Summary:

- In Q4 2022, the company’s revenue was $24.29 billion, up 1.9% from the last three months of 2021, despite a significant decrease in people’s desire to vaccinate against COVID-19.

- According to the Wall Street Journal, Pfizer’s management is in talks to acquire Seagen to expand the company’s portfolio with promising cancer-fighting medicines.

- Paxlovid sales amounted to $1,834 million in Q4 2022, showing a significant increase compared to the previous year.

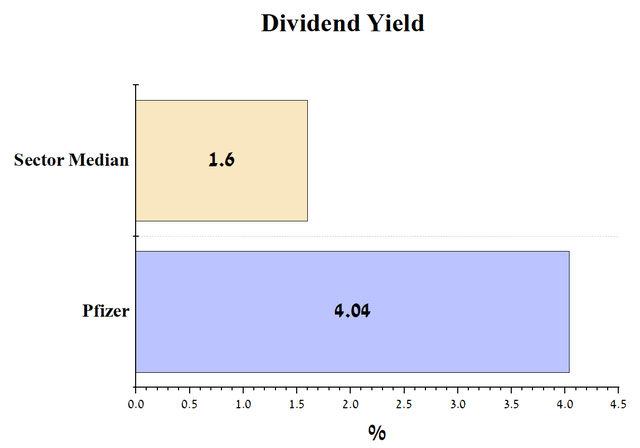

- Pfizer’s current dividend yield of 4.04% is not only significantly higher than the largest pharmaceutical companies but outperforms other sector leaders such as Procter & Gamble and Coca-Cola.

- This article will present the factors that make the company an attractive asset for dividend investors and the risks that anyone considering Pfizer as a long-term investment should be aware of.

Drazen_/E+ via Getty Images

Pfizer (NYSE:NYSE:PFE) is one of the largest pharmaceutical companies in the world, specializing in the development and manufacture of medicines for the treatment of a wide range of diseases, such as cardiovascular diseases, cancer, and autoimmune diseases, and a vaccine portfolio for the prevention of influenza, COVID-19 and other viruses.

In Q4 2022, the company’s revenue was $24.29 billion, up 1.9% from the last three months of 2021, despite a significant decrease in people’s desire to vaccinate against COVID-19. Overall, Pfizer’s management achieved the financial results announced in the guidance published in the third quarter, showing an all-time record in revenue of $100.33 billion and more than $31 billion in net income. The company’s EBITDA margin of 43.9% for 2022 continues to grow yearly, outperforming industry mastodons such as Merck (MRK), Novartis (NVS), and Roche Holding (OTCQX:RHHBY) (OTCQX:RHHBF).

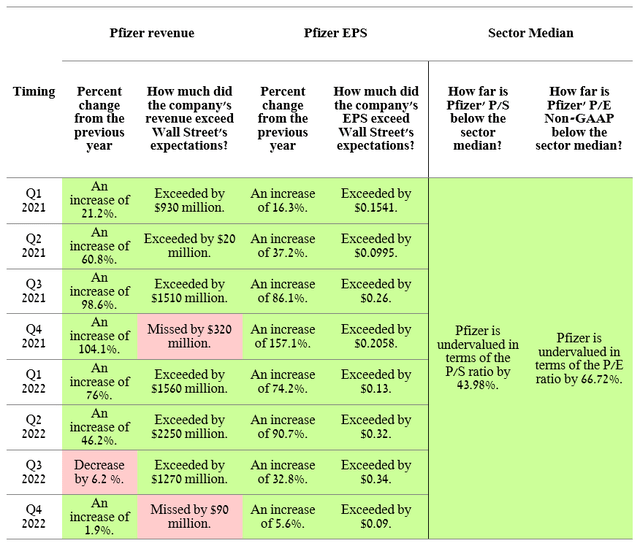

Author’s elaboration, based on Investing.com

This article will present the factors that make the company an attractive asset for dividend investors and the risks that anyone considering Pfizer as a long-term investment should be aware of.

