Summary:

- I must again disagree with the bulls’ opinion and leave my Sell rating unchanged.

- RIVN experiences declining demand and increased competition in its market, and it may use up its cash quicker than expected.

- The company will have to lower the price – “per-unit costs fall below the selling price” sounds like a fairy tale to me right now.

- Porsche stock can be bought TODAY for half of RIVN’s projected P/E ratio for FY2030. Don’t only focus solely on sales-based valuation metrics.

Mario Tama

Intro & Thesis

Let me say it right away – I am not an expert on the automotive industry and have never covered this sector professionally in the equity research team of analysts at any investment bank. I rather take a generalist approach and try to provide the most reasonable “generalist view” and discuss it with those who are out of touch with reality and blindly believe what they want to believe.

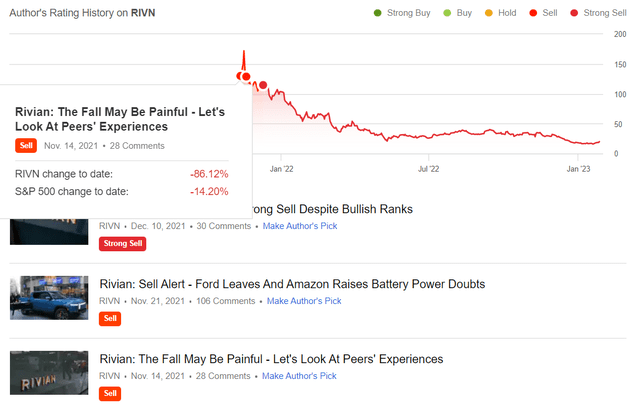

When Rivian Automotive, Inc. (NASDAQ:RIVN) just went public at an $80 billion valuation – and did not yet have a car on the road – I immediately went against the bullish calls. After studying the historical experiences of previous peers, it was clear to me by mid-November 2021 that the bubble would not continue to rise. And so it happened – before the enchanting deflation, I tried 2 more times to warn investors of the impending collapse:

Seeking Alpha, Danil Sereda’s coverage

I am not trying to boast about myself. I just want to immediately protect my call from the attacks of those who want to accuse me of generalism – even though I am not an expert in this industry, my approach is based on common sense and helps avoid deep portfolio drawdowns by not getting into stocks like RIVN at their peak.

RIVN became one of the worst performers in its industry in FY2022 – the same continued in FY2023:

As you can see in the chart above, using Bank of America as an example, RIVN’s terrible performance does not deter analysts, who offer the stock as a buy and see an upside potential of 216.7% based on various valuation multiples:

BofA [January 20th, 2023], with author’s notes![BofA [January 20th, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-1675137608311021.png)

Well, 0.5x EV/sales and 3x EV/EBITDA looks very conservative. However, I must again disagree with the bulls’ opinion and leave my Sell rating unchanged – I have several reasons for this decision.

Ratings, ratings, ratings…

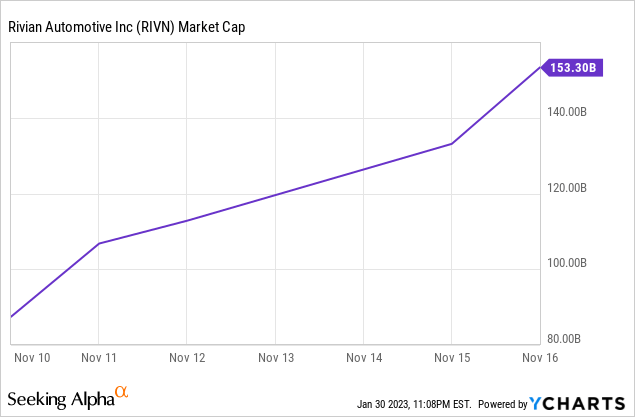

Companies that can achieve such a huge valuation for basically the idea of launching a large-scale production always attract the attention of the crowd. Rivian attracted so much attention from the very beginning that its initial valuation of $80 billion quickly became $100 billion, then $140 billion, and finally crossed $150 billion in a matter of days:

And that was even though its goal was to use the proceeds from the IPO to create a major automotive company, which, although focused on electric vehicles, is a very capital-intensive and cumbersome business, just like traditional automakers.

