Summary:

- PepsiCo’s stock has underperformed the S&P 500, as an extended valuation reverses on slowing growth expectations.

- Valuations have improved over the last 12 months, but high cash/savings yields offer serious competition for defensive-minded investors.

- I am anticipating the opportunity to purchase shares on a price slide under $150 later in the year, as the recession hits.

atakan/iStock via Getty Images

I last wrote an article on PepsiCo, Inc. (NASDAQ:PEP) in January 2023 here, explaining why its high valuation did not match well with a slow growth forecast. Fitting my expectations, the stock price has declined by -4% since my effort was posted 14 months ago. Not a spectacular dump, but the PEP total return including dividends has lagged the S&P 500 blue-chip average advance by a wide margin (-29%).

Seeking Alpha – Paul Franke, PepsiCo Article, January 21st, 2023

Today’s valuation is somewhat improved, but interest rates are even higher, posing an alternative investment conundrum for new buyers. If you can capture 5% annual yields from Treasury bills, with the near guaranteed return of 100% of your upfront investment, waiting for a PepsiCo pullback still appears to be the logical course of action.

For my money, I am in no hurry to purchase shares. Either a stock market bear drops all stocks including PepsiCo to more reasonable levels, or falling interest rates will have to materialize later this year to get me off the sidelines. However, in terms of defensive trading characteristics, I do feel Pepsi should “outperform” the overall U.S. equity market in a crash or bear market scenario. As a consequence, I am upgrading my official rating from Sell to Hold. The optimal investment angle may be to avoid shares, if you do not own them, waiting for a steeper price slide under $150 into the autumn. At that point, a better valuation and even stronger dividend story will make sense to own.

Recession Worries

Is a greater than -20% price slump the future for PepsiCo in 2024? Not necessarily, but the odds of PepsiCo sales and earnings disappointment vs. analyst forecasts are real in a recessionary environment, exacerbated by the weight loss drug mania of the day. A recent Numerator survey of 92,000 people points to a 6% to 9% drop in grocery purchases by individuals using GLP-1 weight loss drugs. And, the greatest revenue hits are to the sugar and snack categories. According to analyst Pamela Kaufman,

Monthly spend on categories most negatively impacted by GLP-1 users for weight loss in include snacks, pastries, and ice cream – while yogurt, fish, and vegetable snacks are most positively impacted.

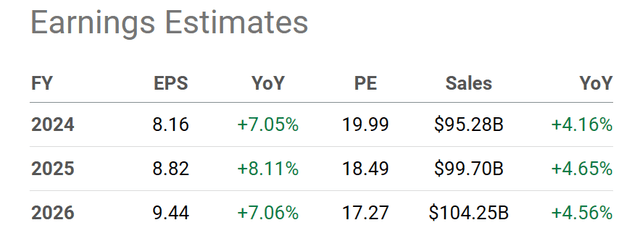

I, personally, view current analyst estimates for EPS as too high, and a best-case scenario. My forecast is for $8 in 2024 to $8.50 EPS in 2026 as more likely in the next couple of years.

Seeking Alpha Table – PepsiCo, Analyst Estimates for 2024-26, Made March 9th, 2024

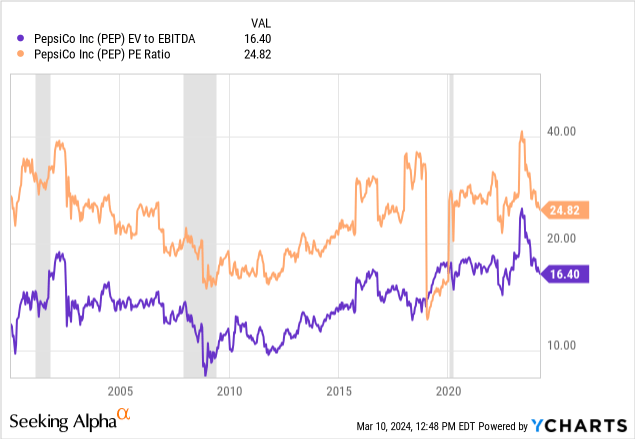

As I mentioned in my 2023 story, PepsiCo sales have struggled in U.S. recessions since 2001, with EPS dipping in each instance. Below is a graph back to 2000 highlighting the experience of a lower Wall Street price for PEP shares during the recession, alongside flat to lower EBITDA and income levels. If you can hold off until a clear recession drop in financial metrics for PepsiCo becomes a reality, your long-term investment returns will benefit. For new readers, I am solidly in the camp expecting a recession this year, and/or a big equity market drawdown generally, with odds higher than 75% for each outcome over the next 6-9 months.

