Summary:

- Today, we revisit a small developmental firm called Zynerba Pharmaceuticals.

- The company is advancing its primary drug candidate Zygel across several indications and the shares trade near the company’s cash balance.

- A full investment analysis is presented in the paragraphs below.

Morsa Images/DigitalVision via Getty Images

“There is no complexity in what is, but only in the many escapes that we seek.” – Jiddu Krishnamurti

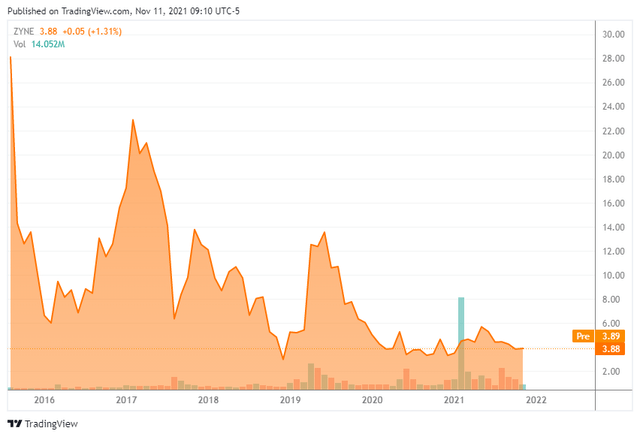

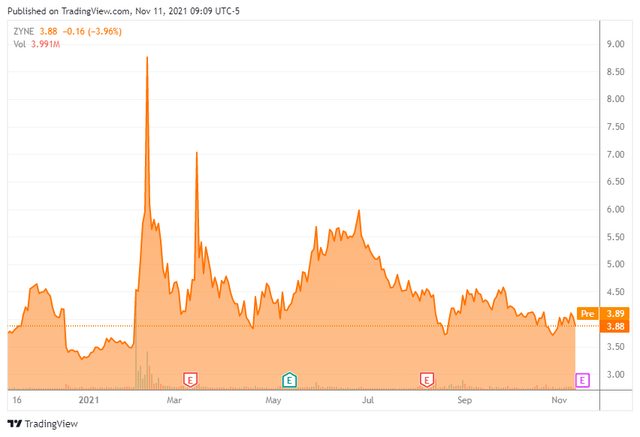

Today, we are looking back in on Zynerba Pharmaceuticals (NASDAQ:ZYNE) for the first time since the start of 2021. This is a name some recent inquiries have come in from Seeking Alpha followers, so it seems a good time to revisit this small biotech concern. A full analysis is as follows.

Company Overview:

