Plug Power: Conditional DOE Loan Guarantee Meets Meme Stock Frenzy – Hold

Summary:

- On Tuesday, shares of Plug Power got a shot in the arm as the company finally managed to secure a much-touted conditional loan guarantee by the Department of Energy.

- Investors shouldn’t get carried away by Tuesday’s news, as the loan is not likely to be funded anytime soon.

- Last week, PLUG reported another set of disappointing quarterly results, with both the company’s top and bottom lines missing consensus expectations by a wide margin.

- The company’s service, fueling, and leasing segments showed improvement. In addition, cash usage was down significantly.

- Given market participants’ increased risk appetite and considering the renewed meme stock frenzy, Plug Power should have no problem selling sufficient amounts of shares into the open market to finance its operations for at least the next couple of quarters. Consequently, I am reiterating my “Hold” rating on the shares.

Olemedia

Note:

I have covered Plug Power Inc. (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

On Tuesday, shares of struggling fuel cell systems, electrolyzer solutions, and green hydrogen provider Plug Power Inc. or “Plug Power” got a shot in the arm as the company finally managed to secure a much-touted conditional loan guarantee by the Department of Energy (“DOE”):

Plug Power Inc. (…) received a conditional commitment for an up to $1.66 billion loan guarantee from the Department of Energy’s (“DOE”) Loan Programs Office (“LPO”) to finance the development, construction, and ownership of up to six green hydrogen production facilities.

The production facilities, which will be selected for financing in accordance with procedures to be set forth in definitive documentation with DOE, will be built across the nation and supply major companies, including Plug’s existing customers, with low-carbon, made-in-America green hydrogen. The hydrogen generated will be used in applications in the material handling, transportation, and industrial sectors. (…)

While this conditional commitment represents a significant milestone and demonstrates the DOE’s intent to finance the project, certain technical, legal, environmental and financial conditions, including negotiation of definitive financing documents, must be satisfied before funding of the loan guarantee.

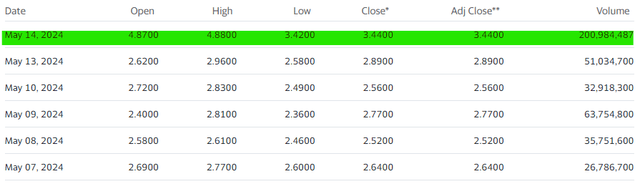

Following the news release in pre-market, shares opened the session up almost 70% but soon started to drift lower and finished near day-lows, but still higher by approximately 20% on massive trading volume:

Yahoo Finance

However, investors shouldn’t get carried away by Tuesday’s news.

Based on the wording of the press release, the funds appear to be earmarked for new plants, which would be in contrast to management’s previously stated expectations of the loan allowing for the refinancing of the completed Georgia facility.

In addition, given the sheer size of the guarantee and the company’s abysmal track record, I would expect the DOE to have imposed very strict funding requirements which might result in the loan not being funded under the current administration.

According to Jefferies (JEF), the required NEPA review could take up to eight months alone.

To get a better impression of the challenges of complying with the DOE’s funding conditions, investors should also take a look at Eos Energy Enterprises or “Eos Energy” (EOSE) an aspiring manufacturer of zinc-based batteries which was granted an almost $400 million conditional loan guarantee in August 2023, but the company still hasn’t met the DOE’s conditions and appears unlikely to do so anytime soon.

Q1/2024 Earnings Discussion

Last week, Plug Power reported another set of disappointing quarterly results, with both the company’s top- and bottom lines missing consensus expectations by a wide margin.

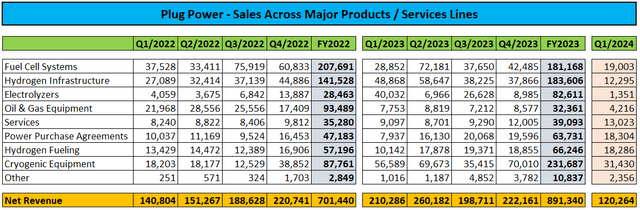

Sales were down by more than 40% both sequentially and year-over-year, with product revenues taking a particularly large hit:

Regulatory Filings

Sales of electrolyzers were down by 96.5% year-over year, as the company only managed to recognize revenue for a single 1 MW containerized unit.

Sales of hydrogen infrastructure were also down heavily as the company deployed just three installations at customer sites as compared to fourteen in Q1/2023.

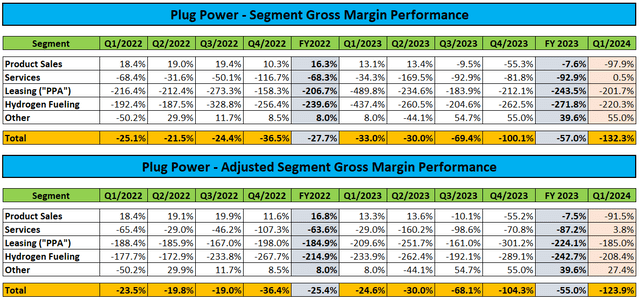

Adding insult to injury, the company’s consolidated gross margin performance deteriorated to a new all-time low:

Regulatory Filings

Even adjusted for the accounting impact of warrants issued to key customers Amazon (AMZN) and Walmart (WMT), consolidated gross margin was negative 123.9%.

While the company showed improvement in smaller segments like services, power purchase agreements and fueling, product gross margins took another major hit.

