Summary:

- Qualcomm Incorporated was an early innovator of wireless technologies.

- It has a high customer concentration risk.

- Qualcomm is diversifying into new growth markets such as mobile AI chips, automotive technology, IoT, and VR/AR/MR chips.

AutumnSkyPhotography

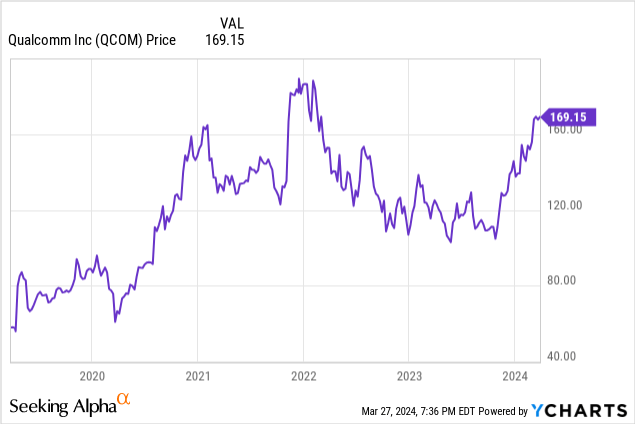

After a considerable downdraft in QUALCOMM Incorporated‘s (NASDAQ:QCOM) stock price since the beginning of 2022 due to a declining mobile phone market, investors started waking up to its potential opportunity in generative Artificial Intelligence (“AI”) near the end of 2023. Although the company may no longer be a go-go growth stock, when investors began looking around for companies that could benefit from the proliferation of generative AI, they found Qualcomm selling for an excellent value and a massive opportunity for providing chipsets that can run AI algorithms locally on a device rather than some far-away cloud. The stock started rising after closing at $103.59 on October 25, 2023, and has never looked back.

On January 8, 2024, Cathie Wood and Ark Invest started buying Qualcomm for two of their ETFs. On January 12, 2024, Citi Research upgraded the stock to a buy, raising the target price to $160 from $110. The day Citi raised the target, the stock was trading around $140. So, the company’s positive attributes are no longer flying under the radar. Its closing price on March 27, 2024, shown on the chart above, is up 63% from its closing price on October 25, 2023. After the sharp rise in stock value over the last five months, some may wonder if they missed the boat on this one. However, although some might question the valuation, I believe investors still have the potential upside in Qualcomm to buy it at the current price.

This article will discuss Qualcomm’s original core wireless business and its opportunities beyond the wireless industry. It will also discuss its first quarter fiscal year (“FY”) 2024 results, review its valuation and a few risks, and explain why investors should consider buying the stock at the current price.

A leader in wireless technology

Qualcomm is an early innovator in wireless technologies; the company started its journey in wireless in 1985. The company owns many patents vital to many of today’s most widely used mobile communications standards. In Qualcomm’s FY 2023 10-K, it describes itself the following way,

“We are a global leader in the development and commercialization of foundational technologies for the wireless industry, including 3G (third generation), 4G (fourth generation) and 5G (fifth generation) wireless connectivity, and high-performance and low-power computing including on-device artificial intelligence (AI).“

The wireless business served Qualcomm well for many years. Since the company had its initial public offering at $0.33 in 1991, the stock was up 51,151.52% to $169.13 on March 27, 2023. The mobile phone market was still in healthy growth mode until 2016, when global smartphone sales peaked, according to Statista. The global smartphone has matured, and, at best, low single-digit growth lies ahead of the industry. One of the biggest reasons Qualcomm is diversifying into other markets is that management wants to enter higher growth and less mature markets to boost revenue growth. Let’s look at some of the markets where Qualcomm plans to diversify.

New growth markets

Qualcomm has entered several promising markets adjacent to its core wireless business that could produce significant growth for years to come. These growth markets include Mobile AI chips, advanced automotive technologies, the Internet of Things (“IoT”), Edge Computing, Generative AI inferencing server chips, and wearable technology.