YCharts – PepsiCo, Enterprise Value to EBITDA & Price to Earnings, Recessions Shaded, Since 2000

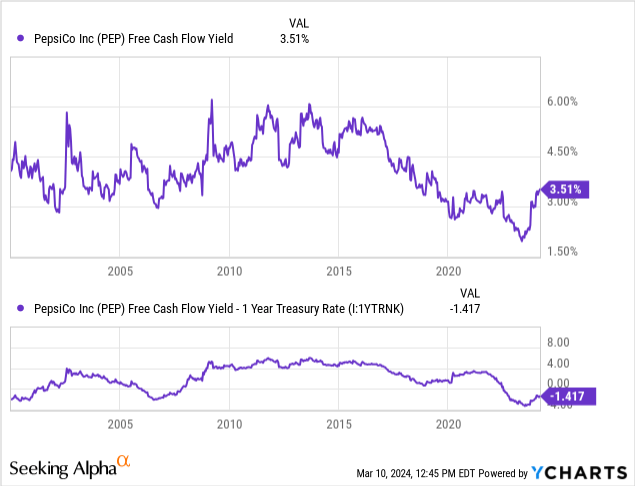

Another issue for me is free cash flow generation at Pepsi has been weakening since 2016. When we compare the free cash flow generation on prevailing share quotes, today’s 3.5% rate has improved over the last 12 months but remains very subpar vs. 5% yields from 1-year Treasury bills. All told, this relative investment yield from PEP last summer was the worst in decades, and has improved very little since. To me, the low free cash flow yield is my primary bearish argument.

YCharts – PepsiCo, Free Cash Flow Yield vs. 1-Year Treasury Rate, Since 2000

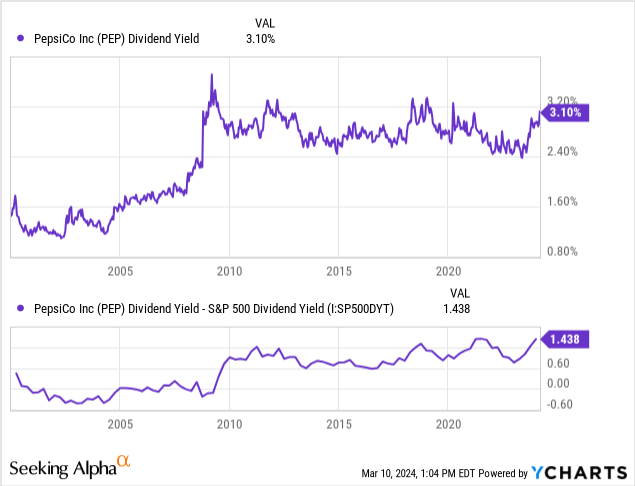

On the flip side of the equation, my main bullish reason to consider PepsiCo is the dividend yield story. The current 3.1% yield is almost double the equivalent offered by the S&P 500 index, with the highest spread of +1.44% over this index in modern times.

