Summary:

- Pfizer has a history of performing well during recessions and bear markets on Wall Street.

- COVID-19 sales may remain high, longer than expected.

- The pandemic vaccine/antiviral income windfall has moved its balance sheet into a super-conservative and liquid setting.

- Valuations are too low as enormous cash flows are reinvested into accretive R&D and acquisitions next year.

Justin Sullivan/Getty Images News

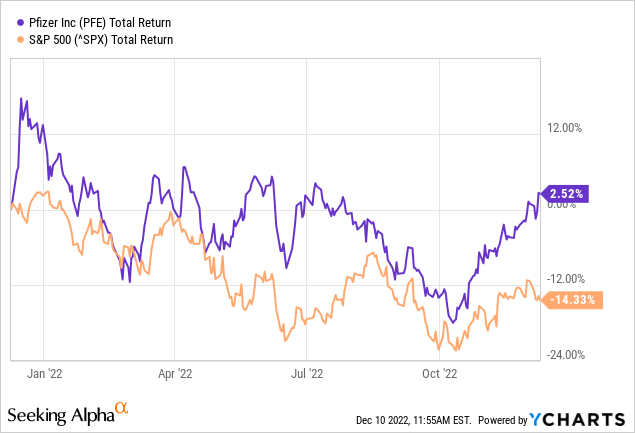

Pfizer Inc. (NYSE:PFE) currently stands out to me as the best risk-adjusted choice to own for 2023 in the defensive pharmaceutical sector, and maybe the entire blue-chip universe trading on Wall Street. The minimal stock gain for 2022 has easily bested the S&P 500 -14% over the past 12 months. Yet, this result has not kept pace with Big Pharma gains as a group. The reason revolves around expectations for its COVID-19 vaccine and antiviral windfall in profits to dissipate over a year or two. The roundup summary is its stock price has been digesting outsized pandemic-related gains from 2021 this year.

