Summary:

- Electric vehicles face challenges, increasing competition, and consumer reticence which has caused a shift in market enthusiasm.

- The driverless electric vehicle future is facing obstacles, particularly in the development of fully autonomous vehicles. This benefits Ford Motor Company’s effective but less ambitious technological solutions.

- Tesla, Inc.’s decline in margins and sole focus on EVs seems to be a decided disadvantage in a period of declining consumer enthusiasm for EVs.

- Ford’s ability to tailor EV plans while still relying on highly profitable internal combustion models should be a major advantage in the coming quarters.

UniqueMotionGraphics

“If you’re looking for the future of the automotive industry, stop looking at FSD and Tesla. Look at Ford Pro. It’s got half a million subscribers with 50% gross margin.” Ford CEO Jim Farley.

Electric vehicles (“EVs”) are on the out. It’s okay; it is to be expected. Tides of market enthusiasm ebb and flow just like the sea as the future becomes more apparent and as the obstacles of reality challenge previous assumptions. Optimistic technologists overestimate their pace of progress here and underestimate it there.

Valuations adjust accordingly. There have been more folks increasingly singing the EV blues across the industry for various reasons, from consumer reticence and political polarization to expiring subsidies and the significant externalities of lithium mining. Despite this, I am still bullish on EVs in the long term. But these building doubts could nonetheless cause bumps for pure EV plays.

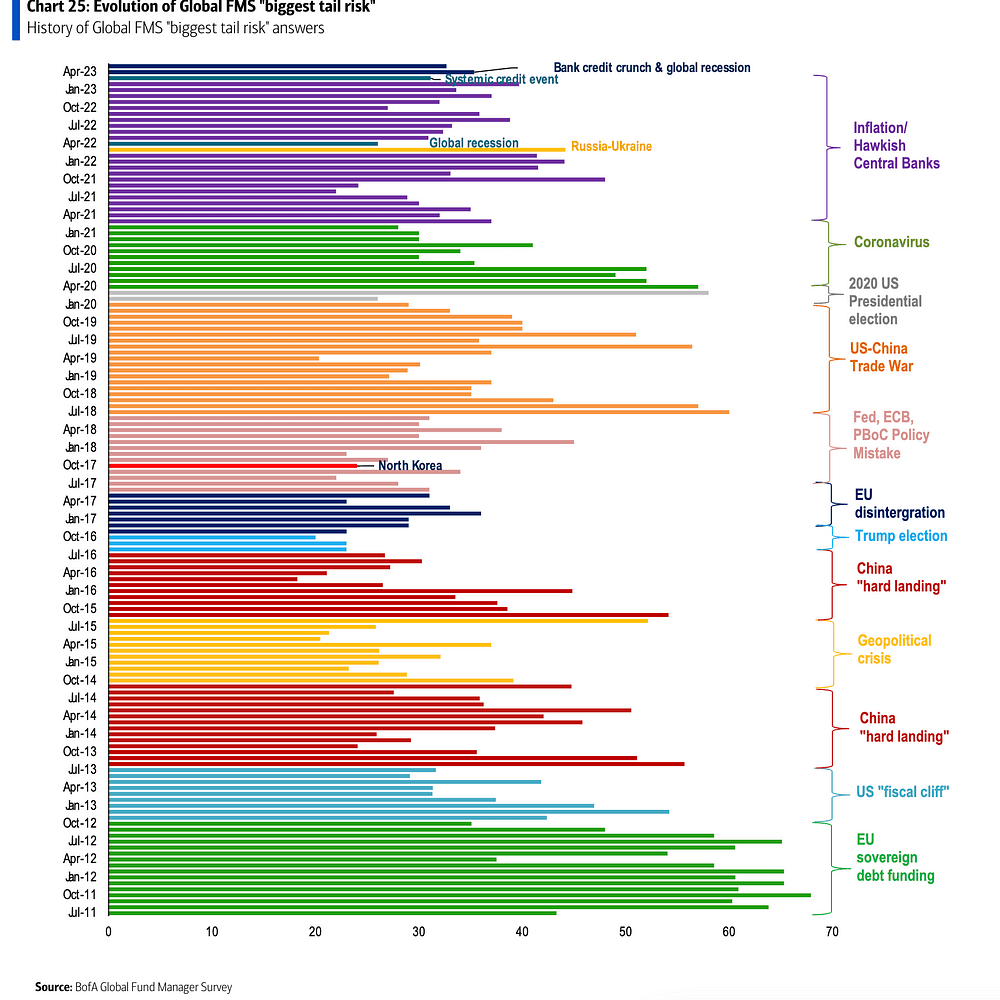

How we value things at any one moment in time is always temporary. In the same way, the primary risk we think is stalking markets rarely ends up being the primary catalyst for downside price action, or how visions of the future in the present are always obscured, imperfect, and subject to correction as time unfolds.