YCharts – PepsiCo, Dividend Yield vs. S&P 500 Index, Since 2000

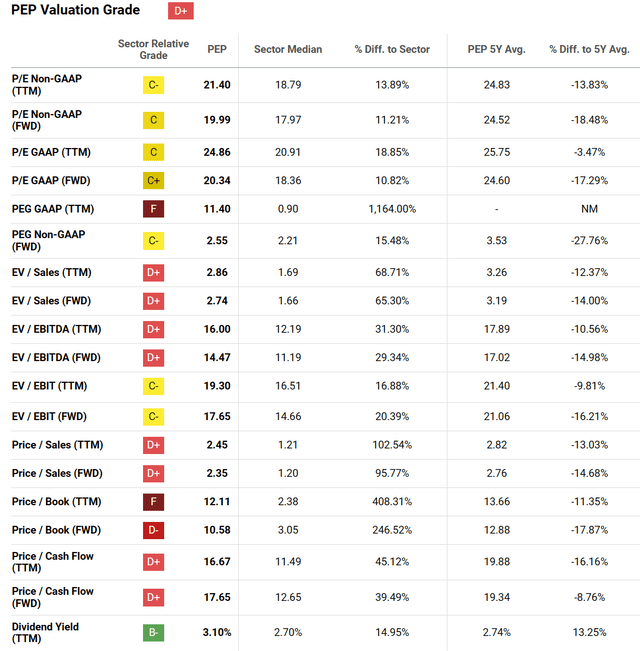

Rounding out the valuation analysis, Seeking Alpha’s computer-scoring system, Quant Valuation Grade is a rotten “D+” today. Why not wait for a smarter setup before buying?

Seeking Alpha Table – PepsiCo, Valuation Grade, March 9th, 2024

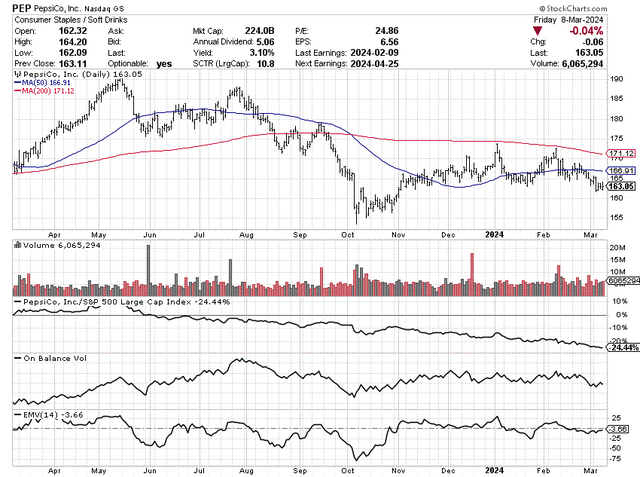

Bearish Chart Momentum

The bummer for PepsiCo shareholders and bulls is the price has been declining over the past year, wickedly underperforming the S&P 500 gain. The current PEP quote is below both its 50-day and 200-day moving averages, and they are in ugly downtrends. On-balance volume trends have been flat to negative since July. And 14-day Ease of Movement impulses have all been selling since May.

StockCharts.com – PepsiCo, 12 Months of Daily Price & Volume Changes

In the end, it appears the share price will resolve its weak trading pattern to the downside, likely to new 52-week lows under $153. Such would fit nicely with my lower valuation buy zone around $150.

Final Thoughts

Pepsi is in a similar boat as most other U.S. blue chips during early 2024. The stock price does not make sense vs. high interest rates and an approaching downturn in operations during a recession. I know it’s difficult to keep some cash back and wait patiently today, when near euphoria and boom investor psychology/sentiment are everywhere you look on Wall Street, especially in the amazingly overvalued Big Tech area of the market.

For prudent long-term investors, building up cash reserves is what I recommend, in anticipation of real bargains appearing in a bear market selloff. I am sitting at a rough 50% weighting in cash earning interest. The problem most face nearer a market bottom is cash to invest is lacking, as most remain fully invested during the down move. Older, wiser investors like Warren Buffett [through Berkshire Hathaway (BRK.A) (BRK.B)] have built up very large cash holdings to both earn a decent savings yield upfront and have investible funds when the stock market nosedives again.

Regarding PepsiCo’s future, I have a quote range forecast of $140 to $190 during the rest of 2024 and 2025. You will almost surely thank yourself years from now, waiting patiently for another couple of months to buy nearer the bottom of this price zone. If you can purchase a position at $150, a number closer to 3.5% will be your initial dividend yield. Plus, price appreciation back to $170 or $180 would/will deliver another +15% to +20% in capital gains during 2025 (as my baseline projection). However, purchasing PEP shares now at $163 may only produce a +5% to +10% total return including dividends over the next 12-18 months. As an alternative, I can capture a similar 5% rate “guaranteed” from cash-like investments for the time being, so I will.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.