Summary:

- Rivian Automotive fell to a new 52-week low this week.

- Rivian’s stock slid after the company announced a green convertible senior notes offering.

- Rivian has guided for a 50K production volume in 2023.

Mario Tama

After the company announced a $1.3 billion green convertible senior notes offering, Rivian Automotive Inc. (NASDAQ:RIVN) set a new 52-week low this week.

The market also declined in anticipation of Friday’s release of labor market data. The short-term impact of the jobs report could push Rivian Automotive to new lows as investors anticipate a possible central bank response that includes swifter rate increases.

Having said that, these incidents have very little to do with how Rivian Automotive operates, and given that a variety of risk assets, such as bank stocks and cryptocurrencies, fell sharply yesterday, I believe there is a window of opportunity to load the truck with Rivian Automotive stock.

Market Sentiment Has Nothing To Do With Rivian Automotive’s Performance

Weakness in the stock market can be an opportunity to load up on stocks of companies that are promising, operate in growth industries and have low valuations. One such stock, in my opinion unfairly penalized over the past few days, is Rivian Automotive.

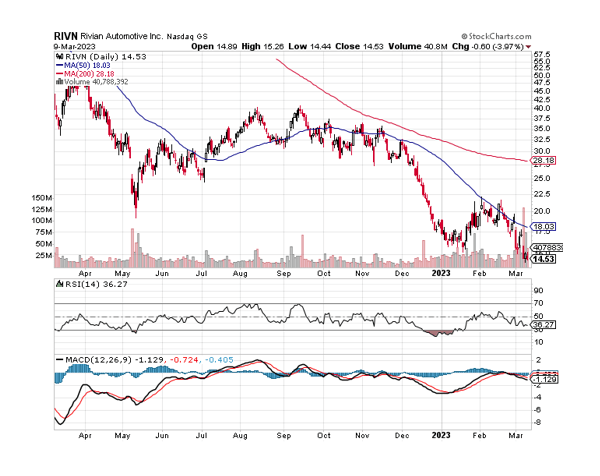

The stock of Rivian Automotive has fallen to a new 52-week low of $14.21 due to a softening market. Rivian Automotive is not oversold (yet), but it may very well become so if Friday’s labor market report comes in stronger-than-expected, according to the Relative Strength Index. A strong labor report might force the central bank to start raising rates aggressively again in 2023, which would be bad for stocks.

RIVN stock is at a turning point. Rivian Automotive was rejected at the 50-day moving average line following two unsuccessful breakout attempts in February, which is regarded as a negative chart signal. So, it’s possible that the stock will soon hit new lows. RIVN may become oversold and offer an even better investment opportunity than it does at the moment, even though the RSI indicates that it is not yet oversold.

Relative Strength Index (Stockcharts.com)

Rivian Automotive’s $1.3 Billion Senior Notes Offering

Rivian Automotive’s price correction last week was driven primarily by two events that have little to do with the company’s performance and execution in the EV market.

Firstly, Rivian disclosed its intention to issue green convertible senior notes with a March 15, 2029 maturity date in order to raise $1.3 billion. There is also an option to sell an additional $200 million of notes if there is sufficient demand.

The company will be able to invest in new ‘green projects’ like clean transportation and renewable energy thanks to the senior notes, which will also be redeemable on or after March 20, 2026.

Secondly, investors frequently pressurize sellers in response to capital offerings because they are concerned about a convertible offering’s potential for dilution. The share price of Rivian Automotive fell by 14.5%, but I believe investors are overreacting to the offering.

At the end of the fourth quarter, Rivian had more than $11 billion in cash, which is more than enough to scale back production of its R1 truck and R1 SUV through 2024.

Strong Production Outlook For 2023 In Place

On its earnings call, Rivian Automotive provided guidance for a 2023 production target of 50K electric-vehicles, suggesting that the company could more than double its production YoY.

Rivian Automotive produced slightly more than 24K electric-vehicles in 2022, falling just short of the company’s 25K production target.

According to rumors, Rivian Automotive has internally floated a 62K production target for 2023, which would represent a 24% increase over the previously announced target.

Huge Sales Ramp Ahead In 2023 And 2024

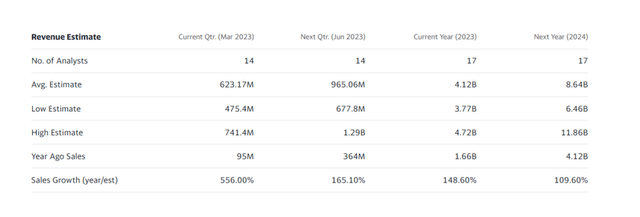

The market currently anticipates sales growth of 149% in 2023 and 110% in 2024, translating to a potential sales volume of $8.64 billion in 2019. The electric-vehicle manufacturer sold 1.66 billion dollars’ worth of its roughly 24K electric-vehicles in 2022.

With a sales forecast of $8.64 billion, assuming the market is somewhat accurate, the value of the electric-vehicle company is now 1.45x sales. (based on 2024 sales). Since Rivian Automotive’s initial valuation was greater than 10x sales, I think the current sales multiple is a great deal.

Rivian Automotive’s sales multiple of 1.45x is a steal for an EV company that is anticipated to more than double production this year (plus an implied 24% upside based on the internal forecast).

Revenue Estimate (Yahoo Estimate)

Why Rivian Automotive Could See A Lower Valuation

Rivian Automotive may face problems with its supply chain, and other economic trends (such as inflation) may be unfavorable to the performance of the EV company and consumer demand in 2023.

The closure of Silicon Valley Bank might affect the financial industry more broadly and lead to another financial crisis. Finally, if investors’ risk aversion is impacted by an intensifying banking crisis, EV stocks may remain unpopular.

My Conclusion

The $1.3 billion green convertible senior note offering and the stock market selloff ahead of Friday’s job report are the two recent occurrences that have caused Rivian Automotive’s stock to decline and hit new 52-week lows.

As both situations have little to do with Rivian Automotive’s performance and strategy in the EV market, I believe investors are overreacting in both instances.

The production forecast for 2023, in my opinion, is reasonable (especially the one that was internally communicated), and the EV company is still anticipated to deliver an impressive ramp in sales this year and the following year.

Since the stock of the company is currently trading at 52-week lows and may be oversold in the near future, I actually believe that Rivian Automotive is a strong investment. The more it drops, the more I buy.

Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.