Summary:

- Pfizer released its Q3 2022 earnings on 1st November.

- PFE had another blockbuster quarter, generating $22.6bn revenues and net income of $8.6bn.

- Based on FY22 guidance, forward P/E is a very low ~7x, but the market knows that COVID revenues will shrink – likely by more than half – in 2023.

- On top of these losses, there are $17bn anticipated losses as a result of patent expirations.

- Management believes it can generate an additional $45bn in revenues before the end of the decade, having splashed COVID cash on new acquisitions and R&D. The outlook is positive, with an element of risk.

Massimo Giachetti

Investment Overview

The Big Pharma Pfizer Inc. (NYSE:PFE) is not renowned for its dynamic share price. As I mentioned in my last note on the company (after news broke of its acquisition of Global Blood Therapeutics), prior to July 2021, the highest price the company’s stock had reached was $45 – and that was way back in the year 2000!

Pfizer stock hit its lowest ebb for 5 years or more in March 2020 at the height of the pandemic-related market crash, sinking to a low of $27. With its unwieldy share float of 5.6bn – only 10 listed companies have issued more shares – things could have got worse for Pfizer had it not been for the success of its COVID vaccine, Comirnaty, and COVID antiviral Comirnaty.

By the end of 2022, Comirnaty will have generated nearly $70bn of revenues, which are split equally between Pfizer and its development partner BioNTech (BNTX), whilst Paxolvid is expected to generate ~$22bn revenues this year. Their success has allowed Pfizer to grow its top line revenues by a staggering 95% year-on-year between 2020 and 2021, and, provided FY22 guidance is met, another 25% this year.

None of the remaining “Big 8” US Pharmaceutical companies – Johnson & Johnson (JNJ), Eli Lilly (LLY), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Gilead (GILD) and Amgen (AMGN) – can come remotely close to matching Pfizer’s growth. Yet, across the past 12 months, Pfizer stock is up by just 4.3%. Only Johnson & Johnson’s stock price has gained by less, whilst the likes of Amgen, AbbVie, BMY and Lilly have posted gains of 22%, 22.5%, 31%, and 34%.

To summarize, when Pfizer is struggling to generate any share price momentum even as its revenues double in less than 2 years, you know that you are dealing with a company that relies much more on its relatively generous dividend payout of $0.4 per quarter, currently yielding 3.43% to attract investors, than on its prospects for share price growth.

Buying Pfizer stock is arguably similar to buying a fixed interest security, although what are the chances that when you want to sell out of your position, a dip in the share price will result in your losing a sizable portion of your capital?

This brings us to Pfizer’s Q322 earnings, which were released on November 1st. These earnings are particularly important because we have arrived at the stage where it is public knowledge that sales of Comirnaty and Paxlovid are going to decline substantially in 2023. Investors want to know how big the fall in revenues is going to be in 2023, and how Pfizer management plans to prevent the share price falling in tandem with the top and bottom lines.

In this article I will take a closer look at Q322 earnings, and discuss management’s plans for the next 5-10 years. It isn’t just Comirnaty and Paxlovid that investors need to worry about – CEO Albert Bourla warned on the Q322 earnings call that losses of patent exclusivity could cost Pfizer an additional $17bn in lost revenues between now and 2030.

The outlook is not entirely gloomy, however, since management is promising up to $45bn in new revenue opportunities – let’s start by analyzing Q322.

Pfizer’s Q3 2022 Earnings – A Tough Comparison To 2021 But A Strong Quarter Nonetheless

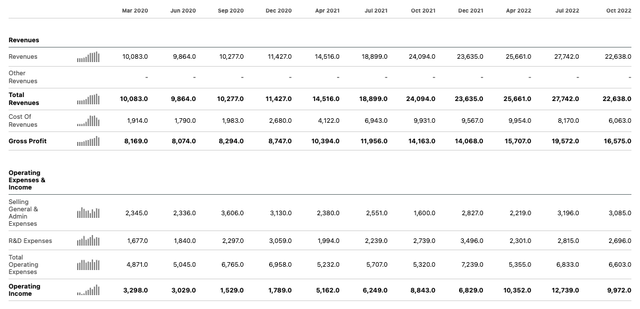

Pfizer generated revenues of $22.6bn in Q322, but as impressive as that figure is in relation to 2 years ago, when Q3 revenues were $10.3bn, it compares unfavorably to last year, when Comirnaty sales were at their peak – down 2% operationally.

