Summary:

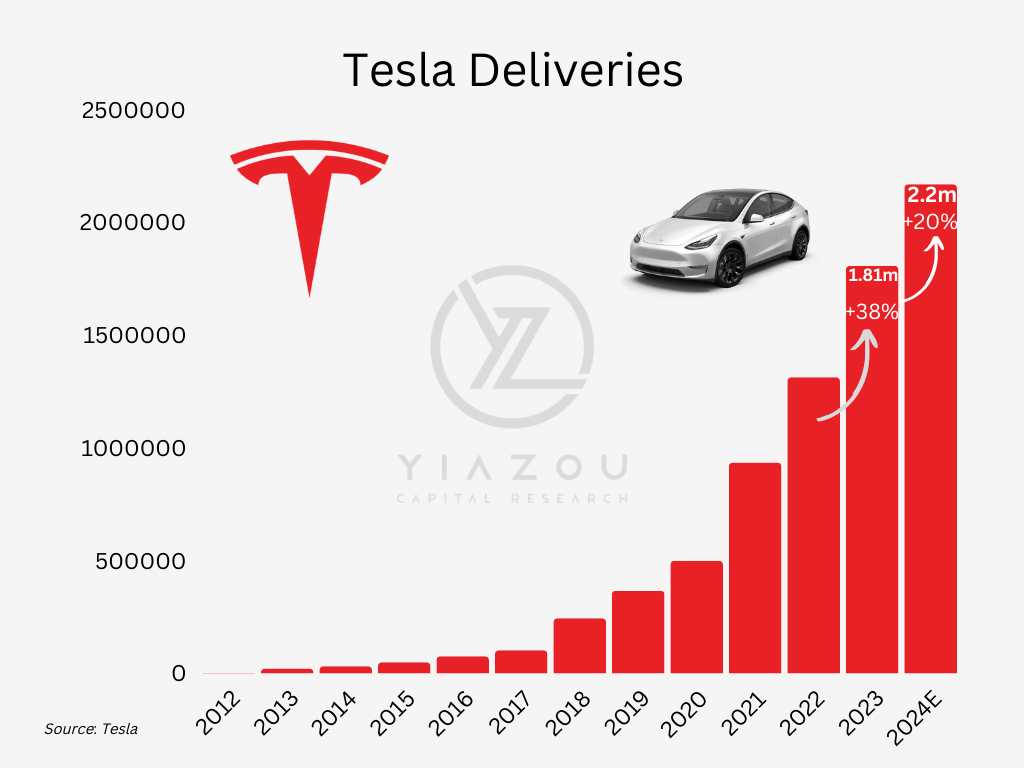

- Tesla, Inc. exceeded 1.8 million vehicle deliveries in 2023, marking a 38% growth and asserting its lead in the EV market.

- Tesla anticipates slower expansion in 2024, focusing on energy sector advancements and AI innovations.

- Tesla’s energy segment outshines its vehicle business, setting the stage for explosive growth and becoming its most profitable business.

Justin Sullivan/Getty Images News

Investment Thesis Update

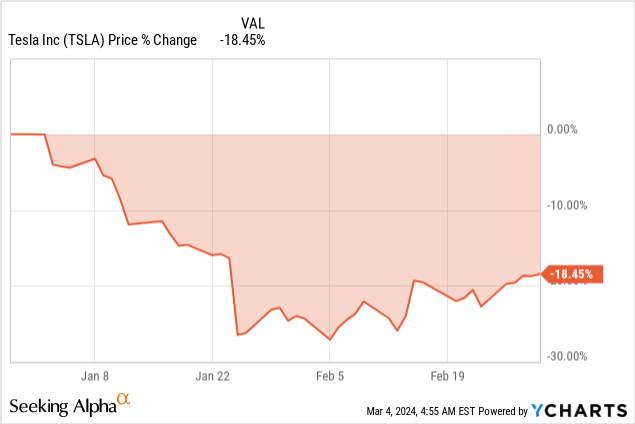

In 2023, Tesla, Inc. (NASDAQ:TSLA) exceeded 1.8 million electric vehicle (“EV”) deliveries, marking a 38% growth and asserting its lead in the EV market. Yet, looking to 2024, Tesla anticipates a slower expansion. This adjustment aligns with its broader goals, emphasizing not just automotive prowess but also the advancement of its energy sector and AI innovations amidst the Cybertruck launch and a focus on sustainable energy. Following the strong pullback of around 20% since our last coverage, we revise our rating upward to strong buy for the medium term.

