Summary:

- Pfizer Inc. has been reported as bidding for Seagen Inc., competing with Merck & Co., Inc. for the cancer drug company.

- Seagen analysts forecast booming sales on FDA approvals of multiple cancer drugs.

- Seagen shareholders should take the deal and cash out at a premium valuation.

- Pfizer needs an acquisition with large future revenues to replace lost COVID-19 sales and LOEs.

Yossakorn Kaewwannarat

Pfizer Inc. (NYSE:PFE) got a big sales boost from the COVID-19 vaccine, and the end of the pandemic has cut off a big revenue stream. The biotech faces a year with a substantial revenue hit, while the company is now loaded with cash from excess vaccine profits. My investment thesis is Neutral on the stock unless Pfizer can make an acquisition, such as Seagen Inc. (NASDAQ:SGEN), for a decent price.

Seagen Deal

The former Seattle Genetics has been in negotiations with major biopharmas like Merck & Co., Inc. (MRK), and apparently Pfizer now, going on since last summer. At one point, Merck apparently offered $200 per share, but Seagen ended talks due to a disagreement on price for a $40+ billion deal.

Currently, Seagen does ~$2 billion in annual revenues. The company is likely to obtain approval for a label expansion for bladder cancer drug Padcev, boosting revenue potential in the years ahead.

Considering the drug works in combination with Keytruda from Merck, this merger combination appears far more likely. Merck would appear to have the greatest insight into the true value of this drug from Seagen.

The reason these companies could fight over Seagen is the revenue forecasts, with analysts predicting revenues jumping to $5 billion by 2026 and reaching a peak of $9 billion by the end of the decade.

Both an expansion of Padcev’s label and the FDA previous approval of Tukysa plus trastuzumab and capecitabine for adults with advanced unresectable or metastatic HER2-positive breast cancer provide multi-billion dollar sales targets. A biopharma like Pfizer looking to replace lost drug sales can use a huge cash balance to generate a potential large sales stream in a few years.

Going back to 2021, analysts were debating whether Seagen would reach an $8 to $9 billion sales level by 2030. The current analyst estimates suggest the biotech produces a slightly higher sales level by the end of the decade, but shareholders would only see a higher valuation, if sales top those levels and grow in the next decade.

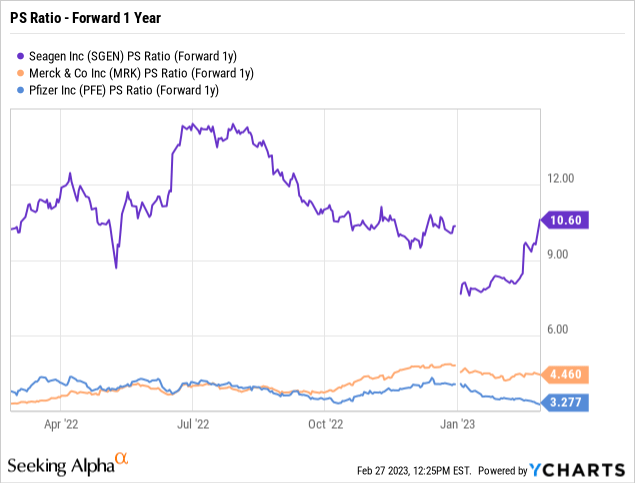

Seagen probably has the best opportunity to unload the stock, with both Merck and Pfizer looking to outbid each other. Shareholders are looking at the potential to sell shares at 4.5x peak sales estimates of up to $9 billion. Right now, the biotech would sell at ~17x 2023 sales targets with a $40 billion buyout.

Both Pfizer and Merck trade at this peak sales P/S ratio already. The suggestion is that Seagen has to produce additional material sales growth over the period in order to warrant an actual higher valuation by the start of 2030, or investors might not see a higher price about 7 years from now.

COVID Declines

Pfizer reported 2022 revenues of $100 billion, and the analysts forecast revenues dipping below $71 billion in 2023. The biopharma even forecast their covid drugs to face steep declines this year as follows:

- Comirnaty revenues of ~$13.5 billion, down 64% from actual 2022 results.

- Paxlovid revenues of ~$8.0 billion, down 58% from actual 2022 results.

- Total COVID-19 revenue of ~$21.5 billion, down 62% from 2022 results.

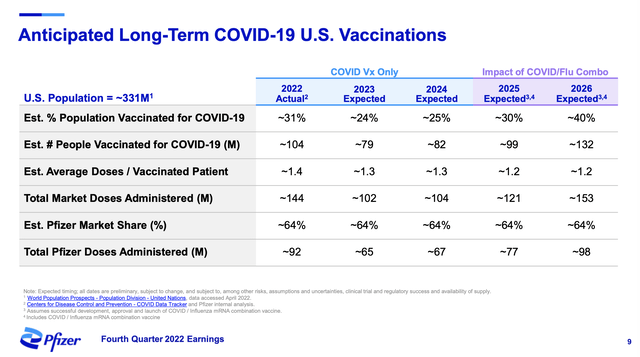

A major part of the investment story for Pfizer going forward is whether the COVID-19 revenues will rebound in 2024. The biopharma projects doses administered to rebound in 2024 and sales to beat the lower levels in 2023 due to inventory absorption.

Source: Pfizer Q4’22 presentation

Considering the questions about the effectiveness of COVID-19 vaccines and therapies, the Pfizer forecasts for higher demand in future years appears aggressive. The company likely faces more downside risk to these revenues, and a deal with Seagen could help fill this future revenue hole.

The large biopharma even faces a high level of LOEs (loss of exclusivity) hitting, up to $17 billion worth of current revenues by 2030. Both Eliquis and Ibrance have LOE in the U.S. by 2027, with worldwide revenues of over $5 billion each at risk.

Pfizer ended 2022 with a cash balance of nearly $23 billion, though the company does have total debt of $36 billion. The biopharma is likely to generate $20 billion in free cash flows this year to provide a lot of the cash needed to close a deal with Seagen. After all, the company paid for $23 billion worth of acquisitions last year and still maintains a large cash balance.

Pfizer has a lot of moving parts, with the biggest issues as to whether the COVID-19 sales of $21.5 billion in 2023 will grow in the future. The Seagen sales could help fill this void.

Takeaway

The key investor takeaway is that Seagen Inc. investors should most definitely accept a buyout topping $40 billion, considering the current sales targets don’t warrant a much higher stock price by the end of the decade. Pfizer needs a large deal to replace the dwindling revenues from COVID-19 vaccine sales and LOEs a few years away. The deal appears a win/win for both Seagen Inc. and Pfizer Inc. shareholders.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.