Summary:

- Quantum computing stocks have been flying high lately amid growing mainstream acceptance of the technology, delivering multiplicative returns in just one month.

- In a simplified manner, we cover the different approaches of IonQ, Inc. and Rigetti Computing, Inc., and how they are positioned to capitalize on the growing addressable market.

- Both stocks are expensive, but IonQ’s proven monetization and robust financial health make it a cautious Buy, while Rigetti Computing is a Hold.

MF3d

Quantum computing stocks have been flying high lately, returning multiplicative returns in just one month. With the market gaining greater conviction that quantum computing will eventually replace all classical computing systems in the future, investors are bidding up the share prices of some leading names in the space. Although the stocks have witnessed sharp corrections in the last few days from their 52-week highs, igniting investors’ interest in dip-buying opportunities.

The four key pure-quantum stocks are IonQ, Inc. (NYSE:IONQ), Rigetti Computing, Inc. (RGTI), D-Wave Quantum Inc. (QBTS) and Quantum Computing Inc. (QUBT). Although, we will particularly be focusing on the two largest companies, IONQ and RGTI.

This article helps Seeking Alpha readers to wrap their heads around the investment opportunities around quantum computing, including the current and prospective use-cases of the technology. Assessing each company’s key financial metrics such as revenue growth and balance sheet health, we cover why IonQ, Inc. is a stock worth buying, while Rigetti Computing is risky and has a “hold” rating.

The promise of quantum computing

McKinsey estimates that the market size of “Quantum Computing” could reach between $45 billion to $131 billion by 2040.

Quantum computing essentially strives to help us better understand and leverage the scientific world around us, which possesses a quantum mechanical structure.

Nature is quantum mechanical when you get down to molecular and atomic interactions. Nature does not obey classical physics, it’s just a very crude approximation. If we really want to understand how nature evolves in time we have to have a system that obeys quantum physics.”

– Olive Lanes, Global Lead for Quantum Learning at IBM, in an interview with Bloomberg (emphasis added).

The reason advanced understanding of the quantum mechanical nature of the world around us is so valuable is because it enhances our ability to simulate objects and materials like never before. This opens up a new form of scientific research across product-based industries (such as biopharmaceuticals) and physical environment control studies (e.g., transportation and logistics).

The ongoing generative AI revolution has also spurred innovation efforts around robotics, both for industrial environments and personal home-use. As tech companies strive to build humanoids that increasingly characterize human capabilities, quantum computing could prove valuable to help robots process the sensory data around more effectively and interact with people more naturally.

Aside from quantum computing’s utility for simulating real-world environments and objects, the technology also holds value in the ‘Services’ segment of the economy, most notably the cybersecurity space. Moreover, powerful quantum computers can decode encrypted data, which poses significant risks of data hacking and breaches. Consequently, heavy investments will need to be made in both the public and private sector to protect data from this new emerging threat. It is of no surprise then that governments are already spending taxpayers’ money on quantum computing solutions to protect national intelligence, as well as deploying the technology for research in other areas like national defense.

Beyond the public sector, there has also been interest from the private sector, particularly from big banks like JPMorgan and HSBC, to beef up their cybersecurity systems adept for the quantum-age.