YCharts – Pfizer vs. S&P 500 Total Returns, 1 Year

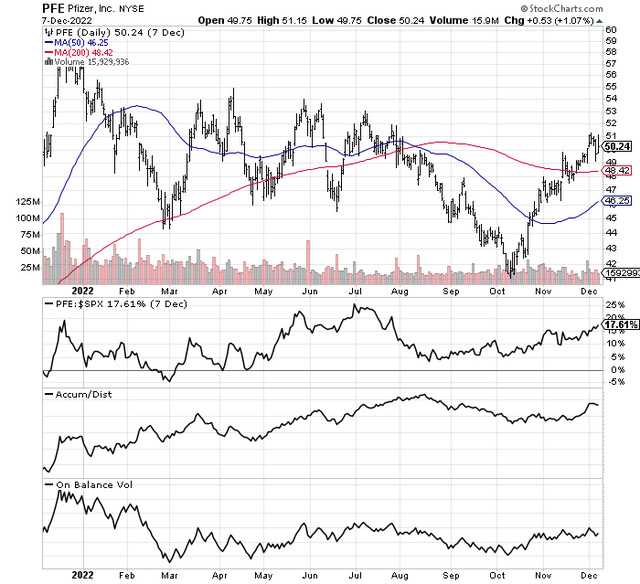

StockCharts.com – Pfizer, 1 Year of Daily Price & Volume Changes

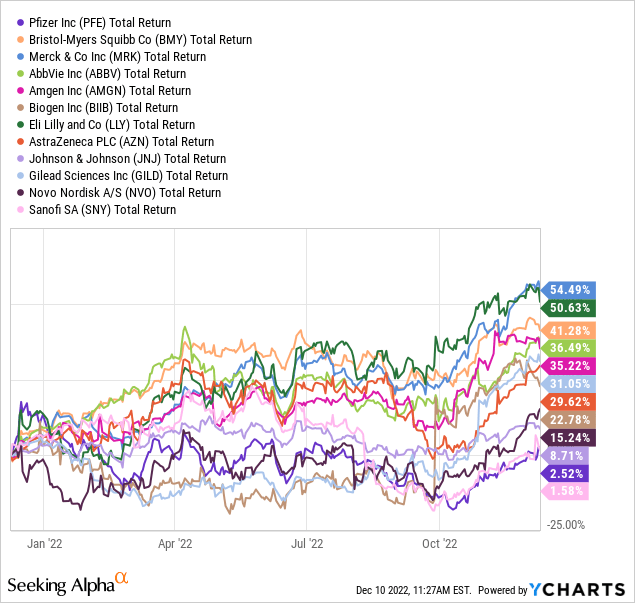

A graph of 1-year total returns vs. major prescription drug-producing peers and competitors is drawn below. The list includes Bristol-Meyers Squibb (BMY), Merck (MRK), AbbVie (ABBV), Amgen (AMGN), Biogen (BIIB), Eli Lilly (LLY), AstraZeneca (AZN), Johnson & Johnson (JNJ), Gilead (GILD), Novo Nordisk (NVO), and Sanofi (SNY). Pfizer’s investor return has lagged in 2022.

YCharts – Big Pharma Total Returns, 1 Year

The good news for investors is Pfizer owns an enviable track record of performing well during and just before/after U.S. recessions. In addition to this hard to ignore bullish argument for ownership, COVID-19 variants may continue to develop, meaning the company’s windfall profit status could remain a meaningful kicker for better long-term growth.

In my view, Wall Street may be miscalculating how high rates of income will be structurally reinvested into share buybacks and the accretive acquisition of smaller drug companies in 2023-24. Pfizer’s balance sheet is entering an A+ ranking zone for safety and liquidity, as the flood of cash is a welcome problem to have entering an economic recession. Lastly, the valuation story may be one of the smartest in all of Big Pharma, including a 3%+ dividend payout likely to rise robustly over the next three years.

When I weigh all the pros and cons (there are a few) to investment around $51 per share, I feel the odds are heavily tilted in favor of decent shareholder gains next year. I have a Buy rating on Pfizer and believe a $45 quote similar to October (if it happens) would represent Strong Buy territory. In terms of confidence weightings, Pfizer is in a small select group of buy-on-weakness candidates I would like to purchase going into 2023.

Recession Outperformance

With the 40-year record inversion of Treasury yields in December, let’s assume a recession is going to happen in 2023. I am firmly in the camp believing a recession is all but guaranteed soon for a variety of reasons, including the chance China’s COVID-19 reopening unleashes new lockdowns and/or a sick-leave problem there in coming weeks (60% of the population could be infected for the first time in 2023).

Potentially, new variant strains may also evolve in China to worry about and vaccine against them into winter next year. Of course, the Chinese COVID economic mess could quickly become a new emergency in Asia, as vaccines made in China are not as effective as Pfizer’s invention, while far fewer Chinese (percent of the population vs. western nations) have received any shots or been exposed to this viral killer. My point is those hoping a China reopening is great news for the global economy, may have to wait 6-12 months for such bullishness to ring true.

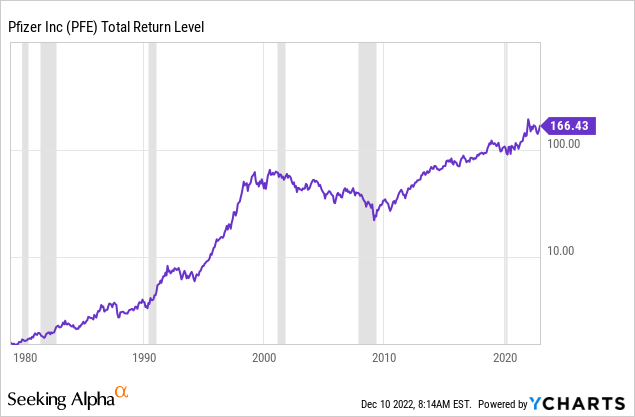

Anyway, Pfizer has a terrific history since 1979 of outperforming the overall U.S. stock market (represented by the S&P 500 index) during recessions. The logic goes pharmaceutical business sales are less cyclical as individuals continue to buy prescriptions, even when economic times are rotten.

Below is a graph of previous economic contractions (shaded in grey), alongside price change and dividend payout stats for Pfizer. Had you invested $1 at the beginning of 1979, and held to December 2022, you would now have $166.43 (before taxes)! That’s the long-term, buy-and-hold compounding idea espoused by investors like Warren Buffett. Pfizer proves out the utility of such a strategy, especially if you own a well-managed blue chip, and can stomach years of down action like 2001-09.