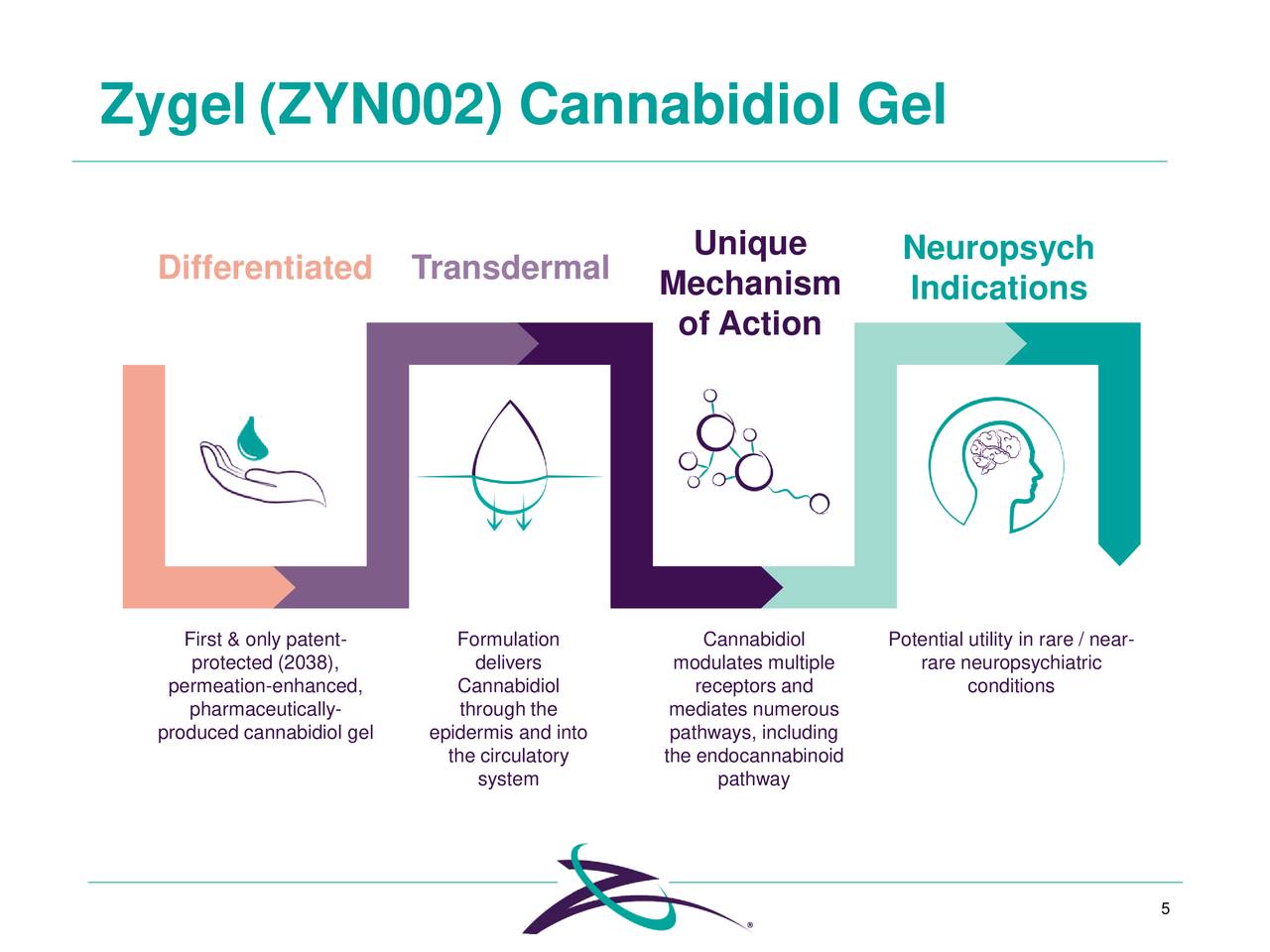

Zynerba is a clinical-stage biotech concern based just outside of Philadelphia. The company’s current focus is to continue to advance Zygel in development, the first and only pharmaceutically-produced CBD formulated permeation-enhanced gel for transdermal delivery through the skin and into the circulatory system. Cannabinoids interact with specific receptors and pathways implicated in a range of diseases throughout the body to produce pharmacologic effects. The company is focused on the Central Nervous System space in their development efforts as cannabinoids have demonstrated positive effects in the CNS and is non-euphoric and non-addictive. The stock trades just under $4.00 a share and the company has not rewarded longtime shareholders to this point (see above). The current market cap of the company is approximately $100 million.