Quantum computing market dynamics

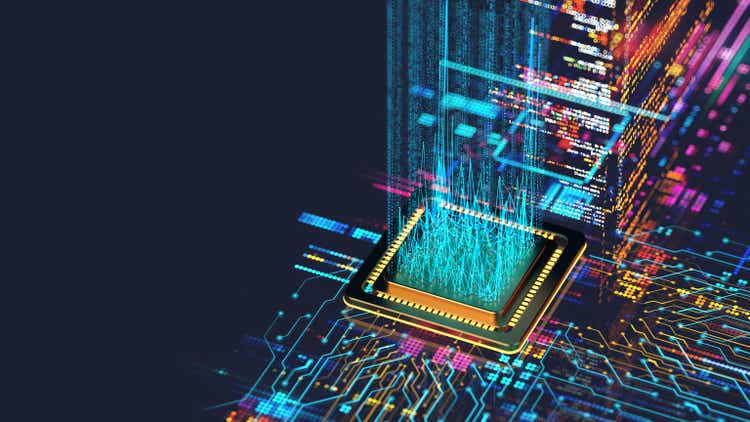

Given the growing addressable market and the numerous players in the quantum computing space, it can be difficult for investors to wrap their heads around which stocks they should be looking into. The graphic below from MarketsandMarkets breaks down the quantum computing market into a few key segments, and lists the main companies competing in each of these areas.

Segmented breakdown of quantum computing market (MarketsandMarkets)

Out of the four quantum pure-plays (IonQ, Rigetti Computing, D-Wave Quantum and Quantum Computing), only IONQ and RGTI are considered system-level players.

Now, it is important to understand that there isn’t just one form of quantum computing, but in fact multiple approaches being experimented by different players. It remains unclear which technique will ultimately prove most effective and commercially viable, but currently the two main forms of quantum computing are “superconducting” and “trapped ion.”

“Superconducting” is currently the most popular quantum computing approach, in which Rigetti Computing is competing against tech giants Google and IBM.

On the other hand, IonQ remains the largest player in the “trapped ion” space, and does not face any competition from any tech behemoths at present.

Now, going into the scientific explanations of these two approaches could take unnecessarily long. For investors, it would be more useful to acknowledge some key strengths and weaknesses of the main quantum computing methods.

A key concept to understand is “coherence,” which IonQ defines as:

Coherence Time: A measurement of the “lifetime” of a qubit, coherence time measures how long a qubit can maintain coherent phase, which allows it to successfully retain quantum information and behave in the ways necessary for it to be part of a useful computation.”

Keeping this in mind, one of the key advantages of the “trapped ion” approach is that it boasts longer coherence times, enabling better information retention, and subsequently also lower error rates.

On the other hand, the “superconducting” methodology is prone to easily losing coherence, particularly due to noise sensitivity. These systems also require extremely cold temperatures to function, whereas the “trapped ion” systems can operate at room temperatures.

However, “trapped ions” qubits are slower than “superconducting” qubits, making the latter more valuable for processes and workloads where speed is of essence.

Superconducting-qubits also perform faster gate operations than other-qubit modalities. Our system gate speeds consistently achieve an active duration of 60 to 80 nanoseconds, which is four orders of magnitude faster than other modalities such as ion traps and pure atoms.

– Subodh Kulkarni, President and CEO of Rigetti Computing, Q3 2024 earnings call.

Furthermore, RGTI could also benefit from the fact that there is a broader industry-wide effort (including from Google and IBM) to make “superconducting” systems the prevalent form of quantum computing.

We believe superconducting-qubits have many advantages over other-qubit modalities including that they are fabricated using well-established semiconductor design and manufacturing techniques.

– Subodh Kulkarni, President and CEO of Rigetti Computing, Q3 2024 earnings call.

So both approaches have their pros and cons to facilitating commercial viability, and the involved companies are continuously working to address the shortcomings of their respective techniques.

Looking beyond the system-level approaches, the subsequent phase of monetization is “Quantum Computing as a Service (QCaaS)”:

QCaaS is projected to see the most significant growth, driven by increasing commercial adoption and the expansion of cloud-based quantum services by major players like AWS, Google Cloud and Azure. By the end of the decade, QCaaS is expected to represent over 40% of the quantum computing market.

IonQ, Rigetti Computing and D-Wave Quantum Inc. each offer their own QCaaS (while Quantum Computing Inc. does not), including through the marketplaces of the three major cloud platforms. These services open the door to recurring software revenue, which can induce the market to reward the stocks with higher valuation multiples (more on that later).

