Summary:

- Does the rumored Seagen Inc. deal jeopardize Pfizer Inc.’s ability to pay dividends to shareholders?

- Despite COVID reset, fundamental numbers look strong.

- However, while I like Pfizer as a company, I acknowledge it is not my typical dividend growth stock.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) is reportedly in early negotiations to acquire cancer-focused biotech Seagen Inc. (SGEN) as Seeking Alpha has reported here. As part dividend growth investor and a long-term follower of Pfizer, I remember when the company had to cut its dividend in 2009 to fund its acquisition of Wyeth. Seagen was a $30 Billion company before this news, and the stock is now trading 13% higher pre-market. Suffice to say, Pfizer investors are looking at paying a premium should the deal go through.

As a Pfizer long, I do hope Seagen acts as the catalyst for Pfizer’s next run-up given the Covid reset. But at the same time, it is natural to worry if Pfizer is once again at the risk of cutting its dividend. As the saying goes, the safest dividend is one that has been increased. Pfizer did announce a dividend increase in December 2022, and that should calm the nerves of investors. However, let’s see what the actual numbers say below.

- Current outstanding share count is at 5.619 Billion.

- The new quarterly dividend is 41 cents per share.

- That would represent a commitment of $2.30 Billion/quarter towards dividends (5.619 Billion shares times 41 cents).

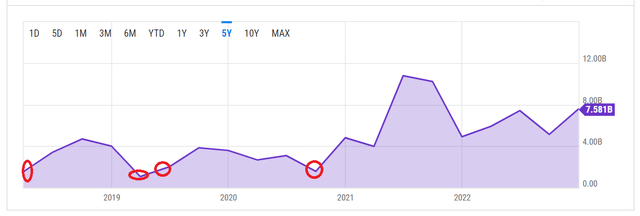

- Pfizer’s average quarterly free cash flow (“FCF”) over the last 5 years was $4.616 Billion. That gives Pfizer a payout ratio of about 50% based on FCF. While that number looks super healthy, let’s not forget the COVID-related strength, especially in 2021, that boosted the average.

- Since I am evaluating the prospects of a dividend cut in this article, it makes sense looking at the worst-case scenario. Only 4 times in the last 5 years has Pfizer had a quarter where the FCF wasn’t enough to cover the current dividend commitment of $2.30 Billion/quarter. This is not a fair way to evaluate things because the current commitment is based on present and future business confidence more than the past results, but again, when evaluating a dividend cut possibility, I tend to be unfair!

- Now, let’s take out the peak COVID-induced numbers from 2021 and instead use 2017’s FCF numbers. The five-year quarterly FCF average drops from $4.616 Billion to $3.728 Billion. The payout ratio in this case jumps up a bit but is still at a comfortable 61%.

- Using a forward EPS estimate of $3.55, Pfizer once again has a comfortable payout ratio of 46%. While earnings are expected to decrease a bit over the next 5 years, the company does have $22 Billion in Cash and Short-term investments.

- Finally, Pfizer’s debt-to-equity ratio stands at an attractive 0.34, which shows the company does not need much debt to finance its current business operations.

- In summary, even if Pfizer ends up paying a 20% premium for Seagen ($36 Billion), the company has enough room in almost all major areas: free cash flow, earnings, cash, and debt, to continue rewarding shareholders with (slightly) increasing dividends, as their recent history suggests. I fear no dividend cut at this moment.

Conclusion

Dividend cuts are part of Pfizer’s history. Although the company has since increased its dividend for 12 consecutive years, investors need to bear in mind that pharmaceutical companies do have their ebbs and flows as they go through periods of striking gold with new products before generic versions may get approved (typically six years).

Pfizer Inc. does not fit my definition of a “perpetual” dividend growth stock due to the nature of its business. However, despite the 2009 dividend cut, numbers show that Pfizer has turned out to be a pretty good investment over the long term. The fact that Merck & Co., Inc. (MRK) walked away from its deal with Seagen may end up providing Pfizer with a bit of an upper hand in this rumored deal. I am monitoring this development with interest, as Pfizer needs a “shot in the arm” (pun intended) after falling 20% YTD based on pre-market price of $41.24.

Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.