In the company’s quarterly report on form 10-Q, management attributed the continued deterioration to a number of issues:

- Customer mix

- Lower margins on new product offerings

- Inventory valuation adjustments

- Volume declines

With immaterial electrolyzer sales for the quarter, the only “new” product offering would be liquefaction systems but with cryogenic equipment contributing just slightly over 25% to quarterly revenues in Q1, I am struggling with this part of management’s explanation.

That said, let’s focus on the improvements in the business with the services segment showing positive gross margins which management attributed to the successful renegotiation of service contracts with certain customers.

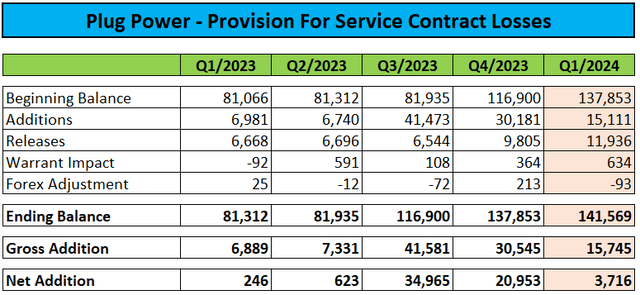

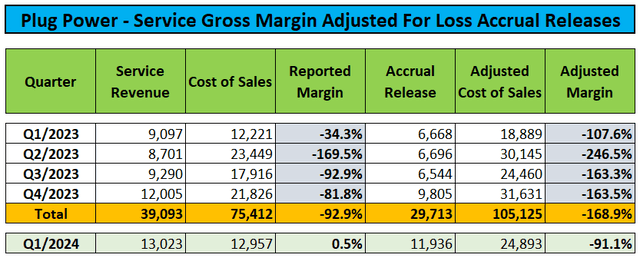

Please note that service margins continue to benefit from the company’s provision for underwater service contracts, as large amounts are released to costs of goods sold each quarter:

Regulatory Filings

Adjusted for the release, service margins remained a far cry from break-even levels; however, the progress is encouraging:

Regulatory Filings

In addition, the company’s leasing segment, which the company refers to as “Power Purchase Agreements” showed some meaningful progress which was attributed to improved pricing and favorable product mix. However, segment gross margin of negative 220% remains nothing to write home about.

Lastly, hydrogen fueling also showed some improvement, but this was mostly the result of lower warrant impact.

On the conference call, management projected the segment to approach gross margin breakeven by the fourth quarter due to a combination of increased hydrogen production and the successful renegotiation of unfavorable legacy supply contracts with key customers.

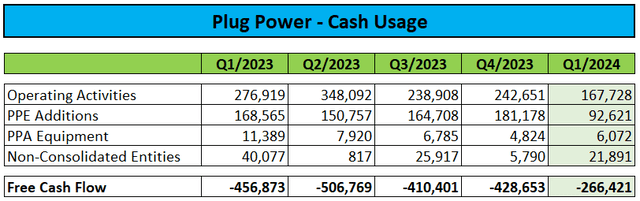

While cash burn remains a major issue, negative free cash flow of $266.4 million and total cash usage of $288.3 million represented an almost 40% sequential improvement due to a combination of lower capital expenditures and decreased cash losses from operations.

Regulatory Filings

However, considering management’s full-year cash usage target of approximately $500 million, further progress remains imperative.

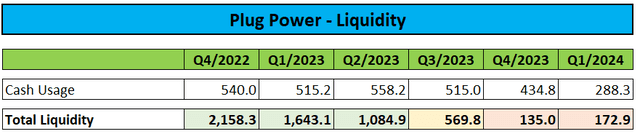

During the quarter, Plug Power raised $305.3 million in net proceeds under its ATM agreement with a division of B. Riley Financial (RILY) and ended Q1 with unrestricted cash and cash equivalents of $172.9 million:

Regulatory Filings

Subsequent to quarter-end, the company raised another $147.8 million under the ATM agreement.

Since inception, Plug Power has sold 135.4 million shares under the ATM agreement at a weighted-average sales price of $3.38 per share, thus increasing outstanding shares by approximately 22% since the end of last year.

With the company’s near-term survival solely dependent on the ability to sell sufficient amounts of shares into the open market, Tuesday’s combination of important news and renewed meme stock frenzy likely helped Plug Power raising tens of millions of dollars in a single session.

That said, with the loan unlikely to be funded in the near future, Plug Power will be required to cover its near-term liquidity needs by additional open market sales, thus resulting in further dilution for existing shareholders.

Bottom Line

Plug Power reported another set of abysmal quarterly results, with sales down by more than 40% and consolidated gross margin deteriorating to new all-time lows as product margins continue to be impacted by a plethora of issues.

However, the successful renegotiation of service and hydrogen supply contracts with key customers as well as the recent launch/relaunch of the company’s own hydrogen production facilities should provide some offset going forward.

While cash burn was much less than in previous quarters, Plug Power will have to show further improvement to come even close to management’s stated full-year target.

Lastly, investors shouldn’t get carried away by the DOE’s conditional loan guarantee, as conditions might be tough to meet for the ailing company.

For my part, I do not expect the loan to be funded under the current administration.

However, given market participants’ increased risk appetite and considering the renewed meme stock frenzy, Plug Power should have no problem to sell sufficient amounts of shares into the open market to finance its operations for at least the next couple of quarters.

Consequently, I am reiterating my “Hold” rating on the shares.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.