Summary:

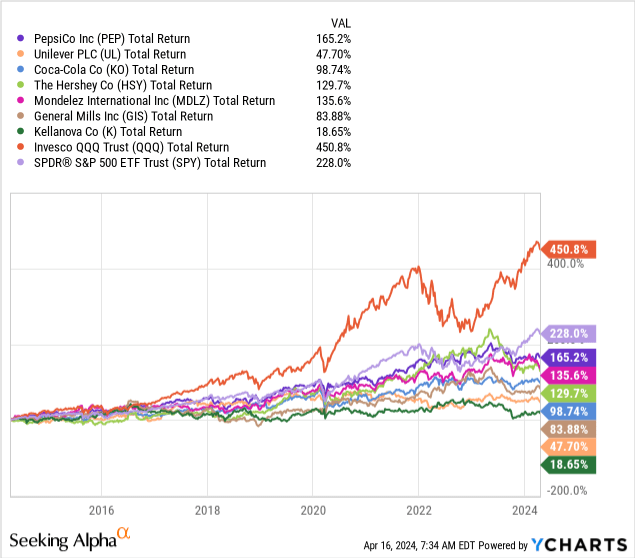

- Consumer staples stocks, including PepsiCo, continue to underperform the market significantly, as they’ve been for the last decade.

- Investors are looking for signs of a turning point in PepsiCo’s first-quarter results, but I don’t expect any surprises.

- PepsiCo’s growth prospects are in line with the market average, but it’s finally trading at an attractive valuation which reflects its limited growth opportunities, but underestimates its resiliency and quality.

- I rate PEP stock a Buy.

jetcityimage/iStock Editorial via Getty Images

Consumer staples stocks continue to underperform the market, and by a significant margin. PepsiCo (NASDAQ:PEP) is no exception.

The snacks & beverages empire is set to report its first-quarter results a week from now, on April 23rd, and investors will anxiously look for signs of a turning point.

Let’s dive into the key focus points in the report, and assess what could finally put some spark back in Pepsi’s stock.

Background

I’ve been covering PepsiCo on Seeking Alpha since March of last year. I maintained a Buy rating all throughout this period, as I found PepsiCo to be a best-of-breed option in the staples sector, due to its exceptional operational quality and diversified portfolio of brands across snacks, dry foods, and beverages.

In addition, I showed how the company is able to maintain or gain share across every segment, despite its larger size.

Unfortunately, my investment thesis hasn’t worked out so far, primarily due to reasons we’ll dive into in the following section.

Consumer Staples’ Painful Underperformance

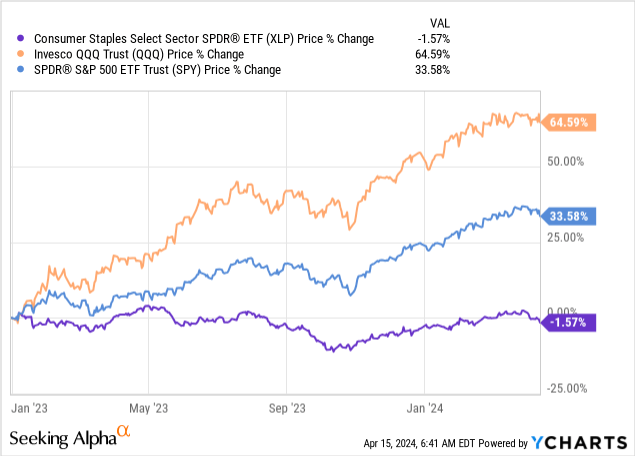

You don’t need me to tell you the market has been on a tear since the beginning of 2023, with the Nasdaq 100 (QQQ) up nearly 65%, and the S&P 500 up more than 33%.

For consumer staples investors, however, this period hasn’t been so great, with the Consumer Staples Select index (XLP) down 1.6%.

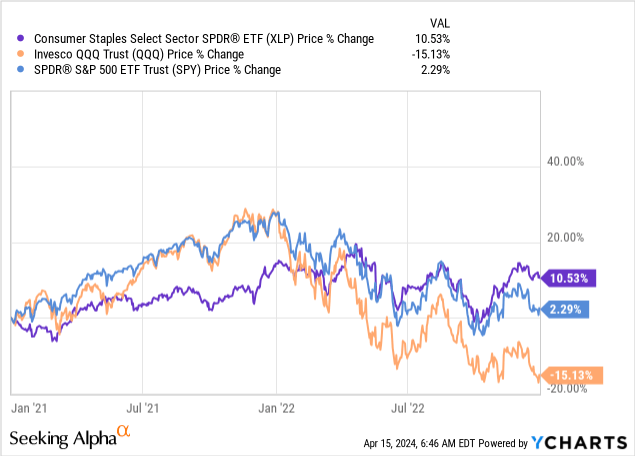

Interestingly, this followed two years of significant outperformance from XLP:

It’s important to dissect what happened during this period to understand the pros and cons of investing in the extremely mature staples sector in general and PepsiCo specifically.