Management’s philosophy for deciding to manufacture AI chips for the above applications is rooted in the idea that most AI inferencing today still occurs in the cloud. However, for AI to become truly useful and proliferate, AI data crunching will eventually need to happen on local devices for multiple reasons. Some of these reasons include:

- Latency: The time it takes for data to travel to the cloud and for inferencing chips to respond and data packets to return takes too long for real-time applications such as autonomous vehicles, factory automation, and medical devices, where quick responses are essential.

- Lower power consumption: AI chips in many IoT, edge, smartphones, and wearables applications operate on batteries. These applications require chips with low power to avoid draining battery power too rapidly.

- Data privacy and security: Private data stays on the device, lowering the ability of cloud providers to mine user data and reducing the threat of hackers accessing user information.

- Reduced Cost: Many local applications perform tasks that don’t require all the computational power of chips located in the cloud, whose power-intensive chips would run up costs. The local chips Qualcomm designs use far less power, lowering the cost of inferencing.

- Offline capability: Local AI chips can still perform tasks when or where the Internet is not available.

If you listen to enough commentary on AI from Qualcomm management, the term “Pervasive AI” might pop up. A pervasive AI world implies that businesses will embed AI technologies into everyday products and services. In this world, almost every service or product you use or interact with will have AI embedded in the core functionality. During the JPMorgan Hardware & Semis Management Access Forum on August 16, 2023, Chief Financial Officer Akash Palkhiwala said the following (emphasis added):

So if you think about pervasive AI, whether it’s a copilot for an office application, or whether it’s a copilot or AI being used on top of content that is being created by users all those use cases requires AI to be on the device. And so we just think there’s a whole set of use cases that demand the need for AI to be on the device. We have really strong technology, we think that enables that. Of course, we have the CPU. We have the GPU and both of those cores can do generative AI. But more importantly, what’s going to be critical in the longer-term in our minds is to have a very low power neural processing engine that can do AI on the device. And if you’re going to do pervasive AI that happens several times every minute, it needs to be extremely low power and the advantage of having our neural processor is it can enable use cases like that.

Source: JPMorgan Hardware & Semis Management Access Forum Transcript.

Pervasive AI is another way to say that AI-enabled wearables and IoT devices will eventually become ubiquitous. CFO Akash Palkhiwala later says in that same conference that the use cases in a pervasive AI world will break down into three broad categories: “consumer, enterprise, and industrial.” No one really knows how large the opportunity will become and how much of the market Qualcomm can capture.

When looking at analysts or even company revenue and earnings estimates, it’s important to remember that they may be underestimating the future growth potential in a pervasive AI world where a future use case not yet imagined may make the opportunity far more significant than anyone can currently estimate. That’s the upside in some new growth areas Qualcomm has entered or will enter.

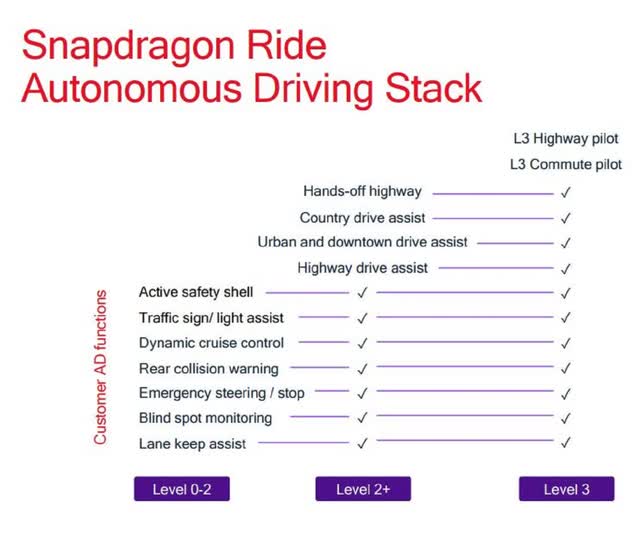

One area investors should monitor is autos. Car manufacturers are rapidly turning autos into computers on wheels, and this business aligns with Qualcomm’s vision of enabling a pervasive AI world. The company has multiple products designed for the auto market. Since its business started in the wireless market, Qualcomm has built a full suite of wireless solutions for this segment, including 5G, Bluetooth, C-V2X (Cellular Vehicle-to-Everything), and Wi Fi.