YCharts – Pfizer Total Returns, Since 1979, Recessions in Grey

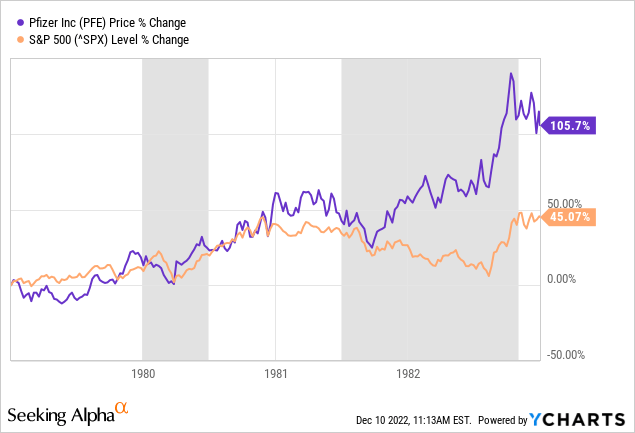

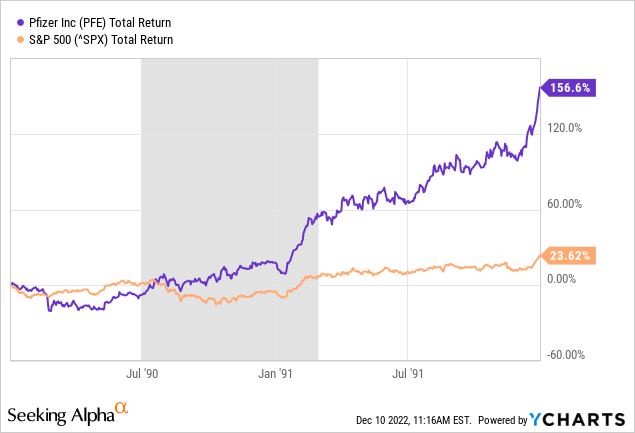

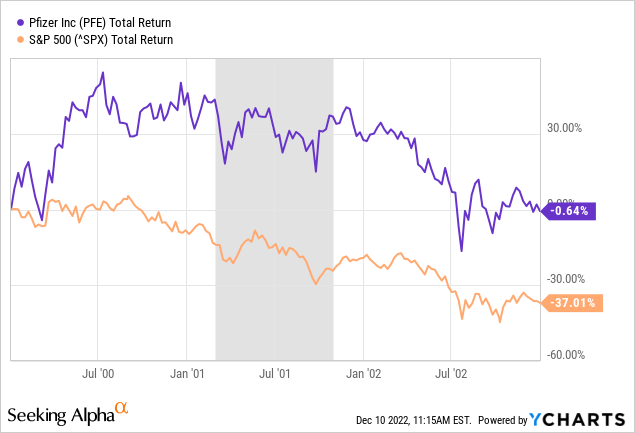

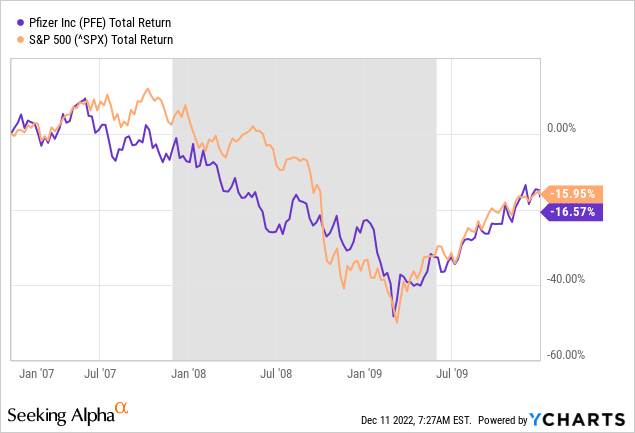

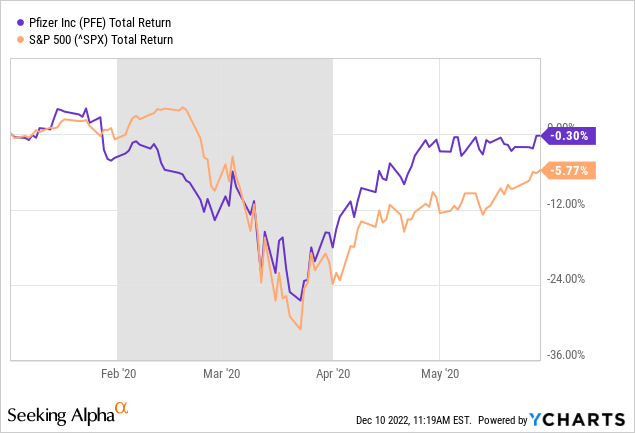

Below are closeup snapshot reviews of previous recession spans looking at Pfizer and S&P 500 index performance. The trend has generally been Pfizer outperforms during both bear markets in equities and recessions. Has the investment return been hugely positive? Not really, but owning a defensive name now makes complete sense, assuming a mild to severe recession is next.