Tesla Surpasses 1.8M Vehicles in 2023

In 2023, Tesla surpassed its goal by delivering over 1.8 million vehicles, marking a significant 38% growth, but entered 2024 with caution. During the fourth quarter, Tesla was on an annualized run rate where the production would have hit close to 2 million cars annually. Despite the previous year’s surge, management anticipates a more modest expansion, slower than 2023’s growth.

While not specifying a full vehicle sales target for 2024, Tesla’s management elaborated on less ambitious growth than in 2023. Ahead of the comment by the Fed, given the present market environment, NewStreet has estimated that there will be 20% to 25% YoY growth in 2024 for Tesla, taking the number of cars to 2.2-2.3 million units. Our estimated 2.2 million deliveries reflect a 20% year-over-year (YoY).

Not surprisingly, in Q4 2023, total Tesla deliveries were 484,507 cars, with 461,538 of them Model 3/Y, accounting for 95.3% of the total deliveries. At the same time, combined deliveries of Model S and Model X surged to about 22,969 units or so, netting off some Cybertruck deliveries. In the fourth quarter of 2023, the combined car production figure at Tesla reaped up to 494,989.

Finally, in the quarter, Tesla commenced sales of Cybertrucks, delivering initial units to customers. They expect the ramp of Cybertruck to be longer than that of other models due to its manufacturing complexity. Tesla now can build more than 125,000 Cybertrucks in a year. With order numbers growing, the company remains focused on ramping up, fulfilling demands, and reducing wait time. As long as the price is affordable, Musk envisions delivering somewhere on the order of a quarter-million Cybertrucks a year.

