Summary:

- Given the huge and growing GLP-1 weight loss market, recent trial data from Viking Therapeutics could make it a potential acquisition target for a larger concern.

- While many bigger pharma names might desire entry into the huge GLP-1 weight loss market, Pfizer makes logical sense on several fronts.

- We discuss the potential of such a combination and offer up several reasons Pfizer would want to at least “kick the tires” on Viking Therapeutics in the paragraphs below.

Martin Barraud

We’re going to engage in some buyout speculation, which is one of the main drivers for the biotech sector. When M&A volume is high, the sector tends to go up. When deal volume is punk, trading action tends to be tepid. In this column, we are going to tee up a potential acquisition of midcap biopharma concern Viking Therapeutics (VKTX) by one of the gianta in the pharma space, Pfizer (NYSE:PFE).

One of the most exciting topics in the healthcare sector is around the huge growth of the GLP-1 weight loss market. This space is projected to grow to $100 billion by 2030 according to JPMorgan Research. The massive opportunity is currently dominated by products from Novo Nordisk (NVO) and Eli Lilly (LLY). We covered Novo with this article earlier this month and also provided a piece around Eli Lilly in late March.

The moat that Novo and Lilly currently enjoy in the GLP-1 space is not going to last forever. Both are developing potential more effective drugs to target this market within their own pipelines, and other large drug makers like Amgen (AMGN) and Roche (OTCQX:RHHBY) are working on their own candidates to bring to market to address this huge and growing market. Smaller names like Altimmune (ALT) and Viking Therapeutics also are advancing GLP-1 candidates within their pipelines as well.

Viking Therapeutics February 2024 Company Presentation

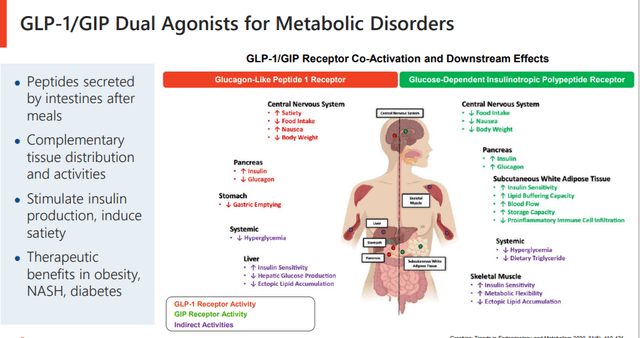

I find Viking the more intriguing of the two small names. Its offering to this space is VK2735, a once-weekly, subcutaneously (or orally) administered dual agonist of glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic peptide (GIP) receptors that’s undergoing assessment in the treatment of obesity. After data from a six-patient highest-dosed cohort in a Phase 1 study revealed a mean 7.8% weight reduction from baseline at day 29 in March 2023, the company embarked on a Phase 2 trial (VENTURE), which recently produced stellar results. The stocks of both LLY and NVO fell on the day the news was announced.

The data released in late February showed that VK2735 was well tolerated and decreased mean body weight (placebo-adjusted) by up to 13.1% at 13 weeks. In addition, no weight loss plateau was observed, meaning additional weight loss past the 13-week cutoff date was likely. A month later, the company disclosed some promising data from a Phase 1 study around the oral version of VK2735. Dosing ran four weeks and the trial demonstrated up to 3.6% placebo-adjusted reductions in mean body weight at Day 34. A phase 2 study around the oral version of VK2735 is scheduled to commence in the second half of this year.

Jefferies noted Viking Therapeutics “scarcity value” when it upgraded the stock to a Buy on March 7 and projected that the oral version of VK2735 could eventually see $12 billion in peak annual sales. However, it’s important to note than any potential commercialization is many years into the future. Obviously, recent trial news put Viking Therapeutics on some potential buyout lists.