Conducting an aggressive M&A policy

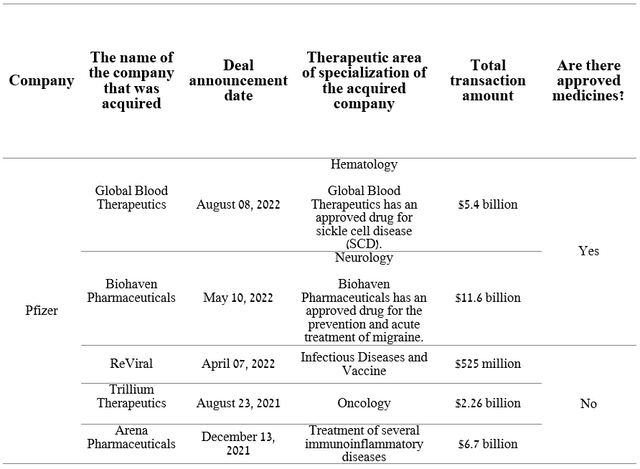

Since the beginning of 2021, the company’s management has pursued an aggressive M&A policy, which has not been observed for many years. The reason for this is the need to rejuvenate the drug portfolio before many of them lose exclusivity in the coming years. In addition, the multi-billion dollar net profit generated from the sale of COVID-19 products allows Pfizer’s Board of Directors to buy out companies whose product candidates have significant competitive advantages in terms of efficacy and safety profile.

Source: Author’s elaboration, based on quarterly securities reports

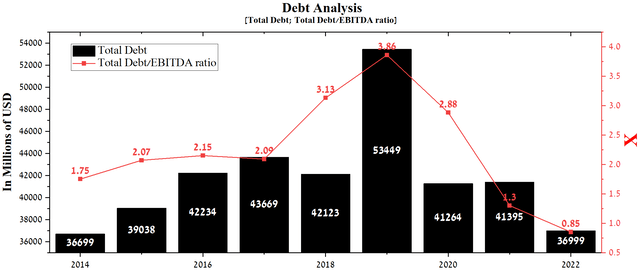

The total amount spent on acquisitions of the five pharmaceutical companies is $26.485 billion. Despite the impressive amount, the company’s total debt continues to decline year-on-year and stood at $39,377 million at the end of 2022. Moreover, the total debt/EBITDA ratio fell below 1x and thus may indicate the absence of serious financial risks associated with debt servicing. As a result, in Q4 2022, Moody’s upgraded Pfizer’s long-term debt rating from A2 to A1 and upgraded its long-term debt outlook to stable. Also, S&P Global Ratings (SPGI) maintains the company’s long-term debt outlook as stable from Q4 2020. Overall, improving the credit rating reduces the company’s vulnerability to continued Fed tightening and boosts investor confidence in Pfizer as it can meet its debt obligations.

Source: Author’s elaboration, based on Seeking Alpha

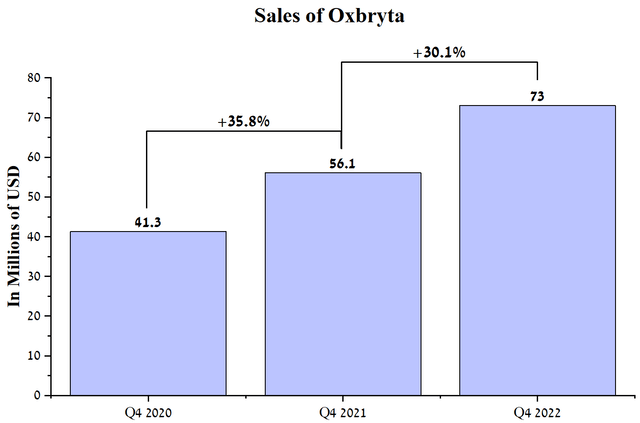

Returning to the discussion of the deals made, we would like to highlight the $5.4 billion acquisition of Global Blood Therapeutics, which has expanded Pfizer’s presence in sickle cell disease. The company estimates the combined peak sales of acquired medicines and candidate products could generate over $3 billion. For example, Global Blood Therapeutics has developed Oxbryta (voxelotor), which is approved in the US, the European Union, and other countries. The mechanism of action of this drug is based on reversible binding to hemoglobin (HB) to increase the affinity of oxygen for this metalloprotein. As a result of the action of Oxbryta, the polymerization of Hemoglobin S is prevented, ultimately leading to a reduction in the crescent of red blood cells responsible for providing oxygen to human tissues and organs.

