Summary:

- Despite the dividend cut, Intel’s EV/EBITDA valuation remains above historical levels.

- In 2022, Intel took steps to receive cash from revenue faster than it would otherwise have been via receivables factoring.

- There seem to be internal issues at Intel that we think must be resolved before re-assessing the stock.

Alexander Koerner

What Comes Next?

Intel (NASDAQ:INTC) rocked investors when it announced it was cutting its dividend by 66% to $0.125 per share annually. The news, which came in a special company call, was not a surprise for those who follow us (you can read our article where we discussed a looming dividend cut here), but it was indeed received as a surprise by the wider market since the stock dropped almost 6% on the news.

Cutting the dividend was, in our view, prudent. Doing so saves the company almost $4 billion per year in cash in a time when it is burning through it at a rapid clip. The company also guided that it would be reducing CapEx spend overall by about 30%. Even with these reductions, we estimate that total CapEx spending could go north of $15 billion in 2023.

With these estimates, we want to address in this article what is likely on the minds of most shareholders–what can we expect from Intel going forward, and what value we ascribe to shares of the company today.

Value Is In The Eye Of The Beholder

Since Intel declined to provide full year guidance, the majority of our analysis of Intel’s current value will rest on historical precedent.

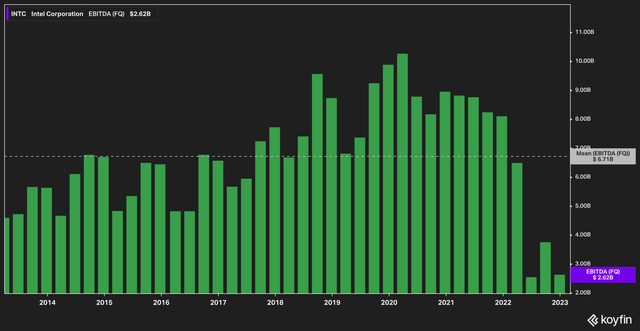

Let’s start with a look back over a 10-year period at Intel’s quarterly EBITDA.

Intel Quarterly EBITDA (Koyfin)

Over the last ten years, the company has averaged quarterly EBITDA of $6.7 billion. This is a far cry from the previous three quarters, in all of which the company reported less than $4 billion.

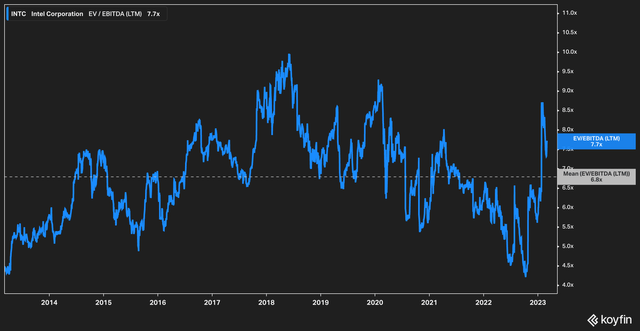

Over the past ten years, the market has assessed an average trailing EV/EBITDA to Intel of 6.8x. When you account for the price decline in the stock already, we see that the current trailing valuation stands at 7.7x, down from almost 8.5x.

Doing the math gives us a target price of $21.83 if Intel reverts to its 10-year historical trailing EV/EBITDA valuation of 6.8x, a roughly 17% fall from current levels.

The real question, of course, is whether or not $21.83 or thereabout is a good true value for Intel.

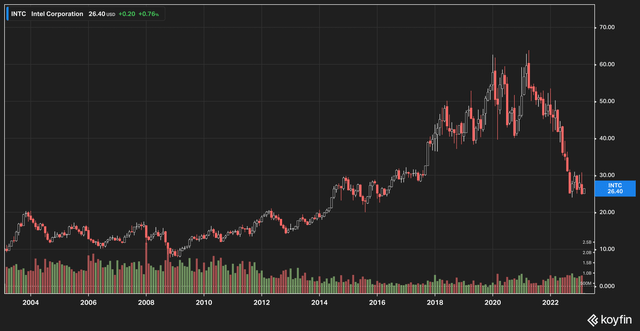

The last time Intel traded in the $20 range was roughly 2014. At that time, the company reported $55 billion in revenue and EBITDA of $24 billion. Analyst consensus for Intel is that in 2023 the company will report $50 billion in earnings and $10 billion in EBITDA.

