Summary:

- Pfizer’s stock has fallen 50% YTD, presenting a potential long-term investment opportunity.

- The company has a significant amount of debt, but its solvency ratios indicate that it is manageable.

- Pfizer needs to find new revenue streams as sales from its COVID products decline, but it has a strong portfolio in other areas of medicine.

Mario Tama

Investment Thesis

I wanted to take a look at Pfizer (NYSE:PFE) as it seems to have fallen out of favor with investors in the recent past, going down as much as 50% YTD, to see if there may be an opportunity to invest for the long-term as it hits its 52-week low. The company has a lot of debt, but it is not too concerning, and I believe the company will navigate the loss of sales from its COVID product successfully as it doesn’t need to depend on those anymore and will find other streams of revenue.

Financials

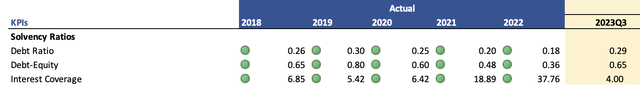

As of Q3 ’23, PFE had around $3B in cash and equivalents and $41B in ST investments, against around $61B in long-term debt. That’s a decent amount of debt, that could potentially detract a lot of investors from committing their capital into the company due to solvency issues and interest rate risks. I don’t think the company is at risk of insolvency, given that it’s PFE. A company that made $100B in sales in FY22 and generated over $37B in operating income, however, to know for sure that the company is in no trouble, I look at three different solvency ratios and look for a pass on all three. First up, the company’s Debt-Assets Ratio has been hovering around 0.18-0.30, which is very low, meaning the company does not rely primarily on debt financing to run its operations. Anything under 0.60 I consider a smart management of debt. PFE’s Debt-to-Equity has been hovering around the 0.36 to 0.65 mark, which is also very acceptable because I consider anything under 1.5 to be manageable. To make sure that the company can pay off its annual interest expense on debt sufficiently, I look at the company’s interest coverage ratio, which ranged from 4 in the most recent quarter to 38 in FY22. For reference, many analysts believe that an interest coverage ratio of over 2 is considered healthy. Being a slight conservative, I like to see at least a ratio of 5, which allows for those bad years of performance. 2x seems a little too close for comfort especially when EBIT is very low for one year and the company has trouble meeting its debt obligations. The low of 4 as of Q3 ’23 is a little deceiving since I only took into account the company’s interest expense and ignored $1B of interest income on its short-term investments, so if I include that, the ratio is 10. Furthermore, if we include all of the items in “Other (income)/deductions-net” the company is positive, which means it gets more in interest income than it pays out.

So, I think it is safe to say that a massive debt pile is more than manageable. Below are those solvency ratios.

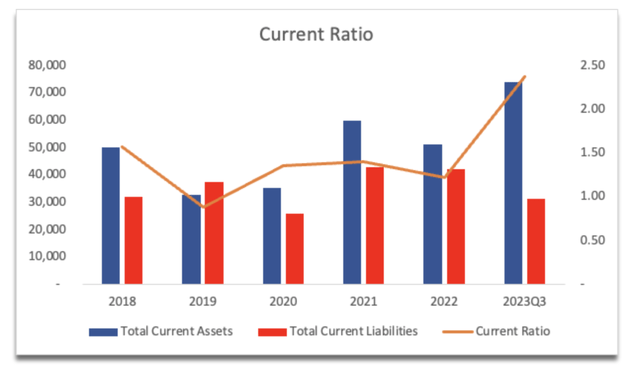

The company’s current ratio for the most part has been over 1 in the last 5 years, and in the most recent quarter, it went up to 2.4, which is more than healthy in my opinion. It can easily cover its short-term obligations and still have enough capital to further the growth of the company. PFE has no liquidity issues for sure.