Source: Author’s elaboration, based on quarterly securities reports

Voxelotor sales continued to grow year on year and were $73 million in Q4 2022. With Pfizer’s vast experience in rare hematology and significant financial capacity to enable aggressive marketing, we believe Oxbryta’s CAGR will be 25% from 2023 to 2027.

In addition, on October 3, 2022, Pfizer completed the $11.6 billion acquisition of Biohaven Pharmaceutical, which adds to one of the leaders in the pharmaceutical industry a portfolio of calcitonin gene-related peptides capable of effectively combating migraines that affect more than a billion people every year worldwide.

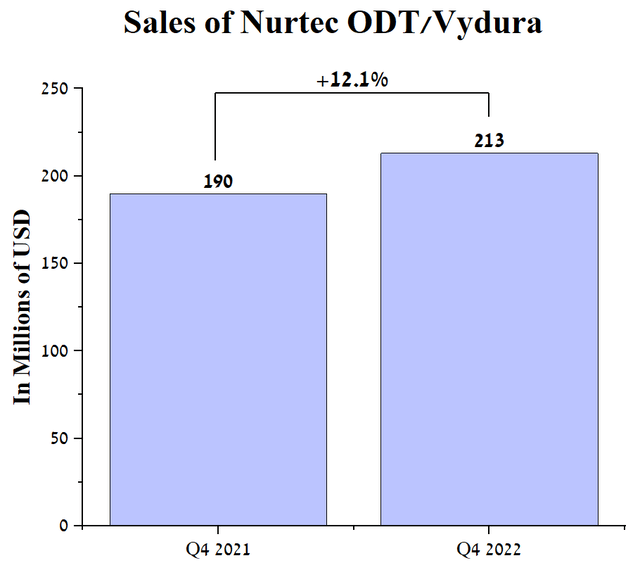

In addition to several product candidates in clinical trials, Pfizer has received Nurtec ODT/Vydura, which is a medicine for the acute treatment of migraine and the preventive treatment of episodic migraine. Nurtec ODT/Vydura sales were $213 million in Q4 2022, up 12.1% year-over-year.

Source: Author’s elaboration, based on quarterly securities reports

Considering the colossal migraine therapeutic market, the drug’s high efficacy, and the oral route, we estimate that Nurtec ODT/Vydura will have a CAGR of 15% through 2027.

Paxlovid is a leader in the COVID-19 therapeutics market

Paxlovid (nirmatrelvir/ritonavir), a medicine that not only saves the lives of hundreds of thousands of COVID-19 patients worldwide but whose sales generated 18.9% of Pfizer’s total revenue in 2022, plays an essential role in the development of the company. At the moment, the following monoclonal antibodies as AstraZeneca’s tixagevimab/cilgavimab, Eli Lilly’s bebtelovimab (LLY), GSK/Vir Biotechnology’s sotrovimab (GSK) (VIR), Eli Lilly’s bamlanivimab/etesevimab, REGEN-COV Regeneron’s (REGN) are not effective as a treatment and protection against COVID-19 due to complete or partial resistance to subvariants of Omicron, which eventually led to the withdrawal of their emergency use authorizations in the United States.

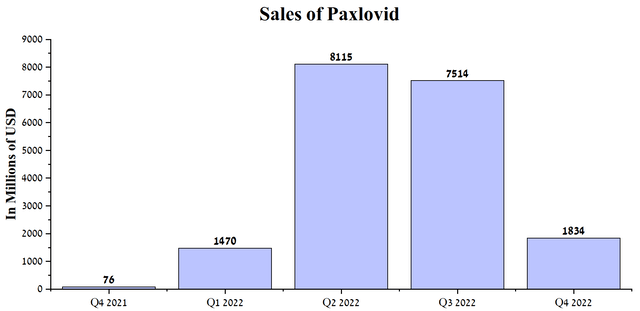

As a result, only Pfizer’s medicine, Gilead Sciences’ Veklury (GILD), and Merck’s Lagevrio are widely used as treatments for a disease whose outbreaks are occurring in various parts of the world due to the rapid mutation of the virus. Paxlovid sales amounted to $1,834 million in Q4 2022, showing a significant increase compared to the previous year. The decrease in sales of this medicine in the last three months of 2022 compared to the previous quarter was primarily due to the decline in the number of cases of COVID-19 worldwide.

