Summary:

- Qualcomm Incorporated’s strong fiscal Q4 financials include over $10 billion in revenue, annualized EPS of $10/share, and a P/E ratio in the high teens.

- The company’s guidance forecasts nearly $11 billion in revenue and EPS approaching $12/share, driven by strong margins and reduced share count.

- Qualcomm leads in segments like Snapdragon processors, automotive intelligence, and Wi-Fi 7, despite risks from potential Intel acquisition and Arm lawsuit.

- With $11 billion in FY24 FCF, Qualcomm remains committed to shareholder returns, offering a total shareholder yield of ~6%.

G0d4ather

Qualcomm Incorporated (NASDAQ:QCOM) is one of the largest semiconductor companies in the world. The company has a market capitalization of almost $200 billion as its stock has trended down from mid-2024 picks. The company also has some major volatility from a potential acquisition of Intel (INTC), along with threats from its largest customers. Despite that, the company’s stock is a valuable investment.

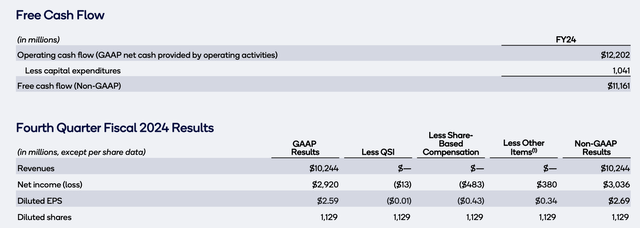

Qualcomm Financial Results

Qualcomm had strong results in the quarter, with more than $10 billion in revenue and annualized EPS crossing $10/share.

Qualcomm Investor Presentation

That puts the company at a P/E ratio in the high teens as the company has continued to see strong margins from its business. The company has remained committed to shareholder returns that it can comfortably afford. The company has an almost 2% dividend yield and almost 3% of buybacks, putting it at mid-single-digit returns.

The company spends virtually all of its cash on shareholder returns at its current valuation.

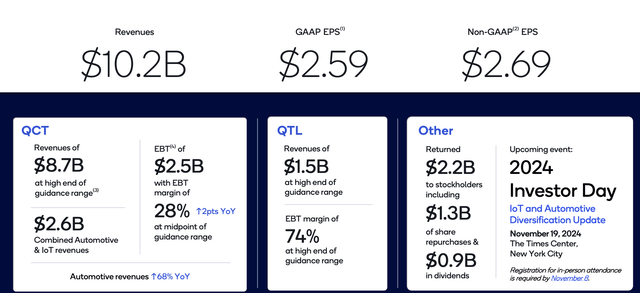

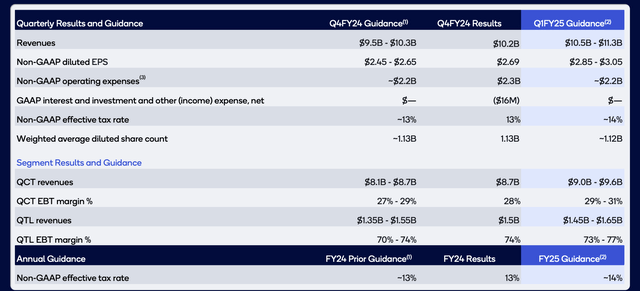

Qualcomm Guidance

The company’s guidance is for continued strength from an impressive portfolio of assets.

Qualcomm Investor Presentation

The company expects almost $11 billion in revenue after coming in at the top-end of its guidance recently. That could push the company’s diluted EPS toward $12/share annualized, an almost double-digit improvement at the midpoint given no expansion in expenses. At the same time, the company continues to reduce its share count.

The company expects strong margins and growth in its guidance, which will enable it to grow its returns and justify its valuation.

Qualcomm Segment Performance

The company has continued to be a leader in its segments despite the risks it faces.

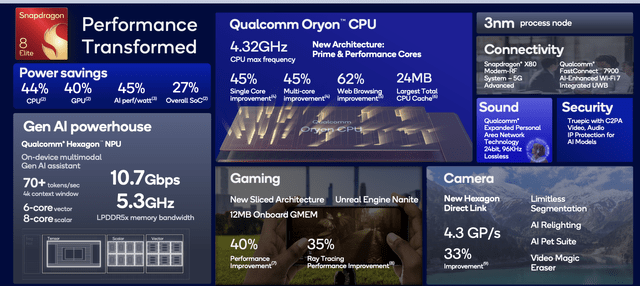

Qualcomm Investor Presentation

The company’s Snapdragon 8 Elite is a leader in handsets with deals with a number of major Arm producers. It’s worth noting here that nearly 50% of Qualcomm’s sales come from China, where a number of major phone producers are based internationally. Future trade wars could be a major impact to the company here.