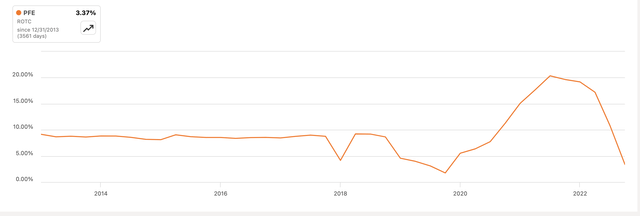

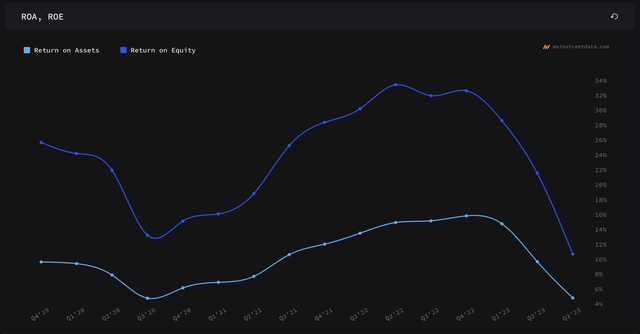

In terms of efficiency and profitability, the latest quarter has not been great. PFE reported a $2.3B net loss due to the expected underperformance of their COVID-19 products. So, ROA and ROE in the latest quarter are not looking very good right; however, I believe once all other products that seem to be growing quite rapidly, will be able to pick up the slack that COVID-19 left behind and these metrics will recover.

ROA and ROE (Main Street Data)

The same can be said about the company’s return on total capital, which took a big hit in the latest quarter, however, just as above with ROA and ROE, this too will recover to around its 10% recent average.

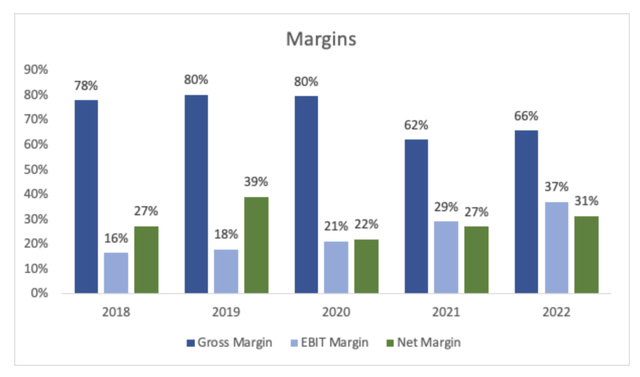

In terms of margins, these have been great over the last 5 years, and with the latest bad performance, I don’t expect to see similar numbers going forward for quite a while until the company ramps down its COVID efforts and starts to focus on other more important things which I will mention in the Comments on the Outlook section.

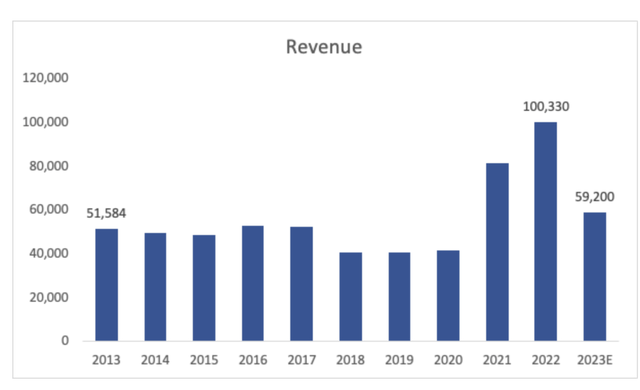

The same can be said about the company’s revenue potential. The big boost the company got in the last 3 years is not going to be achievable without some new catalyst as COVID is not a big issue anymore for many people, so the company needs to find a new catalyst going forward. I expect the company will not see $100B in sales for quite a few years unless it succeeds in getting that new catalyst.

Overall, the drop in stock price seems justified. PFE had been griding steadily down for years now, and then when COVID hit, it got rejuvenated and the share price followed suit. No one expected COVID to stay around for too long, and so the sales dropped significantly, and so did the company’s value. Now, for the company to grow, it needs to continue to research other avenues of top-line growth and move on from the highs of the COVID-19 boom.

Comments on the Outlook

I’ve been getting messages from the doctors to get my booster, pretty much bi-monthly. I am just ignoring them at this point because I don’t think there is a point anymore. I haven’t heard any news of COVID resurgence, or at least none of my social media covers it anymore. I know people who got it 3 or 4 times and every time they get it, it gets milder and milder. The demand for the shots or pills is not there, and it will continue to trend down. PFE will incorporate a COVID shot into the seasonal flu shot, so people will still get a shot on an annual basis, however, Comirnaty and Paxlovid revenues are projected to be down around 70% and 95%, respectively from FY22, so it’s safe to say the company is doing the right thing of moving on from this.

The company has many different drugs under its portfolio, so PFE needs to return to being the company that has reach in many different areas of medicine and put COVID behind them.