The vast majority of staple companies reached saturation. There’s no more significant geographic expansion opportunity, and no large categories to tap into. Moreover, many of the incumbents, like PepsiCo, who try to expand through acquisitions or internal innovation fail to reach a significant enough scale to move the needle with those new products, simply due to the sheer size of their mature businesses, and inability to drive true disruption.

What these companies do have going for them is unparalleled distribution and economies of scale, as well as the fact that they’re selling consumables (i.e., a product that’s usually bought on a weekly or even daily basis).

These two colliding trends result in something Peter Lynch defined as a stalwart. Or, in simple words, a company that grows very slowly, but is very predictable.

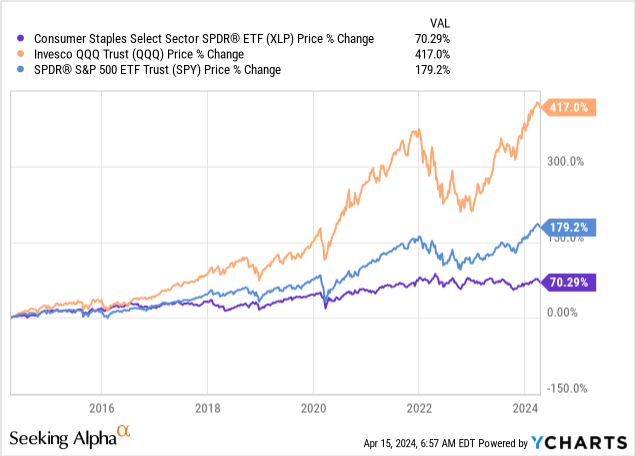

The problem is, that when markets are going up (first graph), investors seek “higher risk” and therefore consumer staples lag behind. And, when the markets are going down (second graph), staples are holding better, but not enough to offset their underperformance (third graph).

So, before investing in a stalwart like PepsiCo, investors must acknowledge they’re investing in a low-risk, low-reward name.

With that, let’s dive into the company’s prospects.

PepsiCo Remains An Industry Leader On All Fronts

PepsiCo had $91 billion in sales in 2023, of which 59% came from food, and the rest from beverages. In most categories the company participates in, PepsiCo is at least in the top three in terms of sales.

PepsiCo Q4’23 Earnings Release

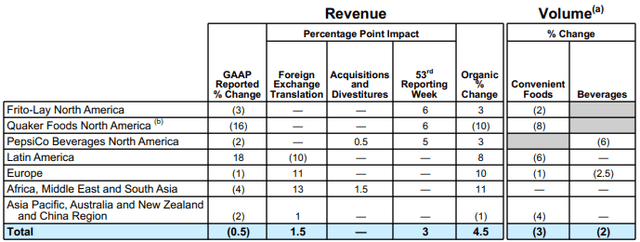

In Q4-23, PepsiCo generated organic growth of 4.5%, but it was dragged down by a Quaker Foods recall. Regarding other segments, PepsiCo generated close to in-line or better in terms of growth.

For example, in North America Snacks, PepsiCo outgrew Mondelez (MDLZ) and Kellanova (K). In North America Beverages, PepsiCo trailed Coca-Cola (KO) only by two percentage points. Furthermore, In terms of profitability, PepsiCo would have achieved a multi-year record if it weren’t for the Quaker Foods recall.

So, PepsiCo continues to deliver industry-leading growth, but unfortunately, that’s not enough:

Although it’s leading all its peers, PepsiCo returned far less than the S&P 500 and the QQQ over the past ten years.

I find it fitting that PepsiCo’s CAGNY presentation started with the slogan “Performing To Potential”, as to say, we’re doing the best we can, but we’re capped by our limited growth opportunities.

The Recipe To Reignite Pepsi’s Stock Heading Into Q1 Results

PepsiCo remains an industry leader among large staple companies and continues to deliver operational improvements. As we saw, that hasn’t been enough to generate market-beating returns because the company’s growth opportunities remain scarce.

With that backdrop, I see three avenues for PepsiCo to outperform the market in the future.

One is during bear markets, but as we saw that’s not enough to offset underperformance over the long term. Two is buying at an attractive valuation, which we’ll discuss in the next section. And three is through achieving a normalized growth module that’s better than the market average.