Financial performance

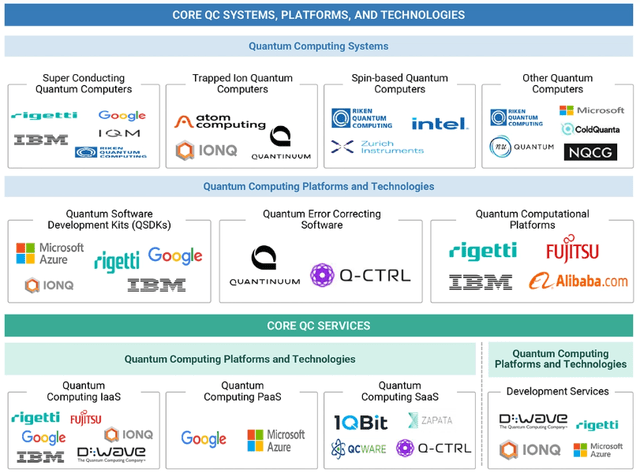

Nexus Research, data compiled from Seeking Alpha

At first glance of the revenue trajectories of each of the quantum stocks, IonQ evidently stands out as a stellar growth stock. While its revenue growth rate slowed last year, it has still been one of the fastest growing companies in the space, and boasts the largest revenue base by a wide lead.

As discussed earlier, the “trapped ion” approach of IonQ possesses advantages that offer commercial value, and the company has garnered a track-record of being able to effectively monetize its technology over the past several years.

Moreover, on the Q3 2024 earnings call, IonQ CEO Peter Chapman emphasized how the company is doubling down on commercial monetization, scoring new contract deals this year.

About 18-months ago, I challenged our teams to answer a critical question. I told them, I don’t care about theoretical algorithms with limited practical applicability. I don’t care about the academic argument about quantum supremacy. Instead, I asked them what are the applications that have the potential to disrupt multibillion dollar industries.

The team has since identified several application areas, where we believe commercial value will be first realized and aligned with our next-generation hardware and IonQ’s production capability.

…

we announce the first two application areas, biopharmaceutical drug discovery and computer-aided simulations for the engineering and manufacturing industries.

As mentioned earlier in this article, quantum computing opens the doors to more comprehensive simulations and research techniques. This is despite the “speed” related shortcomings of the “trapped ion” approach. Its longer coherence times and relatively lower error rates are proving valuable for research workloads in “biopharmaceutical” and “manufacturing industries.”

Given IonQ’s fast-growing and largest revenue base relative to its pure-quantum peers, it also grants the company the opportunity to continue building upon this lead by having more money to re-invest into the business and build more superior technology.

today’s early noisy quantum computers can provide value even before they are perfected. If we are right, it gives us a significant advantage by generating early meaningful cash collection as we work towards perfection.

– CEO Peter Chapman, IonQ Q3 2024 earnings call.

Furthermore, we covered earlier how quantum computing will play a big role in cybersecurity protection, and IonQ has been making notable progress on this front too, announcing a partnership with “Applied Research Laboratory for Intelligence and Security” (which is a research center part of University of Maryland College Park):

To design a first-of-its-kind, networked quantum computing system for the Department of Defense (DOD). Future phases of the project, which have yet to be awarded, include the construction, delivery, and maintenance of these systems.

Note that these one-off projects could also potentially create smaller recurring revenue streams through “maintenance” services as well.

Broadly speaking, IonQ is building up a robust business, buoyed by growing demand for its “trapped ion” technology.

On the other hand, Rigetti Computing’s revenue trend has been more unstable and lumpy in nature.

Revenue and gross margin variability is to be expected at this stage of the company’s evolution, given the variable nature of our contract deliverables and timing with major government agencies.

Rigetti Computing’s main strength lies on the foundry side, as underscored by its contract with the Air Force Research Lab:

it was awarded a five-year Indefinite Delivery Indefinite Quantity (IDIQ) contract with the Air Force Research Lab (AFRL) Information Directorate to supply its researchers with quantum foundry services. This contract allows AFRL to leverage Rigetti’s fabrication and manufacturing capabilities to build customized quantum systems.”