Author

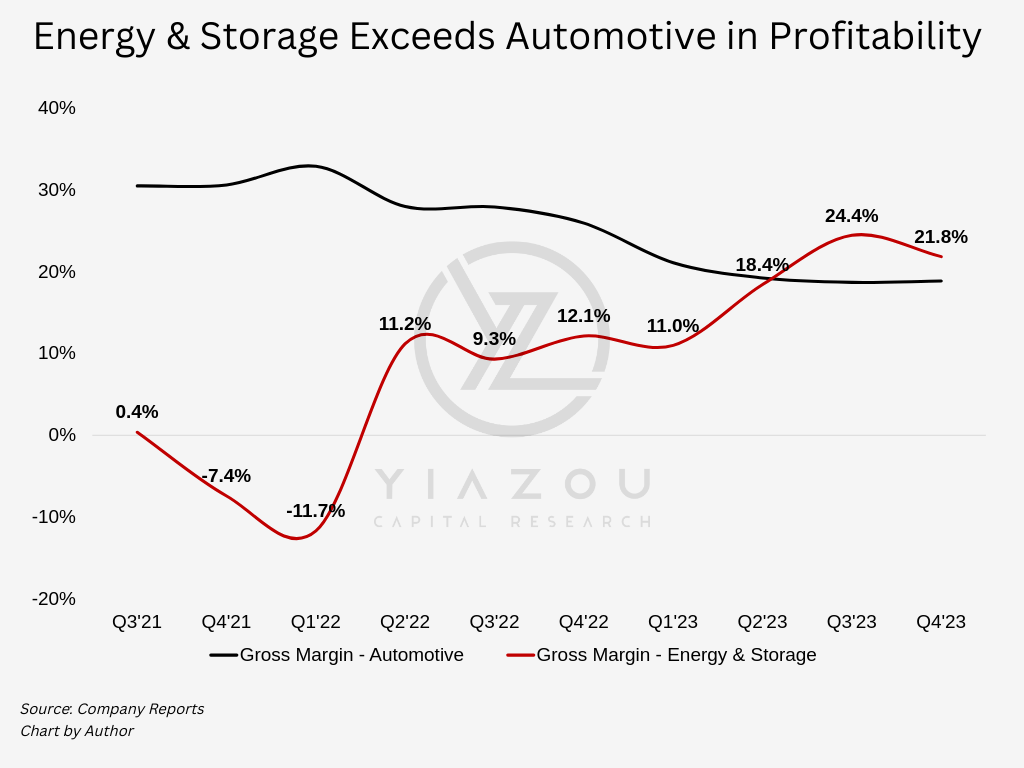

Energy Segment Outshines Vehicles, Setting the Stage for Explosive Growth

This segment added about 14.3% to the total revenue. The average YoY growth over these last six quarters was 53.9%, with about 17.4% of growth plugged into Value Research Online. The non-core group saw its gross margin improve by 188 basis points during Q4’23 over Q4 ’22, further illustrating the potential in this segment to make much profit for Tesla, together with sequential cost improvements boosting overall profitability.

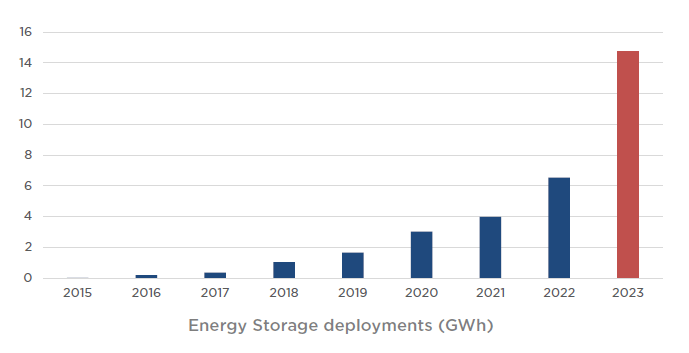

On the back of all these, the business had a revenue increase north of 50% year-on-year. Tesla’s energy business overtook that of the vehicle business in Q3 2023 and has remained so up to Q4 2023. The line, trickling slowly northwards, makes it plain that the formatting is intended in the sense that energy storage is on track to be huge.

Tesla’s energy business gross profit margin surpassed its vehicle business in Q3 2023 and remained so in Q4 2023. Consequently, energy storage is gradually emerging as Tesla’s most profitable business. Hence, this indicates the importance of their energy storage business, which will be the primary driver of the company’s strongest growth.

Author

Tesla expects continued growth in deployment on a trailing twelve-month basis in the future, with volatility on a sequential basis, impacted by logistics and the global distribution of projects at any given time. The management continues to ramp the 40 GWh Megafactory in Lathrop, CA, toward full capacity. They have also officially launched another 40 GWh Megafactory project in Shanghai, China – a replication of the Lathrop facility. Therefore, production is expected to start toward the end of 2024.

Tesla Q4 Update

Lastly, Tesla moved to the latest Master Plan: back to sustainable energy. The ultimate goal is to achieve 100% sustainable energy utilization by 2050. This milestone can only be met when at least 240 terawatt-hours (TWh) of energy storage capacity is installed: power station energy storage and car batteries. In this ambitious milestone, the Megafactory Tesla shall have a significant role in energy storage.

