Salesforce.com’s Upcoming Earnings: 3 Things You Need To Know

Summary:

- In the light of recent events, shareholders would need watch out for any indication of a shift in Salesforce’s growth strategy.

- The level of share buybacks and stock-based compensation also will be an important part of the upcoming earnings release.

- Guidance about future GAAP operating profitability will be in the spotlight as the company lays off a significant amount of its workforce.

Stephen Lam

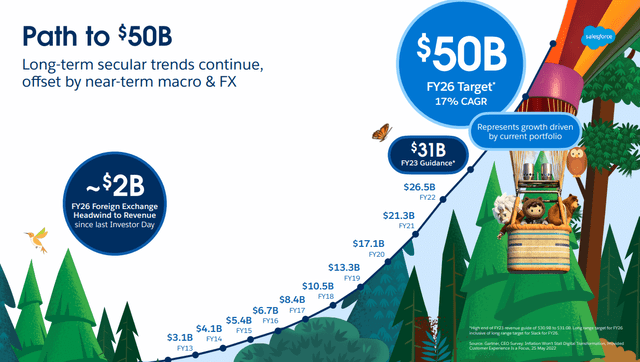

With every consecutive quarterly results, the pressure for Salesforce, Inc. (NYSE:CRM) to deliver on its strategy is rising. Indeed, the revenue growth in recent years has been spectacular and the company is on track to achieve its somehow arbitrary goal of reaching $50bn worth of sales in fiscal year 2026.

Salesforce Investor Presentation

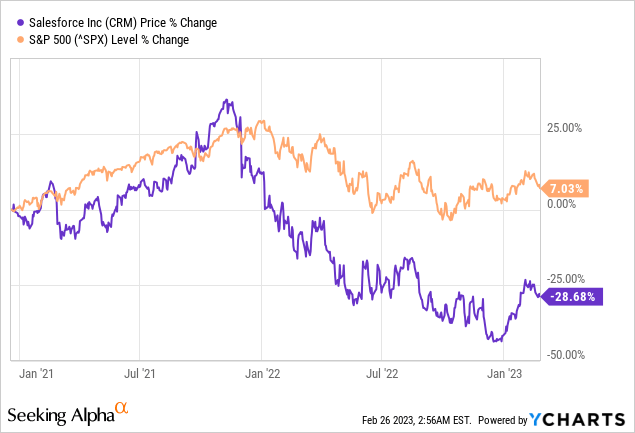

At the same time, however, the share price chart has been going in the other direction. Since I first outlined a number of major red flags for CRM’s shareholders in December of 2020, the share price has plunged by nearly 30%.

Given how rough 2022 was for most equity investors, some people could rightfully so point to market-wide forces putting pressure on CRM. However, the broader equity market returned 7% during the same period. Moreover, for the most part of 2021, Salesforce’s share price was still underperforming the market on an absolute basis, and if we take into account risk, things would look even worse for the software giant.

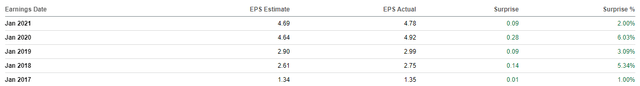

That’s why the pressure on Salesforce to deliver during the upcoming earnings is enormous. So far, the company has been consistently beating expectations on its annual earnings announcements, although we should keep in mind that the EPS numbers below relate to Non-GAAP figures (more on that later).

Seeking Alpha

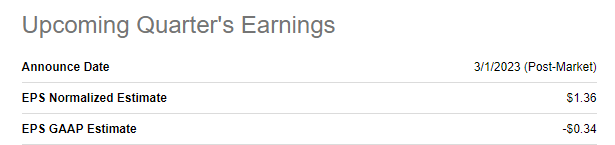

The current Non-GAAP EPS is expected to come at $1.36, which is the mid-range of the management’s guidance of $1.35 – $1.37.

Seeking Alpha

Having said that, in light of increased interest by activist investors and the recently announced layoffs, investors should be prepared for unexpected changes in Salesforce’s growth strategy during the earnings announcement March 1.

A Potential Strategy Shift

This divergence between the share price performance and Salesforce’s size confirms that the current strategy is not working. That’s why, during the upcoming earnings release, investors should be looking closely for any indication of a strategy shift.

Yet another confirmation that the current growth strategy is not creating shareholder value is the large number of activist investors circling around the company.

Seeking Alpha

So far, it has become clear that five activist investors have recently become involved with Salesforce – Elliott Management, Third Point LLC, ValueAct Capital, Inclusive Capital Partners and Starboard Value.

It’s not yet clear whether proxy fights will be avoided and how many board seats will these activist investors secure. However, one thing is clear at this point and that is these new investors will be looking at Salesforce pursuing either spin-offs or cost-cutting measures.