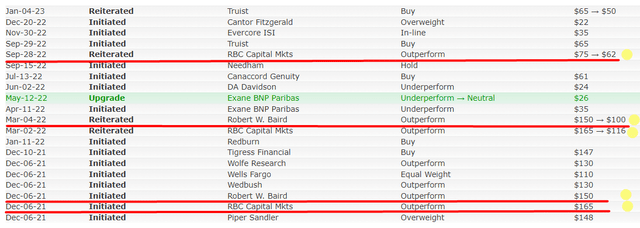

From the initiation of coverage, various banks issued extremely positive outlooks – almost until the end of the 1st half of 2022 – only the price targets changed:

Most major banks – from Morgan Stanley to Mizuho – have simply changed their price targets so that the implied upside potential still looks impressive, but not outrageous. You know – the old price targets in the $150-160 per share range look too off against today’s $18 per share price.

In fact, from what I see, the Street’s positivism has not gone away:

CNBC Morgan Stanley [January 25, 2022], with author’s notes Goldman Sachs [January 30, 2023], with author’s notes

![Morgan Stanley [January 25, 2022], with author's notes](https://static.seekingalpha.com/uploads/2023/1/31/49513514-16751414932632608.png)

![Goldman Sachs [January 30, 2023], with author's notes](https://static.seekingalpha.com/uploads/2023/1/31/49513514-16751419720622983.png)

This Wall Street positivism is still having an impact on the broad mass of retail investors – after a 72% decline (1 year) and only a modest recovery since the beginning of 2023 (+4.04%), about 58% and 69%, respectively, of those surveyed on earningswhisper.com believe that RIVN stock will grow in the foreseeable future and beat consensus figures at its next earnings report. This market sentiment seems quite optimistic to me.

Disinflation is a product of the coming recession

In addition to Tesla’s (TSLA) big wave of price cuts since the end of 2022, there was news on Monday that Ford (F) also intends to cut prices for its electric Mustang Mach-E – disinflationary processes, as it suddenly turned out, do not occur on their own, but as a rule – against the backdrop of a decline in demand and economic activity. Apparently, selling cars has become more difficult as banks’ requirements have become tougher – lending rates continue to rise, and according to The Kobeissi Letter of January 22, the average car payment has reached a record $800/month. At the same time, delinquent auto loans are up 27% this year and credit card debt is up 15% in 2022 [biggest jump since 2008] – credit financing will likely remain expensive until the Fed cuts rates.

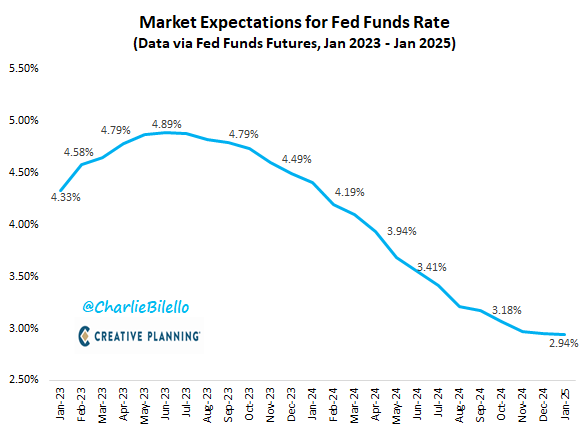

Now the market expects the rate cuts to start in November 2023 and continue throughout 2024, and the Fed Funds rate to fall back below 3%:

Charlie Bilello

Why would the Fed want to lower interest rates? Inflation is going to go down, sure thing. How is that going to be accomplished? In my opinion, through a decline in demand.