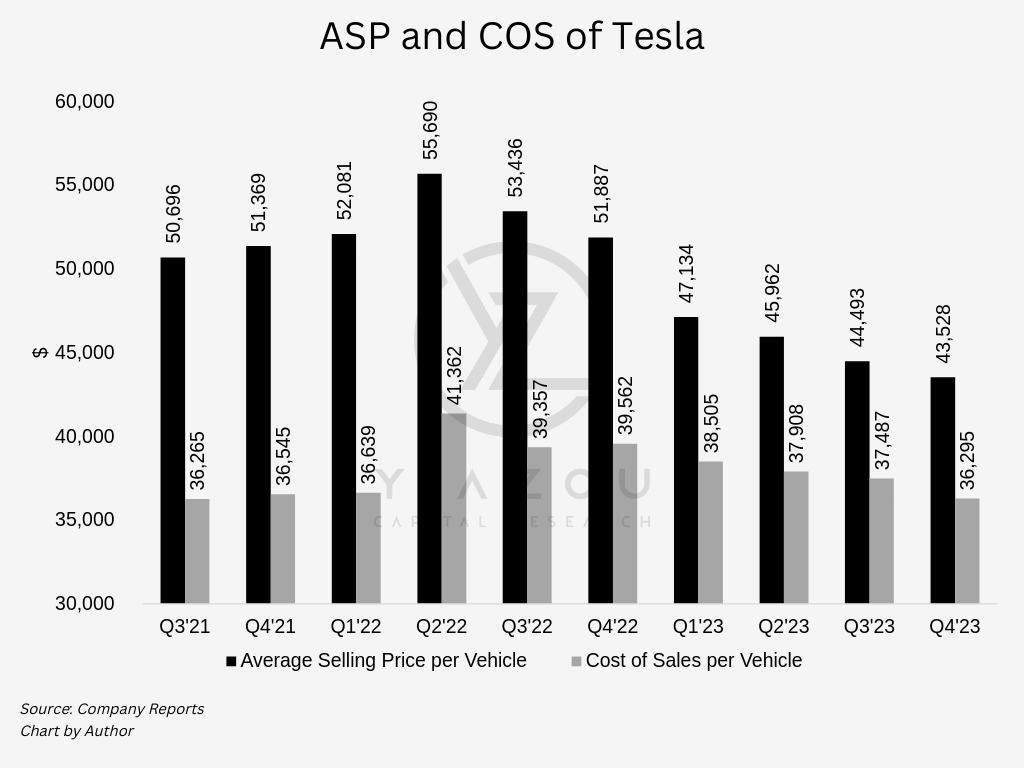

On the Road to Affordability: Tesla’s Smart Play with Declining ASPs

TSLA’s gross profit margin has been on a downward trend for the last seven quarters, driven by a declining average selling price (ASP) of its vehicles and a relatively stable cost of sales per vehicle. The gross profit margin of TSLA dropped to 17.6% during Q4’23 (but at a slower pace), down from 23.8% during Q4’22. The average selling price of TSLA’s vehicles dropped to $43,528 during Q4’23, down from $51,887 in Q4’22, registering a 16.1% YoY decline.

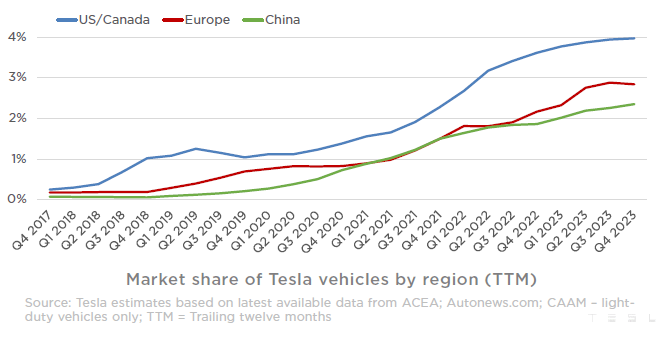

As part of its strategic initiative to democratize autonomous driving, Tesla has been consciously reducing the ASP of their vehicles and making them more affordable. With this strategy, Tesla aims to extend its market reach while fortifying the entire AI-driven automotive technology ecosystem. The Tesla ASP is now less than the average non-luxury car price of $45,000.

Author

The primary driver behind the decrease in the ASP was Tesla’s deliberate price cuts to expand its market reach. Concurrently, Tesla managed a modest 8.3% YoY reduction in the cost of sales per vehicle during Q4’23. This strategy has also supported Tesla in tackling the increasing competition from BYD, the biggest rival for now, especially in the Chinese market, which contributes 22.5% to the total revenue, based on the Q4 2023 disclosure. With a gradual decline in ASP, TSLA has gained market share each quarter in China.

Tesla Q4 Update

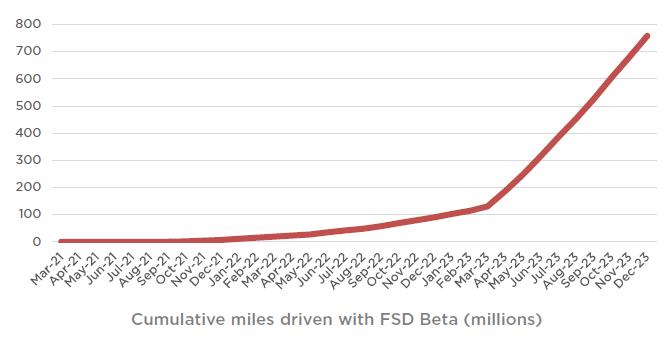

Tesla isn’t merely an automobile manufacturer; it’s transforming into an automotive technology powerhouse. Beyond integrating their native supercomputer, Tesla Dojo, into vehicles, Tesla’s strategic developments pave the way for licensing their advanced machine learning algorithms to third parties. This shift enhances Tesla’s core business and unlocks lucrative opportunities for the electric vehicle maker in diverse markets.

