derivatives, currency charges, restructuring, acquisition/divestiture costs, and impairments.

PepsiCo expects some volume recovery in the second half of the year for the business, though it is likely to end the year flat. We do expect some boost to margins and volume coming from Quaker’s supply chain recovering from its major recall. For Frito-Lay in North America, PepsiCo will take more aggressive mix and pricing adjustments to boost volumes, with a similar strategy for the North American beverages segment. This will likely weigh down full-year revenue growth, though PepsiCo does still expect it to fall within the 4-6% range for the full year 2024. On the upside, operating margins expanded just shy of 100bps to 15.2%, attributed to productivity and standardization initiatives.

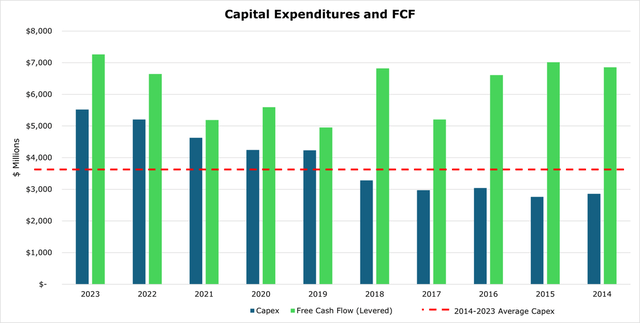

Outside of the United States, the business grew 7%, which is above the long-term expected average. As a bonus, outside of the US segment, margins tend to be slightly higher. We feel that PepsiCo’s future beyond baseline growth is likely to come internationally, with bolt-on acquisitions of local brands that more organically match consumer preferences. On top of this, PepsiCo is engaging in elevated capex to support building out the supply chain in high-margin high-growth areas like India and Latin America.

Within the US, capex spending is going toward modernizing digital infrastructure, which includes analytics and additional automation opportunities. While specific targets were not stated, PepsiCo did say that these investments will improve the resilience of the supply chain and allow much quicker responses to changes in consumer preferences.

Over the medium-term, PepsiCo does expect to see moderation in capex spend once the US digitization project is completed, which, we believe, will go toward growing the dividend, and additional international brand expansion. For the full year 2023, capex spend was $1.6 billion over the long-term average, with a likely similar figure for 2024.

BuildingBenjamins

Capital use is prioritized in the following: 1 organic business growth, 2 dividends, 3 M&A, and 4 share repurchases. Currently, PepsiCo projects it will repurchase an additional $1 billion in its shares for the year, and $7.2 billion in dividends. PepsiCo pays out a 3.1% dividend yield, most recently increasing the dividend by 7% in February 2024, marking its 52nd consecutive year of increases. Since 2010, PepsiCo has maintained a 7.7% dividend payout CAGR, and we expect this to remain on a go-forward basis.

While PepsiCo’s balance sheet is skewed toward debt financing, it holds an interest coverage ratio of 14.6x and a debt to EBITDA of under 3.0x. Currently, PepsiCo has an A+ rating from S&P.

The long-term target for organic revenue growth across all segments is 4-6%, with earnings per share marginally higher in the high-single-digits. Operating margin expansion is targeted at around 15.5%. Revenue growth is currently being driven by a strong and expansive international opportunity. Once consumer spending recovers over the medium term in developed markets, we feel PepsiCo’s volumes will follow suit.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.