Summary:

- Pfizer has been a losing investment for several years, but stronger trading momentum is starting to appear.

- An easily covered and safety-minded 6% dividend yield is very attractive today. Undervaluation arguments to own shares also exist.

- PFE stock could prove one of the smartest defensive plays to own the rest of 2024 and into 2025, given a major bear market selloff is next for Wall Street.

Simfo/E+ via Getty Images

Pfizer (NYSE:PFE)(NEOE:PFE:CA) has been a losing investment idea for several years, really since peak pandemic demand was reached for its leading COVID vaccines and antiviral prescription drugs. I have mentioned the stock several times as a strong income/yield proposition starting in 2022, with better than sector average valuations. Yet, the share quote has responded with flat to even lower pricing. My last bullish article was posted in December here.

Finally, some stronger trading momentum has appeared since April. The kind you can easily quantify. The kind that hasn’t existed since December 2021. Does such trading activity guarantee more gains are coming for PFE shares? Of course not, but I am quite confident this defensive name will widely “outperform” the S&P 500 for total returns if a bear market plays out the rest of 2024.

With Wall Street analysts timid in their expectations, trend-following investors absent from ownership today, a 6% dividend yield available for those entering/holding a position, and the valuation story completely supportive of bullish forecasts, it’s not hard to believe a brighter future for the stock has arrived (from a pre-existing contrarian, income, and value point of view).

What the positive trading momentum may be telegraphing is aggressive share selling supply could be exhausted, while the number of buyers is picking up steam. My argument is, why not be bullish on Pfizer today, one of the largest and most profitable pharma businesses by sales and equity market capitalization?

Technical Trading Analysis

The main point I want to make in this article is buyers may be in the early stages of getting the upper hand vs. sellers. If this proves true, a trend toward higher prices, perhaps over several years, is worth adding to your portfolio.

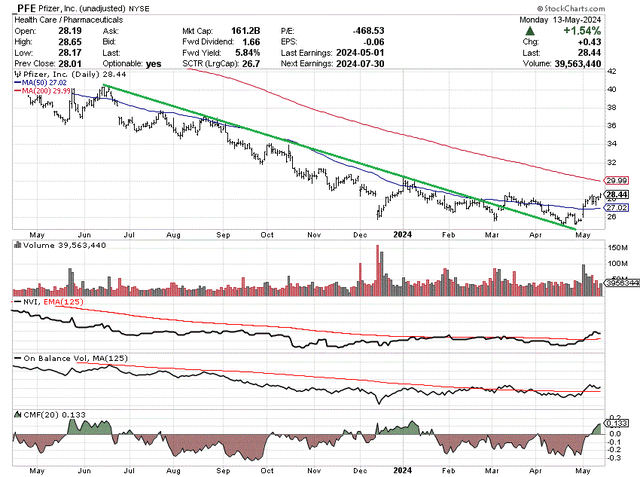

After declining on a consistent basis during 2023 and the first few months of 2024, a clear trendline breakout patter has developed since March. I have drawn a summary of this idea with a green line on the 12-month chart below of daily price and volume changes. A successful retest of the trendline in April has transitioned into the highest share price since January. More good news is the 50-day moving average has been crossed to the upside and is turning higher over the last week.

StockCharts.com – Pfizer, 12 Months of Daily Price & Volume Changes, Author Reference Point

In addition, I have drawn Negative Volume Index (which looks at slower volume days only), basic On Balance Volume (comparing day-to-day up to down volume, plotted at the close), and 20-day Chaikin Money Flow (a measure of intraday volume) readings.