Source: Author’s elaboration, based on quarterly securities reports

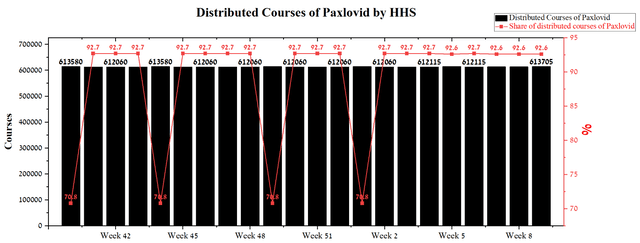

On the other hand, in the first two months of the first quarter of 2023, the number of cases of COVID-19 in the United States exceeded by 11% compared to the first two months of the fourth quarter of 2022. Considering that Paxlovid continues to maintain high efficiency in the fight against new virus variants and its relatively low price, these factors favorably affect the growth in the share of nirmatrelvir/ritonavir courses that were distributed in the United States by HHS. In recent months, the percentage of distributed Paxlovid has consistently exceeded 90% and only occasionally fell to 70.8% due to AstraZeneca’s tixagevimab/cilgavimab. With AstraZeneca’s drug withdrawn from the market in Q1 2023, we believe there is no barrier to Pfizer’s drug continuing to dominate the multi-billion dollar COVID-19 therapeutics market.

Source: Author’s elaboration, based on HHS

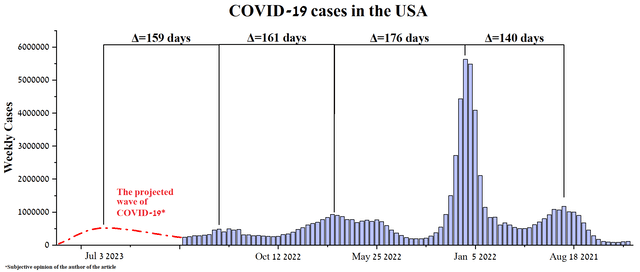

On the other hand, after the end of the wave of coronavirus cases in December 2022, when 500,000 patients were registered every week, the situation is currently stabilizing. We analyzed the growth and decline trends in the number of cases of COVID-19 over the past year and a half. We noted that the interval between the peaks of coronavirus waves ranges from 140 days to 176 days, that is, on average, every 159 days, a new wave of incidence begins in the United States. Consequently, according to our model, a sharp increase in the number of cases of COVID-19 will occur in June-July 2023, creating additional demand for Paxlovid.

Source: Author’s elaboration, based on CDC

Pfizer management predicts that sales of this drug will amount to $8 billion. However, we believe that this conservative estimate and our sales model for Paxlovid will be in the range of $9.8 billion to $10.5 billion.

High dividend yield and the share repurchase program

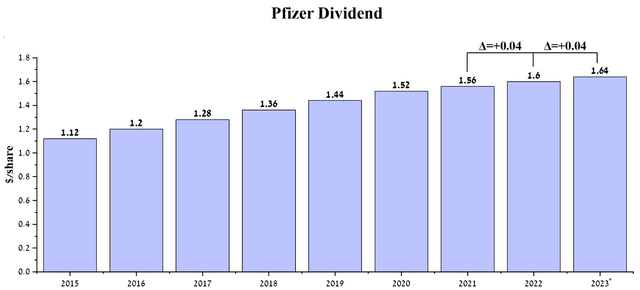

The implementation of an abnormally aggressive M&A and R&D policy over the past two years and increased competition among manufacturers of anti-cancer therapies had a minimal effect on Pfizer’s margins. Consequently, this has contributed to a consistent increase in the company’s dividend yield over the past 12 years. Given that for the 1st quarter of 2023, dividend payments amounted to $0.41 per share, we believe in maintaining this value for the remaining three quarters of 2023, and as a result, for the current year, Pfizer investors should receive dividends of $1.64 per share, up 2.5% from a year earlier. In addition, the dividend payout ratio is 24.32%. The relatively low value of this financial indicator demonstrates the possibility of continuing the policy of increasing dividend payments in the coming years, which, given the current price of the company’s shares of $40.5, is a beautiful moment for long-term investors.

Source: Author’s elaboration, based on Seeking Alpha

Pfizer’s current dividend yield of 4.04% is not only significantly higher than the largest pharmaceutical companies but outperforms other sector leaders such as Procter & Gamble (PG) and Coca-Cola (KO).

