Summary:

- Despite a remarkable 45% rebound, RIVN’s January gains have largely dissipated as shrewd sellers took their profits.

- The market likely expects Rivian to post a weak production outlook for 2023.

- With a more hawkish Fed back in focus, unprofitable growth stocks like Rivian could face more pain.

- Following a dramatic sell-off last week, RIVN may be on the brink of yet another speculative recovery.

Justin Sullivan

Rivian Automotive, Inc. (NASDAQ:RIVN) is slated to report its FQ4’22 earnings release on February 28, as investors look toward CEO RJ Scaringe and team to assure them of its production ramp.

However, with RIVN stock topping out in early February before giving up most of its January gains, investors are likely expecting a weak release.

We updated investors that RIVN was due for a speculative set-up in early January, despite the doom and gloom then. Accordingly, RIVN surged nearly 45% from its January lows toward its recent highs before sellers digested those gains.

However, given that it was a speculative call, we hope investors who picked RIVN’s lows have cashed out accordingly and not held the bag on the way down. In addition, it’s important to remember that speculative positions are not meant to be a long-term buy-and-hold opportunity, primarily reserved only for companies with solid fundamentals and highly defensible competitive moats.

RIVN investors should be pretty familiar with its volatility. However, its current short interest as a percentage of float (6.77%) suggests it’s not a prime short target compared to another fledgling EV maker Lucid (LCID). The Saudi Arabia PIF-backed luxury EV maker has a short interest as a percentage of float of nearly 31%.

A relatively high short interest could also increase the potential for a short squeeze if earlier short sellers decide to cover their bearish bets if they anticipate more optimistic sentiments returning, driving a rapid momentum surge.

As such, RIVN investors should not expect a massive short-covering opportunity heading into earnings. Hence, we believe the recent selloff could be linked to lowered investors’ confidence about its ability to provide a strong production outlook for 2023.

We updated in a recent article on Lucid, highlighting why the EV maker’s tepid 2023 outlook implies that it could be facing significant pressure, likely from weak underlying demand trends.

However, while Rivian and Lucid compete in different verticals, their production ramp will likely still be the most critical yardstick of progress contributing toward their profitability.

Revised Wall Street estimates suggest Rivian should hit adjusted EBITDA profitability by FY26. However, given its sub-scale production levels, Rivian is also expected to burn through significant amounts of cash.

Accordingly, Rivian is expected to burn through $17.4B of cash through FY26. However, it only has $13.27 in cash and equivalent. As such, Rivian will likely need a liquidity raise, which could be further complicated by a worse-than-expected production ramp.

Is it a significant cause for concern? Rivian still has significant backers, with Amazon (AMZN) as the most critical shareholder owning 17.2% of its holdings. However, it remains to be seen whether the company will be keen to raise its ownership as it deals with significant challenges of its own.

Ford (F) has already backed out from the leading pack, as it owns just 1.14%. The leading automaker highlighted that the “monetization of the company’s Rivian stake is now almost complete.”

As such, Ford likely expects Rivian to be a direct competitor as it ramps up its F150 Lightning production to dominate the EV landscape in the US, even though it faced some battery challenges recently.

Notwithstanding, we don’t expect Rivian to be struck with near-term liquidity issues, but investors will need to keep a close eye on the potential for more dilutive fundraising activities. Moreover, its valuation has fallen dramatically from its post-IPO highs, which could worsen the potential dilution significantly.

As such, unless Rivian has a massive cornerstone backer like Saudi Arabia’s PIF, investors must carefully consider their capital allocation and time horizon in RIVN.

While we continue to see opportunities in RIVN, given its volatility, we don’t encourage investors to hold it as a core holding, given its production ramp uncertainties and cash runway.

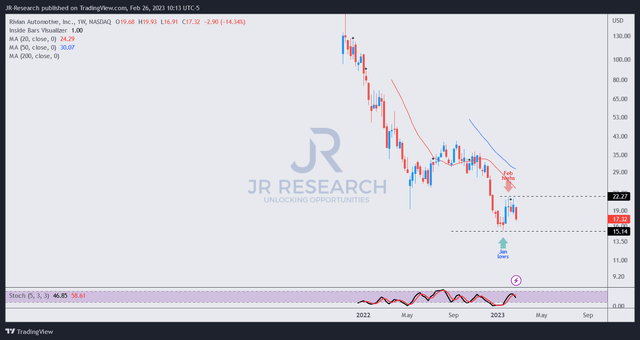

RIVN price chart (weekly) (TradingView)

RIVN formed its top in early February, as sellers distributed astutely before forcing a steep selloff last week.

Given the renewed focus on a potentially more hawkish Fed, unprofitable growth stocks like Rivian are back in the crosshairs of bearish investors as they anticipate more pain ahead.

However, with the steep pullback, RIVN is back within the 1x NTM Revenue zone. Buyers who have the conviction that the bottom-fishers will defend the current levels from its January bottom can consider adding here ahead of earnings.

Otherwise, they can also consider waiting for a constructive consolidation phase indicating accumulation before joining the bottom-fishers for another speculative ride.

Rating: Speculative Buy (Reiterated).

Note: As with our cautious/speculative ratings, investors must consider appropriate risk management strategies, including pre-defined stop-loss/profit-taking targets, within an appropriate risk exposure.

Disclosure: I/we have a beneficial long position in the shares of AMZN, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!