Nonetheless, RGTI has fallen short of producing consistent revenue growth the way IONQ has been delivering.

Additionally, Rigetti also faces competition from tech heavy-weights like Google and IBM in the “superconducting” space, which could undermine pricing power and profit margin prospects going forward. Whereas, IonQ remains the leader in the “trapped ions” arena, without facing competition from any big tech titans.

Although despite Google and IBM likely promoting their own, in-house quantum solutions through their respective cloud platforms, the two largest cloud providers, Amazon AWS and Microsoft Azure don’t have their own “superconducting” endeavors. This gives Rigetti the opportunity to still build a customer base through these marketplaces.

Nonetheless, both IONQ and RGTI presently remain deeply unprofitable, with net profit margins of -458% and -510%, respectively. Hence, it is vital to assess balance sheet health as well when making investment decisions in these stocks.

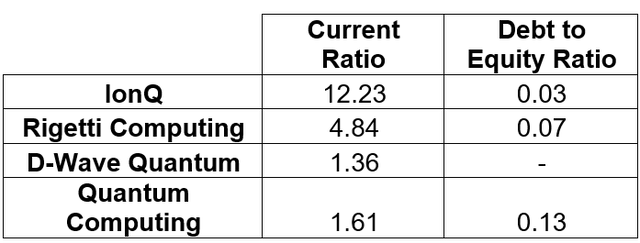

Nexus Research, data compiled from Seeking Alpha

For context, a current ratio of between 1.5 and 2 is generally considered healthy, as the company can easily pay off its short-term debt obligations. Aside from D-Wave, the other key quantum computing stocks have healthy current ratios. In fact, IonQ and Rigetti’s significantly higher current ratios reflect that these companies have excess cash to invest into the business as new opportunities arise. This is an attractive position to be in when competing in a high-growth sector like quantum computing.

Furthermore, except for D-Wave, these quantum stocks also have extremely low debt to equity ratios, which means the balance sheets of these companies are healthy.

Although it is worth noting that Rigetti has been issuing new shares to raise fresh new capital and strengthen its balance sheet.

During the third quarter of 2024, we raised $12 million from the sale of 11.3 million common shares under our current ATM program. As of September 30, 2024, up to 60.2 million of common stock remains available for sale under our current ATM program.

– CFO Jeff Bertelsen, Rigetti Computing Q3 2024 earnings call.

New share issues indeed dilute “per share” financial metrics, subduing stock price performance to a certain degree.

Overall, IonQ remains in the best financial position, both from the perspectives of revenue growth and balance sheet health.

Risks

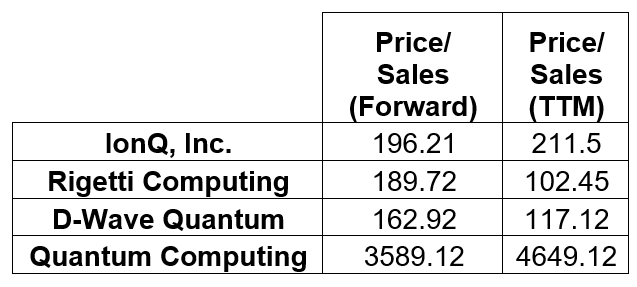

The recent run-up in quantum stocks has led to extended valuations. The chart below aggregates the Price-to-Sales multiples of the four key stocks in the space, both on a Forward basis and on a Trailing Twelve Months (TTM) basis.

Data compiled from Seeking Alpha

Quantum Computing (QUBT) is trading at a particularly ludicrous valuation, at around, 4600x TTM sales. As for the other companies, while these stocks may seem cheaper relative to QUBT, they are certainly not reasonably priced at present.