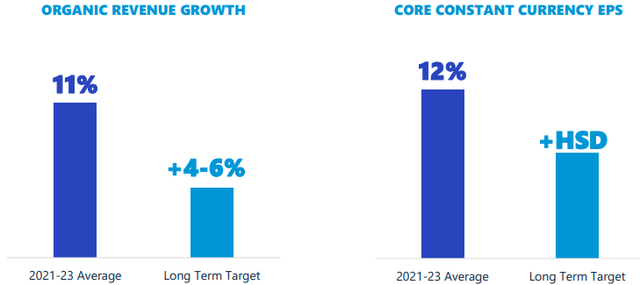

Historically, the average revenue growth of the market (represented by the S&P 500), is 5.3%, and EPS growth is 7.5%. For PepsiCo to beat the S&P 500, those should be the targets.

As it currently stands, the company’s long-term targets fall right in line with the market average:

PepsiCo CAGNY Presentation 2024

However, as a global company, PepsiCo’s actual results are lower than its organic results, as the Dollar continues to strengthen against most other currencies.

In 2024, the company expects to achieve the lower end of its organic growth guidance with 4%, and core EPS growth of 8%. If guidance is upgraded or Q1 results come above that pace, obviously that could be favorable for the stock, but I find it unlikely.

In short, I don’t see a probable path for PepsiCo to drive above-market growth over the long term. That’s not a knock on the company, it’s just a matter of its already huge size. That leaves us with valuation.

PEP Stock Valuation

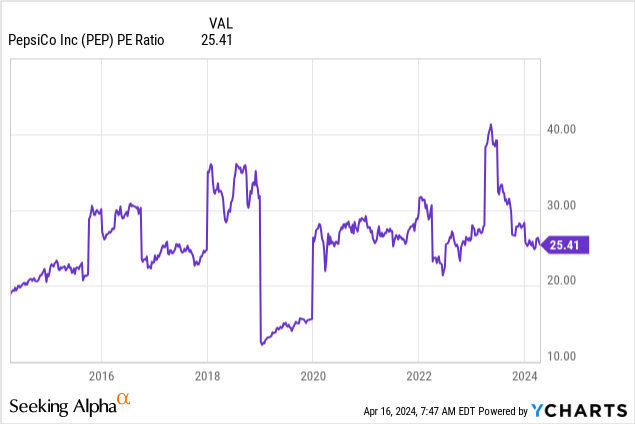

Consumer staples stocks have long been considered compounders, which provide a safe way to achieve long-term success in the market, through resilient growth and growing dividends.

They became so popular after the financial crisis that they normally traded at above-market multiples, somewhere in the 25x P/E range.

When we look at PepsiCo, that’s right around the average multiple the stock traded at over its last decade, while the S&P 500 is historically in the low twenties or high-teens.

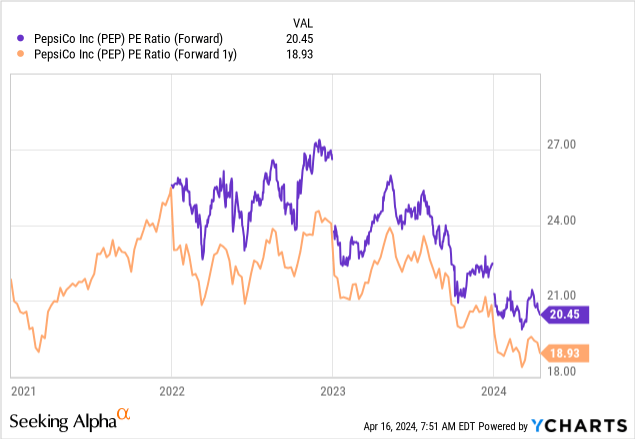

Looking ahead, we see a different story:

PepsiCo currently trades at a 20.5x P/E over consensus estimates for 2024, which are in line with the company’s guidance. That’s way below historical averages, and slightly below the S&P which is at 21.3x.

That puts PepsiCo in a much better position to outperform the market, being much more resilient and predictable than the average company.

As such, I find PepsiCo to be attractive at these levels, and I’d consider accumulating shares ahead of the report, which I expect to be in line with expectations.

Conclusion

PepsiCo has been an unquestionable leader in the consumer staples sector, but that wasn’t enough to provide market-beating returns due to limited growth opportunities and a relatively high valuation.

As the market re-rated the company, which is now trading at a below-average valuation despite being one of the most resilient and predictable businesses in the world, PepsiCo is looking much more attractive.

The company is set to report its first-quarter results next week, on April 23rd, and I expect in-line numbers. That would be enough to justify a Buy at the current valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.