Qualcomm also provides the car’s computing system interface through a digital cockpit filled with personalized features for both the driver and passengers. These features include driver monitoring systems, safety and security cameras, high-resolution displays, Wi Fi and Bluetooth systems, premium audio with noise cancellation systems, infotainment systems, AR, and generative AI.

Also included in auto revenue is Advanced Driver Assistance Systems (“ADAS”), which is a safety and driver assistance feature that is starting to become common on new vehicles. ADAS features include emergency braking, adaptive cruise control, lane assist (helps automatically keep a car in its lane), lane departure warning (alerts driver as the vehicle crosses lane markers), high beam control, driving monitoring, and more. The platform uses multiple cameras, radar, lidar, C-V2X, maps, and an on-board computer. The following image from Snapdragon Ride Platform Presentation shows some of the features that Qualcomm’s system includes:

Snapdragon Ride Platform Presentation

Qualcomm’s leading collaboration partner for developing ADAS up to level 3 driving is BMW (OTCPK:BMWYY). Other companies Qualcomm has collaborated with are Renault (OTCPK:RNSDF, OTCPK:RNLSY) and Cariad, the software arm of the Volkswagen Group (OTCPK:VWAGY, OTCPK:VLKAF, OTCPK:VWAPY).

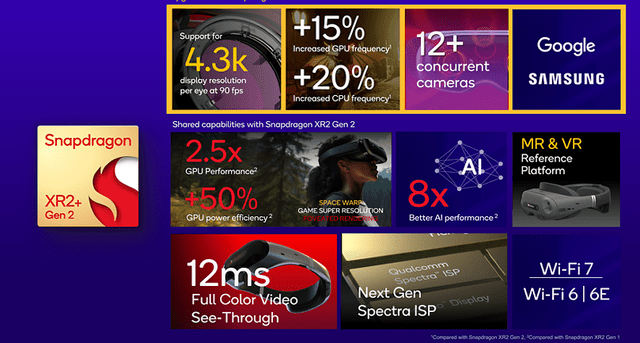

The last Qualcomm expansion area that I will discuss in this article is Virtual Reality (“VR”), Augmented Reality (“AR”), and Mixed Reality (“MR”) chips — an area investors should monitor as the market has high revenue growth potential. AR technology overlays virtual images onto a real-world view but limits users from interacting with the virtual elements in their vision. MR technology also overlays interactive virtual elements into a real-world view, except users can interact with those elements. The difference between AR and MR is the level at which a person can interact with the virtual images. Last, VR technology creates a 100% simulated interactive 3D environment.

Let’s review a few of the most significant players in the space. First, there is Meta Platforms (META), whose primary vision appears to be a fully immersive virtual world experience called the metaverse. This experience mostly takes place on the company’s proprietary VR hardware. Later, the company developed MR headsets (Quest Pro) and AR glasses (Ray-Ban). Meta and Qualcomm formed a partnership where Meta will use custom Snapdragon XR platforms and collaborate to develop future technologies for building the metaverse. If the metaverse pans out and becomes as big as Meta CEO Mark Zuckerberg thinks it could be, this partnership could be a potential growth driver in the future.

Next is Alphabet’s (GOOGL, GOOG) vision for AR, MR, and VR. Over the years, Google has developed many AR, MR, and VR hardware projects. The company has reportedly discontinued all of them, with the latest cancellation being Project Iris, Google’s attempt to produce AR glasses. It cancelled Project Iris in 2023. Various news outlets have reported that Alphabet recently tried to create a partnership with Meta, where Alphabet wanted Meta’s AR, MR, and AR hardware to use the Android XR software platform. However, Meta rejected that deal. Instead, Google collaborates with Samsung (OTCPK:SSNLF) and Qualcomm to develop an AR and VR platform.

Other significant Qualcomm AR/MR/VR customers include HTC Corporation (OTC:HTCKF) and Pico Interactive, owned by ByteDance (BDNCE), the parent company of TikTok.