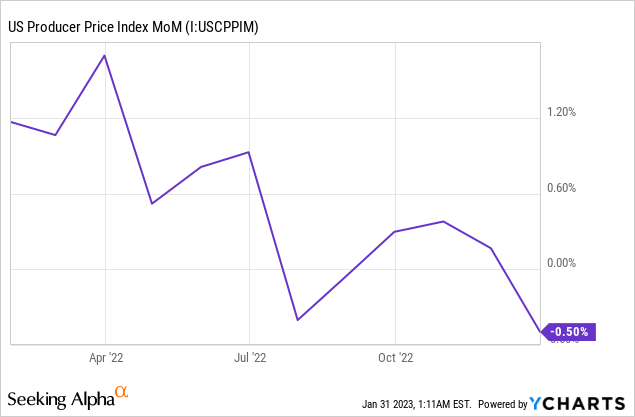

That’s why we see a drop in producer prices across the board – not just in the automotive industry:

Historically, the current setup has only led to a recession – a soft landing was only possible against the backdrop of already subdued inflation, which we have not yet experienced:

Kantro [Twitter: @MichaelKantro]![Kantro [Twitter: @MichaelKantro]](https://static.seekingalpha.com/uploads/2023/1/31/49513514-1675146056597211.jpg)

Therefore, anything that has a long duration and does not generate FCF – for example, RIVN – is likely to be suppressed once the Fed starts to lower the interest rate. Basically, the monetary easing that everyone is waiting for signifies the fact of the beginning of a recession. That’s how I see the current macroeconomic environment – you may disagree with me [welcome to the comment section below]. Rivian, even as it relies on its massive backlog, will continue to burn cash, and the thesis of those who look only at the size of the cash cushion on the company’s balance sheet becomes irrelevant.

Rivian’s Cons beat Pros

As far as I can see, banks and retail bulls have roughly the same arguments for buying RIVN stock at current levels – I have summarized the key points for you:

- The company operates in a very attractive sub-segment (SUVs, pickups, and delivery vans) and should avoid capital dilution until 2024 thanks to the liquidity already accumulated;

- Revamped strategic partnership with Amazon (AMZN);

- Per-unit costs fall below the selling price;

- Rising consumer interest in EVs and the government stimulus [Inflation Reduction Act];

- The company’s strategy in software and services will likely lead to better monetization prospects.

This all sounds good, but as you may have noticed, it speaks of a rather distant future or the existence of a capital cushion, which seems imaginary to me.

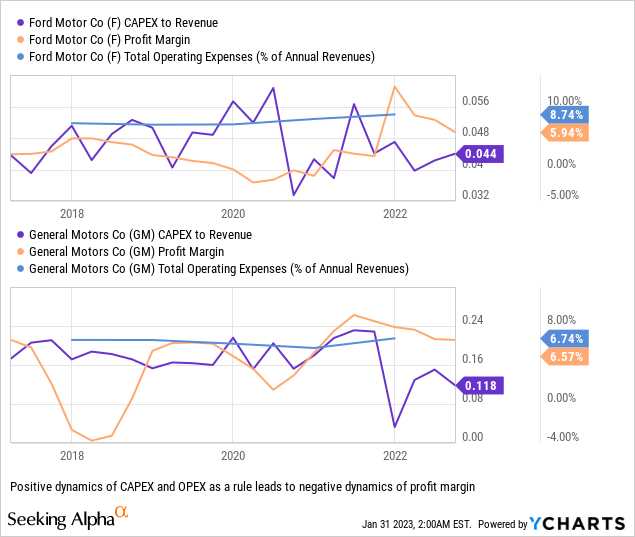

As I wrote above, the automotive industry is very capital-intensive. Expanding production requires huge investments or CAPEX and operating expenses (OPEX), so manufacturers make a fairly low-profit margin while scaling up.