On one hand, management can’t afford to admit that the current growth strategy is not delivering the desired results for shareholders. On the other hand, compromises with activist investors would probably need to be done in order to avoid proxy fights. After all, significant amounts of shareholder capital has been put into Salesforce’s recent acquisition spree.

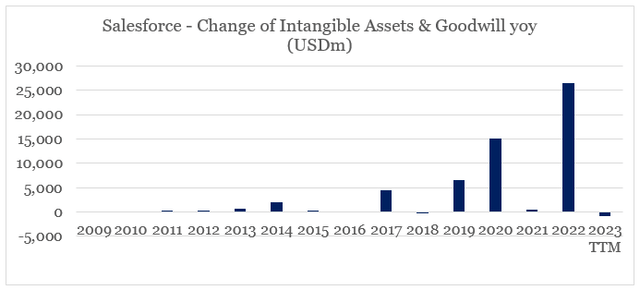

prepared by the author, using data from SEC Filings

That’s why investors should listen carefully for any slight change in language regarding future acquisitions and potential spin-offs from Salesforce’s recent deals.

A potential red flag here would be a sudden change in the narrative in a similar fashion to Nvidia (NVDA). As Nvidia’s recent deal with Arm collapsed and early indications of a slower growth ahead emerged, a new exciting narrative about “an inflection point in AI” has emerged. This is not necessary a bad thing for shareholders, however, such drastic changes in the narrative about future growth drivers are an indication that there might be more troubles ahead.

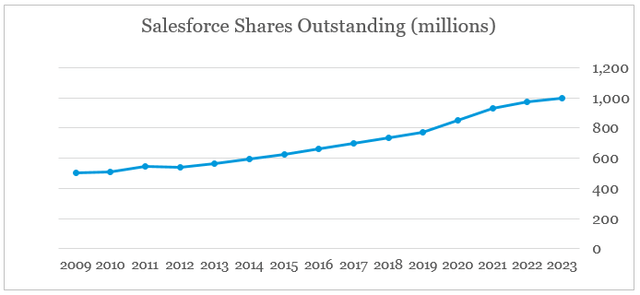

Shareholder Dilution Needs To Stop

Shareholder dilution, another red flag that I raised all the way back in 2020, seems to have become an issue at Salesforce. Pursuing all these exciting acquisitions over the years has not come cheap for shareholders as their stakes in the company were significantly diluted.

prepared by the author, using data from SEC Filings

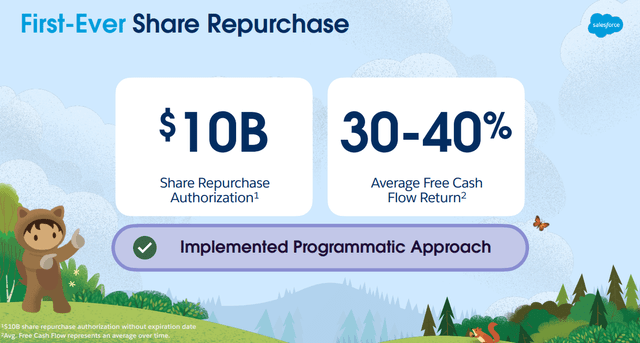

That’s why during the last quarter, Salesforce initiated a share repurchase program and spent roughly $1.7bn on buybacks. In total, the share repurchase authorization amounts to $10bn, which at present is equal to roughly two years’ worth of free cash flow.

Salesforce Investor Presentation

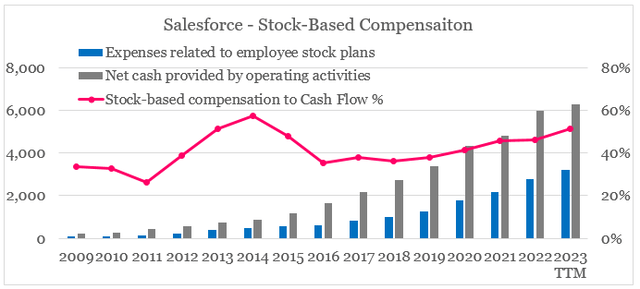

The reason why this ambitious share repurchase plan is needed is because the amount of stock-based compensation has reached extreme levels in recent years. During the past 12-month period, the amount of stock-based compensation expense stood at more than 50% of Salesforce’s cash flow from operations.

prepared by the author, using data from SEC Filings

A recent analysis that I did within the semiconductors industry shows an inverse relationship between companies’ level of stock based compensation and their share price returns.

Moreover, the stock-based compensation would need to be sustained or even increased in order to retain talent and reduce cash outflows. At the same time, pressure from activist investors and shareholders more broadly is likely to increase as they see their holdings being diluted while at the same time the share price is losing value. Therefore, investors should look closely for clues regarding the much needed balancing of future priorities and what implications would all that have for future free cash flow.