Pfizer quarterly revenues historic (Seeking Alpha)

On the plus side, gross profit and operating income were up substantially compared to Q321, although operating income fell by nearly $3bn sequentially. Diluted earnings per share (“EPS”) increased by 40% year-on-year to $1.78.

In short, this was a relatively strong quarter for Pfizer, driven primarily by sales of Paxlovid, which apparently accounted for ~33% of all revenues, with Comirnaty accounting for ~19%, and Pfizer’s ex-Covid blockbusters, the Pneumococcal conjugate vaccine Prevnar, blood thinner Eliquis, breast cancer therapy Ibrance, and cardiomyopathy therapy Vyndamax generating respectively 7%, 6.5%, 5.7%, and 2.7% of revenues.

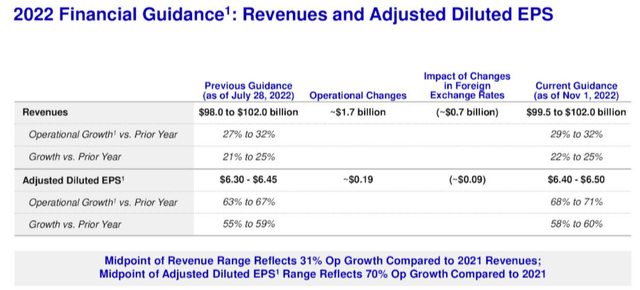

Pfizer FY22 Guidance (Q322 Earnings Presentation)

If we look at Pfizer’s FY22 guidance, again we can say that the outlook is an upbeat one – at least for 2022. The operational growth of ~30% is astounding for a major Pharma – usually it would take a mega-money acquisition to effect such a rise, and the taking on of ~$50bn or so in debt (witness BMY’s takeover of Celgene, or AbbVie’s acquisition of Allergan), but in Pfizer’s case the company has not had to find any additional cash to realize this incredible growth.

The EPS growth is, if anything, even more impressive – adjusted diluted EPS of $6.375 at the midpoint implies a forward price to earnings ratio of ~7.4x, which is easily the best of any Big Pharma.

The obvious concern here however is that Comirnaty and Paxlovid revenues could fall by anything between 50-75% next year, and it is hard to imagine Pfizer’s share price reacting positively to such a fall in revenues, offsetting any likely gains suggested by the very low forward P/E. Nevertheless, if nothing else, what these extra revenues have done for Pfizer is given the company a significant amount of additional capital with which to future-proof the business.

The Path To Substantial Ex-COVID Revenue Growth – Spending The Comirnaty / Paxlovid Cash

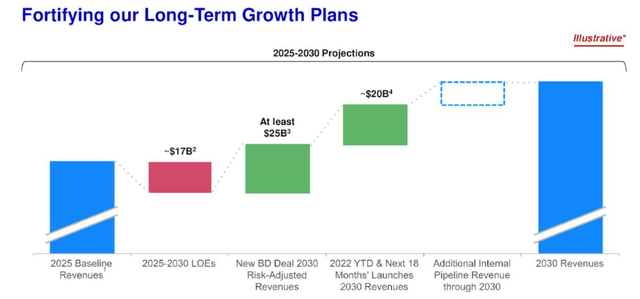

CEO Albert Bourla devoted a substantial portion of the Q322 earnings call to explaining how Pfizer planned to offset $17bn of lost revenues between 2025 – 2030 as a result of drugs losing patent protection.

Pfizer’s plan to offset LOEs of key products (Q322 earnings presentation)

As we can see above, management is confident it can add $25bn of risk adjusted revenues to the top line via the buyouts it been able to complete with its additional Comirnaty / Paxlovid income.

As a reminder, since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; and, finally, a $525m deal for Reviral and its antiviral therapeutics targeting respiratory synctial virus (“RSV”).