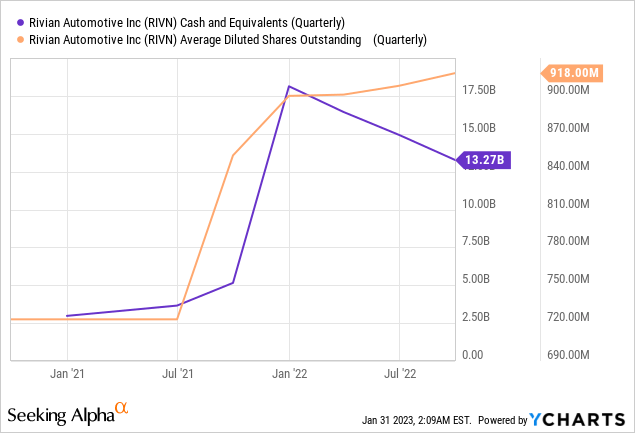

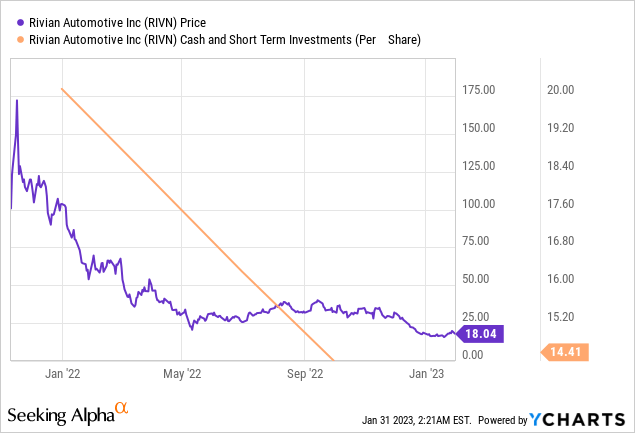

RIVN’s entire history is built on scaling – the company needed to use the proceeds from its IPO to build plants and begin producing vehicles shortly thereafter. At the end of 2021, RIVN had just over $18 billion in cash and ST investments, according to Seeking Alpha. For just 3 quarters of FY2022 (9 months), the company burned through 26.8% of that cushion – with this burn rate, the company reached $1.049 billion in TTM revenues. Now that even veterans of the auto industry like Ford are being forced to cut prices – which is bad for RIVN anyway, both from a competitive standpoint and as an indirect indication of the state of demand – the company is likely to deplete its cash much faster than the Street expects. What will follow this? Most likely – a capital dilution.

In the 9 months of 2022, RIVN spent $1.075 billion on CAPEX and $2.938 billion on OPEX – the former down 19.66% y/y, while the latter up 74.5% y/y. I expect today’s $14.41 per share to drop significantly very quickly if spending keeps coming up – RIVN will then very quickly unwind one of its bullish arguments, namely the margin of safety.

To be competitive, the company will have to lower the price – “per-unit costs fall below the selling price” sounds like a fairy tale to me right now, especially given how sticky the labor/production costs are (disinflation will come from slowing housing rather than lowering input costs for labor and R&D).

Government support as a catalyst for growth seems too vague – and most importantly – it applies to the industry as a whole, not specifically to Rivian. The company is a small niche player with a market capitalization larger than Nissan Motor Co., Ltd. (OTCPK:NSANY), which generates 63 times more revenue (TTM).

According to Bank of America, RIVN will not even be profitable in FY2025 – the Seeking Alpha consensus does not talk about breakeven until FY2027. The implied price-to-earnings (P/E) by FY2030 stands at ~4x. If you think that’s cheap, think again, because for half that multiple you can buy shares of Porsche Automobil Holding SE (OTCPK:POAHY) today, which has a forward EBIT growth of ~24%.

That is, Rivian is worth 2 times more than Porsche if it were already profitable, which will not be the case in a few years.

The Bottom Line

I titled my article “slippery road” – exactly the kind of ground under Rivian’s wheels that I see against the backdrop of all that is currently happening in the capital markets.

EPS and revenue projections promise the tremendous opportunity for the company in 6-7 years – as you can imagine, this is too far in the future to pay twice the market for this distant goal [Porsche was a clear example].

At the same time, it is important to understand that RIVN is unlikely to break even on EBITDA by FY2025, as BofA’s predictive multiples tell us:

Based on the foregoing, I would not just focus on the price-to-sales ratio or EV-to-sales ratio when analyzing RIVN. For me, the stock is not worth the risks and should be avoided at the current price levels.

Thanks for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!

![BofA [January 20th, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-16751360886638098.png)

![BofA [January 20th, 2023]](https://static.seekingalpha.com/uploads/2023/1/31/49513514-16751512863451123.png)