Source: Author’s elaboration, based on Seeking Alpha

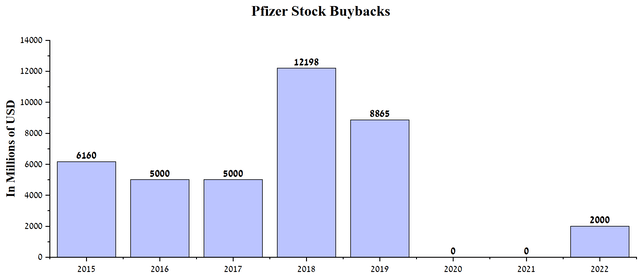

In addition to dividends, Pfizer also has one of the most effective tools to improve the company’s investment attractiveness, and it is the share repurchase program. However, Albert Bourla, as CEO of the company, has not engaged in an active share buyback policy since the onset of COVID-19. One possible reason for this could be the need to rejuvenate the portfolio of approved drugs and to expand the company’s presence in therapeutic areas with high unmet medical needs to offset the decline in revenue from COVID-19 products and those whose exclusivity will end in the next five years. In 2022, Pfizer bought back two billion dollars of shares, breaking a two-year trend of inactivity.

Source: Author’s elaboration, based on quarterly securities reports

As of December 31, 2022, the remaining amount under Pfizer’s share buyback program was $3.3 billion. However, in our estimation, the company’s management will not use this money until the share price falls below $36 per share, which is a strong support level in terms of technical analysis.

Risks

Loss of exclusivity of Pfizer products

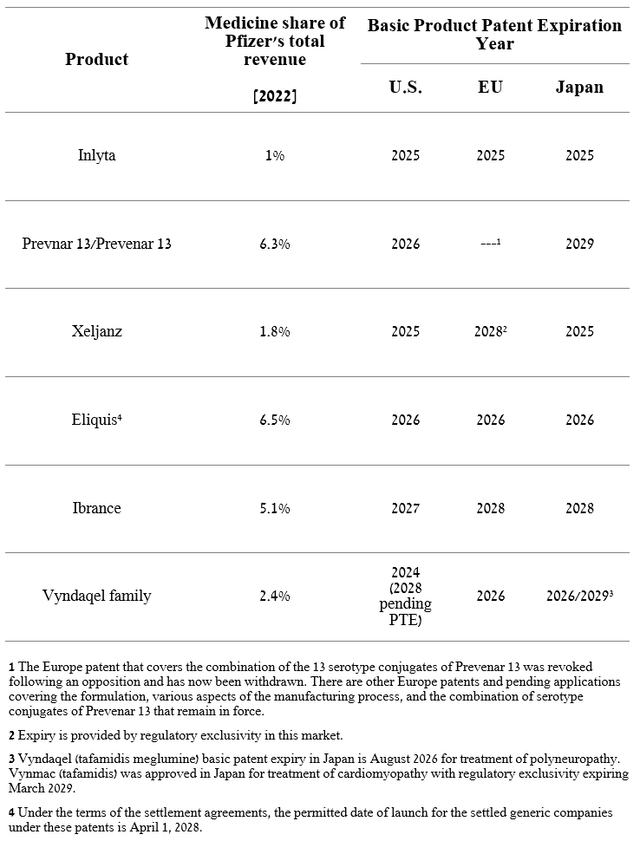

Before discussing the impact of the end of exclusivity for several of Pfizer’s essential drugs, it should be noted that this refers to the expiration of patents that protect the exclusive right of a pharmaceutical company to manufacture and subsequently commercialize a branded drug that it owns. In other words, when patents expire, pharmaceutical companies can produce generic versions of the branded drug, leading to more competition and lower patient costs as healthcare providers seek to move patients to cheaper generics. But at the same time, the impact of the loss of exclusivity of a particular drug on the company’s financial position can be different and depends on the share of its sales in total revenue, the level of competition from generic manufacturers, and the presence of next-generation medicines in the company’s portfolio that can replace an obsolete product. One of Pfizer’s strategies to mitigate the impact of the loss of exclusivity is to pursue an active R&D policy to diversify its product portfolio and increase revenue in the company’s favorable COVID-19 era. The table below highlights the key six medicines, whose combined sales account for 23.1% and whose generic versions are expected to be on the market before 2028.