B of A Fund Manager Survey

And just because there are temporary setbacks to the all-electric future we had previously envisioned doesn’t mean all is lost for EV investors. Indeed, we often need to observe price weakness as an opportunity to lower costs based on long-term positions. While recent price weakness might seem like an opportunity for Tesla, I think the relatively higher engagement of founders in the Magnificent Seven is a distinct disadvantage for Tesla in the coming quarters.

Ford Motor Company (NYSE:F) and Tesla, Inc. (TSLA) will both define the future of Electric Vehicles and a brand new future for mobility, but there are a few reasons that I prefer Ford to Tesla right now. Accordingly, I am downgrading Tesla to a Hold. I am keeping Ford at a Buy. The reasoning is below:

- Global demand for Electric Vehicles is slowing, and Tesla, being the market share leader, is most sensitive to this reality.

- While competitors can slow EV plans to variable demand and rely on the cash cows of Internal Combustion and Hybrid models, Tesla is relatively more exposed to the building of EV pessimism.

- Consumer hesitance is building regarding EVs and their relatively unique features. Issues such as not starting or having reduced battery range in cold weather are entering public perception after the recent Arctic Blast.

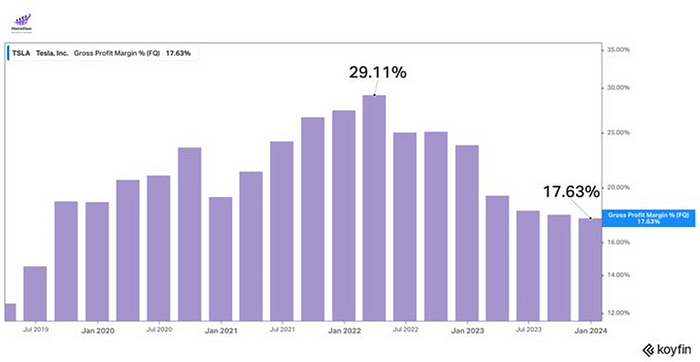

- Tesla’s CEO flopped on their recent earnings call and gave pessimistic guidance. He has cut margins to the point his flexibility may be impaired in adverse demand scenarios.

- Setbacks in critical technologies at the core of Tesla’s long-term planes, mainly autonomous driving, have created a significant opening for Ford in its middle-tier AV technology and Ford PRO segment.

- Tesla’s lineup is getting aesthetically stale at a time when demand is decreasing for EVs; Ford’s newer models and more traditional advertising strategy should enable it to gain market share at Tesla’s expense, even as overall EV demand slows.

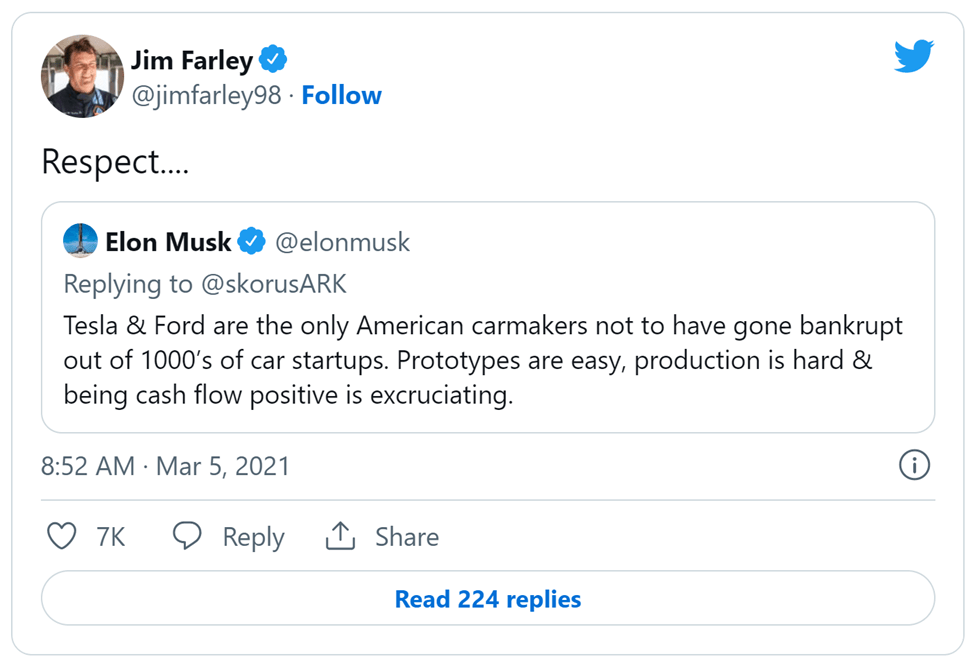

Now, let’s remember that I have generally shunned the Ford versus Tesla motif that comes up so frequently. I am NOT recommending selling a stock as outstanding as Tesla, particularly if you’re a long-term holder. Tesla will likely have good days ahead, but it seems to be in a malaise to me. I have argued that owning both is essential for thematic investors in Electric Vehicles. Only two major American automakers have never gone bankrupt, and I want to own those two.

