Summary:

- The significant drop of over 20% from December highs to last week’s lows left PFE investors nursing their wounds.

- Pfizer’s underwhelming FY23 outlook still fell short of downgraded analysts’ estimates.

- With the reset in forward expectations, weak holders have likely fled, igniting the return of long-term buyers seeing opportunities in weakness.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) investors who added more positions at its December highs have seen a significant collapse since then. Accordingly, PFE fell nearly 22% (in price-performance terms) from its December top through its lows last week, as it failed to participate in the 2023 rally.

For a stock that delivered a 10Y total return CAGR of 9.4%, the extent of the recent decline has likely hurt. Is it reasonable? Of course. We cautioned investors not to expect another record year in our previous article. However, the company saw further headwinds in its COVID franchise (vaccine and treatment) in 2023, as its guidance underperformed the previous consensus estimates.

As a result, Pfizer’s forward earnings estimates have been marked down further, causing its valuation multiples to surge from its previous lows.

Management is confident that 2023 could be the bottom for its COVID revenues as it begins to leverage the private commercial market. However, the initial go-to-market motion requires an increase in OpEx, as Pfizer attempts to maintain its market leadership.

Notably, management sees a stable vaccination rate through 2024, with improved gains from its potential combination vaccine from 2025. Its oral treatment Paxlovid is also expected to be a critical growth driver, as Pfizer doesn’t have to share revenue and margins with BioNTech (BNTX).

Despite that, we believe investors must consider the execution risks as Pfizer enters a new era in COVID vaccines, tapping the private market. Still, Pfizer should benefit from an improvement in pricing dynamics (between $110 to $130) as it moves away from its government inventory.

Moreover, R&D costs are expected to be higher in 2023, projected to increase by 8.7%. As such, combined with the estimated sharp decline in FY23 revenue of more than 31%, investors should expect its adjusted EBIT margins to be impacted markedly.

Wall Street analysts’ estimates suggest an adjusted EBIT margin of 30.5% in FY23, down from FY22’s 37.1%. However, analysts also anticipate an inflection in its profitability, as FY24’s adjusted EBIT margin is projected to recover to 35.1%.

With that in mind, investors need to decide whether they are confident of the company’s ability to transit successfully to the private commercial market.

Furthermore, management still needs to navigate the $17B loss of exclusivity (LOE) from 2025-30, behooving Pfizer to accelerate the success of its pipeline.

Hence, we urge investors to pay close attention to the company’s development over the next year, as management highlighted it expects “up to 19 new products or indications in the market over the next 18 months, with 15 from its internal pipeline and 4 via recent business development deals.”

As such, the critical question facing investors is whether they think these challenges have been priced in, given the significant pullback from its December highs?

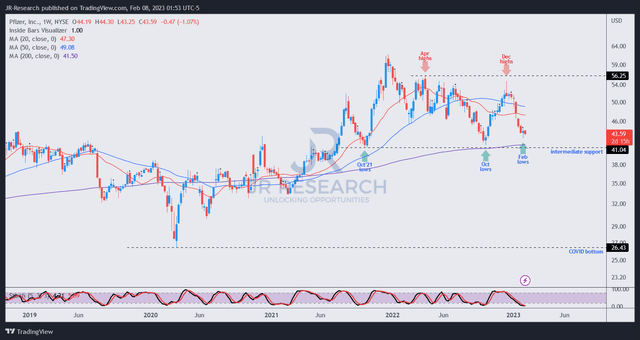

PFE price chart (weekly) (TradingView)

As seen above, PFE has retraced from its December levels, which was also an astute bull trap. Market operators ensnared late investors who hopped on the recovery in December.

However, PFE’s NTM EBITDA multiple of 8.2x is in line with the highs in December, as analysts slashed their estimates over the next twelve months.

Despite that, we believe the reset in analysts’ expectations is constructive, as seen in the recent post-earnings February lows in PFE’s medium-term price chart.

We believe savvy market operators had likely anticipated an uninspiring outlook by management, leading to the pullback from December. Hence, by the time the analysts cut their projections, PFE has likely already bottomed.

It’s critical to note that PFE has retraced to its long-term bottom but needs to stay above its 200-week moving average (purple line) for our bottoming thesis to remain intact.

Hence, management has the opportunity to assure the market that Pfizer’s $25B in de-risked future revenue stream is on track to attract more long-term buyers back into the market.

Rating: Buy (Revised from Hold).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!