Source: Author’s elaboration, based on 10-K

At the moment, there is a decrease in sales of COVID-19 products and, as a result, pressure on the company from various financial institutions is increasing since it is not entirely clear with what specific drugs Pfizer management will be able to offset the loss of exclusivity of such blockbusters as Ibrance, Prevnar 13 / Prevenar 13 and Eliquis, commercialized in partnership with Bristol-Myers Squibb (BMY).

Acquisition of Seagen

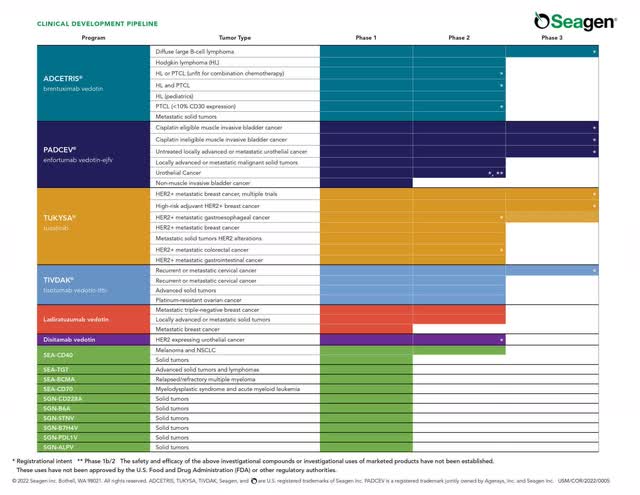

According to the Wall Street Journal, Pfizer’s management is in talks to acquire Seagen (SGEN) to expand the company’s portfolio with promising cancer-fighting medicines. Several product candidates are in phase 3 clinical trials, and as a result, if the primary and secondary endpoints are reached, there is a high probability that the FDA and EMA will approve their use, which can dramatically increase the company’s revenue in the medium term.

Source: Seagen Pipeline

As of March 3, 2023, Seagen’s capitalization was $33.86 billion, and given that the company refused to sell itself to Merck for $40 billion, in the current conditions, there is a high probability of two outcomes. The first of these, which we estimate is unlikely, is the acquisition of Seagen’s entire portfolio of medicines for more than $40 billion to persuade the company’s management and key investors to complete the deal. And the second one, which is more likely, is the exclusion of Padcev from the agreement to avoid additional investigations from the antitrust authorities and reduce the occurrence of a conflict with Merck, a partner of Seagen. According to our estimates, if the deal to acquire Seagne goes through as part of the second outcome, then its amount could reach $32-33 billion.

Given that Seagen is still a loss-making company, its acquisition could negatively affect Pfizer’s EPS in the next 5-6 quarters and reduce its financial flexibility in the post-COVID-19 era. Moreover, total debt could also rise above $55 billion due to the need to finance this massive acquisition. As a result, this may lead to a refusal to increase dividend payments in 2024-2025, which may also decrease the investment attractiveness of Pfizer on the part of dividend investors. Consequently, we expect the company’s share price to drop to $36 in the short term in this case.

Conclusion

Pfizer is the world’s leading pharmaceutical corporation, founded in 1849 and specializing in the manufacture and sale of medicines for the treatment of various diseases, including cardiovascular, oncological, and autoimmune diseases. The company also has a collection of vaccines that protect against the flu, COVID-19, and other viruses, which have been vital to achieving record revenue, operating income, and other financial indicators for 2022.

Since 2021, the company’s management has been pursuing an aggressive M&A policy that has not been seen in many years, thanks to the sale of COVID-19 products, which brought tens of billions of net profits to Pfizer in recent quarters. The resulting profits are effectively converted not only into accelerating their developments but also by acquiring companies whose medicines have significant competitive advantages over those currently considered gold standards in various therapeutic areas. In addition, rejuvenating the company’s product portfolio reduces the risk of a substantial drop in revenue due to the loss of exclusivity of several blockbusters in the next six years.

Despite the high dividend yield and margins of the business, and an extensive pipeline of product candidates, long-term investors need to take into account the risks not only described in this article but the tense situation around Ukraine and the continued increase in the Fed interest rate, which could lead to a short-term decrease in the company’s share price to $36. However, despite them, we believe Pfizer is significantly undervalued among the pharmaceutical companies in the S&P 500 (NYSEARCA:SPY) and could be an excellent candidate for dividend investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.