Twitter

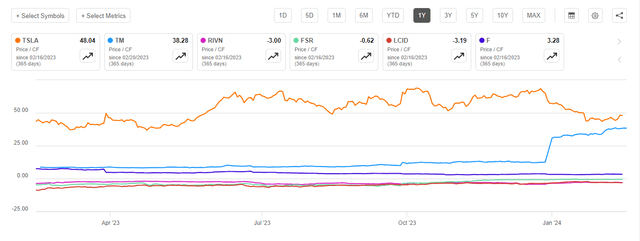

Remember those days after the post-pandemic when it seemed like a driverless future was just around the corner? Tesla has proven doubters wrong with its prolific rise to the world’s largest electric vehicle maker. Environmental and Social Governance ETFs were launching to great fanfare, and anything with a blueprint for an EV was trading at preposterous multiples. Recently, Toyota Motor Corporation (TM) has been closing the gap with Tesla on key valuation metrics. This is a state of affairs that would have been unimaginable in 2021. But reality has changed since then, and 2021-esque EV optimism isn’t likely coming back anytime soon.

The story of Toyota Motors closing some of the large gap that had previously existed between it and Tesla on Price to Free Cash Flow (“FCF”) has occurred over the past months as doubts over EVs have risen. One motif that appears to arise is that many consumers, and some in the auto industry, are starting to tout hybrids. Ford still has hybrid models, and Tesla does not. If consumer proclivities continue in the direction of hybrids, this will be a distinct advantage for Ford over Tesla.

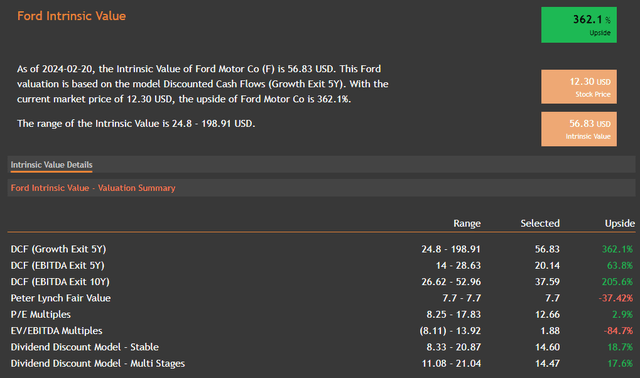

Of course, this reality has helped EV valuations come back down to Earth now. But the legacy automakers with more flexible EV plans never quite got the multiple boost that pure EV plays got during the bull market. However, now what seemed like a weakness, the legacy internal combustion engine (“ICE”) business, seems like a distinct strength against the pure EV plays like Tesla, particularly given the significantly higher margin of error that Ford has compared to Tesla for our specific purposes.

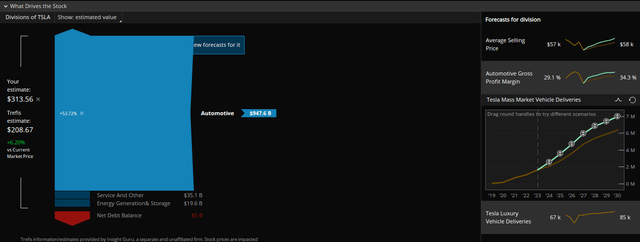

Some fundamental realities impeding the driverless electric vehicle we could all see so clearly in 2020 and 2021 have proven more indefatigable than initially supposed. Particularly fully autonomous vehicles. These marvels of the future appear stuck there for quite some time. Safety issues, amongst others, are making the path slower than many thought. Of course, this was when Tesla’s multiple was soaring, and there was talk of it not being just a car company but a “Technology” company.

Koyfin

While I have been bullish on Tesla for good reason in the past, I am now downgrading it to a hold based on elevated founder risk and the general lack of positive catalysts on the horizon. The declining margins are part of a strategy to defend market share, which may be successful, but that’s definitely the strategy of an auto manufacturing company and not the Technology company we had imagined at the heights of the EV mania.

Tesla’s fall from grace is about more than just the company. Of course, this firm is excellent, as evidenced by its storied ascendence through capital markets. But the problem is, when you’re playing at the highest level with the big boys, there’s only so much room for error. There are many ways to analyze stocks, but Nvidia and Tesla have been the respective darlings of the markets at different times. But Tesla’s higher “founder risk” compared to Ford’s and other competitors in the market is a crucial factor leading to my downgrade.

