Summary:

- The semiconductor industry should continue to see strong growth over the next decade, despite its cyclical nature.

- Texas Instruments is a strong play in the semiconductor industry and I have had it on my watchlist for a while now.

- Texas Instruments has a strong balance sheet and continues to buy back its own stock.

- Texas Instruments is fairly valued.

- Exposure to automotive is a strong future growth factor for Texas Instruments.

William_Potter

Investment Thesis

I am a big fan of the semiconductor space, and I like a lot of companies in it. I know there are a lot of different visions on how the industry will be going forward, and I have heard people say they expect the sector to have peaked and will never reach higher levels again. I find this very hard to believe and I remain very bullish on the semiconductor sector in general.

I believe the ongoing digitalization will continue for years and decades to come, and semiconductors will be the literal new oil and be the engine of our society. For all future innovations, higher-performance semiconductors will be needed, and this will keep pushing the sector to innovate. So, no, the semiconductor sector is far from done growing. According to a report from Allied Market Research, the semiconductor market is expected to hit over $1 trillion by 2031, growing at a 6.21% CAGR. McKinsey expects the semiconductor market to reach this market size by 2030, at a CAGR of 6-8%.

I already have a few semiconductor companies in my portfolio right now. I like to cover all parts of this industry within my portfolio since I like the whole process. The semiconductor industry mainly exists of equipment manufacturers, semiconductor manufacturers (fabs), and semiconductor developers. Most companies cover just one of these three segments, but some cover two.

One that does cover two, for example, is Texas Instruments Incorporated (NASDAQ:TXN), as they are a semiconductor manufacturer, but also develops its own semiconductors. This way they do everything in-house, and this makes them way less reliant on other companies for their production. I currently do not own any position in Texas Instruments (“TI”). I have a very strict rule for myself to not have more than 15% of my personal portfolio invested in a single sector. The semiconductor industry is currently sitting at 14%, so this makes it hard to invest more in this sector.

I have had TI on my watchlist for a while now. The downturn in semiconductors so far this year is offering a lot of interesting buying opportunities, and I believe TI might be one of them. For this reason, I will be covering TI in this article and will see whether it’s is a buy at current levels. This is my initial coverage of Texas Instruments, and so I will take a thorough look into the company, its fundamentals, and its opportunities.

Texas Instruments

Texas Instruments is an American-based technology company with its headquarters in Dallas, Texas. TI is a manufacturer of semiconductors and sells its products globally. When thinking about semiconductors, the first companies that will probably come to mind for most people are Nvidia (NVDA) and Advanced Micro Devices (AMD). These are designers of high-performance GPUs and CPUs for things like gaming or data centers. Of course, these companies are not really this easy to explain, but just to give you an idea, these are companies who create many headlines with their state-of-the-art chipsets.

TI creates different kinds of semiconductors, as they are mostly focused on analog chips and embedded processors with the main focus on industry and automobile. Analog is very different from the digital chips of other manufacturers. Unlike digital chips which can only differentiate between “off” and “on” or “ones” and “zeros,” analog chips can process graduations like waveforms such as speech or video. Analog chips are the bridge within the digital world.

Analog semiconductors condition and regulate “real world” functions such as temperature, speed, sound and electrical current. Digital semiconductors process binary information, such as that used by computers. In addition, analog semiconductor manufacturers tend to have lower capital investment requirements for manufacturing because their facilities tend to be less dependent than digital producers on state-of-the-art production equipment to manufacture leading edge process technologies.

Simply put, digital chips are pretty much useless without analog chips, and therefore analog chips are found in about everything. Analog chips will, for this reason, continue to increase in demand for automotive and other sectors, as shown by the following statement:

“Analog chips typically use mature chip processes, e.g., 90 nm to 300 nm. There are technical and commercial reasons why these will continue to be produced at mature progress nodes and not at leading-edge process nodes. Unfortunately, the demand for analog chips is also increasing for mobile phones—for the RF front-end, the sensor processing, the high-end audio, and the contactless payment, to name a few. Considering the growth in vehicle segments and propulsion mix, the average number of analog chips per car is expected to increase by 26% in 2023 compared with 2021. This growth can be mainly attributed to the ongoing electrification trend.”

As stated above, analog chips are generally a lot bigger than their digital groundbreaking counterparts made by Nvidia and AMD, which are being made as small as 3nm. This also means there is less groundbreaking equipment needed, like the machines from ASML (ASML), and therefore less Capex required for TI.

Analog and embedded processors account for 80% of TI’s revenue. The company holds a whopping 45,000 patents, so innovation is nothing unfamiliar for TI. Texas Instruments is a real force in the semiconductor industry and the main player in their segment, proven by the more than 100,000 customers the company serves. The company has a total portfolio of over 80,000 products. TI manufactures these products across its 15 manufacturing sites worldwide. The company employs approximately 31,000 people all over the world.