The company has continued to build up its performance with AI strength, power savings, and cutting-edge 3 nm silicon. The company has maintained competitiveness with leading Apple processors, which is an impressive accomplishment.

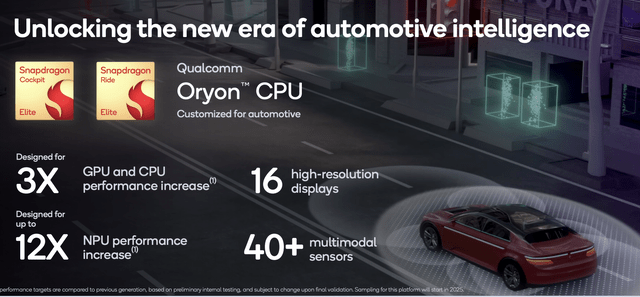

Qualcomm Investor Presentation

The company is also continuing to build up its automotive intelligence, an important field as cars get safer even in a non-self-driving world. The company has seen 3x GPU and CPU performance increase here and the ability to provide higher tech displays with numerous sensor inputs. Major car companies are less tech-competitive here, so the company can build a stronger moat.

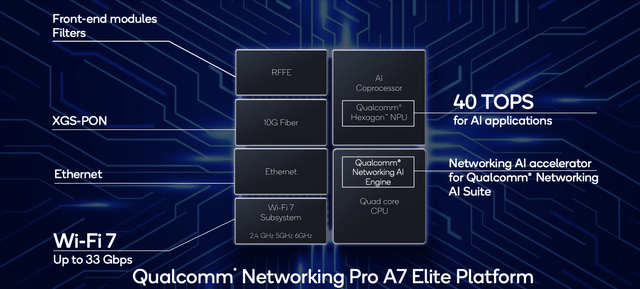

Qualcomm Investor Presentation

In Wi-Fi and Ethernet, the company also remains a leader with Wi-Fi 7 being built up with 33 Gbps total speed. The company’s licensing business QTL has also continued to achieve incredibly strong margins of more than 70%, and we expect those margins to remain strong.

Qualcomm Shareholder Returns

Overall, as we partially discussed above, the company remains committed to shareholders.

Qualcomm Investor Presentation

The company had more than $11 billion in FY24 FCF. That has enabled the company’s annual FCF of almost $9 billion, and we expect the company to continue providing its lofty shareholder returns. Given its P/E its total shareholder yield is capped at ~6%, however, we expect the company to be able to continue growing especially based on its guidance.

Those returns show the company’s financial strength.

Intel and ARM

There are two major discussions underway here that could impact Qualcomm substantially.

The first is that the company might buy Intel in its weakened state. These are all rumors, but with Intel’s $110 billion market capitalization, it would be one of the largest tech acquisitions of all time. It would be incredibly expensive before any premium that’s paid. Such an integration would face lengthy antitrust proceedings and be difficult to integrate, which is worth noting.

The second is another lawsuit for the company, a feud with one of its most important business relationships with Arm Holdings (ARM). That’s escalated recently with a 60-day notice of cancellation from Arm for the IP underlying much of its assets. How it resolves remains to be seen, but similar to the company’s lawsuits with Apple (AAPL), it could be an expensive and drawn-out process.

Thesis Risk

The largest risk to our thesis is that Qualcomm’s customers are some of the largest companies in the world. The company spent years in a very public lawsuit with Apple, the largest company in the world, over licensing fees that it ultimately won. However, rumors are that Apple is now looking to cut out the company. Aspects like this could hurt future shareholder returns.

Conclusion

Qualcomm is a leader in tech, especially for companies that don’t have the scope to build their own cutting-edge products. The company’s Snapdragon processors, for example, remain strong and while some companies like Samsung have struggled, we expect that to support the company’s ability to continue performance.

The company has numerous business segments, including licensing, that continue to drive strong margins. The company has some major potential interesting developments and risks with an acquisition of Intel and lawsuits with Arm. However, overall, we expect Qualcomm Incorporated to continue its growth, making the stock a valuable investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.