YCharts – Pfizer vs. S&P 500 Price Change, 1979 to 1982, Recessions in Grey

YCharts – Pfizer vs. S&P 500 Total Returns, 1990 to 1991, Recessions in Grey

YCharts – Pfizer vs. S&P 500 Total Returns, 2000 to 2002, Recessions in Grey

YCharts – Pfizer vs. S&P 500 Total Returns, 2007 to 2009, Recessions in Grey

YCharts – Pfizer vs. S&P 500 Total Returns, January to May 2020, Recessions in Grey

COVID-19 Lingers

All else being equal, Pfizer should be researched as a buy proposition from its defensive and safety trading characteristics alone. However, the investment equation is tilted more toward gains in Pfizer than previous recessions. Why? For starters, the COVID-19 pandemic will not go away quietly. And, the biggest beneficiary of this trend in the U.S. stock market may be Pfizer, with its revolutionary and leading vaccine/antiviral development programs.

How big of an immediate impact has COVID-19 made on Pfizer results. Total 2020 revenue for the company was $41 billion. Today, sales are $100 billion on a trailing 12-month basis! And, annual net income has jumped from $10.7 billion in 2019 to roughly $30 billion today. COVID shot sales to the U.S. government (Comirnaty and Pfizer-BioNTech), foreign governments, and healthcare organizations worldwide have been a major tailwind. But other inventions to fight the pandemic, like antiviral Paxlovid have also been a boon to sales. During the first nine months of 2022, 45% of revenues came from the U.S. (38% in total from Uncle Sam) and 55% from overseas demand.

What if COVID-19 variants require new vaccines every fall/winter for years? If this is our future, Pfizer operating results could be in a great position to “beat” expectations again during 2023 and beyond.

King-Maker Balance Sheet

At the end of September, Pfizer held $36 billion in cash and liquid investments vs. roughly $40 billion in total debt. The COVID-19 windfall has basically allowed the company to become net debt free again, for the first time since 2009. That year the company purchased drug giant Wyeth for $68 billion, adding a considerable amount of goodwill and intangible accounting. Other large past transactions include the 2000 Warner-Lambert deal for $115 billion and Pharmacia merger for $60 billion in 2003. The last big asset shuffle was the 2019 combination of OTC healthcare products with GlaxoSmithKline plc (GSK), listed as a Long-Term Investment on the balance sheet. Honestly, management may now be on the lookout for another major acquisition in 2023, as it reinvests cash piling up on the balance sheet.

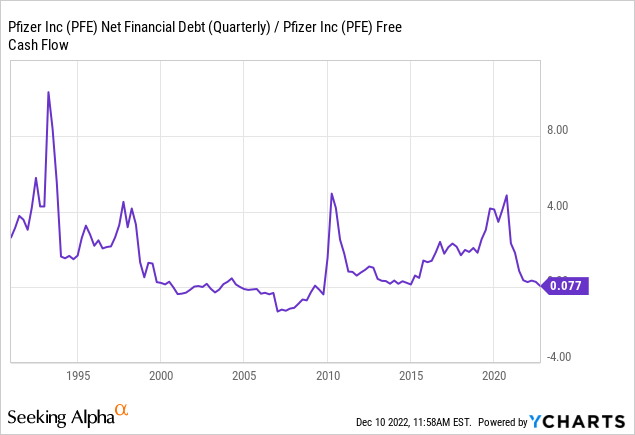

Below is a graph of net financial debt (total debt minus cash) vs. free cash flow generation. Essentially, the company will be net debt free in early 2023, and in its best financial shape since 2009. Negative numbers on the graph mean more cash than debt are held on the balance sheet, while free cash flow is positive. All told, Pfizer owns a vastly improved investment outlook in my mind vs. early 2020, a function of skyrocketing pandemic-related sales/income.

