Summary:

- Dell Technologies is poised to benefit from AI infrastructure demand and a PC market rebound, justifying a “Hold” rating with a target price of $138.

- Despite recent revenue challenges, stable margins, and strong infrastructure solutions demand support a positive outlook for Dell.

- Anticipated growth in private server capacity and PC sales further bolster Dell’s mid-term growth prospects.

- Much of Dell’s potential is already priced in, offering moderate upside with a “Hold” rating.

JHVEPhoto

Investment thesis

Dell Technologies (NYSE:DELL) is well-positioned to benefit from several near- and mid-term catalysts, making it an attractive, albeit moderately priced investment opportunity. Key drivers include the growing demand for AI-based infrastructure and a rebound in the retail PC market, both of which are expected to fuel revenue growth. With a target price of $138 and a 17.6% upside, Dell offers moderate growth potential, justifying a “Hold” rating with a positive outlook.

Business overview

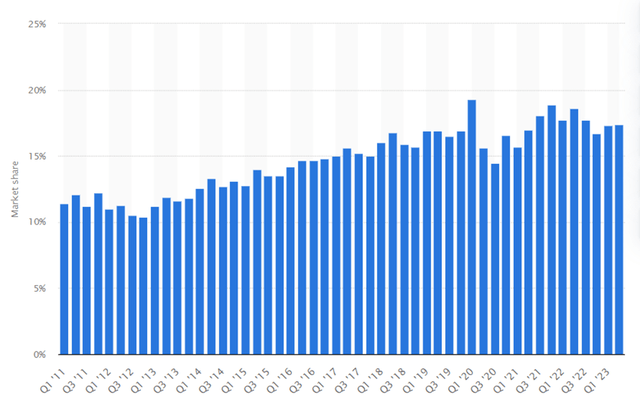

Dell Technologies Inc. is an American multinational technology company formed by a merger of Dell and EMC Corporation in 2016. Dell’s products include personal computers, servers, monitors, computer software, computer security and network security, as well as information security services. According to Statista, Dell’s global market share (in units) hovers around 17%, making it the world’s third-largest PC vendor behind Lenovo and HP.

Statista

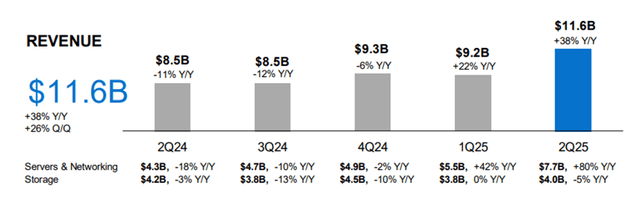

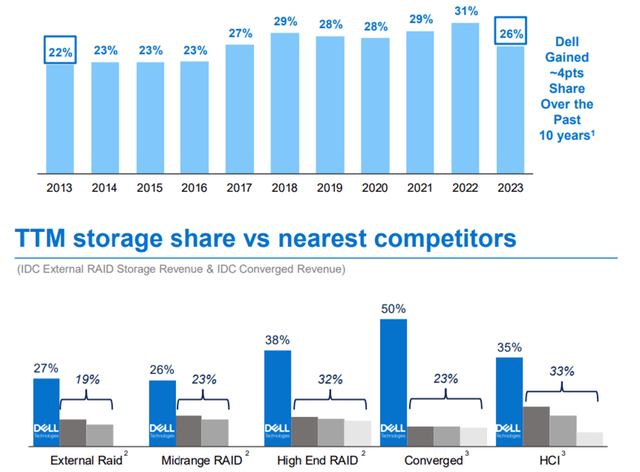

In terms of infrastructure solutions (servers, storage), Dell remains a top-1 player, according to Gartner, and is now performing incredibly well due to the release of AI-based servers and stable sequential demand growth for traditional solutions.

Dell

Dell

Although Dell is a manufacturing company, it’s not a capital-intensive business. The company doesn’t manufacture most of its peripherals, but buys them wholesale from vendors, assembles them, and then sells them at a premium. As a result, capital expenditures are typically around $3 billion (1.0x D&A or less) and free cash flow conversion rates are around 50-60% of EBITDA in a normal business cycle.