Source: September Company Presentation

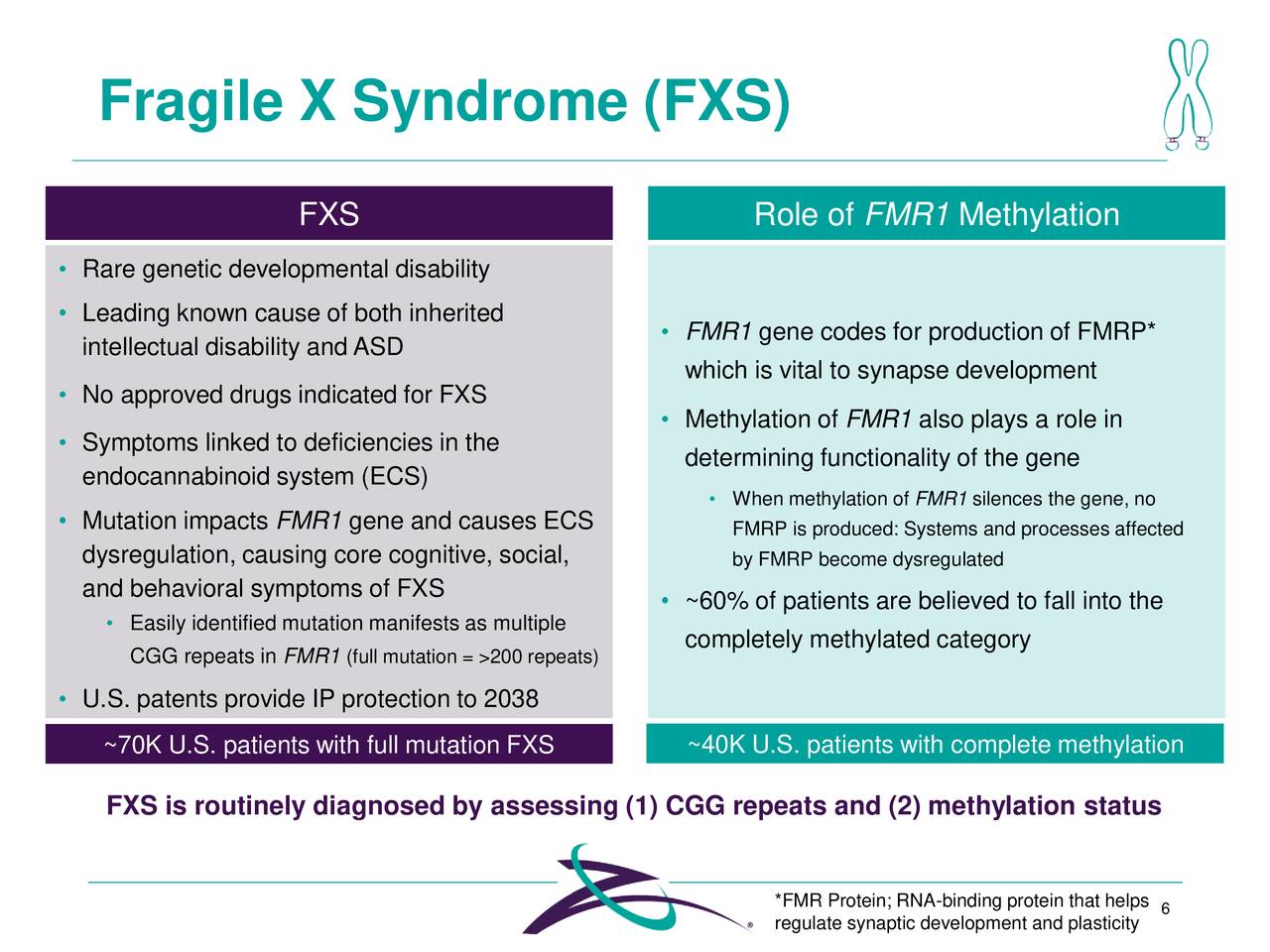

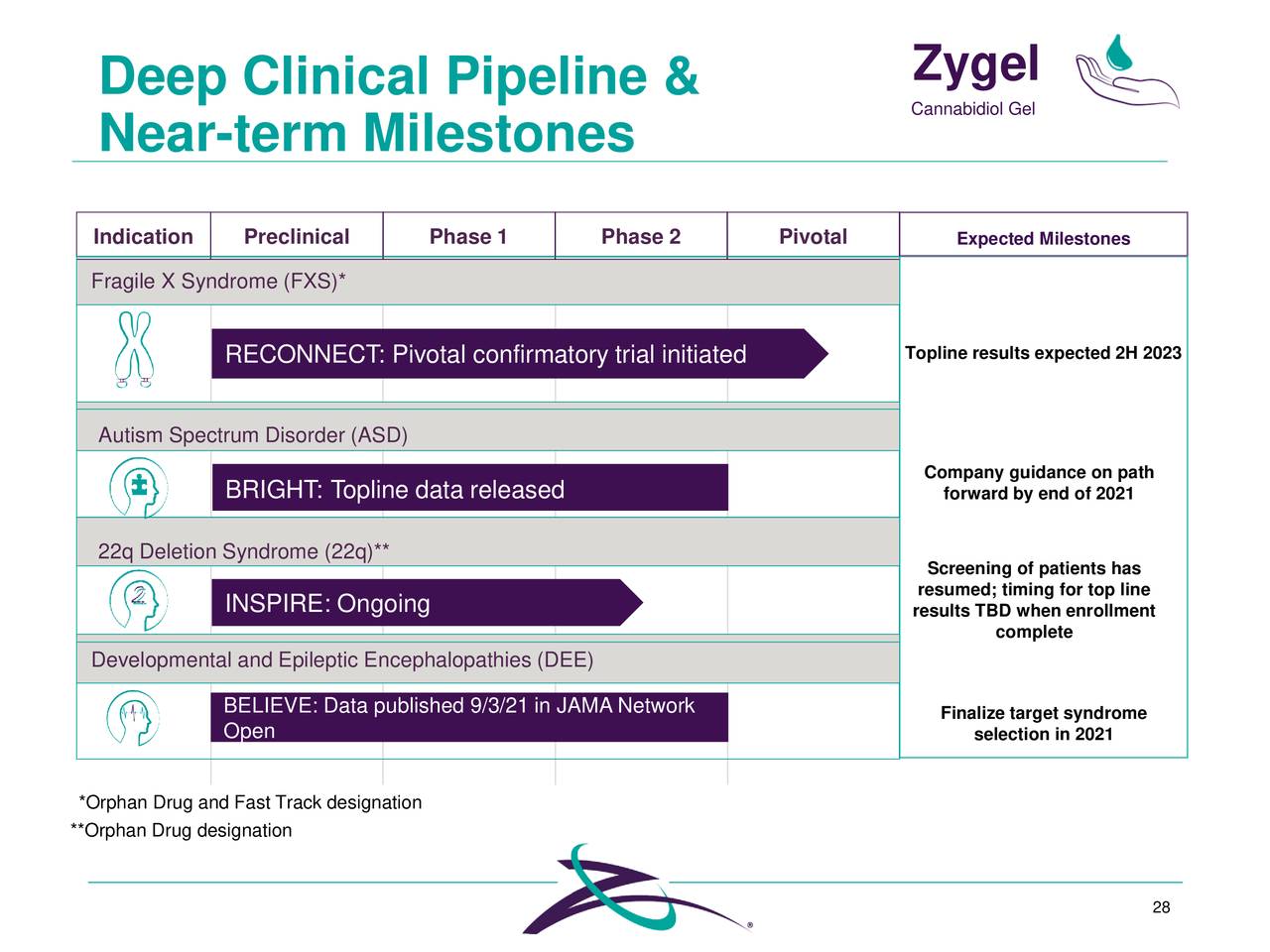

The company’s core and really sole focus is developing Zygel as it believes this compound has potential unique features that could treat a variety of rare disease indications. The most advanced of these efforts is evaluating Zygel to treat Fragile X Syndrome.