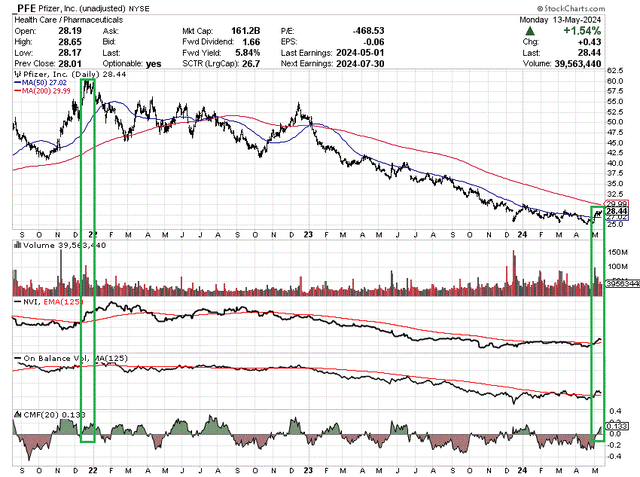

The last time price was trading above its 50-day MA, while NVI and OBV both traded above their 6-month moving averages and were near 6-month highs, and concurrently 20-day CMF was positive, happened all the way back in December 2021 (green boxes). So, it’s entirely possible the selloff pressure on share pricing over 28 months has ended.

StockCharts.com – Pfizer, 33 Months of Daily Price & Volume Changes, Author Reference Points

Terrific Dividend Yield

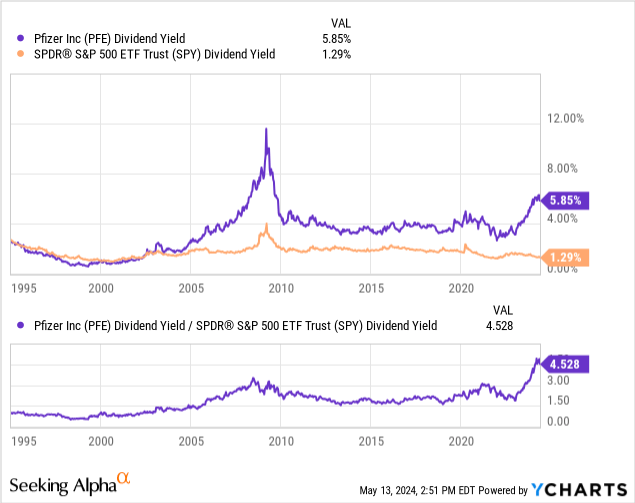

For those waiting for a better technical momentum entry in Pfizer, now may be the best time to jump aboard and capture its 5.85% trailing (6% likely forward) yield in your account. A 6% yield is better than the whole U.S. Treasury yield curve of 4.5% to 5.4%, and the quarterly payout will almost surely rise over time with earnings expansion on new drug discoveries and general inflation in the economy.

Compared to the blue-chip S&P 500 index equivalent cash dividend rate, Pfizer’s yield is a record 4.5x higher (5.85% vs. 1.29%). This spread ratio in distributions is even much better than the previous high of 3.3x during the 2008-09 Great Recession. I rank Pfizer’s yield as probably one of the safest upfront 6% numbers available in the stock market. The income story is in the same ballpark as the Realty Income (O) proposition for upfront size, diversified safety, and steady growth potential.

YCharts – Pfizer vs. S&P 500 ETF, Trailing Dividend Yields, Since 1995

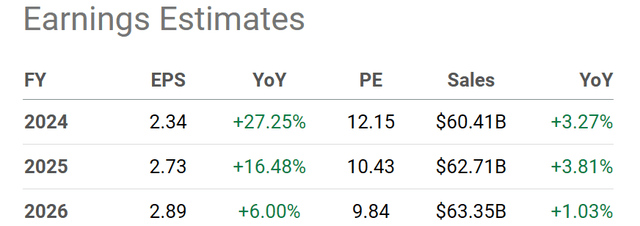

Supporting the dividend payout, sales and earnings are projected to rise in future years, after the slide in results during 2022-23. Yes, Wall Street analysts have moved estimates lower than 18 months ago, however a 60% payout rate from income generation by next year is well within an acceptable range historically.