Last is Apple (AAPL), which released Vision Pro in February 2024. Customers can use Vision Pro as an MR or VR headset, although the company doesn’t promote the technology as being in either category. Instead, the company calls Vision Pro a “spatial computing” device. According to one publication, instead of using Qualcomm chips like a few of its competitors, Apple uses its proprietary M2 Silicon chip and its purpose-built R1 graphics processor. I included Apple here because its AR/MR/VR solutions could be a significant competitor to other companies in the space using Qualcomm solutions.

The above markets are all potential high-growth areas, one reason some investors are willing to give Qualcomm a higher valuation.

Excellent first quarter FY 2024 earnings results

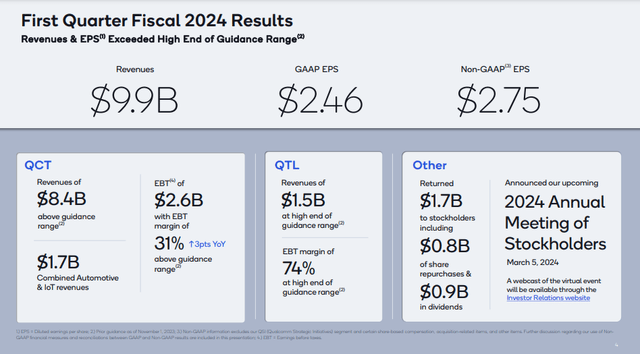

The image below shows Qualcomm’s first quarter FY 2024 highlights breaking out the company’s two reporting segments: QCT (Qualcomm CDMA Technologies) and QTL (Qualcomm Technology Licensing). QCT represents revenue generated from hardware and software based on Qualcomm’s 3G, 4G, and 5G intellectual property sold to customers for usage in mobile devices, IoT devices, edge networking products, automotive systems, and other devices. QTL is the company’s global intellectual property licensing program.

Qualcomm First Quarter FY 2024 Investor Presentation.

First, let’s discuss QCT, which Qualcomm further divides into three reportable revenue streams: Handsets, Automotive, and IoT. One important thing to remember about the company’s results over the last year is that the mobile phone and IoT industry has languished in a downturn. The good news is that Handset and Auto revenue are rebounding higher in the first quarter, as shown in the charts below.

From Seeking Alpha Seeking Alpha

It’s good to see Handset’s revenue growth accelerate, as it is Qualcomm’s largest revenue source. Chief Financial Officer Akash Palkhiwala said about the segment (emphasis added):

Handset revenues of $6.7 billion were higher than our prior expectations primarily due to the increased demand driven by the acceleration of Android flagship launches with our Snapdragon 8 Gen 3 mobile platform. Notably, our Android handset revenues from Chinese OEMs exceeded our expectations of greater than 35% sequential growth.

Source: Qualcomm First Quarter FY 2024 Earnings Call Transcript.

One reason that investors have taken interest in the company lately is that experts like market intelligence service International Data Corporation (“IDC”) forecast the global smartphone market to recover in 2024, growing 2.8% over 2023, which is in stark contrast to a downbeat market that smartphone manufacturers have encountered recently. According to IDC, “Over the past seven years, the worldwide smartphone market has contracted six times on an annual basis.” If smartphone growth does reaccelerate, it could act as a revenue growth tailwind for 2024 and beyond.

However, Qualcomm management predicts little to no increase in the number of handsets sold globally in 2024 compared to 2023. So, investors should continue monitoring this segment to see if revenue continues upward. If Handset growth continues, investor sentiment toward the stock should grow even more positively.