Pfizer believes Etrasimod can be a multi-billion dollar selling asset, and expects Nurtec and the remainder of Biohaven’s portfolio to contribute peak sales of ~$6bn per annum. GBT601, if approved, will likely compete with Vertex (VRTX) and CRISPR Therapeutics (CRSP) SCD therapy Exa-Cel – which is also expected to provide a functional cure. If Pfizer’s drug can hold its own, there may be a $3 – 5bn selling asset here, and in RSV, Pfizer has 2 candidates, one a maternal vaccine, and the other indicated for elderly patients, that CEO Bourla believes offers “a potential multi-billion peak revenue opportunity.”

Doing some very rough math, if we look at an optimistic scenario where Etrasimod earns peak sales of ~$7bn per annum, the migraine franchise ~$6bn, the SCD franchise ~$5bn, the RSV vaccines $3 – $5bn, and Trillium’s assets $2 – $3bn, then we realize Bourla’s anticipated additional $25bn per annum of revenues.

$20bn More In Pfizer’s Pipeline?

Bourla is not stopping there, however. The CEO and his management team believes that there is a further $20bn of peak annual sales currently progressing through Pfizer’s proprietary pipeline. On the Q322 earnings call, Bourla told analysts:

Perhaps even more exciting is the wave of potential growth drivers emerging from our R&D pipeline in the near term. Over the next 18 months, we expect to have up to 19 new products or indications in the market, including the 5 for which we have already begun co-promotions or commercialization earlier this year.

If successful, these 19 launches, of which more than 2/3 have the potential to be blockbusters, will be the most ever in Pfizer’s history. The 15 in-house-developed projects alone could potentially represent approximately $20 billion in 2030 sales, which would more than offset the expected LOE impact.

Many of these programs are already largely de-risked from a clinical perspective. The majority of them were discovered in-house and nearly all of them would be for indications outside of COVID-19.

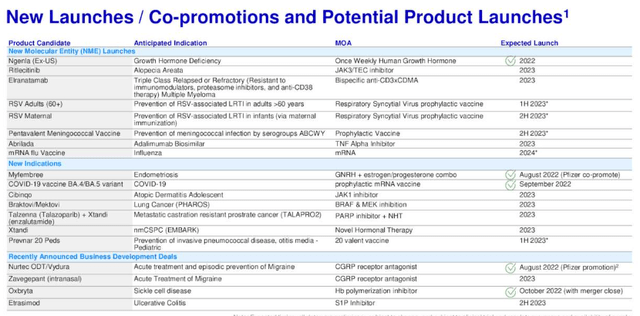

In fact, there appears to be some significant overlap here with the assets acquired through the buyout deals discussed above, based on a slide from the earnings presentation appendix:

Pfizer new launch pipeline (Q322 earnings presentation)

Singling out some of the internal assets, however, Ritlecitinib is a JAK inhibitor approved for treating alopecia – a $1bn market opportunity on its own, although Pfizer will very likely push for label expansions into, e.g., rheumatoid arthritis, Crohns’ Disease and other autoimmune conditions.

Elranatamab in triple class refractory myeloma is an exciting prospect, although the myeloma market is a relatively crowded one, whilst Cibinqo is a potential $3bn per annum selling anti-inflammatory, some analysts believe, approved for Atopic Dermatitis and a long term replacement for $2.5bn per annum selling Xeljanz.

A messenger-RNA flu vaccine may have blockbuster potential – although it would need to compete not only against industry incumbents produced by Big Pharmas Sanofi (SNY) and GSK (GSK), as well as, likely, a rival MRNA vaccine from Moderna (MRNA), whilst the Humira biosimilar Abrilada would also compete in a congested market for likely no more than low triple-digit million revenues.

Looking at oncology, Braktovi and Mektovi – already approved for melanoma and coloractal – are now being tested in lung cancer – the largest oncology market, whilst Talzenna and Xtandi may be headed for label expansions in prostate cancer. In summary, there may not be quite $20bn in additional revenue here, but Pfizer may potentially have another ace up its sleeve.