Realizing the utmost potential of its supercomputer capabilities compels Tesla to accumulate substantial data and log extensive driving miles. This imperative accentuates the need for Tesla to elevate its car sales volume, emphasizing the critical role of enhancing affordability across its vehicle lineup. This unified strategy underscores Tesla’s grander vision-not confined to mere car production but aiming to establish itself as a pivotal force in the evolving realm of automotive technology and machine learning.

The chart’s upward trajectory will intensify as Tesla aims to make its cars more accessible, catering to the mass market. This strategic move will concurrently enhance the supercomputer’s capabilities in training Full Self-Driving (FSD) systems. Reaching the mass market also hinges on Tesla rapidly expanding its supercharger stations, which have exhibited robust growth, averaging 31.6% YoY for the past five quarters. Notably, this expansion has paced well the impressive average car delivery growth of 39.9% during the same period.

Tesla Q4 Update

Optimus: A Visionary Step Towards a Billion Humanoid Robots by the 2040s

Unveiled at Tesla’s groundbreaking Artificial Intelligence (AI) Day event, the Optimus AI Robot, colloquially known as “Tesla Bot,” marks a bold stride toward crafting a versatile humanoid robot. Beyond mere automation, Tesla envisions Optimus as a solution for handling tasks deemed unsafe, repetitive, or mundane for humans.

Despite Tesla executives withholding specific details about the production timeline for Optimus, there’s a likelihood that the initial units of these humanoid robots could hit the market as early as next year. Notably, the AI technologies integral to Tesla’s cars seamlessly transition to the 2nd generation of Optimus, utilizing the same AI inference computer and training technology. The development of AI technology for both vehicles and robots will happen concurrently.

Key competitors in this burgeoning market include Boston Dynamics, Agility Robotics, and Figure. Other players such as Sanctuary, Apptronik, 1X, Fourier, and Unitree emphasize advancing dexterous manipulation hardware, emulating human hands.

Optimus can find a path to reach its target through cluttered and dynamic homes and workplaces, according to the tech expert Taimur Ijlal, thanks to complex computer vision, neural networks, and real-time decision-making algorithms. While Boston Dynamics and Agility Robotics excel in cutting-edge robotic capabilities, their robots often come with higher costs. Therefore, Optimus is in a position of cheap offers compared to the high costs of other robots, which would indicate the true state of the robotics market and open the way to the newly identified market segments for the product.

Elon Musk asserts that Optimus is the most sophisticated humanoid robot under development globally. In a recent video clip, the humanoid machine exhibits noticeably smoother and steadier movements than its predecessors, indicating ongoing enhancements by the engineering team, potentially leading to a launch in 2025, and all this at a speculated cost of less than $20,000. Mask envisions the Optimus project surpassing the significance of Tesla’s vehicle business, foreseeing a future where a billion humanoid robots could populate the Earth by the 2040s.

Elon Musk recently captivated social media by posting a video on X of the humanoid robot Optimus, which quickly went viral. The video showcases Optimus navigating a lab unassisted, including making turns, sparking widespread excitement. Musk’s post, “Optimus strolling around the lab,” teases the robot’s capabilities, following a previous video where Optimus folded a shirt, hinting at future autonomous functions in various environments.