As for Automotive, Qualcomm is still in the early stages of scaling the business. Chief Executive Officer (CEO) Cristiano Amon said about Snapdragon Ride, its auto product, on the first quarter earnings call:

Automotive continues to be an important pillar of our growth and diversification strategy. Notably, 75 new models launched commercially in 2023 were for technologies, highlighting Qualcomm’s [growing] scale in automotive and execution of our design wins. Earlier this month at CES (Consumer Electronics Show), we announced our collaboration with Bosch to have our Snapdragon Ride Flex SoC power their new central vehicle computer. As a reminder, Snapdragon Ride Flex enables the fusion of infotainment in ADAS functionalities on a single SoC enabling automakers to realize a unified central-compute and software-defined vehicle architecture that scales across tiers. Additionally, we demonstrated digital cockpits connected services and advanced driver systems enabled by gen AI models running locally on the Snapdragon platform.

Source: Qualcomm First Quarter FY 2024 Earnings Call Transcript.

The IoT segment remains stuck in an inventory correction caused by weaker demand in an uncertain market across 2023. If IoT revenue rebounds soon, it should help investor sentiment towards Qualcomm as it is part of the company’s new growth markets and essential for its diversification efforts. Once the economy becomes less uncertain and demand returns, this segment’s revenue should return to growth. The following chart shows that IoT revenue remains on a downward trend.

Seeking Alpha

As for the QTL segment, the good news is that Apple extended its license agreement to March 2027. Apple is looking to move away from Qualcomm technology in the long term, and several years ago, some thought Apple might have cut ties with Qualcomm by now. A two-year renewal gives management several more years to diversify its business so that if and when Apple does leave, the blow won’t land as hard. CEO Cristiano Amon said on the earnings call:

First, Apple exercised its unilateral option to extend its global patent license agreement for an additional two years, taking the existing agreement through to March 2027; second, we have renewed long-term agreements with two significant Chinese smartphone OEMs. In addition, we continue to negotiate new agreements or renewals with other key licensees and OEMs, including some whose current agreements are set to expire in early fiscal 2025.

Source: Qualcomm First Quarter FY 2024 Earnings Call Transcript.

The table below from Qualcomm’s first quarter FY 2024 earnings release shows QCT and QTL revenue and EBT metrics for 2023 and 2024. The acronym EBT stands for earnings before taxes. Qualcomm reports EBT to remove the impact of taxes on earnings, which may be very different depending on the region. The company includes EBT to give investors a better view of each segment’s core profitability.

Qualcomm First Quarter FY 2024 Earnings Release

Qualcomm’s first quarter 2024 QCT EBT margin was 31%, compared to 28% in the first quarter of 2023. In the first quarter of 2024, QCL’s EBT margin was 74%, compared to 73% in the first quarter of 2023. So, core profitability is up for both reporting segments compared to last year. Let’s look at the consolidated results:

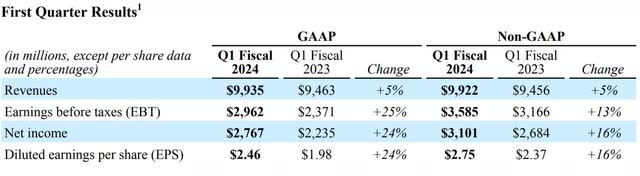

Qualcomm First Quarter FY 2024 Earnings Release

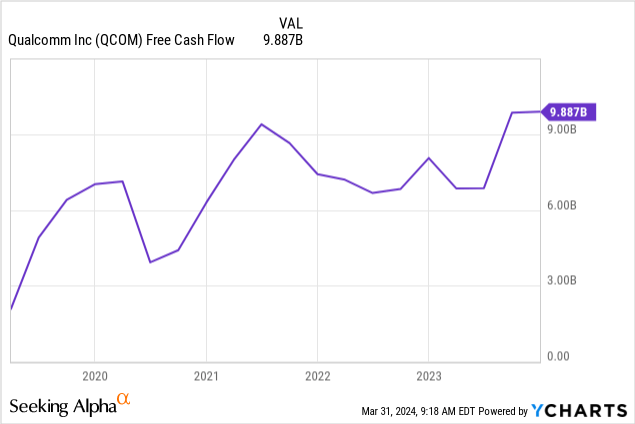

Qualcomm’s total first-quarter GAAP revenue increased by 5% to $9.94 billion, above analysts’ expectations of $9.52 billion. Its first-quarter GAAP diluted EPS was up 24% over the previous quarter to $2.46, above analysts’ expectations of $1.97. The company produced a free cash flow (“FCF”) trailing twelve-month (“TTM”) of $9.887 billion in the first quarter.