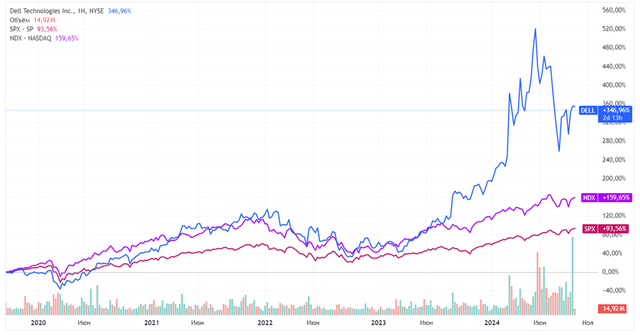

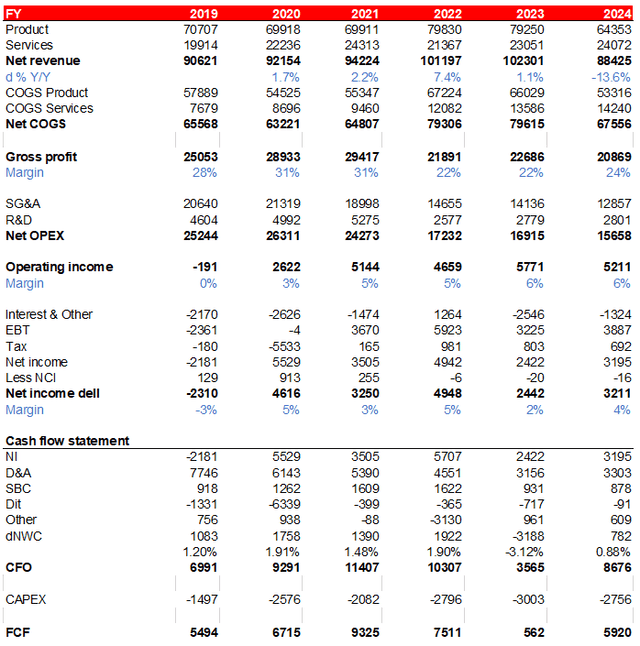

Business performance & mid-term growth prospects

Over the past 2 years, Dell stock has significantly outperformed the major indices due to its high AI exposure. The company saw significant demand growth in infrastructure solutions (mostly AI-related servers), but the growth wasn’t supported by financials, as revenue grew only 1.1% in FY2023 and declined 13.6% in FY2024 (CY22 and CY23), although margins remained stable due to OPEX reductions. The main reason for the decline in sales was the distressed situation in the PC market. The volatile share price performance was largely based on investor expectations.

TradingView

Company data

Despite the controversial financial performance, we believe that Dell is well positioned in all of its business segments in the near to medium term:

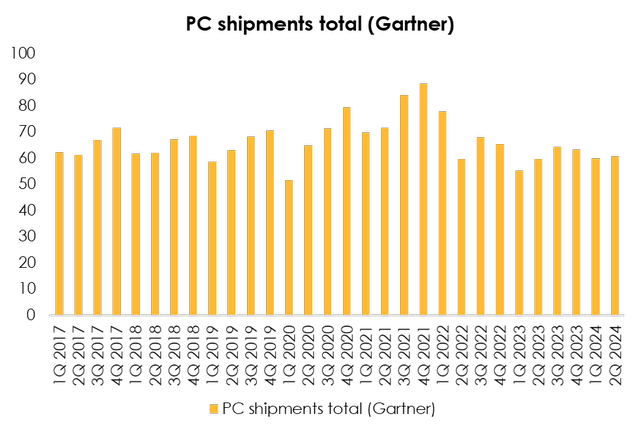

First, commercial PC sales should rebound in the nearest term. In the last post-Q2 earnings call, management mentioned that they expect CSG revenue growth in the second half of the year, as they see demand picking up. Independent analysis also supports these expectations: IDC expects PC shipments to grow by 2% in CY2024 (taking into account that shipments were down in the first half of the year, they should be up in the second half of the year) and then to grow significantly by 8% in 2025. This makes sense, as the PC shipments have been stagnating since 1Q 2022 even despite rapid technological development. Additional momentum will come from the suspension of Windows 10 support in October 2025. That means no software will be released on that operating system, so customers who haven’t yet upgraded to the latest version are likely to accelerate their efforts. These are all users of pre-8th generation Intel CPUs and Z170/370 motherboards (released at the end of 2017).

Gartner

Current CSG’s operating margin is above 6%, even with low shipment volumes, which is a normal margin rate and in line with management’s long-term expectations. The updated product mix and recovering volumes are expected to increase this.

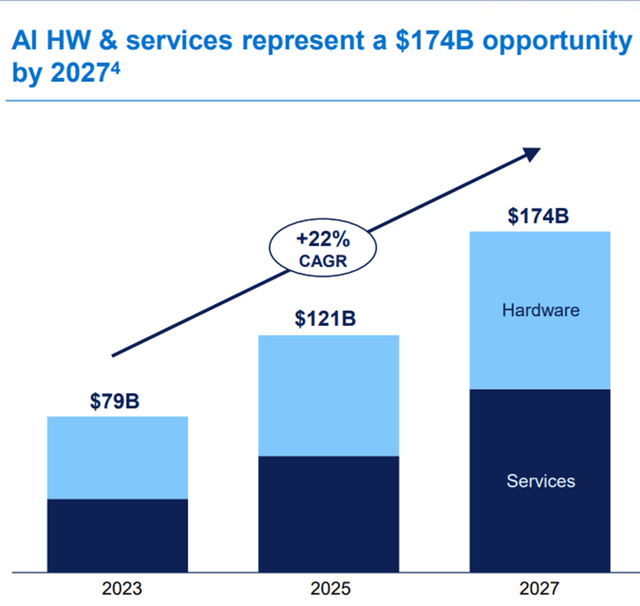

At the same time, the Infrastructure Solutions division, which is actually in positive momentum, will sustain its growth rates in the medium term. According to IDC’s analysis, the expected market CAGR in the mid-term is 22%, and we believe that Dell will be able to realize most of its potential: the product matrix is differentiated by different architectures and components (Nvidia, AMD, Intel), which makes its solutions universal for the customer pool.