Texas Instruments locations (Texas Instruments)

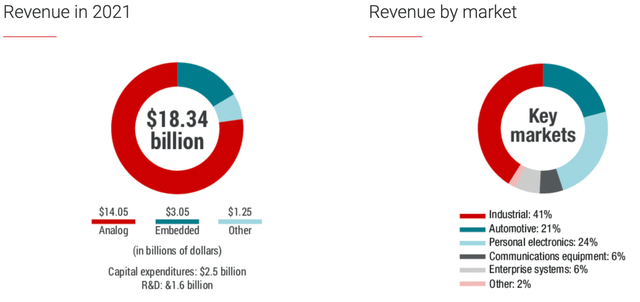

That TI is an important firm is also shown within its financials. They managed to generate $18.34 billion in 2021. Analog was by far its biggest segment and offers the biggest growth opportunities. Its biggest markets were industrial, personal electronics, and automotive.

As the company states:

We’re investing and increasing capacity in 45- to 130-nm technology nodes, which provide the optimal cost, performance, power, precision and voltage levels required in all markets, including the harsh environments typical to industrial and automotive. Our investments in these technologies recognize the criticality and long-term need for these nodes and allow us to provide customers with products that will be needed for decades to come.

The fact that TI makes and designs its semiconductors in-house does give the company a lot of flexibility and a lot of opportunity for cost effectiveness:

Our goal is to deliver products to our customers where and when they’re needed. Our flexible manufacturing strategy and control of our supply chain provide greater assurance of supply to meet current and future demands, with robust business continuity processes to support unpredictable markets. We have the ability to source more than 75% of products from multiple sites to speed up delivery time for our customers.

Texas Instruments is a very solid and huge player in their specific field. The global ongoing shift towards digital will be strong over the next decade and a tailwind for the semiconductor industry. Texas instruments is very well positioned to take advantage of the sector’s growth. Their dominance in analog semiconductors will give them a very strong advantage. Their presence in secular growth industries such as automotive and industrial will keep growth going, even during an economic downturn.

Another advantage of TI is its presence in the American semiconductor market. Asia has been the dominant region in semiconductor manufacturing for years now, but this is about to change – or the attempts are there, at least.

Signed into law on August 9th, the inflation reduction act was designed to boost U.S. competitiveness in the semiconductor industry. The goal is to increase domestic semiconductor manufacturing and decrease dependence on Asian semiconductor manufacturing. A McKinsey report adds the following:

It also seeks to jump-start R&D and commercialization of leading-edge technologies, such as quantum computing, AI, clean energy, and nanotechnology, and create new regional high-tech hubs and a bigger, more inclusive science, technology, engineering, and math (STEM) workforce.

The chips act directs $280 billion in spending over the next 10 years. $200 billion of this total will go to scientific R&D and commercialization. $53 billion is for semiconductor manufacturing, R&D, and workforce development. The other $24 billion is destined to tax credits for chip production. TI will be a direct beneficiary of this legislation since it is already aggressively expanding its presence in American semiconductor manufacturing. As stated above, there will be funds available for both design/ R&D and manufacturing. TI is a strong player in both.

They announced in May that it will start building a new fab in Sherman, Texas. This new fab will likely require $30 billion in investment and is supposed to create as many as 3,000 jobs. The 25% tax credits, which the new legislation offers for the expanding of manufacturing of semiconductors in the U.S., will be used to fund plans like the new fab of TI. This way TI will be able to save 25% of their Capex plans or be able to build 25% more capacity for the same amount of Capex. The new legislation is a strong tailwind for Texas Instruments.

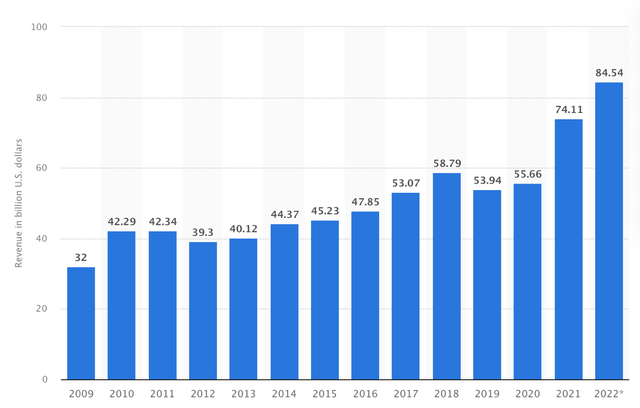

Global growth in the analog semiconductor market has been strong for years and will remain strong over the next decade. So, how does this strength show in their latest financial results?

Analog semiconductor market growth (Statista)

Financial results

First of all, I would like to suggest reading this article by Best Anchor Stocks for a real deep dive into the financial results, as he looks at every aspect of it.

Now let’s have a look at the recent quarterly results. On October 25th TI presented its 3Q22 results. Revenue for the quarter came in at $5.24 billion with a net income of $2.3 billion. Revenue saw a 13% increase YoY and strong performance remained. Free cash flow for the quarter came in at $2 billion and $6 billion for the last twelve months. The free cash flow margin was a whopping 30% of revenue, which is an incredible performance considering the high inflation and energy prices pushing down on the economy. This is what management added:

Revenue increased 1% sequentially and increased 13% from the same quarter a year ago, about as expected. During the quarter we experienced expected weakness in personal electronics and expanding weakness across industrial.