FCF may have jumped in 2023 partly because management pulled back on capital expenditures (“CapEX”). Qualcomm’s 2023 10-K stated,

“We reduced our capital expenditures in fiscal 2023 in response to the weakness in the macroeconomic environment (which negatively impacted consumer demand for smartphones and other devices that incorporate our products and technologies).”

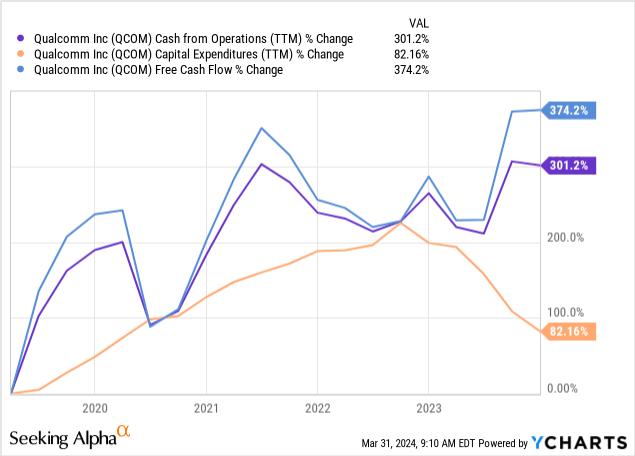

As the economy picks up, management may start spending heavily on CapEx again, so FCF may go up slower than it did in 2023. The chart below shows percentage changes in cash from operations up and CapEx down, resulting in a jump in FCF in 2023.

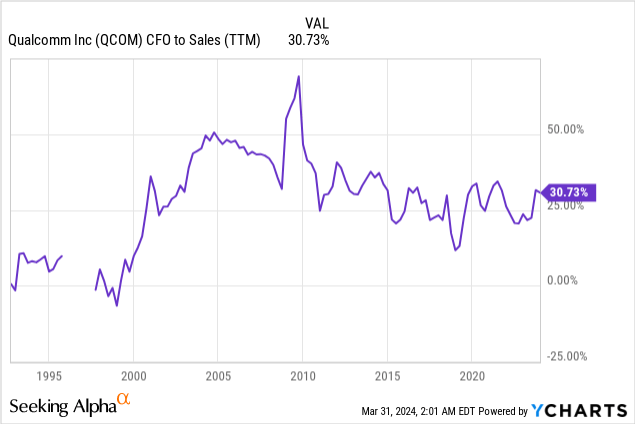

Another metric to follow is cash flow from operations (“CFO”) to sales, also called the operating cash flow margin. This metric shows how efficiently the company converts sales to cash flow. The chart below indicates Qualcomm had first quarter FY 2024 CFO to sales of 30.73%, an excellent number that bodes well for the company growing its FCF, as long as management keeps its capital expenditures low.

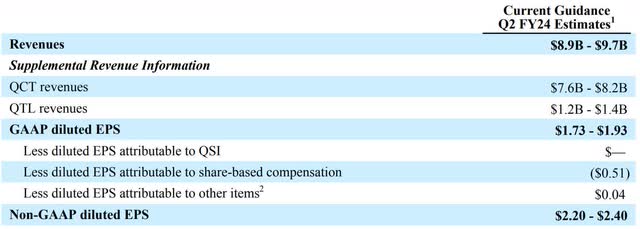

Qualcomm’s second-quarter FY 2024 guidance of $9.3 billion at the midpoint was in line with analysts’ expectations. Management’s non-GAAP guidance EPS at the midpoint was above analysts’ forecast of $2.25.