When you compare Tesla’s recent earnings performance to Nvidia’s, you start to see why one became the third most valuable company in the world recently and why the other didn’t. Tesla sells $40,000 cars at 20% margins, and Nvidia sells $40,000 chips at 80% margins. And they are often competing for the same high-beta money in markets.

Risks And Where I Could Be Wrong

Doubting Tesla is always risky, particularly after it has experienced some significant price decline. However, one thing that gave me pause was an excellent analysis by another Seeking Alpha contributor about some technical downside that may be creeping up. But Tesla has had many irons in the fire of R&D, and Technology Analyst Dan Ives believes the firm is grossly underestimated on AI capability. The most significant risk to my thesis is that Tesla could unveil some serious AI capability that enables it to get back on the multiple expansion train and achieve the market darling status it has recently been known for.

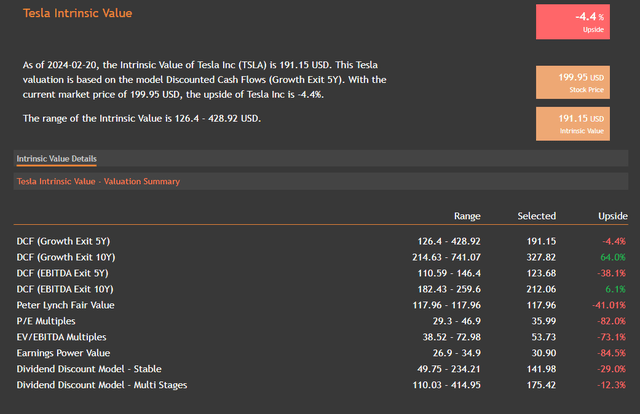

After the recent fall, the stock is also pretty reasonably valued, if a bit overvalued. However, given how high it has been in the past, you can consider this undervalued for this stock. This may be the perfect time to buy Tesla, given that the likely path of rates will be down in the comic quarters, even though there have been some recent hiccups in the downward path of inflation.

Another risk is that Ford may underperform relative to Tesla if a recession hits. This is because, despite price cuts, Tesla still serves a more affluent customer on the coast whose purchasing power will likely be less adversely affected by the curtailment of economic activity than Tesla customers. Furthermore, CEO Elon Musk and Tesla have made cultural inroads in the Red states where EV hesitance is highest. If Tesla sells more vehicles than currently projected, it is likely undervalued.

This could prove a financially lucrative move that could erode Ford’s dominance in the Truck market if the Cybertruck and future iterations are successful. A breakthrough in autonomous driving technology, which many think is most likely to occur at Tesla, would render the call in this article very wrong. Furthermore, an increasingly aggressive UAW could cause Ford significant headaches and setbacks to increasingly complex EV plans.

Conclusion: Ford’s Margin Of Safety Makes It A Better Buy Right Now

The wave of EV pessimism that is sweeping markets and has battered once sky-high valuations is likely not going to end anytime soon. Artificial intelligence seems to be consolidating the market for excessive optimism for the time being. This could save Tesla and bring it back to market darling status, given its significant investments and capabilities in the area. Yet, the detached management struggling to communicate effectively with investors is a crucial handicap where Ford is exceedingly vital. Mr. Farley has used Tesla’s missteps to make himself the primary challenger in the EV market, anemic growth or not.

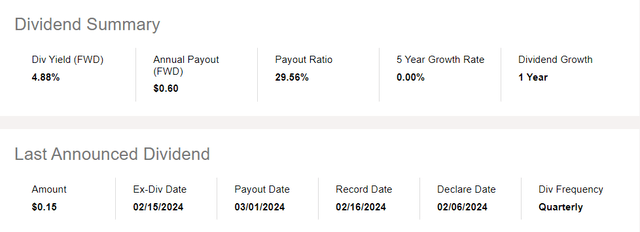

But the valuation picture for Ford is just so much more appealing, and it also has a solid capital return policy that should help investors achieve compounding during the EV enthusiasm slump. Tesla does not have this advantage unless you want to create a synthetic dividend, a strategy I’ll discuss with Tesla and a few other high-flyers in an upcoming article that you should check out.

The combination of superior valuation and a capital return policy that will make EV pessimism work for the long-term investor leads me to believe Ford is the better buy right now. Tesla should be held until there is more clarity around compensation and incorporation issues and a rekindling of the EV optimism. The simple reality is that pure EV plays are more disadvantaged in a receding tide of enthusiasm for EVs, and current valuations do not reflect this reality.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.