Summary:

- Quantum Computing Inc. is a high-risk investment with potential in the quantum computing industry, but market readiness and revenue generation are uncertain.

- Quantum computers can solve complex problems faster but are less accurate, making them suitable for machine learning and AI but not all tasks.

- The valuation is speculative; high price-to-sales ratios reflect the potential for future revenue, but the market’s development remains unpredictable.

blackdovfx

The Quantum Computing Investment Thesis

Quantum Computing Inc. (NASDAQ:QUBT) is a company in a very exciting industry of the future. The analyst Deep Value Investing also published a very readable article a few days ago with a really good comment section. So if you want to dig deeper, I suggest you check out his article.

Quantum, which was listed via SPAC on July 15, 2021, is active in the field of quantum computing. Before that, a beverage company was bought in 2018, which is why you sometimes read that it was a beverage company before. However, in my opinion, this was just a move to make it easier for the company to go public.

I see a lot of potential in quantum computing, but whether it will be exploited is another question. Therefore, I see Quantum as an interesting high-risk investment, but it remains to be seen whether the company can really create a product that will be in demand by the millions.

What Is It That Makes QUBT Different?

Today’s computers have a CPU that, along with memory, makes sure that information is processed. And there are so-called switches, which can be either 0 or 1, in other words, on or off. And while this system is great for many of the applications we use today, it does not seem to be the ideal solution for really complex optimization problems.

Quantum computing, on the other hand, is supposed to make it possible to be in a so-called superposition, i.e., the quantum bits can represent more than one possibility. In contrast, a binary system is either 0 or 1, but not both at the same time. Therefore, quantum computers can perform several complicated calculations simultaneously, which should lead to a considerable time saving. Since quantum computers try to find the most probable answer, they are faster and can solve more complex problems, but they also seem less accurate. Therefore, they will not be suitable for all tasks.

However, in the fields of machine learning and artificial intelligence, which are currently in high demand, quantum computers are likely to be superior. But, it appears that it is still far from being ready for the market, and current applications are more academic in nature. Interesting in this context is this Reddit (RDDT) thread on quantum computing.

Interestingly, Amazon (AMZN) launched its Quantum Embark project a few days ago, giving hope that quantum computers are closer than many thought. As a result, quantum-related stocks have responded strongly, including Arqit Quantum (ARQQ), a quantum security company I wrote about.

In general, it is very difficult to predict which companies in this industry or whether this industry will bring the success that many are hoping for. While large companies like Amazon, IBM (IBM), and Microsoft (MSFT), as well as smaller players like IonQ (IONQ) and Rigetti Computing (RGTI), have promising ideas, a finished product with billion-dollar sales still seems a long way off. On the one hand, the risk is high that the product will not be ready for the market for 10 years or more, or even not at all. On the other hand, though, the potential is also enormous if one can identify the company now that will write a success story like Nvidia (NVDA) did.

In any case, Quantum Computing is trying to position itself as a chip manufacturer in the quantum computing market with its foundry.

For example, IBM, which is doing a lot of research into quantum computing, has published a roadmap that says it will be 2033+ before quantum computing will be fully realized. That is a long way off.

QUBT’s Balance Sheet

Since the market readiness and the big revenues are so far in the future, it is of course important that the cash position is sufficient to ensure the liquidity of the company until then. With $3 million in cash and another $40 million, there is a cash position of approximately $43 million. With negative FCF of approximately $11 million TTM, the current cash position should provide a cash runway to cover the next 3–4 years if cash burn remains constant.

I think the cash burn rate is going to increase. However, I think the current liquidity should be sufficient to be liquid for the next two years. Then there will probably be further dilution of shareholders, or there will be an entry of investors, or there will be an increase in debt.

Things I Noticed

Looking at the most recent SEC filings, I noticed that there are several amended annual reports. An amended 10-K for fiscal year 2023 and three amended 10-Ks for fiscal year 2022 have been filed. The explanation note for this is as follows:

Quantum Computing Inc. (the “Company,” “we,” “us,” “our” and other similar terms) is filing this Amendment No. 1 (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2024 (the “Original Form 10-K”), to restate its consolidated financial statements, including the notes thereto, for the years ended December 31, 2023 and 2022, contained in the Original Form 10-K, and to replace the Report of Independent Registered Public Accounting Firm prepared by BF Borgers CPA PC (“BF Borgers”) included in the Original Form 10-K with the Report of Independent Registered Public Accounting Firm from BPM LLP (“BPM”) included in this Amendment, and to make certain other changes as described herein. This Amendment is being filed as a result of the SEC’s order of May 3, 2024 suspending BF Borgers from appearing and practicing as an accountant before the SEC and the Company’s subsequent retention of BPM to replace BF Borgers as its independent registered public accounting firm.

Source: Amended 10-K/A.

Here you can find a release from the SEC about BF Borges and that more than 1,500 SEC filings are affected. Obviously, such a situation creates work, as a new auditor must be found to perform the audit again. But Quantum has found one, and I think the next few annual reports will be able to get by without an amendment.

Valuation

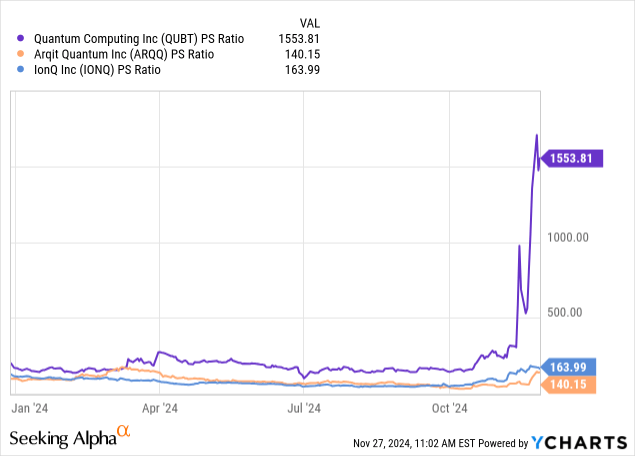

The price-to-sales ratios are incredibly high, but as I wrote in my Arqit article, you can’t really use them for valuation because these companies simply have such low sales because there are no real existing customers and products yet. It is still a bet that the ideas of these companies will generate considerable revenues in the future. If the ideas work, the companies would be mercilessly undervalued currently, but the probability that they will not work is also high, and then they would be mercilessly overvalued at the moment.

Currently, probably nobody can say exactly how this market will develop. Therefore, it is important to react to information here and always be open for new information that can change the own opinion. For my part, I find this area very intriguing and may build up a very small position in it, but I am still not sure which company I will choose.

Conclusion

Quantum Computing Inc. is on my watch list because I think the industry is going to make a lot of noise in the future. However, since it is difficult to predict which companies will be the winners, I am still waiting to build a position. But I will keep an eye on the company, and if the foundry is successful, my interest in Quantum is sure to grow.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.