While PFE had somewhat established oncology expertise before, the acquisition of SEAGEN will help the company boost the segment further. This should bolster the company’s ADC capabilities (antibody-drug conjugates, which are a type of targeted cancer therapy), which SEAGEN is a leader in the sector.

Besides the oncology segment, PFE still has good contributors to the top-line growth of internal medicine like Eliquis and Vyndaqel, which continue to perform very well, and also new products like Abrysvo and Prevnar 20.

In terms of FDA approvals, the acquisition comes with potentially quite a few in the pipeline that can become successful and very profitable, which will no doubt affect the company’s stock price one way or another. The company is always researching new ways of helping society with treatments and the pipeline will continue to grow.

Overall, I believe that the company will go back to its normalized revenue growth and continue to acquire key players in certain areas of medicine to keep its expertise at a top level, however, I do see further downside because of the revenue growth coming down significantly without a big catalyst in sight for now.

Valuation

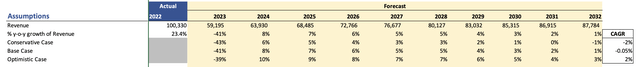

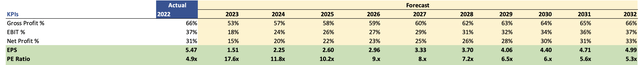

I decided to be quite conservative on my revenue assumptions. For FY23, I’ve baked in the massive revenue drop due to COVID being trivial and will not make many sales going forward. Also, I would like to have a much higher margin of safety. To cover all my basis, I also modeled a more conservative case, and also a more optimistic case. Below are those assumptions, and their respective CAGRs compared to FY22 performance.

In terms of margins, I also went quite conservative to give myself more margin of safety. Expenses will increase quite a bit from the onset and will slowly improve over the next decade. Below are those assumptions with FY22 comparisons.

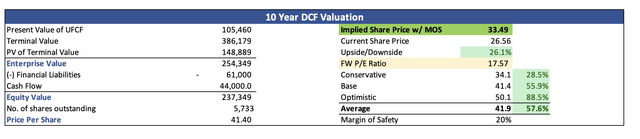

For the DCF analysis, also decided to use a 10% discount rate instead of the company’s 6% or so WACC just to give myself that little bit of extra room for error. I also went with a 2.5% terminal growth rate, as I would like the company to at least match the long-term inflation target of the US. And just because I like to sleep well at night knowing that I didn’t overpay for a stock, I am adding another 20% MoS to the intrinsic value calculation. In my opinion, this is a very conservative outlook for the company. In a decade, the company is still not going to reach $100B in sales. With that said, PFE’s intrinsic value is $33.50 a share, which means the company is trading at a nice discount to its conservative fair value.

Closing Comments and Risks to Consider

So, even with quite conservative estimates, the company is a buy at this price level. The company went down over 50% since its highs, which was justified because of the massive drop in revenue; however, it seems like the drop was too aggressive and the company is not very liked at the moment, which could present a good opportunity to start a long-term position.

I will be opening a position very soon, maybe sometime in January because I feel there may be more tax-loss harvesting happening for the rest of the month. I feel the conservative estimates take into account the company’s negative sentiment in the market and provide good downside protection. I wouldn’t mind it dropping some more after I open my position as that would give me opportunities to enter at an even better price.

Of course, it’s not without its risks. The company operates in a very volatile sector, which tends to see a lot of fluctuations, especially if the company is looking for breakthrough FDA approval on a drug or treatment. Expect volatility if PFE is looking to get something groundbreaking to be approved and it doesn’t. Failure in late-stage clinical trials or some unexpected safety issue can lead to a significant loss of capital to the company.

Future acquisitions may lower the company’s profitability and add on even more debt, which is not ideal for investors who tend to avoid companies with massive leverage, especially if interest rates continue to be hiked, however, that seems much less likely now but not out of the realm of possibilities.

The negative sentiment may continue for a while longer, which will continue to drive the share price further down.

The company spends a decent amount on R&D. That is a very costly expense that if proven to be not profitable, will be for naught and the company will see a massive drain on cash flow and lower margins, and the stock price will follow suit.

So, it is all up to you whether you want to have a position in the pharma juggernaut for the long term or not. I believe that at this price point, the risks are worth it, and I will welcome further short-term deterioration in its share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.