Summary:

- PepsiCo is seeing strong organic growth and enjoys high profitability.

- Its zero sugar offering is gaining solid traction in both the U.S. and internationally.

- The stock could give potentially strong long-term total returns from the current price.

Lemon_tm

One of the biggest mistakes for young investors is to try to swing for the fences every time with higher-risk speculative names. Even Warren Buffett tried to do that in his early years with so-called cigar butt stocks with “one or two puffs left”.

Hopefully, most of them eventually realize that the key to long-term success is to compound wealth through consistent hitting of singles and doubles, with the operative word being consistency.

This brings me to the large moat-worthy consumer staples giant, PepsiCo (NASDAQ:PEP), which has delivered strong returns for investors not just over years but generations. Let’s explore what makes PEP a great holding for income and potentially strong total returns.

Why PEP?

Pepsi is perhaps best known for its namesake beverage along with iconic brands Mountain Dew and Gatorade. Its offerings go beyond beverages, it also owns Doritos, Lays, Fritos, and Quaker, to name a few. In fact, snacks now account for over half of the company’s sales and profits.

PEP’s strategic move into snacks many years ago has done well for the company to diversify its income stream away from just sugary beverages. Management has invested heavily in the snacks segment which generates higher margins and bigger profits than beverages.

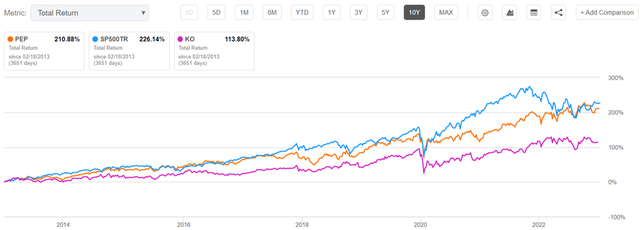

The company also takes advantage of its sheer size to gain cost advantages over smaller rivals in both the beverage and snack segments, allowing it to invest more in marketing and product innovation. This has enabled PEP to stay ahead of competitors and is reflected by its strong total returns. As shown below, PEP’s total return over the past decade is nearly double that of its arch-rival Coca-Cola (KO).

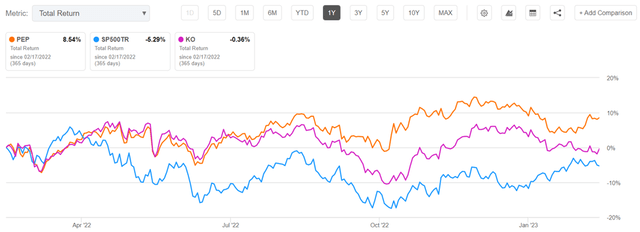

While PEP’s total return over the past decade slightly trails that of the S&P 500 (SPY), it’s worth noting that it comes with far less volatility and offers downside protection. As shown below, PEP has weathered the market downturn over the past 12 months much better than the market average and KO.

Meanwhile, PEP continues to impress with robust 15% organic sales growth during the fourth quarter, driven in large part by 18% growth in sales. Growth is also translating to the bottom line, with 10% growth in adjusted EPS.

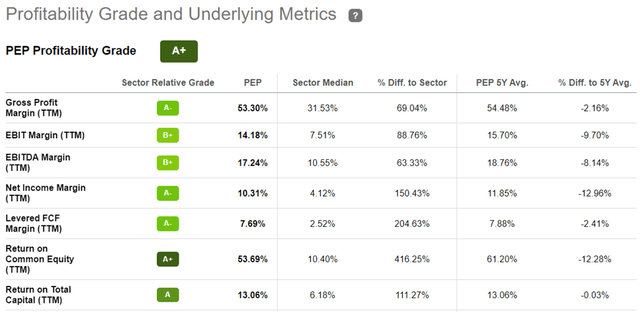

Notably, PEP is seeing strong traction in its snack brands Doritos, Cheetos, and Lay’s, all seeing double-digit growth, and in its newer innovative beverage offerings such as Pepsi Zero and Celsius, which generally appeal to younger and fitness-conscious consumers. As shown below, PEP maintains strong profitability with an A+ grade and EBITDA and Net Income margins that are well in excess of the sector median.

Looking ahead, PEP could see meaningful growth from its zero sugar offerings, which could help to stem the decline of traditional full sugar carbonated beverages. This category appears to be resonating well with consumers compared to the prior generation of diet drinks, as highlighted by management during the Q&A section of the recent conference call:

Zero is clearly a segment of the beverage category that is growing much faster than kind of full sugar all over the world. And Pepsi Zero, or Pepsi Max as we call it in some markets, has been very strategic product for us in Europe, and in other parts of the world.

In the U.S., we were investing in other parts of the Pepsi brand. Now, this is going to be the center of the strategy for the Pepsi brand. We think that the non-sugar segment of Colas will continue to grow very fast in this country. We’re seeing consumers pivoting.

I think the R&D in our company has done a great job in giving consumers Zero sugar choices that are as good as full sugar choices or better from the taste point of view. And we’re asking consumers Zero sacrifice to pivot to Zero Sugar version. And Bonnie just to give you a data point Pepsi Zero Sugar grew 26% volume in the fourth quarter so that business is really growing.

Importantly for conservative investors, PEP carries a very strong A+ rated balance sheet. It’s also a Dividend King that’s grown its dividend for 50 consecutive years. While PEP’s yield isn’t particularly high at 2.6%, the dividend is well protected by a 67% payout ratio and has a 5-year CAGR of 7.4%.

Should PEP be able to maintain this level of growth, it could deliver long-term total returns of 10% annually, similar to the S&P 500, but with far less volatility. This could be achieved in the near term, as analysts estimate 7% to 9% annual EPS growth over the next 2-3 years.

Admittedly, PEP isn’t cheap at the current price of $176 with forward PE of 24. However, I believe the current valuation to be fair, considering the aforementioned long-term total return potential and durable business model that can weather various economic cycles. Analysts also have a Buy rating on the stock with an average price target of $186, implying potential for near term capital appreciation as well.

Investor Takeaway

PepsiCo is a top-tier consumer staples stock with an impressive track record of growth and stability. It benefits from a strong portfolio of brands that have managed to remain relevant in an increasingly changing landscape, all while maintaining strong profitability.

While PEP stock may not be cheap at current levels, its balance sheet strength, dividend safety, and long-term total return potential make it a reasonably conservative choice for a total return portfolio.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!