YCharts – Pfizer, Net Debt to Free Cash Flow, Since 1992

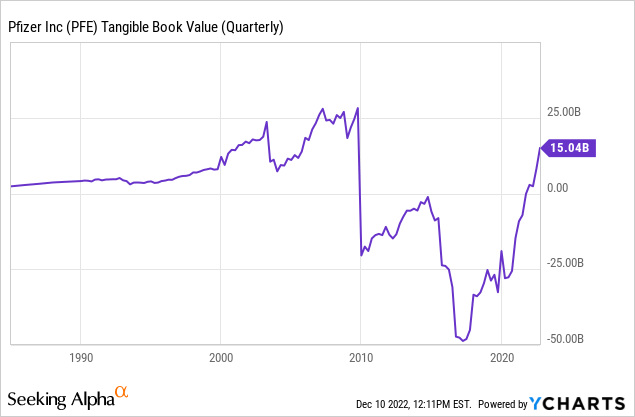

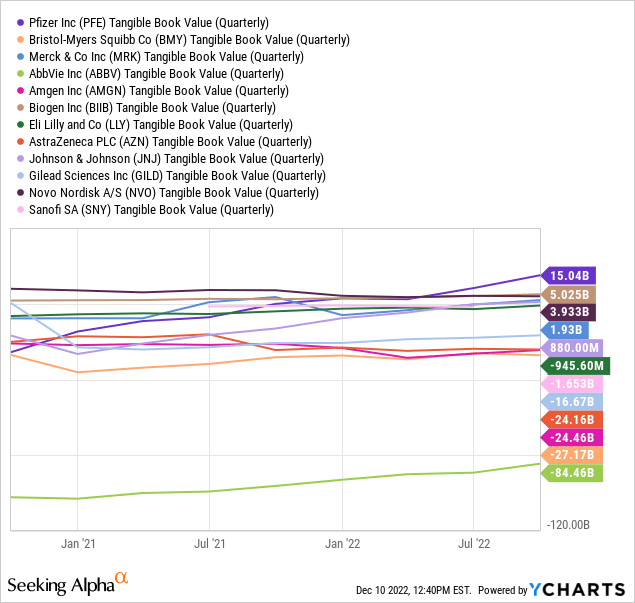

Not only are cash holdings racing higher, but enough of it has appeared to create a “tangible” book value again, where physical assets are greater than total liabilities. Most Big Pharma outfits run negative tangible book value business models on overpriced acquisitions (vs. hard assets) and intangible patent-asset accounting for new drugs. In late 2022, Pfizer stands out as having the strongest tangible book value setup, with amazing cash flow “growing” this fundamental business positive rapidly. Pfizer should have a record tangible book value above $30 billion in 6-9 months, assuming management does not entertain a major takeover bid.

YCharts – Pfizer, Tangible Book Value, Since 1987

Having a tangible book value now provides the financial flexibility to take advantage of a coming recession through intelligent R&D expansion and acquisition efforts. Pfizer scores the highest in Big Pharma for financial flexibility right now. For example, enough cash will exist by spring to theoretically purchase one of my Big Pharma favorites – Biogen (BIIB) and its undervalued drug development pipeline, without using debt or equity issuance. [I wrote about Biogen’s improving momentum chart pattern in October here.]

YCharts – Big Pharma, Tangible Book Values, Since Late 2020

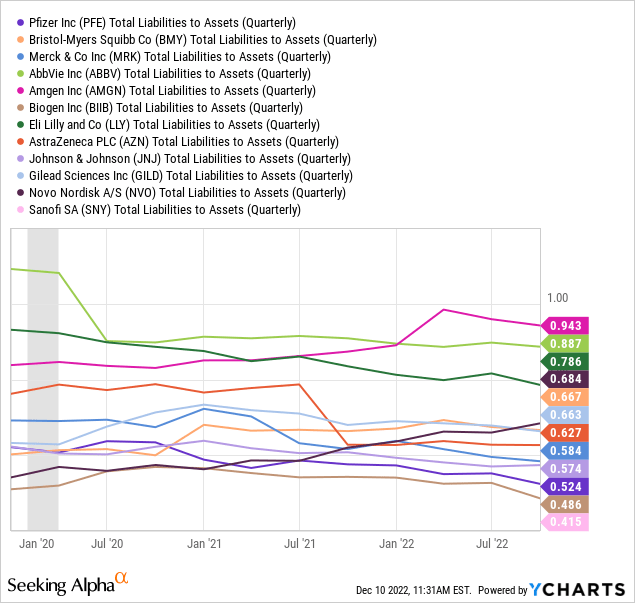

Total liabilities to assets have fallen to 52%, the lowest ratio in years, and far better than peers and competitors.