Seeking Alpha Table – Pfizer, Analyst Estimates for 2024-26, Made May 13th, 2024

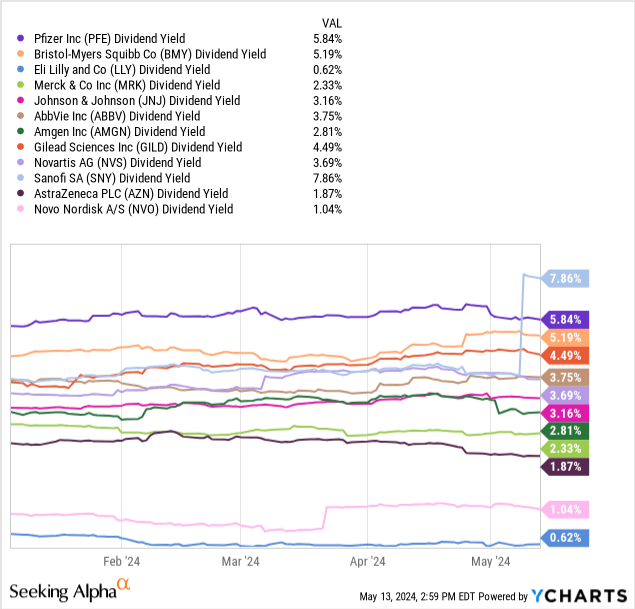

More good news, the trailing 5.85% yield ranks Pfizer near the top of the Big Pharma group of companies. Sanofi (SNY) is another pick I own in the sector with a strong dividend yield backdrop. After Sanofi, peers and competitors are delivering far lower yields. This sort group includes Bristol Myers Squibb (BMY), Eli Lilly (LLY), Merck (MRK), Johnson & Johnson (JNJ), AbbVie (ABBV), Amgen (AMGN), Gilead Sciences (GILD), Novartis AG (NVS), AstraZeneca PLC (AZN), and Novo Nordisk A/S (NVO).

YCharts – Pfizer vs. Big Pharma Peers, Trailing Dividend Yields, Year-to-Date

Undervaluation Setup

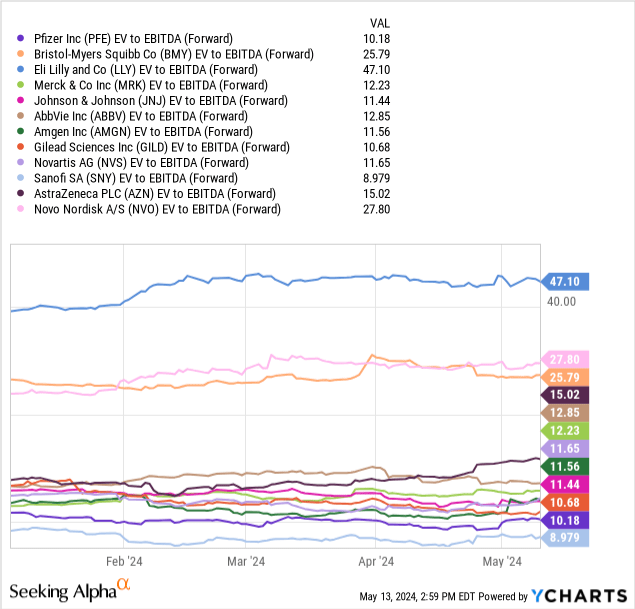

On the valuation front, Pfizer carries one of the smaller debt loads of the major drug companies. So, after years of price decline, the setup of “enterprise value” to EBITDA is the one to focus your attention. If you purchased the whole company, including both debt outstanding and equity, Pfizer has the cheapest valuation on expected core cash flow creation (on a 12-month basis through projections for the next 3-6 months of operations). Only Sanofi is less expensive.

I will interject I also own Gilead Sciences currently. GILD is another Big Pharma pick with an outlier undervaluation argument going for it, just a step below Sanofi and Pfizer.