As for the growth across segments; the article of Best Anchor Stocks put this down very nicely:

- Personal electronics: mid-teens decline

- Industrial: flat

- Automotive: around 10% increase

- Communications equipment: high single digits increase

- Enterprise systems: mid-single digits increase

During the latest quarter, the company returned $2 billion to shareholders in the form of dividends and share buybacks. This return of capital was well covered by free cash flow. Last September, TI announced management approved an additional $8+ billion in share buybacks, bringing the outstanding total to $15 billion. TI has a very strong history of buybacks and has reduced shares outstanding by 46% since 2004. Management does not buy at the high prices seen last year, but increases buybacks during times when they genuinely believe the stock is undervalued.

Where TI managed to report strong quarterly results with growth remaining despite the very bad economic circumstances, the stock still dropped 5% over the next trading day. The reason? The outlook. Texas instruments guided for fourth-quarter revenue of $4.4 -$4.8 billion and EPS of $1.83 – $2.11. These show a drop of 5% and 13%, respectively. We cannot say this came as a surprise by looking at the results of other semiconductor manufacturers and the worsening economy. As a long-term investor, this is not a problem at all, and for sure no reason to think about selling your shares. This is simply the result of a worsening economy and no business-specific problems.

Balance sheet and valuation

TI currently holds a total cash position of $9.09 billion on the balance sheet and a total debt position of $8.94 billion and this gives it a strong net cash position of just over a billion. This is what I like to see when investing in a business, a low debt position, and a nice cash cushion. This strong cash position is supported by its strong free cash flow and TI receives an A+ for its profitability from Seeking Alpha Quant.

The company is currently valued at a forward P/E of 17.12. This is 24% below its historic multiples and a 7% discount to the sector average. I believe the current valuation is fair for TI and it, therefore, receives a C- for valuation from Seeking Alpha Quant. On a forward P/E basis the company receives a B-. For a beautiful business such as TI, this seems like a fair price and therefore a good price to start a position.

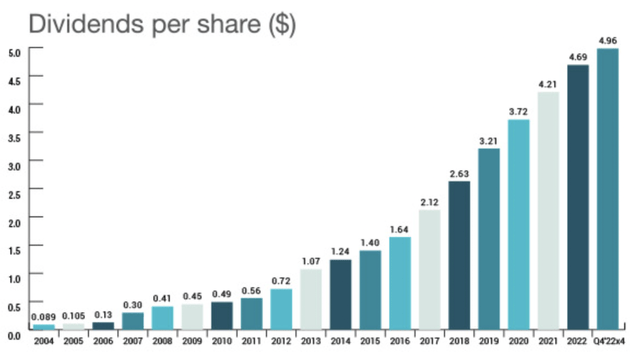

As for the dividends, TI is a gem. It has been paying a dividend ever since 2004 and has grown its dividend at a CAGR of 25% since then. In 2021 the dividend payment only required 62% of their yearly free cash flow. In 2022 the company increased its dividend by 8%, the 19th consecutive year of dividend increases.

Dividend growth (Texas Instruments)

Texas instruments pays a strong dividend yield of 3.04% while having a payout ratio below 50%. The company receives an A- for its yield and a B+ for dividend safety.

Risks

Well first of all, important to note, the China ban from the U.S. has no significant impact on the business of TI. This is important to mention these days when discussing an article about a semiconductor company. Management was very clear that this is no threat to the business.

For the long-term, I honestly do not see many downside risks for TI. Its market position is strong and it is focused on strong growth areas such as industrial and automotive. The near term is a different story, with the current economic slowdown we are witnessing. A serious economic slowdown and potential recession will appear to be a problem for TI as well. A drop in consumer spending will result in a drop in the sales of personal electronics and, potentially, automotive. These drops in spending will have an impact on the demand for products of TI. Yet again, I will state, this is no company-specific problem and for sure no long-term issue.

Conclusion

I do not own shares of Texas Instruments yet, but I am highly interested in opening a position on TI in the near term. I believe the current share price is fair for a company of this size and reliability. I would recommend buying TI at current valuations. The company has a great moat within the industry which it can leverage to keep growing. Management knows how to select the best growth opportunities (and how to drop weaker ones) and has great exposure to the automotive and industrial segments. The dividend and buyback history form an extra safety net for shareholders, with a current yield above 3%. Strong growth is on the horizon and investors who can look through the near-term volatility and market drops, will be able to reap the rewards over the next decade.

I will start buying shares of TI in the near term, as I see Texas Instruments as one of the stronger players within the semiconductor industry. Of course, I do want to limit my exposure to this industry and will need to stay patient for a while still.

I rate Texas Instruments a solid buy. I do recommend to start with a smaller position and slowly buy more as time passes, since we do not know where the economy is headed and lower stock prices are highly likely.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.