Dell, IDC

Several sources also confirm that enterprise demand for the private server capacity is likely to increase in the near term. A Recent Barclays CIO Survey shows that 83% of enterprises plan to move workloads back to the private cloud from the public cloud, creating additional demand for the compact solutions (or basically most of Dell’s product mix).

The division margins are also normal, although pricing and shipping of AI servers are not yet stabilized. However, Dell’s management mentioned that they both increased on gross and operating terms due to optimized pricing and ancillary cost optimizations.

Financial results forecast assumptions

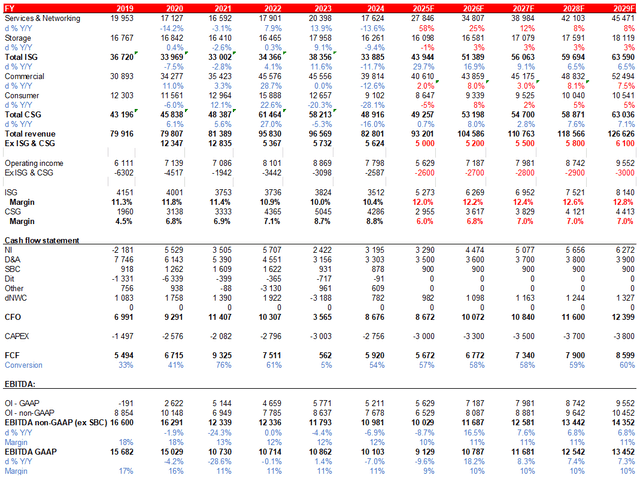

For financial modeling, we used a simplified top-down approach and sources such as IDC, Gartner, and management guidance.

Key assumptions are:

– Server & Networking revenue will grow above market for nearly 2 years, following positive current momentum and superior AI server market share, but will then decelerate due to expected repatriation of workloads to private capacity.

– Storage will remain neutral, slightly outpacing inflation.

– Consumer PC shipments will grow at IDC’s projected rates (no market share gain/decline), but commercial PC shipments will outpace them due to more frequent refresh cycles for enterprise customers.

– Margins will remain in the middle of management’s long-term expectations (11-14% for ISG and 5-7% for CSG), but CSG normalization will occur in FY2026 due to the timing of the full normalization cycle.

Under these fairly conservative assumptions, we expect Dell’s EBITDA to grow at a 5.6% CAGR over the next 5 years.

Company data, Invest Heroes calculations

Valuation

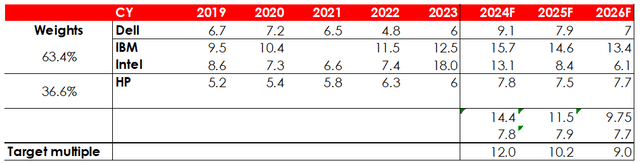

Dell has historically been a cheap company, with an average adjusted EV/EBITDA multiple of about 6.5x. However, the release of AI servers and growing demand for data centers have made investors love the company. To estimate the target EV/EBITDA multiple, we decided to use adjusted SOTP & relative valuation approaches.

To estimate the target multiple, we carried forward the current multiples of analogues (IBM & Intel for the ISG proxy, HP for the CSG proxy) and the relative weights in EBITDA of each business.

Seeking Alpha

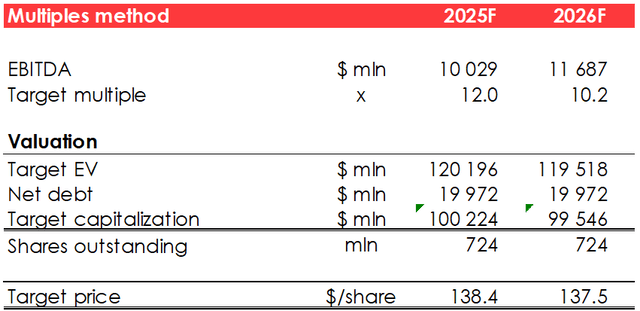

Using this approach, we estimate a fair share price of $138.0 and an upside of 17.6%. The rating is HOLD with a positive outlook, as we have used mostly conservative assumptions for future projections.

Invest Heroes

We’re quite optimistic about the near- and mid-term outlook for Dell’s business. Growing demand for AI server capacity and repatriation of public to private workloads create significant upside for the ISG division. At the same time, the expected recovery of the consumer PC market will also be a support for the company in the near term. However, most of the coming upside is already priced in, so the investment assumes a moderate upside.

Conclusion

In conclusion, Dell Technologies is well-positioned to capitalize on both short- and mid-term growth drivers, particularly in its AI-based server offerings and the anticipated rebound in the PC market. While the company has faced recent challenges in revenue growth, stable margins and strong demand for infrastructure solutions support a positive outlook. The projected increase in private server capacity and PC sales further solidify Dell’s growth prospects. However, given that much of this potential is already reflected in its current valuation, the investment presents a moderate upside with a “Hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.