The Trade-off Between Margins And Growth

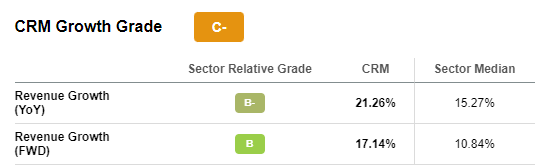

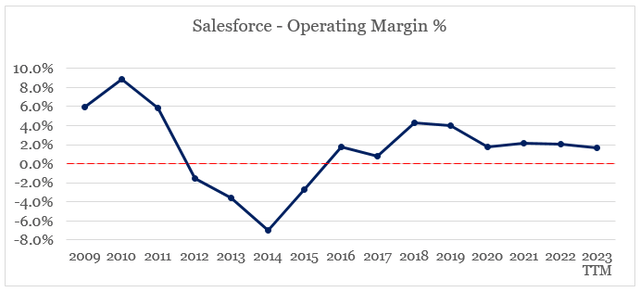

Two major problems that Salesforce has been confronted with have been the slowing revenue growth rate and the struggle to achieve high GAAP profitability.

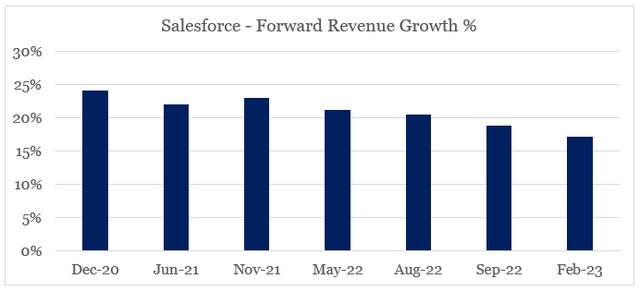

When I first covered Salesforce back in December of 2020, the expected forward revenue growth rate was slightly above 24%. Almost every single time I followed up on my initial analysis, however, the expected growth rate was slightly lower to now reach 17%.

Salesforce

prepared by the author, using data from Seeking Alpha

This might not sound as much and 17% expected growth rate is still impressive. However, should Salesforce’s current acquisition-led strategy come under scrutiny, the growth engine of the company will be at risk.

Moreover, CRM needs larger scale in order to achieve higher operating margins on a GAAP basis.

prepared by the author, using data from SEC Filings

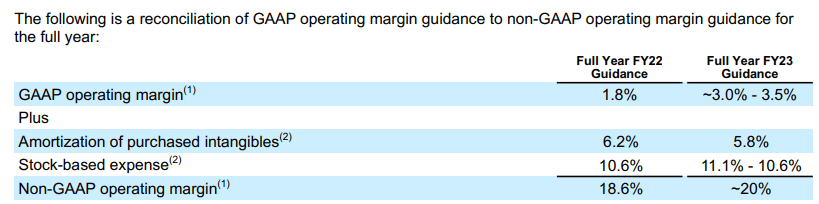

Even if we exclude the amortization of intangible assets, which results from Salesforce’s recent acquisitions, the high level of stock-based expenses needed to run the business can’t be underestimated. I covered all that in further detail here.

Salesforce SEC Filings

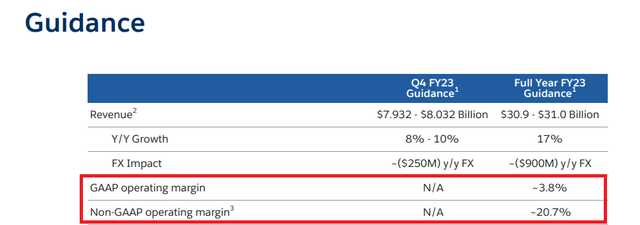

From a margin point of view, the fiscal year of 2023 is not expected to bring anything vastly different from the past periods with GAAP operating margin expected to be 3.8%.

Salesforce Investor Presentation

What investors should watch closely, however, is any update on the planned layoffs and what impact they would have both on the top and the bottom line of the company.

Seeking Alpha

So far the management has indicated that it expects to incur approximately $1.4 billion to $2.1 billion in charges in connection with the layoffs, of which between $800m and $1.0bn are expected to be incurred during the quarter reported this week.

More importantly, this means that we should expect Salesforce to provide guidance for significantly higher GAAP margins going forward as a result of this plan. Whether or not the current revenue growth rates could be achieved with a reduced workforce, however, is an open-ended question.

Conclusion

After years of following an aggressive acquisition-led strategy, Salesforce is now at a crossroads. On one hand, the company could double down on its current strategy and hope that share price will recover, or on the other it could compromise with activist investors and alter its course.

During the upcoming earnings announcement later this week, Salesforce management would most likely provide us with some indications on what this course would look like. Having said that, decisions regarding future capital allocation, share buybacks, stock-based compensation, operating margins and organic growth will be in the spotlight of the upcoming earnings release.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

Looking for better positioned high quality businesses in the cloud space?

Looking for better positioned high quality businesses in the cloud space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning. The opportunities laid out in the service also capitalize on inefficiencies in the market associated with short-termism, momentum chasing and narrative driven expectations. For more information follow the link provided.