Source: September Company Presentation

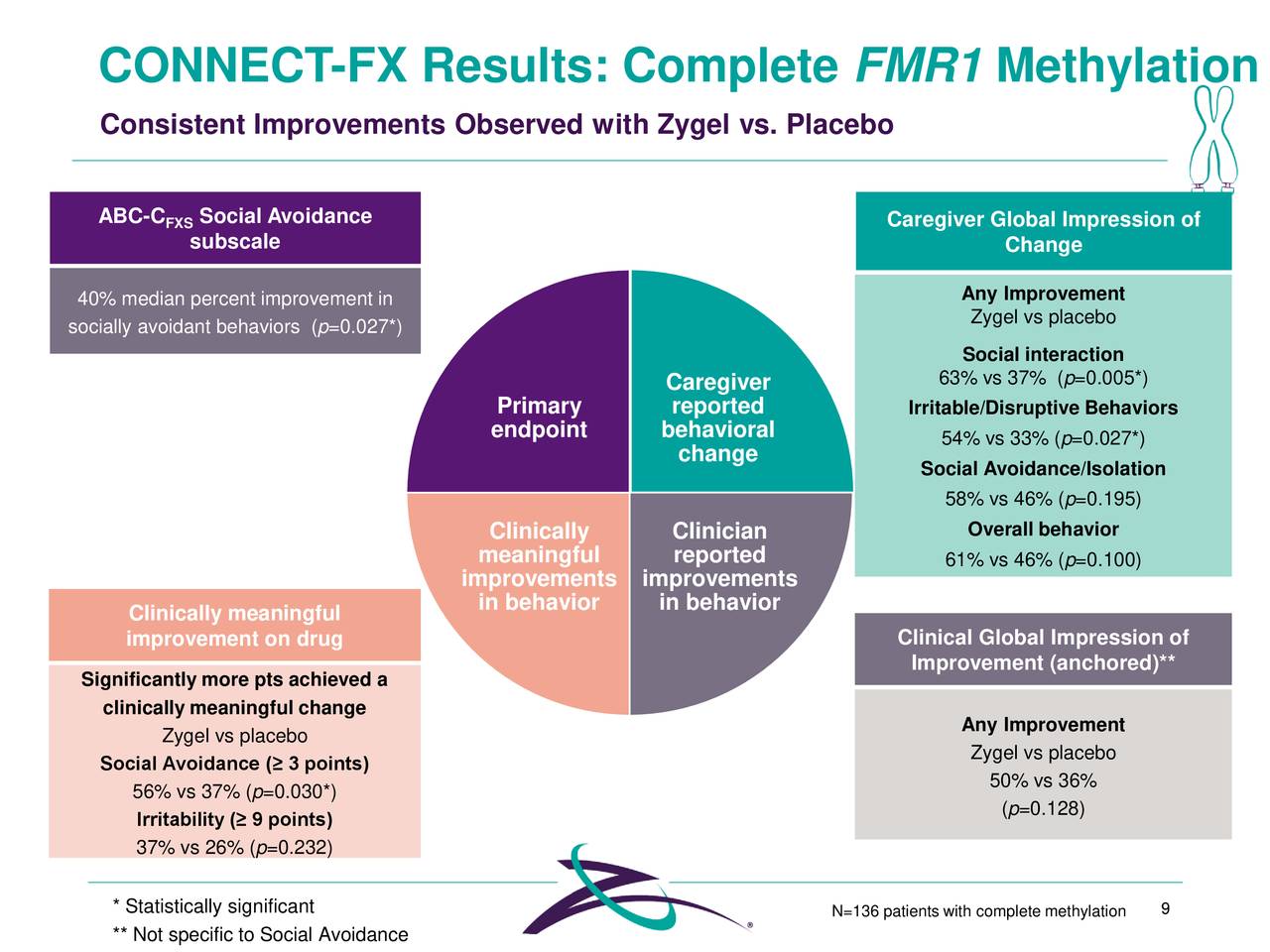

This rare affliction affects some 70,000 individuals in the United States and currently has no FDA-approved treatments. Zygel is currently being evaluated in an ongoing study, FX-Connect, which has had some mixed results to date.