We already covered how IonQ has proven to be the strongest performer in terms of revenue growth. However, the recent rally in these stocks has little to do with past performances. It has more to do with the improving prospects of future revenue growth as quantum computing gains more mainstream acceptance. This is as AWS launches its Quantum Embark program and Google boasts of the performance capabilities of its new Willow chip for quantum computing workloads. The announcements of new partnership contracts between these pure-quantum companies and early adopters of the technology has also been a key factor in driving sector performance, such as the recent news of Quantum Computing Inc. (QUBT) signing a deal with NASA.

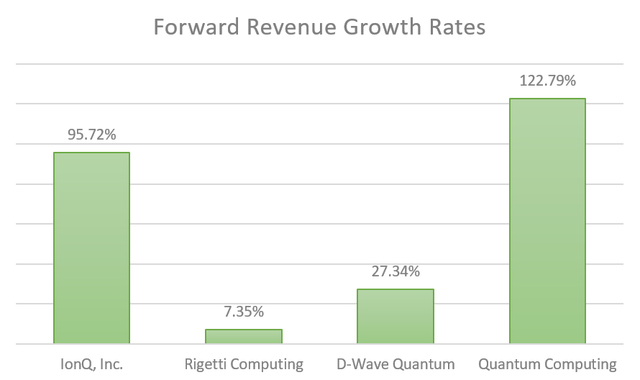

Below are the projected forward revenue growth rates for the key quantum pure-plays.

Nexus Research, data compiled from Seeking Alpha

IONQ and QUBT currently offer the highest projected revenue growth rates. Between our two companies of focus, IonQ and Rigetti Computing, IONQ remains the more appealing option with revenue set to almost double over the next year, while RGTI revenue is expected to remain flat. Moreover, it makes little sense for these two stocks to be trading at similar Forward Price/ Sales ratios of around 190x, given the wide discrepancy in expected top-line growth rates.

Buyers of RGTI shares at these levels are essentially speculating that new contract deals will be announced over time that should prove the commercial value of its technology offerings. Whereas, IONQ already boasts a strong track record of persistent revenue growth to support the case for investing in the stock.

Furthermore, regardless of the predicted revenue growth rates, these ultra-high valuation multiples also make them vulnerable to steep corrections due to broader macro conditions. Most recently, the Federal Reserve signaled fewer rate cuts going into 2025. If inflation rates continue to rise higher, it is the risky growth stocks like the pure-quantum plays that will be hit the hardest amid tighter monetary policy conditions.

Moreover, at the industry-level, quantum computing remains a nascent technology where different approaches are still being experimented. It remains to be seen which technique will prove most effective and commercially viable.

Keep in mind that we also have the generative AI revolution underway. The market is currently debating about whether the heavy investments into the technology will generate sufficient returns over time amid the slow adoption rates across sectors and industries. So if investors are already questioning the high valuation multiples of AI-centric stocks as they wait for justifiable returns on investments, it certainly raises the bar for pure-quantum companies as well.

Many businesses are still organizing their data records and structures to be fit for company-wide AI deployments, so quantum computing is unlikely to be on the priority lists of C-suite executives for the foreseeable future.

As a result, the current high valuation multiples of the quantum stocks seem to be overestimating the technology’s monetization potential over the near-term, making them prone to steep sell-offs.

Final Word

Out of the pure-quantum plays, IonQ is the only company with a solid revenue growth track record that proves the monetizability of its technology, and also boasts the strongest balance sheet to support future investments that build upon its lead.

While Rigetti Computing also benefits from a strong balance sheet, its revenue growth track trajectory has been relatively underwhelming compared to IonQ. Its weak future projected revenue growth rate does not support the case for buying the stock either at such an extended valuation.

Make no mistake, both stocks are expensive, but IonQ appears to be the one that is worth buying, albeit cautiously. A dollar-cost averaging approach is recommended when investing in the stock, given the volatile nature of its share price performance.

IONQ has been assigned a Buy rating, while RGTI is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in IONQ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.