Qualcomm First Quarter FY 2024 Earnings Release

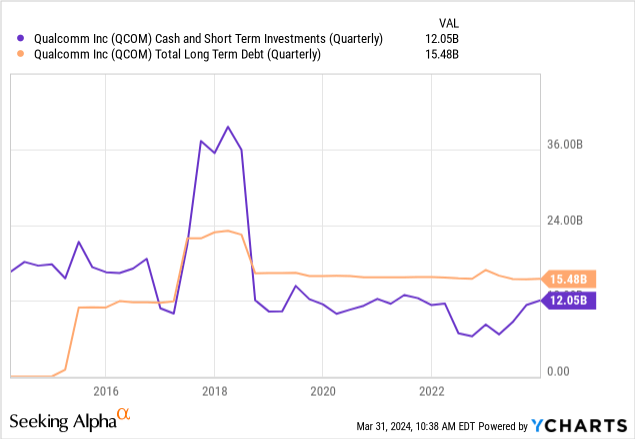

The chart below shows that Qualcomm’s long-term debt exceeds its cash and short-term investments. So, let’s look at a few additional metrics. Calculating the net debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) ratio using numbers from Seeking Alpha, the ratio was 1.02 at the end of the first quarter, a number indicating that it can pay its long-term debt. It has an interest coverage of 16.29, meaning that the company can cover the interest on its debt with operating income. It has a quick ratio of 1.88, meaning it can pay its short-term obligations. As a result, I believe Qualcomm is in solid financial condition.

Overall, Qualcomm’s first quarter FY 2024 results were good. Its future looks bright, with possible tailwinds from growth in the mobile handset market in 2024 and beyond and potential upside from diversifying into areas like IoT.

Risks

One of the biggest risks with this company is its high customer concentration risk in its core wireless business, exacerbated by some of those customers coming from China. Any friction between the U.S. and Chinese governments that results in more trade restrictions could negatively impact Qualcomm. Additionally, it faces significant competition from companies like Broadcom (AVGO), MediaTek (OTCPK:MDTTF), and others in the wireless space. If one of its competitors takes away one of Qualcomm’s significant customers, it could negatively impact its revenue.

The competition in its wireless business is real, and investors are sensitive to any reduction in Qualcomm’s wireless market share. One reason the stock dropped 5% the day after reporting first-quarter earnings on December 31, 2024, is the market share loss at Samsung ((SSNLF)) — a reason that its diversification efforts are so important. The company’s Auto, IoT, and AR/MR/VR business widens its customer and revenue base and, hopefully, in the future, blunts the impact of any losses in its wireless business.

Another consideration is competition with Apple. The 2023 10-K states (emphasis added):

Apple purchases our MDM (or thin modem) products, which do not include our integrated application processor technology, and which have lower revenue and margin contributions than our combined modem and application processor products. Consequently, to the extent Apple takes device share from our customers who purchase our integrated modem and application processor products, our revenues and margins may be negatively impacted.

Source: Qualcomm 2023 10-K.

Apple is also developing proprietary wireless modem technology, efforts that have yet to bear fruit. Recently, Apple extended its agreement with Qualcomm to use its modems until 2026, which is good news. The bad news is that Qualcomm can potentially lose all of Apple’s wireless business over the long term if Apple develops and moves to its proprietary modem technology.

Qualcomm is a controversial company. Several government entities have investigated it in the past for alleged antitrust practices. Qualcomm wins most of its court cases, but occasionally it loses. Additionally, a few companies have hooked horns with Qualcomm in court over its licensing practices, including Apple, which is one reason Apple wants to move away from Qualcomm’s wireless technology. More recently, Arm Holdings (ARM) sued Qualcomm for infringing its patents. An investor in Qualcomm risks the company losing a major dispute over patents or business practices in court, potentially significantly impacting revenue.