Chasing The Obesity / Diabetes markets

In previous posts on Pfizer, I have questioned how it can be possible that a company on track to generate ~$100bn in revenues in 2022 – Pfizer – can be worth ~$80bn less than a company on track to deliver ~$29bn of revenues – Eli Lilly? Surely, by almost any measure, Pfizer ought to substantially be the more valuable company, yet the 2 companies respective market caps are $261bn and $343bn.

CEO Bourla indirectly answered this question himself on the Q322 earnings call when he commented:

An exciting quarter, for sure. But in our company and our industry, it’s all about what’s next. The next breakthrough medicine or vaccine, the next game-changing, the next solution to an unmet patient need.

The market believes that in Tirzepatide – a drug that has won approval to treat Type 2 Diabetes and may soon win a further approval, under a different brand name, to treat obesity, and Donanemab, an Alzheimer’s therapy chasing accelerated approval – Lilly is in possession of the likely 2 best-selling drugs for the next 2 decades. Analysts believe both could generate >$20bn per annum in sales, and unlike Comirnaty and Paxlovid, they could do so every year for a decade.

The good news for Pfizer shareholders is that Pfizer actually has a drug in development that has the same mechanism of action as Lilly’s Tirzepatide. In fact, Pfizer has 2 – Danuglipron and PF-07081532, which are both oral GLP1 agonists, like Lilly’s drug. Both are in Phase 2b studies, the former in obesity, the latter in Type 2 Diabetes and obesity, and Pfizer’s plan is to take one into a Phase 3 trial, depending on which presents the best safety, efficacy and dosing profile.

During the pandemic, Pfizer showed – perhaps against all odds – that it could emerge victorious in a drug development race with an exceptionally lucrative prize on offer. Perhaps the best news to emerge from the Q322 earnings review is the news that it is still in the T2D / obesity race. This is the next major pharmaceutical market, and it could end up being larger than any other.

Conclusion – Pfizer’s Journey To 2030 Is Not Straightforward But Your Money Ought To Be Safe Invested Here

To summarize the above discussion, Pfizer produced an extraordinary quarter of earnings in Q322, which, thanks to the Big Pharma’s extraordinary success developing COVID vaccines and therapies, actually compares unfavorably to the prior year.

These incredibly profitable quarters – net income in Q1, Q2 and Q3 was respectively $7.9bn, $9.9bn, and $8.64bn – will not last, as Comirnaty and Paxlovid sales come tumbling down in 2023. Management is not yet prepared to discuss by how much, but all may be revealed when the company hosts its investor day on December 12th.

That clouds the picture when it comes to calculating what revenues Pfizer may be generating by 2025, but what we do know is that while the Pharma expects to lose $17bn of revenues as assets lose patent exclusivity, it is expecting to generate an additional $45bn of revenues between 2025 – 2030.

My best guess would be that Pfizer will not earn >$80bn – as it did in 2021 – in a single year in any year from 2023 – 2030, but it could come very close towards the end of the decade. There is an outside chance that Pfizer could gain entry to the highly lucrative obesity / diabetes markets, and if that were to happen, another $100bn revenue year would then become a possibility.

Looking at the downside, the pharmaceutical may be lucrative and high margin, but it can also be tough and unforgiving. There is no guarantee that any of Pfizer’s assets it has pegged for blockbuster sales will even be approved by the regulatory authorities in the U.S., Europe, and other territories, let alone go on to generate the forecast sales.

According to my discounted cash flow analysis, however, if Pfizer can achieve revenues of $70bn in FY24, and then grow its top line at a CAGR of ~6%, all else being equal, the company will be looking at very nearly ~$80bn of revenues and net income of close to $22bn in 2030. Using a weighted average cost of capital of ~10%, and either applying discount factors, or using an EBITDA multiple, the present value of Pfizer stock is somewhere between $53.5 – $64 per share, I calculate, i.e., a premium of either 15%, or 37% to current value.

Taking into account the risks of trial failure and competition I would lean towards the lower value, but on balance, I would argue that there is – just about – more to investing in Pfizer than simply collecting the dividend and hoping the stock price does not fall.

There is genuine upside potential in play also, although Pfizer management faces some tricky challenges integrating all of its acquisitions and guiding all of its 19 or so pipeline assets through the approval process and into the market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.