Source: September Company Presentation

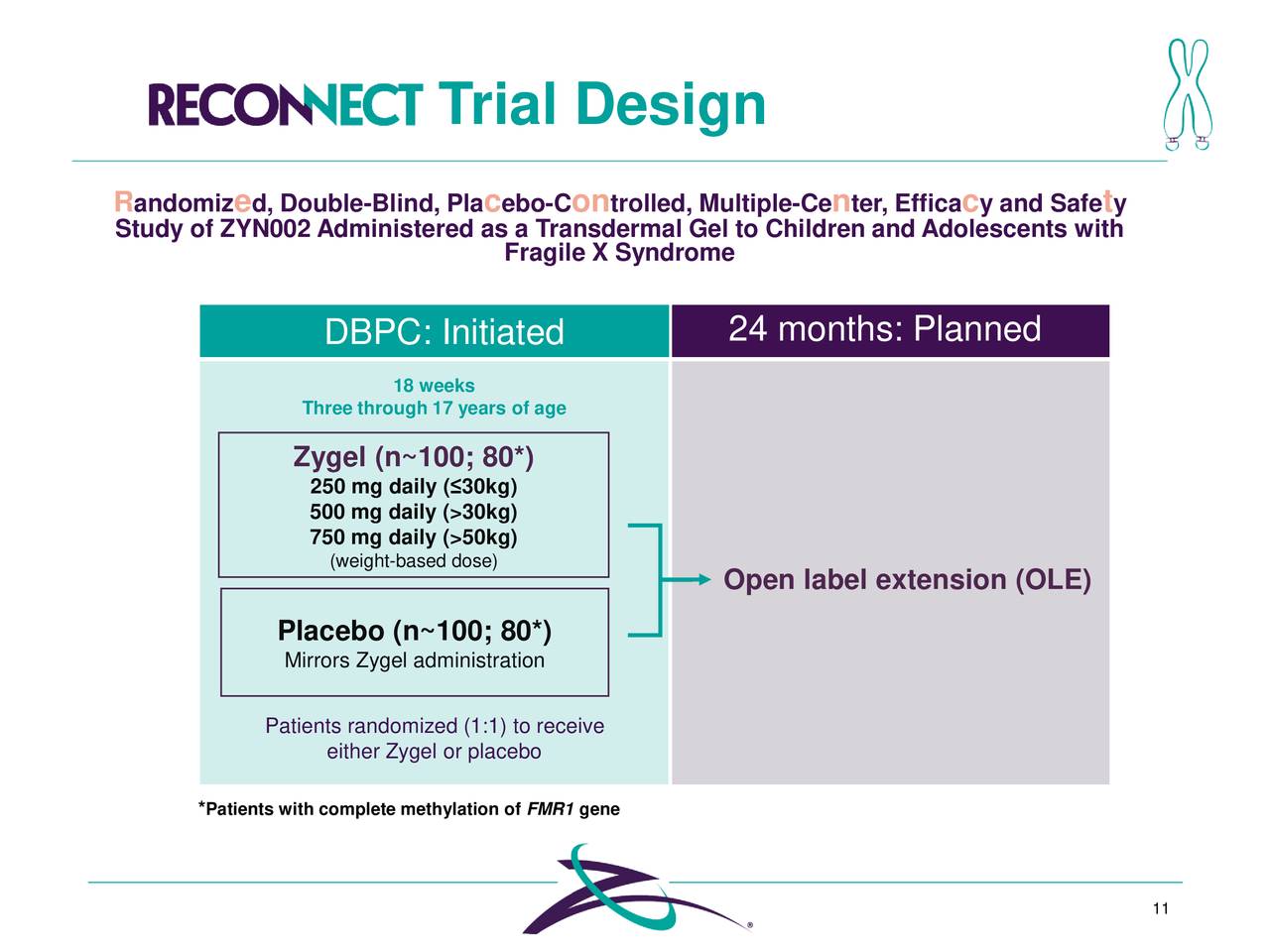

In addition, a pivotal, confirmatory trial “RECONNECT” is underway and a key topline Phase 3 readout should happen sometime in the second half of 2023.

