Summary:

- Qualcomm Incorporated is pushing into AI chips for PCs and smartphones, providing exceptional growth avenues.

- The wireless chip company has a new multi-year agreement with Samsung, providing tools for generative AI in smartphones.

- The stock trades at only 15x FY25 EPS estimates with potential upside to both EPS targets and further room for market expansion.

AutumnSkyPhotography

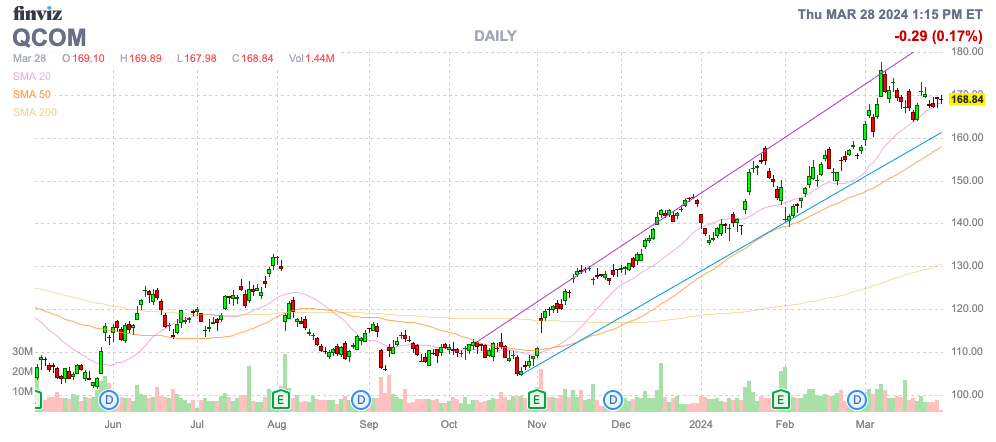

Qualcomm Incorporated (NASDAQ:QCOM) has come roaring back after the stock was an easy buy around $105. The wireless chip company, pushing into artificial intelligence, or AI, chips, isn’t the same easy money now trading up at nearly $170, but Qualcomm isn’t priced like an AI play yet. My investment thesis remains ultra Bullish on the stock, which is still trading below a market multiple.

Source: Finviz

AI Chip Push

The handset market appears to have peaked placing Qualcomm in a precarious position, if the company was still reliant on this sector for growth. The wireless chip company has already shifted into the Automotive and IoT sectors with the latest push into AI chips for both PCs and smartphones providing exceptional growth avenues.

Source: Qualcomm FQ1’24 presentation

Qualcomm has a new multi-year agreement with Samsung (OTCPK:SSNLF) with the recently launched AI features of Snapdragon 8s Gen 3 Mobile Platform providing the smartphone manufacturer with tools to lead in generative AI. CEO Cristiano Amon discussed the new features on the GalaxS24 on the FQ1’24 earnings call as follows:

The GalaxS24-Series includes on-device AI features such as live translate, interpreter, chat assist, nitography and more. This marks the beginning of how gen AI will evolve the overall smartphone experience and highlights the significant opportunity for Snapdragon platforms.

Best Buy (BBY) has already discussed how Samsung smartphones were hot due to the generative AI features focused on the Snapdragon chips from Qualcomm as discussed by the CEO on the recent Q4 ’23 earnings call (emphasis added):

There are many examples of innovation, both already introduced and expected through the year that we believe will drive interest, including the Samsung AI enabled phone. We are already seeing materially more demand than we expected…

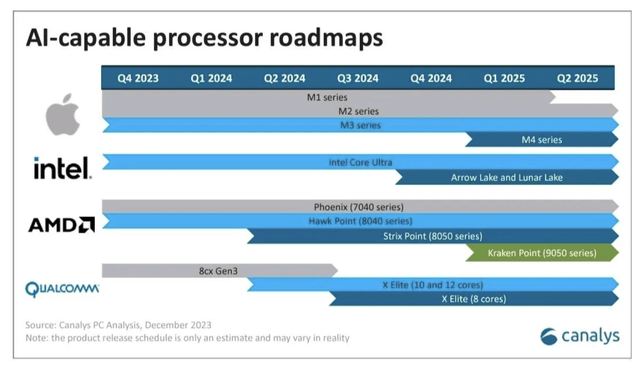

While the AI-enabled chips from smartphones is a natural extension of Qualcomm’s handset market, the big story are the AI PC chips. The company has the Snapdragon X Elite chip coming out in laptops around mid-2024. The chip appears to test favorably compared to AI chips coming out from Intel (INTC) and Advanced Micro Devices (AMD) along with the M3 chip used by Apple (AAPL).