YCharts – Pfizer vs. Big Pharma Peers, EV to Forward EBITDA, Year-to-Date

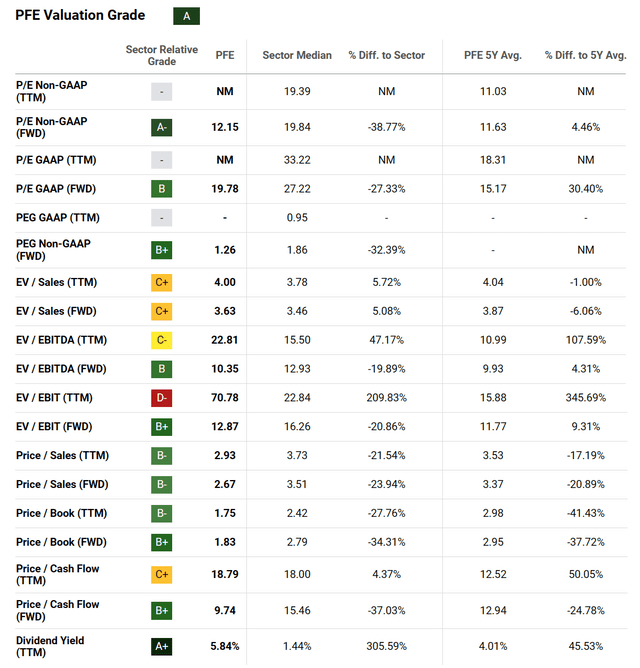

On a larger scale review of valuation metrics, Seeking Alpha’s computer-based Quant Valuation Grade of “A” for Pfizer nicely aligns with my research conclusion. If you want a value pick in Big Pharma, with an exceptional income component, Pfizer is the real deal at $28 a share today.

Seeking Alpha Table – Pfizer, Quant Valuation Grade, May 13th, 2024

Final Thoughts

With bear market odds high and rising for Wall Street the rest of 2024, investors should be on the hunt for defensive income names right now. Major prescription drugmakers have typically been a group to own during recessions and large downdrafts in the S&P 500.

Pfizer is well positioned to benefit from capital flows into safer pharmaceutical businesses. It may be a top destination for funds searching for both high immediate income and sound valuations characteristics.

The latest momentum turnaround since April appears to be quite supportive of the argument an important bottom in share pricing was reached in the first few months of 2024. For sure, new price gains beyond $30 (the 200-day moving average) will start to grab the attention of trend followers and hot money traders on Wall Street.

What are the downside risks? To me, the standout problem Big Pharma will face in coming years is federal government action to cap drug pricing and therefore related business profitability through Medicare price negotiations with the industry.

For Pfizer specifically, how it reinvests its cash flow flows into new products, including research and development, will be key. The pandemic windfall is over, and key drugs will be coming off patent protection. The success or failure of its investment in (takeover of) Seagen cancer-drug development will be one factor to watch. The company paid a high acquisition price for Seagan, which sharply diluted PFE per share results for 2024-26. The long-term wisdom of this management decision is still open to debate.

Largely with the help of the Seagan assets, 49 cancer drugs are in various stages of trial currently, with an estimate by the company as many as 25 new Pfizer cancer therapies could be approved by the FDA over the next 5 years.

Pfizer Website – Cancer Treatment, May 14th, 2024

Considering a rotten macroeconomic environment may be next in America, I have Pfizer price targets of $35 by the end of this year and $40 for late 2025. Good for annualized total returns of +20% to +25% over the next 24 months, such gains may be award-winning vs. sizable losses in the overvalued Big Tech area of the market, as one example. Also, initial waves of stock market selling could keep PFE in the $25 to $30 range over the next 2-3 months. All other variables remaining the same, I do suggest adding to positions if this is our near-term future.

I continue to rate Pfizer stock a Strong Buy, and own a small position. When you gather together all the positives, few other blue-chip stocks in the U.S. have as powerful a combination of reasons to own a stake as Pfizer. How many other investments hold superb contrarian sentiment, trading momentum, dividend income, and obvious undervaluation logic for ownership? Total return PFE outperformance of the S&P 500 is my baseline projection over the next 12 months, measured against a flat to lower price forecast for U.S. equities generally.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, SNY, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.