Summary:

- Today, we revisit ocular concern Aerie Pharmaceuticals.

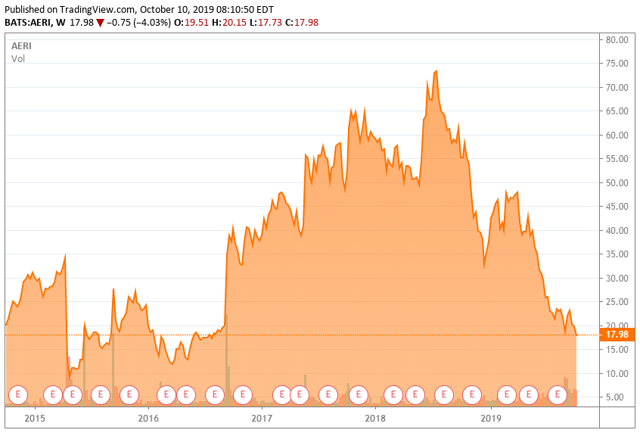

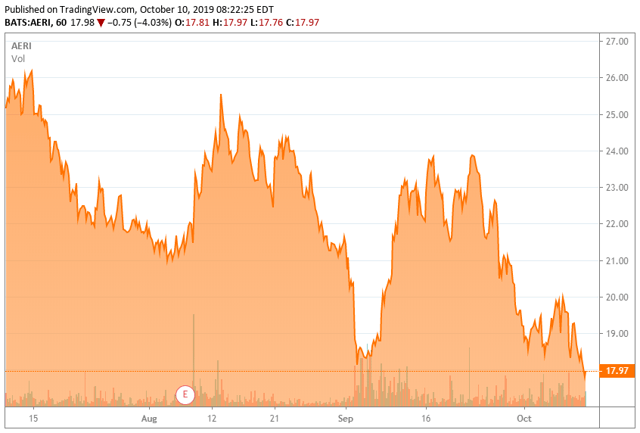

- The company has struggled as a newly minted ‘Tier 3’, with the stock down some 60% in 2019 to date.

- A fully updated investment analysis is presented in the paragraphs below.

Art is a revolt against repression.” – Marty Rubin

Today, we revisit an ocular concern that was a big winner a few years ago as it advanced its product portfolio. However, commercialization has been a different story, and the stock has had a sharp drop in 2019. We revisit this small-cap name in the paragraphs below.

Company Overview

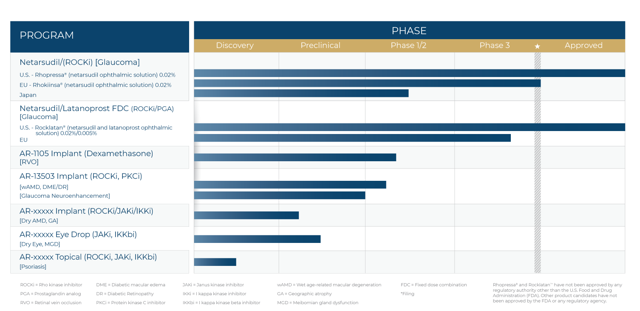

Aerie Pharmaceuticals (NASDAQ:AERI) is a North Carolina-based ophthalmic pharmaceutical company that IPO’d in 2013. The company is focused on changing the lives of patients with glaucoma, retinal diseases, and other diseases of the eye. The company has two FDA-approved drugs on the market: Rhopressa which lowers elevated eye pressure in patients with open-angle glaucoma and ocular hypertension, and Rocklatan for the reduction of intraocular pressure in patients with open-angle glaucoma or ocular hypertension. Beyond the two approved drugs, the company’s pipeline is young with the next two most advanced product candidates, AR-1105 and AR-13503, being in Phase 1/2 of development. Aerie Pharmaceuticals trades for just around $18 a share and currently has a market capitalization of roughly $1 billion.

Pipeline:

Source: Company Presentation

Rhopressa:

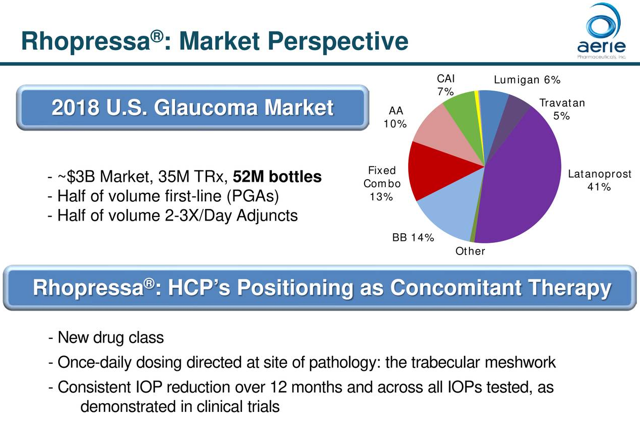

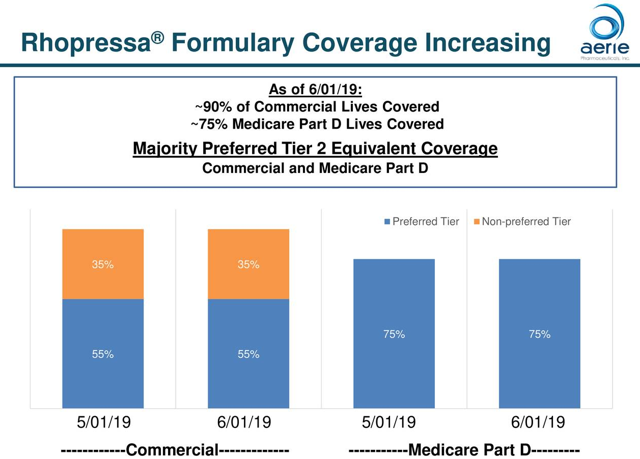

Rhopressa is a once-daily eye drop for the lowering of elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension and was approved by the FDA in December 2017. The drug works by increasing the outflow of fluid inside the eye through the trabecular meshwork, which is the primary fluid drain in the eye. The drug was launched in the U.S. in 2018 and is seeking approval in European and Japanese markets. Enrollment for the Rhopressa’s Phase 2 clinical trial in Japan is now complete, ahead of schedule, and topline results should be available in Q4. If successful, a Phase 3 trial will follow. The market for the drug is roughly 50% commercial insurers and 50% Medicare Part D. As of the latest quarter, the company has gained access to the majority of lives covered under both commercial and Medicare Part D plans. Effective May 1st, Rhopressa’s Medicare Part D preferred tier coverage increased from approximately 40% to 75%. At that point in time, commercial coverage for Rhopressa was 90% of lives, with 55% of lives in a preferred tier. Management pointed out that all the feedback from the field is positive when it comes to the performance of the drug. The thing holding back sales is managed care coverage. The number of prescribers continues to grow, but roughly 75% of the target audience of 14,000 eye care professionals haven’t prescribed the drug before.

Source: Company Presentation

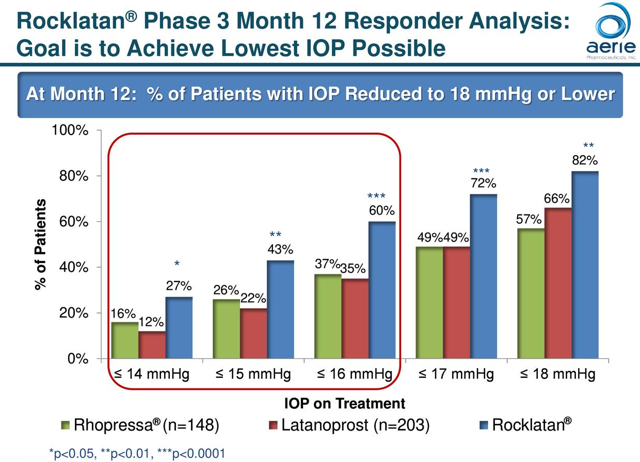

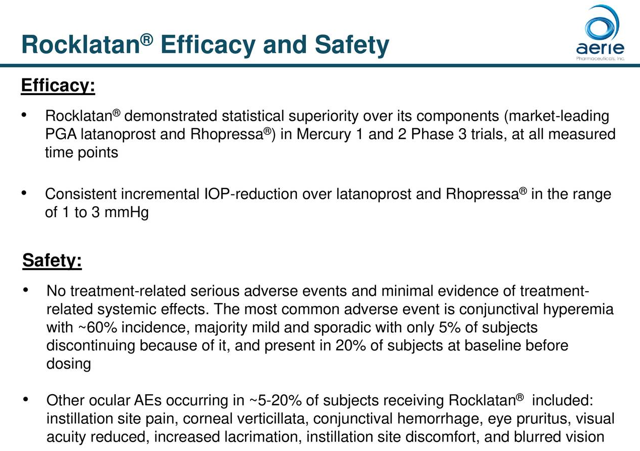

Rocklatan:

Rocklatan is a once-daily eye drop that is a fixed-dose combination of latanoprost, the most widely-prescribed prostaglandin analog, and netarsudil, the active ingredient in Rhopressa. The drug was approved by the FDA, launched in May of 2019, and has already gained non-preferred brand coverage with payors that represent over 60% of commercial lives. The company continues to meet with commercial and Medicare Part D plans to accelerate market access for Rocklatan, and they have launched a single savings card to reduce out-of-pocket costs for commercially-insured patients. The company is projecting that Rocklatan will have the majority of lives covered under commercial and Medicare Part D lives by the end of 2019. Also, the company is seeking to gain approval in Europe, and the Phase 3 Mercury trial, being conducted to support commercialization in Europe, continues to progress.