The fact Qualcomm made an AI-capable processes roadmap chart from Canalys is a massive step in the right direction. The company has a legitimate opportunity to capture market share in the PC market now.

Naturally, Qualcomm has a long way to go from building an AI PC chip that test greats to actually convincing consumers to purchase a laptop with the chips. The mobile chip company is definitely the Cinderella story in the AI PC sector, but the PC business is just a bonus at this point.

Qualcomm is set to release updated design wins for the Automotive segment with the March quarter results (expected May 1st). The chip company has already outlined orders in the automotive segment leading to sales growing from under $2 billion reported in FY23 surging to $4 billion in FY26 based on a total contract book topping $30 billion.

A prime reason for the large and growing Automotive order book is the fusion of infotainment and ADAS functionalities on a single SoC with the follow features:

- Snapdragon Ride Flex – high-performance central compute SoCs that are designed to support mixed-criticality workloads across heterogenous compute resources, allowing for digital cockpit, advanced driver-assistance system (ADAS) and AD functions to co-exist on a single SoC.

Back To Normal Valuation

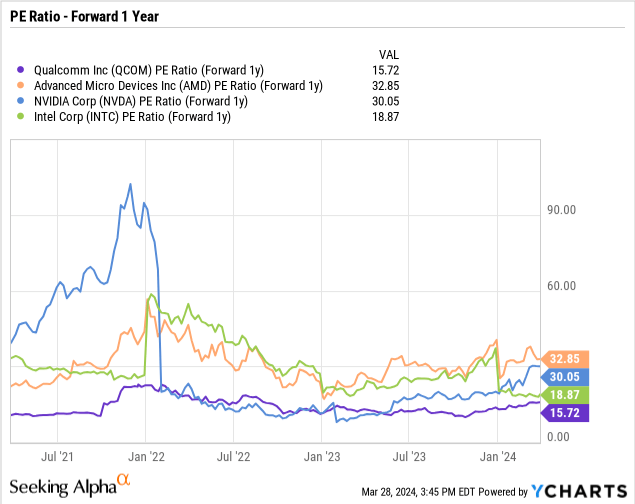

A key to understanding the investment story is understanding how cheap Qualcomm traded back at the lows. While chip stocks regularly trade at 20x, 30x, or even higher multiples of forward earnings, especially AI chip companies now, the wireless chip company still only trades at ~15x FY25 EPS targets.

In essence, Qualcomm is just back to trading at a more normal valuation with known opportunities for growth in AI chips only now starting to kick off in the just ending FQ2. The PC chip portion won’t start until mid-year while the IoT and handsets business should improve in 2024.

As discussed in the prior research, Qualcomm peaked with a $12.53 EPS in FY22, yet the 5G business is set to grow ~10% this year. Along with the large growth in the Automotive business through FY26, the company should be back to reporting record results long before AI PC chips gain material market share.

The stock only trades at 15x FY25 EPS estimates of just $10.76. Qualcomm is cheap based on EPS estimates still far below the peak levels while the business should ultimately top those peak levels from back in FY22 providing the opportunity for both earnings growth and more multiple expansion.

Takeaway

The key investor takeaway is that Qualcomm has rallied substantially off the October lows, but the stock is still cheap unlike most chip stocks. Investors should’ve used the weakness in 2023 to load up on the wireless chip giant, but Qualcomm is still cheap now and could head far higher on a rebound in profits and further multiple expansion, with any success in AI PC chips possibly lighting a fire under the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end Q1, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.