Source: September Company Presentation

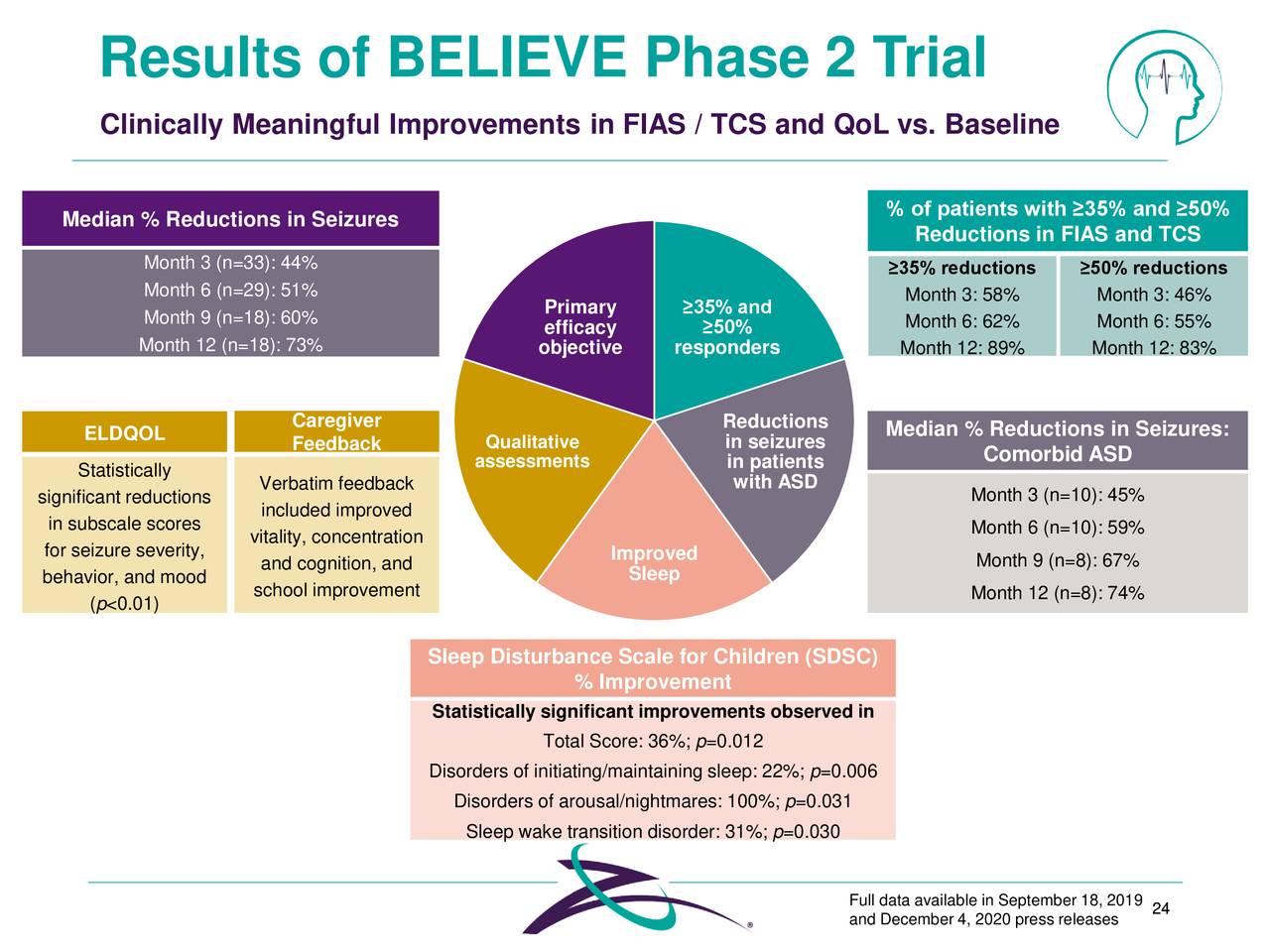

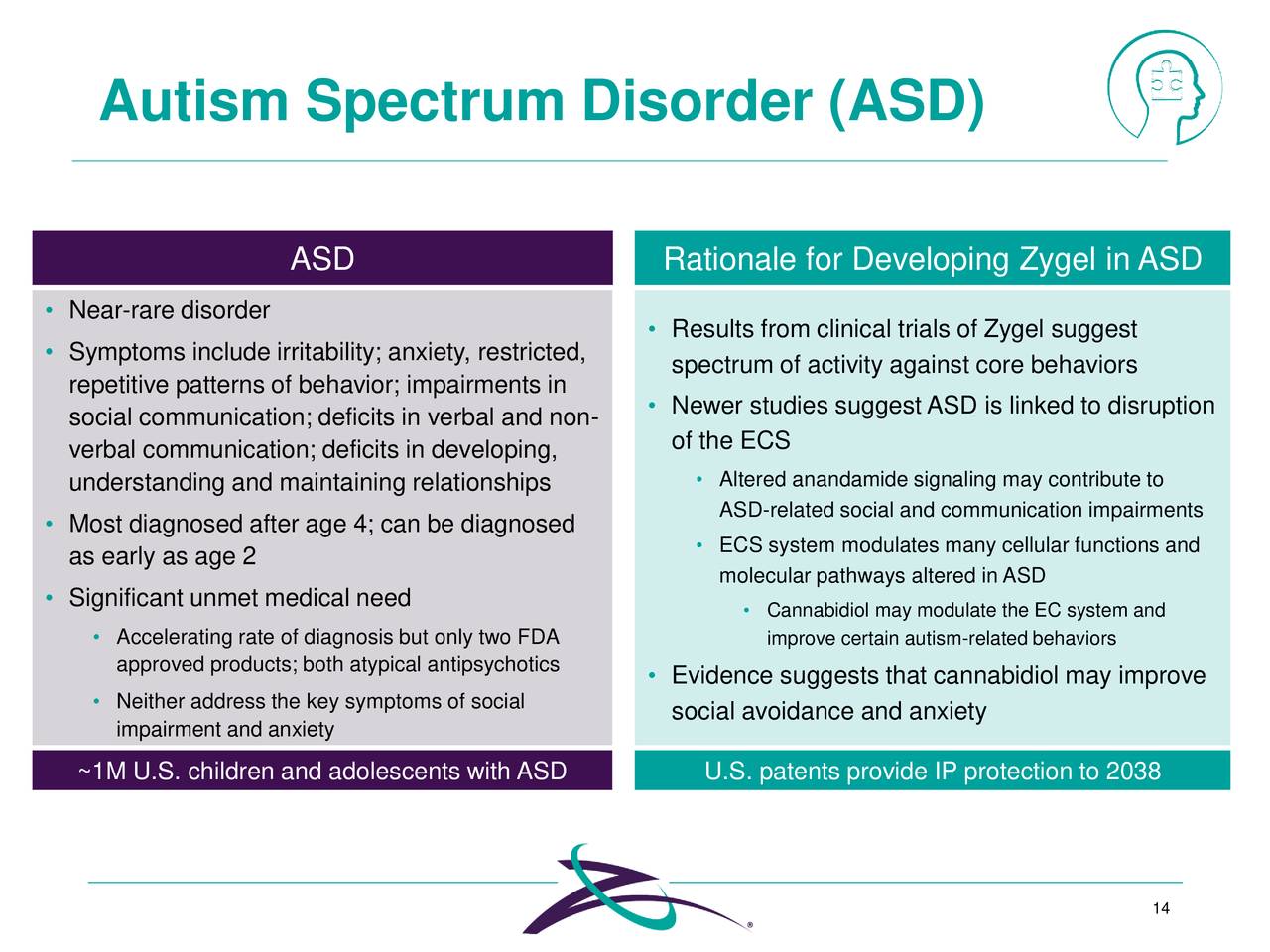

Zygel is also being evaluated for other disorders including Autism Spectrum Disorder [ASD], Deletion Syndrome, and Developmental and Epileptic Encephalopathies [DEE]. The most promising and advanced effort is in ASD.

Source: September Company Presentation

A Phase 2 study evaluating the safety and efficacy in treating ASD showed some significant impacts on key metrics. The company has received positive guidance from the FDA around next steps for this indication and leadership should detail the path forward for this indication by the end of this year.

Source: September Company Presentation

Analyst Commentary & Balance Sheet:

Since early May, four analyst firms including Cantor Fitzgerald and Canaccord Genuity have reissued Buy ratings on the stock. Price targets proffered are in a tight range of $8 to $9 a share. Needham seems the lone pessimist on the shares, reissuing a Hold rating on August 9th.

The company ended the first half of this year with just over $85 million in cash and marketable securities after posting a net loss of $10 million for the second quarter. Leadership stated on its conference call following the earnings release that this cash position is ‘sufficient to fund operations and capital requirements well into the first half of 2024‘. There has been no insider selling or buying in Zynerba’s shares so far in 2021.

Verdict:

Source: September Company Presentation

The good news about Zynerba is that it has more than enough cash runway to get to critical topline results for Zygel in Fragile X Syndrome in the second half of 2023. Cash on hand almost equals the stock’s market capitalization at current trading levels.

The bad news is there is unlikely to be a major catalyst, outside of the unlikely event of a buyout, between now and then. In addition, as another recent article on Seeking Alpha points out, the company has had a bumpy developmental journey with several trial failures along that road.

Therefore, the only way I personally can play this name is within covered call holdings as my bet is stock trades sideways and the cash balance provides a floor for the shares. Options liquidity varies by the day around ZYNE, but patient investors will get their covered call orders filled. Outside of that, I have no investment recommendation on Zynerba currently.

“Perfect logic applied to insufficient information in limited time almost always results in a flawed decision” – Gyan Nagpal

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ZYNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own a small holding of ZYNE through a covered call position.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present and update my best small-cap Busted IPO stock ideas only to subscribers of my exclusive marketplace, The Busted IPO Forum. Try a free 2-week trial today by clicking on our logo below!