Source: Company Presentation

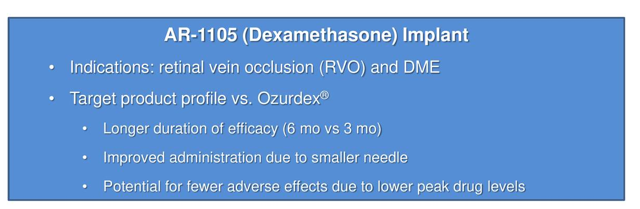

Ar-1105:

AR-1105 is an intravitreal, fully biodegradable PRINT-manufactured implant that releases the steroid dexamethasone to treat diabetic macular edema. The implant is designed to reduce the treatment burden for DME. The number of people with diabetic retinopathy in the United States is expected to roughly double by 2050, rising from 7.7 million to 14.6 million, and nearly half of all people with diabetic retinopathy will develop DME. An IND was filed in December of 2018, and a Phase 2 study in the treatment of macular edema due to retinal vein occlusion was initiated in March 2019.

Source: Company Presentation

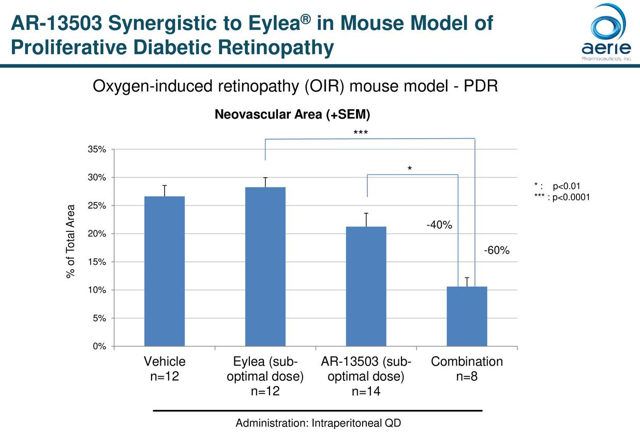

AR-13503:

AR-13503 is an inhibitor of Rho kinase and Protein kinase C designed to treat wet age-related macular degeneration, diabetic retinopathy, and related diseases of the retina. As of August 20th, dosing is underway in a Phase 1 trial evaluating the safety and tolerability of the drug in patients with neovascular age-related macular degeneration or diabetic macular edema. The estimated completion date is September 2021.

Source: Company Presentation

Analyst Commentary and Balance Sheet

As of June 30th, 2019, the company had cash and cash equivalents of roughly $110 million, compared to approximately $200 million as of December 31st, 2018. Research and development expenses for the second quarter were $20.9 million, compared to $18.1 million in Q2 of 2018. Selling, general and administrative expenses for the quarter were $34.4 million, compared to $33.1 million in Q2 of the prior year. Total revenues for the quarter came in at $15.8 million, compared to $2.4 million in Q2 of 2018. The uptick in volumes hasn’t met the expectations of management, “full year 2019 net revenue guidance range to $70 million to $80 million, down $110 million to $120 million.” Overall, the net loss for the quarter was $47.1 million, compared to $55 million in the prior year. The company expects the total cash burn in 2019 to be between $162 million and $170 million, up from their prior projections of $130 million to $140 million. The company did a $275 million convertible debt offering earlier this month to address its near-term funding needs.

Wall Street remains sanguine on the company’s prospects despite the fall in the stock over the past year. Seven analyst firms, including Needham and Piper Jaffray, have reiterated Buy ratings on the stock over the past two months. Price targets proffered have ranged from $45 to $63 a share.

Verdict

Aerie has experienced the growing pains we see so often in ‘Tier 3‘ names as they move from a developmental focus to one based on commercialization. It should be noted that a beneficial owner has added over $20 million to his core holdings since mid-August.

I still have a small ‘watch item’ position in Aerie at this time. The stock may be trying to form a bottom near current levels. It might be worth consideration as a small trading position with a stop loss limit or within a small buy-write option strategy. However, until a significant drop in quarterly cash burn is achieved, AERI does not seem worthy of more than that at this time.

Repression may begin as a means to an end, but it always ends up being an end unto itself“- Garry Kasparov

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum.

Disclosure: I am/we are long AERI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Before the bell every Monday morning we provide an in-depth analysis on an undervalued small/midcap stock and outline a simple option strategy to make a tidy profit even if the underlying stock does little over the coming months. If you are not signed up yet for this free service, just click HERE to download our latest report. This action will also ensure you receive all future free reports as published as well.