YCharts – Big Pharma, Total Liabilities to Assets, Since January 2020

Valuation Is Too Cheap

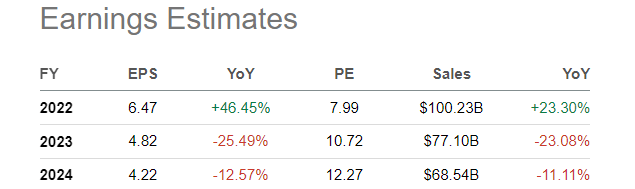

Nonsensically, investors are today putting a low valuation on Pfizer, effectively discounting a major sales drop in COVID-19 items soon. Yet, this expectation may prove premature.

Below is the current Wall Street analyst operating forecast for 2022-24. My thinking is sales and EPS may not drop as much as projected, especially as funds are reinvested in other areas.

Seeking Alpha – Pfizer, Analyst Estimates for 2022-24, December 10th, 2022

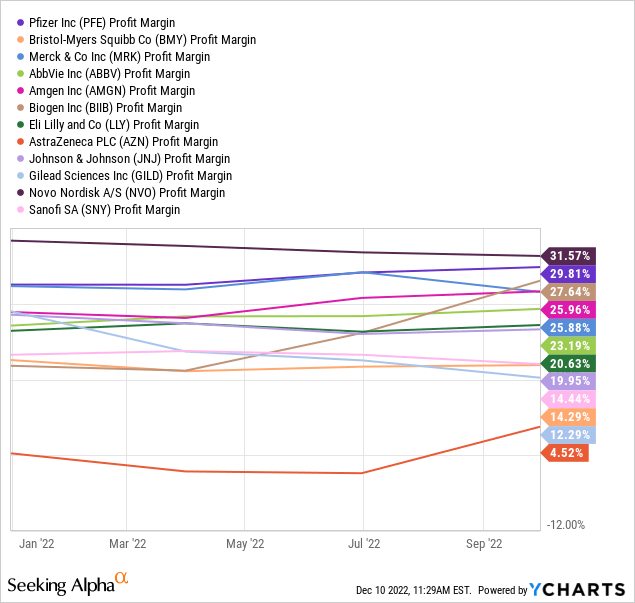

In addition, if you want to own a business with an incredible profit margin on sales, few companies in ANY industry stack up to Pfizer’s almost 30% net income rate over the trailing 12 months (with the majority of S&P 500 businesses under 10% final margins).

YCharts – Big Pharma, Trailing Net Income Margin, 2022

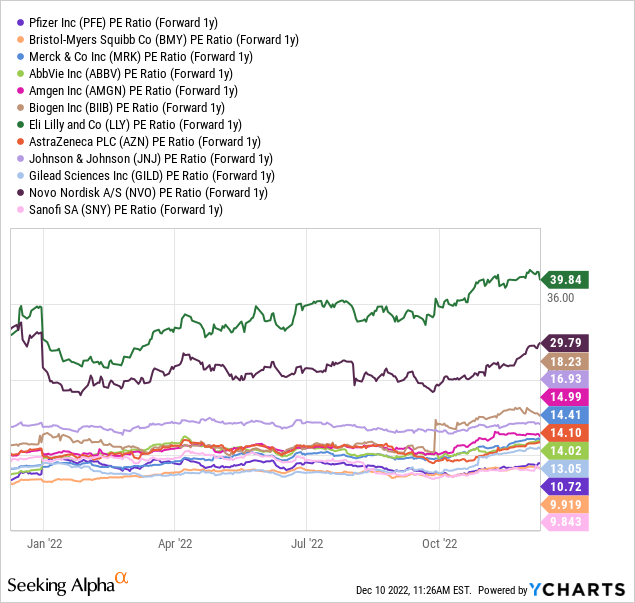

On a forward 1-year estimate of income, Pfizer’s P/E ratio of 10.7x is one of the lowest in the Big Pharma sector, and quite a distance from an S&P 500 ratio above 20x in a recession scenario next year.