While revenue seems to be just a bit off by comparison, EBITDA is way down. Cash from operations is similarly off, with expectations for 2023 at around $13 billion, compared to 2014’s operating cash flows of $20 billion.

Any way you slice it, Intel is revisiting its past by delivering lower top line revenues and even lower below top-line figures. This leads us to conclude that while our target of $21.83 is a relatively good baseline target, we wouldn’t be surprised if the stock were to fall further before settling into a range.

Work To Do In Receivables

Inventory was a topic mentioned several times in the company’s last earnings call. Rising inventory levels were certainly on the minds of analysts and management, and Intel management said that they would expect the backlog to remain through the first half of 2023.

Less attention has been paid, however, to the company’s pulling forward of its receivables and its impact on cash flow. In a related note, we highlighted in an earlier article how Intel began utilizing commercial paper as evidence for the coming dividend cut. You can read our rationale by clicking here.

Let’s start by looking at the company’s days sales outstanding.

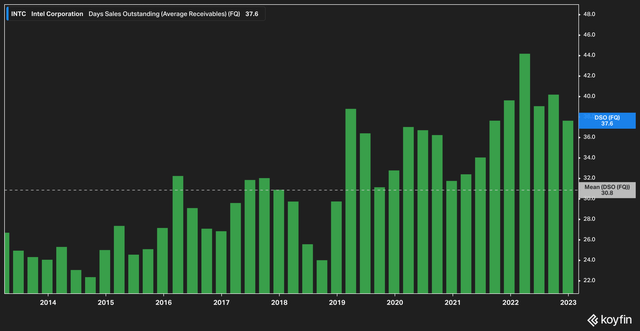

Over the last 10 years, Intel has averaged a days sales outstanding [DSO] of 30.8. DSO allows us to analyze how a company is converting its receivables into cash. A rising DSO can suggest many things: it may be that the company is recognizing more revenue before it is turned to cash, that customers are taking longer to pay, or that the company has extended longer payment terms to customers.

There are a few problems with this. If a company recognizes revenue more aggressively by extending terms to customers, then it could be creating a problem where the chickens will come home to roost by creating a revenue surplus today and shortfall tomorrow.

The steady rise in DSO at Intel is suggestive that the company needs cash more quickly than customers are paying. To support this, we turn to the company’s 10K (page 46) where Intel took certain actions in regard to its liquidity:

In the second half of 2022 these actions included, among others, negotiating with suppliers to optimize our payment terms and conditions, adjusting the timing of cash flows associated with customer sales programs and collections, managing inventory levels and purchasing practices, and selling certain of our accounts receivable on a non-recourse basis to third-party financial institutions. While such actions have benefited, and may further benefit, cash flow in the near term, we may experience a corresponding detriment to cash flow in future periods as these actions cease or as the impact of these actions reverse or normalize.

A lot to unpack here. We can reasonably conclude from the company taking steps to “optimize our payment terms” that the company is looking to delay payments rather than send cash out the door earlier. Further, “adjusting the timing of cash flows associated with customer sales” could mean many things, but we think it’s reasonable that the company is looking to pull in sales earlier than before.

The “corresponding detriment to cash flow in future periods” however, is the largest sign to us that investors should perk their ears up and pay closer attention to the company’s revenues and cash flows in the near future, even after accounting for cost cuts.

Interestingly, Intel also engaged in the selling of portions of its accounts receivable for–from what we can tell–the first time. This is another way for companies to accelerate the receipt of cash. A company will take the unpaid bill from a client and sell it at a discount to a financial institution, who will then take the full cash proceeds from the client. In this case, the company sold these on a non-recourse basis, which means that if the customer defaults and doesn’t pay, then the financial institution that purchased the claim is simply out of its investment.

Of course, you can imagine that to take on this risk, the financial institution will take a larger cut from the selling company in order to be compensated for the risk. On page 92 of its 10K, Intel disclosed that it had engaged in the sale of $665 million of its accounts receivable.

The Bottom Line

It isn’t breaking news to declare that Intel has some work to do in order to right the financial ship. We will be watching closely as Intel executes its plan to restore financial health. However, at the current time we believe that a combination of weakness in its core PC business, coupled with a high level of inventory and a rising DSO metric, make the company a risky bet at current prices. Our opinion remains negative in light of these issues, and we believe the price is likely to fall further until they are resolved. We’ll continue to monitor these for possible future inflections.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.