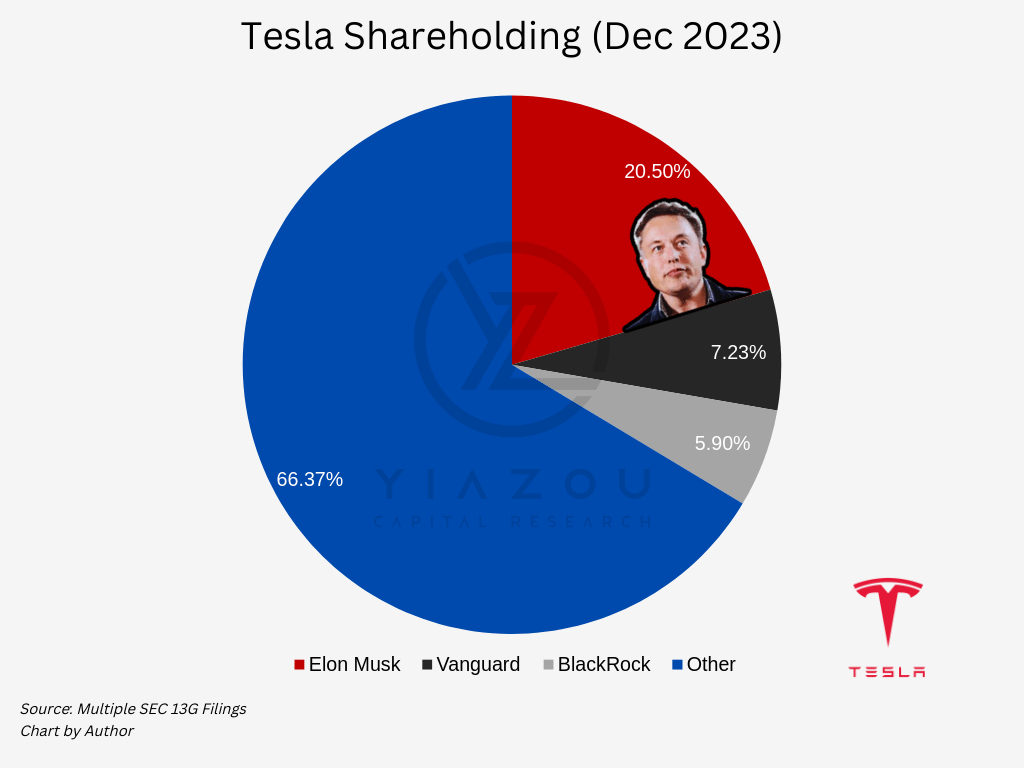

Musk Seeks Greater Control: Aims for 25% Stake in Tesla

In January 2024, Elon Musk, the CEO of Tesla, tweeted about his desire to increase his ownership stake to 25%. Musk stated that he is (emphasis added):

uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control.

He emphasized that this level of ownership would allow him to be influential but not to the extent that he couldn’t be overturned. He wants to ensure that the major decisions related to Tesla’s future, especially AI and robotics, align with his vision.

Some Tesla shareholders have pledged their support for Musk’s ownership goal. They recognize the importance of maintaining AI initiatives within Tesla, as these projects are crucial for the company’s growth and innovation. Investors are concerned that Musk’s establishment of a separate company for his next-generation AI projects might adversely affect Tesla’s valuation. Many are drawn to Tesla because of its AI-related initiatives, such as the FSD chip and robotic developments.

As of now, Musk’s ownership stake in Tesla stands at approximately 13%. A recent SEC filing revealed that his ownership has soared to 20.5%, worth over $120 billion. Musk’s wish to control even more of Tesla will undoubtedly add to the pressure on Tesla’s board of directors in 2024. Finally, analysts anticipate that the Tesla Board and Musk will work to resolve this issue over the next 3-6 months.

Author

Concluding Thoughts & What to Expect

While Tesla refrained from offering explicit guidance on future revenue, earnings, or margins, it cautioned about a “notably lower” growth trajectory for its auto business in 2024. Anticipating robust growth in storage, Tesla foresees its storage business outpacing the automotive sector. Positioned between growth phases, the company prioritizes seamless execution for the forthcoming wave driven by next-gen vehicles, energy storage, and FSD capabilities.

Despite the early phase of the Cybertruck rollout, Tesla notes improvements in per-unit costs, leading to sequential enhancements in auto-gross margin. For 2024, the focus is on expanding output, cost reduction, and increased investments, with capital expenditure expected to exceed $10 billion.

Finally, the production of next-gen platform vehicles is planned for the second half of 2025, contingent on interest rates influencing margins. Thus, acknowledging potential fluctuations in growth rates, Tesla emphasizes the transitional phase between two significant growth waves, attributing slower growth in 2024 to the upcoming launch of the next-generation vehicle. Nevertheless, the favorable outlook and strong pullback offer an attractive entry point for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.