YCharts – Big Pharma, Forward 1-Year Estimated P/E, 2022

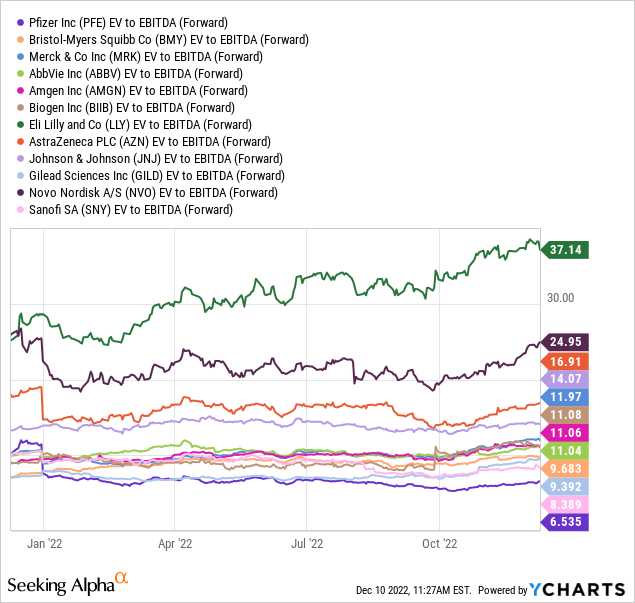

However, when we subtract huge building cash numbers while adding minor debt totals, enterprise value calculations are entering bargain territory. Below is the ratio comparison of EV to forward estimated EBITDA (the ultra-basic cash earnings, apple-to-apple comparison for peers with different debt and cash levels). Pfizer’s 6.5x multiple is insanely low today, a 40% discount to the median peer average.

YCharts – Big Pharma, EV to Forward Estimated EBITDA, 2022

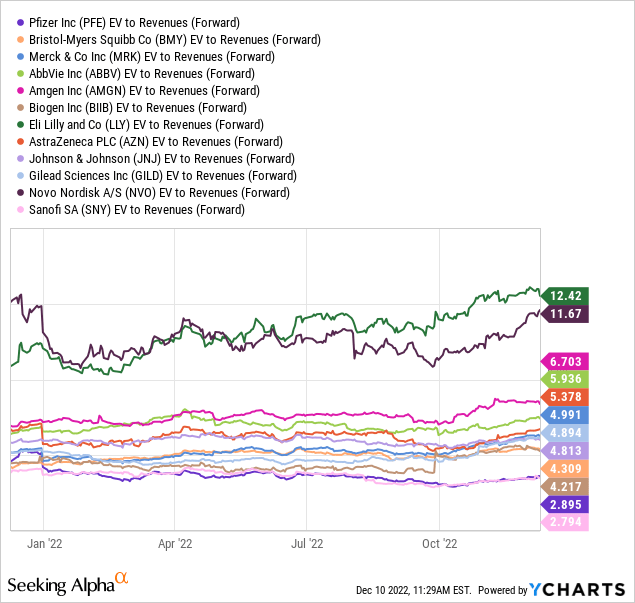

EV to sales is likewise trading at a 40% discount to the median average of the peer group. Again, this setup expects peaking COVID-19 demand in 2022 (which may be realistic), although a substantial drop in 2023 is far from certain.