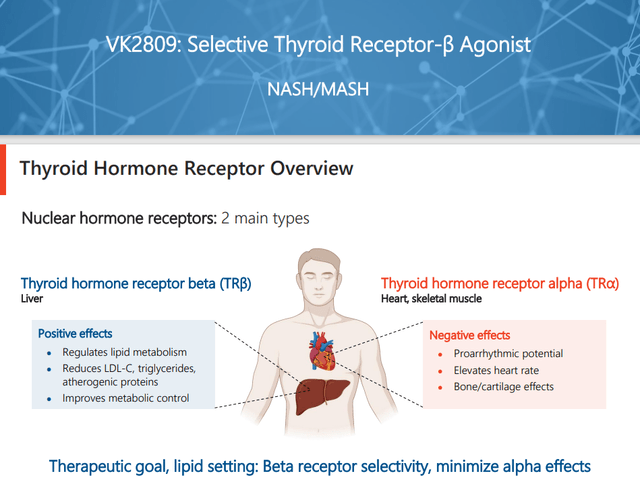

Eli Lilly was rumored to be interested early in the year but deal talks are speculated to have fallen apart around the price of a takeout, a number that certainly has gone up significantly after recent trial data. Viking currently has a market cap of approximately of just over $7.5 billion, very digestible for a larger concern given the potential size of the GLP-1 market. Viking also has a thyroid receptor beta agonist candidate dubbed VK2809 that’s being evaluated for the treatment of NASH, a market that could approach $50 billion by 2035 according to a recent report. VK2809 successfully completed a Phase 2b study last year. Viking Therapeutics recently raised approximately $550 million cash via a secondary offering and ended the fourth quarter of 2023 with just over $360 million of cash and marketable securities on its balance sheet.

Viking Therapeutics February 2024 Company Presentation

While many big pharma names could make sense as a logical suitor for Viking, I personally like Pfizer for several reasons. First, this huge pharma concern obviously has the financial means to make such an acquisition. Second, the company has been aggressive on the acquisition front as revenues from COVID mRNA vaccines and treatment Paxlovid have plummeted from their peaks. As a result, earnings have plummeted for Pfizer from a recent peak of over six bucks a share to just over $1.80 a share in FY2023. That said, the shares of PFE do yield north of 6% now, and the stock seems to be trying to form a bottom. Earnings also seemed to have troughed and the current analyst firm consensus projects $2.20 a share in profits in FY2024 and nearly $2.75 a share in FY2025.

Seeking Alpha

The other reason Pfizer will likely continue to make purchases to build its pipeline and product portfolio is that the company also faces some key patent expirations in the coming years such as around Ibrance and Prevnar 13.

Pfizer’s biggest deal to date was the $40 billion-plus purchase of oncology related Seagen which was completed late last year. Most importantly, Pfizer already has shown interest in this in this space with a GLP-1 candidate called Danuglipron that produced solid weight loss data in a recent Phase 2b trial. However, trial development was halted due to the side effects that Danuglipron produced in the study. Why not pick up VK2735 via a purchase of Viking that delivered better weight loss without all the side effects of Danuglipron?

Will this proposed combination happen? It should be noted that all buyout speculation, is just that, speculation. That said, I’m hardly the only one teeing up Viking Therapeutics as a potential buyout target. However, the acquisition would make logical sense on several fronts. I offer up the idea in that context.

It’s also quite reasonable and even probable to assume Pfizer could feel spurned with its recent failure in the GLP-1 space. Management could believe it’s now too far behind Novo Nordisk and Eli Lilly in the GLP-1 space to effectively catch up, despite this huge market, to throw good money after bad. Maybe it will decide a potential bidding war over Viking is just not worth it as well. The pharma giant might just decide to focus its acquisition dollars on continuing to build out their pipeline in oncology which the purchase of Seagen advanced notably.

Regardless of whether this combination happens in the coming months, I own both stocks. Viking because of its potential, either as a standalone entity or as a buyout target. Pfizer because it has become a classic value stock in an overbought market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, VKTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.