Valuation

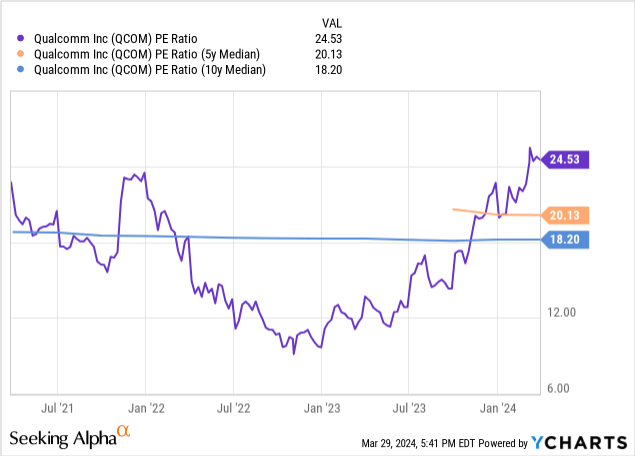

Although I have seen people call Qualcomm a “Value” stock, it is far from bargain basement prices. The last time it sold at genuine bargain basement prices was when the price-to-earnings (P/E) ratio on a TTM basis was in the single digits in late September or early October 2022, well below its ten-year median. The chart below shows that the stock now trades well above its five- and ten-year median TTM P/E.

Seeking Alpha Quant grades Qualcomm’s valuation as a D. However, looking on the positive side, its TTM P/E of 24.53 is below its sector median P/E of 28.95, suggesting that the market may undervalue the stock compared to the wireless sector. The following table compares several companies in the chip or wireless industry from the highest EPS growth rates to the lowest.

| Company Name | Forward P/E | Calendar Year 2025 Analyst Consensus Estimated EPS growth |

| Advanced Micro Devices (AMD) | 32.93 | 50.37% |

| Qorvo (QRVO) | 14.89 | 27.59% |

| Arm Holdings | 82.18 | 26.63% |

| Broadcom | 23 | 21.94% |

| NVIDIA (NVDA) | 30.02 | 21.29% |

| Skyworks Solutions (SWKS) | 13.04 | 19.77% |

| NXP Semiconductors (NXPI) | 15.69 | 14.28% |

| Qualcomm | 15.74 | 10.57% |

Generally, when a stock’s forward P/E multiple exceeds its EPS growth rate, the market may overvalue it. In contrast, when a stock’s forward P/E multiple is below its EPS growth rate, the market may undervalue it. If you use that standard, Qualcomm may be overvalued at this time. Investors looking for undervalued stocks would be better off looking at AMD, Skyworks Solutions, and Qorvo.

The following reverse discounted cash flow, or DCF, shows the implied free cash flow (“FCF”) growth rates over the next ten years for Qualcomm’s closing price of $169.30 on March 28, 2024.

Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$9877 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 6.5% |

| Stock Price (March 26, 2024, closing price) | $169.30 |

| Terminal FCF value | $19.097 billion |

| Discounted Terminal Value | $105.180 billion |

| FCF margin | 27.24% |

Analysts estimate EPS will grow at a CAGR of around 16% over the next five years. I believe the company can translate enough of its EPS growth to achieve FCF growth of at least 6.5% over the next ten years, justifying today’s stock price — however, one word of caution. EPS growth doesn’t always translate to FCF growth, and investors should monitor whether Qualcomm has significant non-cash expenses, which can cause higher EPS growth than FCF growth.

For instance, a company with very high stock-based compensation (“SBC”), a non-cash expense, can cause EPS to grow faster than FCF. Qualcomm produced a SBC as a percentage of revenue of 6.06% in the first quarter of FY 2024 and 6.93 in FY 2023, which is relatively low. So, the company doesn’t have an issue on the SBC front.

Why Qualcomm is a buy

Unlike a few other technology companies that people expect to produce blazing-hot revenue growth from generative AI, Qualcomm is a relatively mature company. Wall Street analysts forecast only mid-single-digit revenue growth over the next three years. However, if its development of on-device AI processing capabilities pays off, the company could potentially exceed analysts’ estimates.

Although Qualcomm may not be a screaming bargain like in late 2022 or early 2023, today’s stock price offers a good value. I consider this stock a growth at a reasonable price (GARP) investment. Qualcomm investors should be in it for its potential revenue growth upside and its ability to efficiently convert sales into cash flow.

Suppose you are an investor looking for a solid growth company that will potentially benefit from the generative AI opportunity. In that case, Qualcomm still sells at a price where the potential upside still exceeds the risks of investing. I rate Qualcomm a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.