YCharts – Big Pharma, EV to Forward Estimated Revenue, 2022

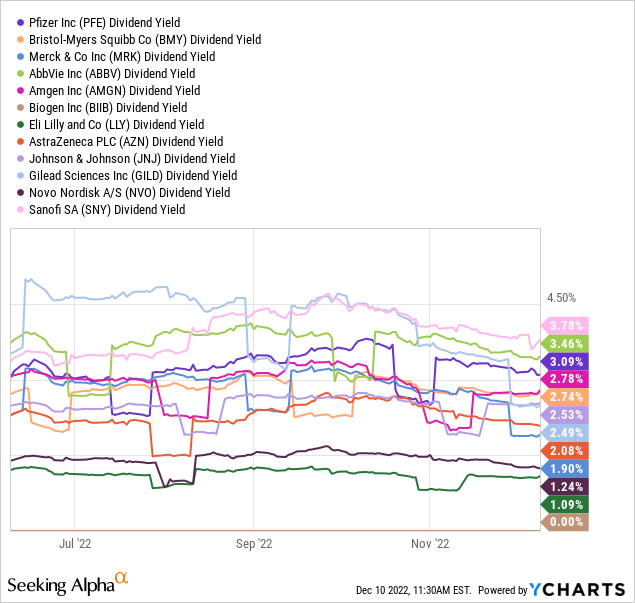

Lastly, the dividend yield of 3%+ for Pfizer owners is exceptional, almost double the S&P 500 rate. It is also near the top of the list in the Big Pharma space. The best news of all is the current payout represents just 30% of income. If sales and income levels remain higher than expected in 2023-25, plenty of room to increase the dividend by 50% or even 100% exists over time. So, investors at $51 currently, may be capturing a 4% to 6% dividend yield a few years out, above most Treasury bond and corporate debt yields for long-term holders. The dividend story by itself may be worth considering Pfizer for purchase, without knowing past recession outperformance trends or how COVID-19 exactly plays out in the future.

YCharts – Big Pharma, Trailing Annual Dividend Yield, Past 6 Months

Final Thoughts

Pfizer’s defensive characteristics during U.S. recessions and bear markets are top notch. Its fundamental business future may be brighter than Wall Street is giving credit. And, valuations are much stronger than the average investor understands. In my view, massive operating income generation alongside defensive trading action during bear markets should be under accumulation by investors today, with a fair valuation closer to industry averages.

What are the risks? I do worry about an overall bear market selloff in U.S. equities keeping the Pfizer price down for a spell. The stock market could easily fall off a cliff into March (perhaps another -15% to -25% price decline) as a recession slashes corporate profits, while investors are forced to liquidate holdings to meet margin calls and pay regular bills at home. Rising unemployment (tanking income) is the last part of the recession cycle to appear. Bearish analyst forecasts of a 5% or greater jump in the ranks of the unemployed during 2023 would be a truly rotten development for the stock market, still quite overvalued on total U.S. capitalization to GDP output stats. So, could a -20% Wall Street dinger, knock 5% or 10% off the Pfizer quote in coming months? Sure, that’s a reasonable projection (not guaranteed of course).

In terms of the operating business, to me the clearest risk revolves around a federal government effort at price controls on popular drugs. While this has been a concern for the industry since the early 1990s Clinton administration, such an effort is now reality going into 2023. Medicare drug price “negotiations” are set to begin soon, as part of the Inflation Reduction Act of 2022 passed by Congress in late summer. If there is any good news, negotiations and implementation will be done in a layered fashion (phases) for fixed-price payments by Uncle Sam through Medicare. The pricing schedules will not begin until 2026, on 10 yet to be selected drugs out of the top 100 sellers, and all 100 will not become eligible until 2030 under current law (adding 10-20 more each year).

Without doubt, the major drug manufacturers and developers will see lower profits than otherwise from the Medicare negotiation plan, but I do not foresee a real effect on Pfizer until 2025 (at the earliest) for how Wall Street values a lower-growth business model than in the past. High drug prices are often referred to as a “necessary evil” to encourage investment in research & development and the rollout of new pharma inventions. The primary drawback of government price-fixing is the rate of discovery for exciting and beneficial medical therapies may implode if the profit-motive (incentive) is taken away.

In conclusion, when I weigh all the pros and cons, I believe Pfizer will likely outline a total return of +10% to +15% in 2023. Not spectacular for sure, but materially better than my flat to minor loss forecast for the S&P 500. It appears Pfizer is once again positioned to outperform the U.S. equity market during an approaching recession. At the very least, a stake in this name should help you sleep better at night, when included as part of a diversified portfolio of assets.

For long-term, buy-and-hold thinkers, Pfizer may be my top risk-adjusted choice on minor price weakness for 2023, if you forced me to pick just one security to own. Paying 11x to 12x future sustainable income generation, with a 3%+ and rising dividend yield, during a weakening economic outlook with bear equity market tendencies, sounds like a solid buy proposition for patient personalities. Late 2022 may have opened the most opportune time to buy Pfizer since 2009, regardless of recession and COVID forecasts. Since April 2009, Pfizer has gained almost +600% for a total return, approximately +15% compounded annually.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE, BIIB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.